Hubei Feilihua Quartz Glass Co., Ltd. (SZSE:300395) Stock Rockets 25% As Investors Are Less Pessimistic Than Expected

Those holding Hubei Feilihua Quartz Glass Co., Ltd. (SZSE:300395) shares would be relieved that the share price has rebounded 25% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 37% in the last twelve months.

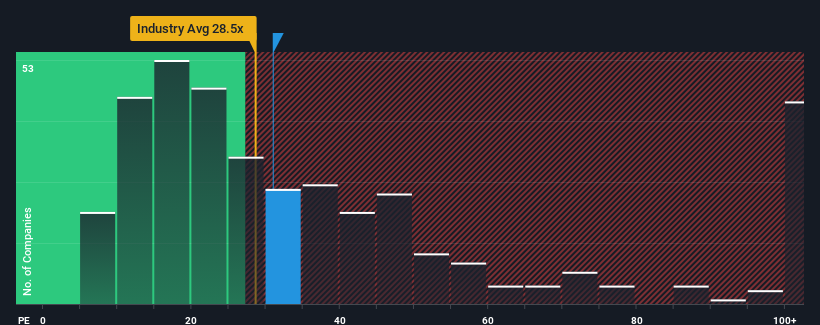

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Hubei Feilihua Quartz Glass' P/E ratio of 31x, since the median price-to-earnings (or "P/E") ratio in China is also close to 30x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Hubei Feilihua Quartz Glass certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for Hubei Feilihua Quartz Glass

Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Hubei Feilihua Quartz Glass' to be considered reasonable.

If we review the last year of earnings growth, the company posted a worthy increase of 14%. Pleasingly, EPS has also lifted 135% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 37% during the coming year according to the seven analysts following the company. That's shaping up to be materially lower than the 41% growth forecast for the broader market.

With this information, we find it interesting that Hubei Feilihua Quartz Glass is trading at a fairly similar P/E to the market. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Final Word

Hubei Feilihua Quartz Glass' stock has a lot of momentum behind it lately, which has brought its P/E level with the market. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Hubei Feilihua Quartz Glass currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Hubei Feilihua Quartz Glass with six simple checks on some of these key factors.

Of course, you might also be able to find a better stock than Hubei Feilihua Quartz Glass. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade Hubei Feilihua Quartz Glass, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hubei Feilihua Quartz Glass might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300395

Hubei Feilihua Quartz Glass

Manufactures and sells quartz material and quartz fiber products worldwide.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives