Lecron Industrial Development Group Co., Ltd. (SZSE:300343) Shares May Have Slumped 25% But Getting In Cheap Is Still Unlikely

Lecron Industrial Development Group Co., Ltd. (SZSE:300343) shareholders won't be pleased to see that the share price has had a very rough month, dropping 25% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 31% in that time.

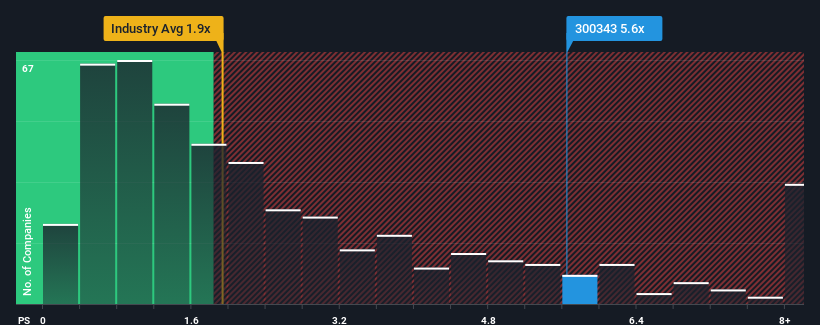

In spite of the heavy fall in price, you could still be forgiven for thinking Lecron Industrial Development Group is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 5.6x, considering almost half the companies in China's Chemicals industry have P/S ratios below 1.9x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Lecron Industrial Development Group

What Does Lecron Industrial Development Group's P/S Mean For Shareholders?

For instance, Lecron Industrial Development Group's receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

Although there are no analyst estimates available for Lecron Industrial Development Group, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Lecron Industrial Development Group's Revenue Growth Trending?

Lecron Industrial Development Group's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 44%. The last three years don't look nice either as the company has shrunk revenue by 4.4% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 23% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this in mind, we find it worrying that Lecron Industrial Development Group's P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

What We Can Learn From Lecron Industrial Development Group's P/S?

A significant share price dive has done very little to deflate Lecron Industrial Development Group's very lofty P/S. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Lecron Industrial Development Group currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. Right now we aren't comfortable with the high P/S as this revenue performance is highly unlikely to support such positive sentiment for long. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

It is also worth noting that we have found 1 warning sign for Lecron Industrial Development Group that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300343

Lecron Industrial Development Group

Lecron Industrial Development Group Co., Ltd.

Adequate balance sheet with questionable track record.

Market Insights

Community Narratives