A Piece Of The Puzzle Missing From Jiangsu Yuxing Film Technology Co., Ltd's (SZSE:300305) 39% Share Price Climb

Jiangsu Yuxing Film Technology Co., Ltd (SZSE:300305) shareholders have had their patience rewarded with a 39% share price jump in the last month. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 18% in the last twelve months.

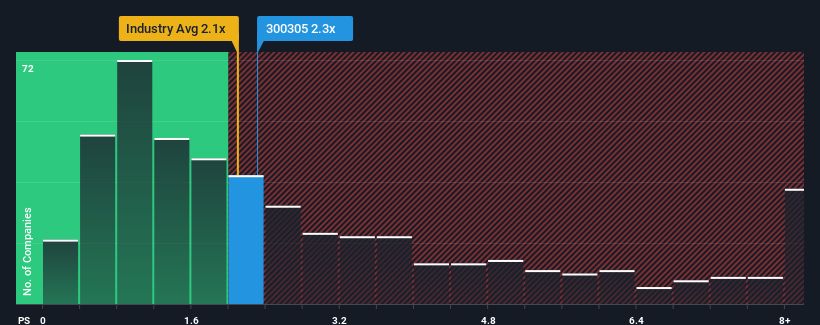

Although its price has surged higher, it's still not a stretch to say that Jiangsu Yuxing Film Technology's price-to-sales (or "P/S") ratio of 2.3x right now seems quite "middle-of-the-road" compared to the Chemicals industry in China, where the median P/S ratio is around 2.1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Jiangsu Yuxing Film Technology

What Does Jiangsu Yuxing Film Technology's Recent Performance Look Like?

Jiangsu Yuxing Film Technology hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Jiangsu Yuxing Film Technology will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Jiangsu Yuxing Film Technology's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 26% decrease to the company's top line. Even so, admirably revenue has lifted 32% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next year should generate growth of 36% as estimated by the dual analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 22%, which is noticeably less attractive.

With this information, we find it interesting that Jiangsu Yuxing Film Technology is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Jiangsu Yuxing Film Technology's P/S

Jiangsu Yuxing Film Technology appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Looking at Jiangsu Yuxing Film Technology's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Before you settle on your opinion, we've discovered 3 warning signs for Jiangsu Yuxing Film Technology (2 don't sit too well with us!) that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300305

Jiangsu Yuxing Film Technology

Engages in research, development, production, and sale of functional polyester films in the People’s Republic of China.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives