Baotou Dongbao Bio-TechLtd's (SZSE:300239) Dividend Will Be Reduced To CN¥0.022

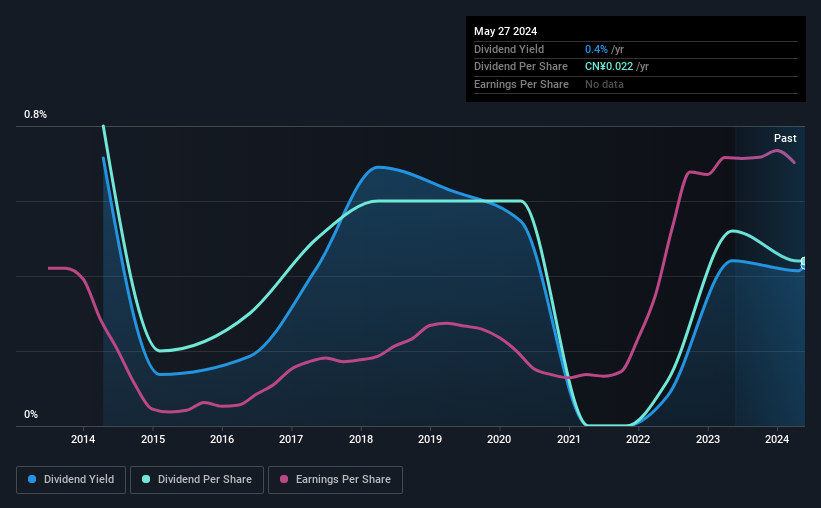

Baotou Dongbao Bio-Tech Co.,Ltd (SZSE:300239) has announced that on 31st of May, it will be paying a dividend ofCN¥0.022, which a reduction from last year's comparable dividend. Based on this payment, the dividend yield will be 0.4%, which is lower than the average for the industry.

View our latest analysis for Baotou Dongbao Bio-TechLtd

Baotou Dongbao Bio-TechLtd's Payment Has Solid Earnings Coverage

If it is predictable over a long period, even low dividend yields can be attractive. However, Baotou Dongbao Bio-TechLtd's earnings easily cover the dividend. As a result, a large proportion of what it earned was being reinvested back into the business.

Looking forward, earnings per share could rise by 20.7% over the next year if the trend from the last few years continues. If the dividend continues on this path, the payout ratio could be 9.1% by next year, which we think can be pretty sustainable going forward.

Dividend Volatility

The company has a long dividend track record, but it doesn't look great with cuts in the past. Since 2014, the annual payment back then was CN¥0.04, compared to the most recent full-year payment of CN¥0.022. The dividend has shrunk at around 5.8% a year during that period. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

The Dividend Looks Likely To Grow

With a relatively unstable dividend, and a poor history of shrinking dividends, it's even more important to see if EPS is growing. It's encouraging to see that Baotou Dongbao Bio-TechLtd has been growing its earnings per share at 21% a year over the past five years. Earnings have been growing rapidly, and with a low payout ratio we think that the company could turn out to be a great dividend stock.

We Really Like Baotou Dongbao Bio-TechLtd's Dividend

It is generally not great to see the dividend being cut, but we don't think this should happen much if at all in the future given that Baotou Dongbao Bio-TechLtd has the makings of a solid income stock moving forward. By reducing the dividend, pressure will be taken off the balance sheet, which could help the dividend to be consistent in the future. All of these factors considered, we think this has solid potential as a dividend stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Taking the debate a bit further, we've identified 1 warning sign for Baotou Dongbao Bio-TechLtd that investors need to be conscious of moving forward. Is Baotou Dongbao Bio-TechLtd not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Baotou Dongbao Bio-TechLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300239

Baotou Dongbao Bio-TechLtd

Engages in the research and development, production, and sale of gelatin, collagen, and additional products in the People’s Republic of China and internationally.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.