There's Reason For Concern Over Beijing Comens New Materials Co.,Ltd.'s (SZSE:300200) Massive 25% Price Jump

Despite an already strong run, Beijing Comens New Materials Co.,Ltd. (SZSE:300200) shares have been powering on, with a gain of 25% in the last thirty days. Notwithstanding the latest gain, the annual share price return of 6.0% isn't as impressive.

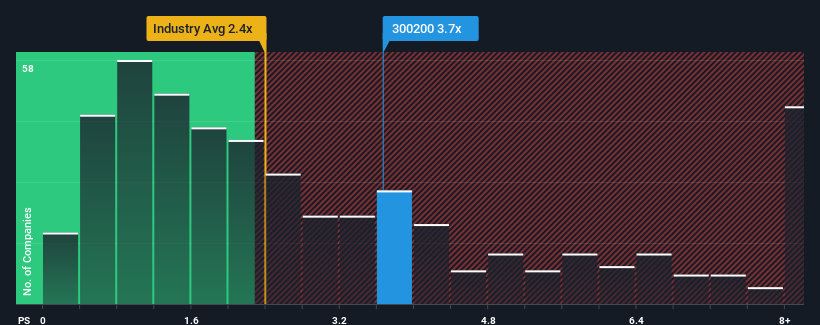

Since its price has surged higher, you could be forgiven for thinking Beijing Comens New MaterialsLtd is a stock not worth researching with a price-to-sales ratios (or "P/S") of 3.7x, considering almost half the companies in China's Chemicals industry have P/S ratios below 2.4x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Beijing Comens New MaterialsLtd

What Does Beijing Comens New MaterialsLtd's P/S Mean For Shareholders?

Beijing Comens New MaterialsLtd has been doing a good job lately as it's been growing revenue at a solid pace. One possibility is that the P/S ratio is high because investors think this respectable revenue growth will be enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Beijing Comens New MaterialsLtd's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as high as Beijing Comens New MaterialsLtd's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a decent 10% gain to the company's revenues. Still, revenue has barely risen at all in aggregate from three years ago, which is not ideal. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 25% shows it's noticeably less attractive.

With this information, we find it concerning that Beijing Comens New MaterialsLtd is trading at a P/S higher than the industry. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What Does Beijing Comens New MaterialsLtd's P/S Mean For Investors?

Beijing Comens New MaterialsLtd shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

The fact that Beijing Comens New MaterialsLtd currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. When we observe slower-than-industry revenue growth alongside a high P/S ratio, we assume there to be a significant risk of the share price decreasing, which would result in a lower P/S ratio. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

It is also worth noting that we have found 1 warning sign for Beijing Comens New MaterialsLtd that you need to take into consideration.

If you're unsure about the strength of Beijing Comens New MaterialsLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Comens New MaterialsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300200

Beijing Comens New MaterialsLtd

Engages in the research and development, production, and sale of composite polyurethane adhesives in the People’s Republic of China and internationally.

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives