- China

- /

- Medical Equipment

- /

- SZSE:300832

3 Growth Companies With High Insider Ownership Boasting 22% Revenue Growth

Reviewed by Simply Wall St

In the wake of the Federal Reserve's first rate cut in over four years, U.S. stock markets have surged to new highs, buoyed by investor optimism. This broad rally has created a fertile environment for growth companies, particularly those with high insider ownership and impressive revenue growth. When evaluating stocks in such a market, companies that combine strong financial performance with significant insider investment often stand out as promising candidates. High insider ownership can signal confidence from those who know the business best, aligning their interests closely with shareholders and potentially driving further growth.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.5% | 52.1% |

| Medley (TSE:4480) | 34% | 30.4% |

| KebNi (OM:KEBNI B) | 37.8% | 86.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.3% | 95% |

| Adveritas (ASX:AV1) | 21.1% | 144.2% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 100.3% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's take a closer look at a couple of our picks from the screened companies.

Hubei DinglongLtd (SZSE:300054)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hubei Dinglong CO.,Ltd. specializes in the research, development, production, and service of integrated circuit chip design and various semiconductor materials, with a market cap of CN¥18.06 billion.

Operations: The company generates revenue primarily from the Photoelectric Imaging Display and Semiconductor Process Materials Industry, totaling CN¥3 billion.

Insider Ownership: 29.9%

Revenue Growth Forecast: 16.5% p.a.

Hubei Dinglong Ltd. has shown strong growth with sales reaching CNY 1.52 billion for the half year ended June 30, 2024, up from CNY 1.16 billion a year ago, and net income rising to CNY 217.84 million from CNY 95.87 million in the same period. Earnings are forecast to grow at an impressive rate of over 34% annually, outpacing market expectations in China. The company also benefits from high insider ownership, aligning management's interests with shareholders'.

- Delve into the full analysis future growth report here for a deeper understanding of Hubei DinglongLtd.

- Upon reviewing our latest valuation report, Hubei DinglongLtd's share price might be too optimistic.

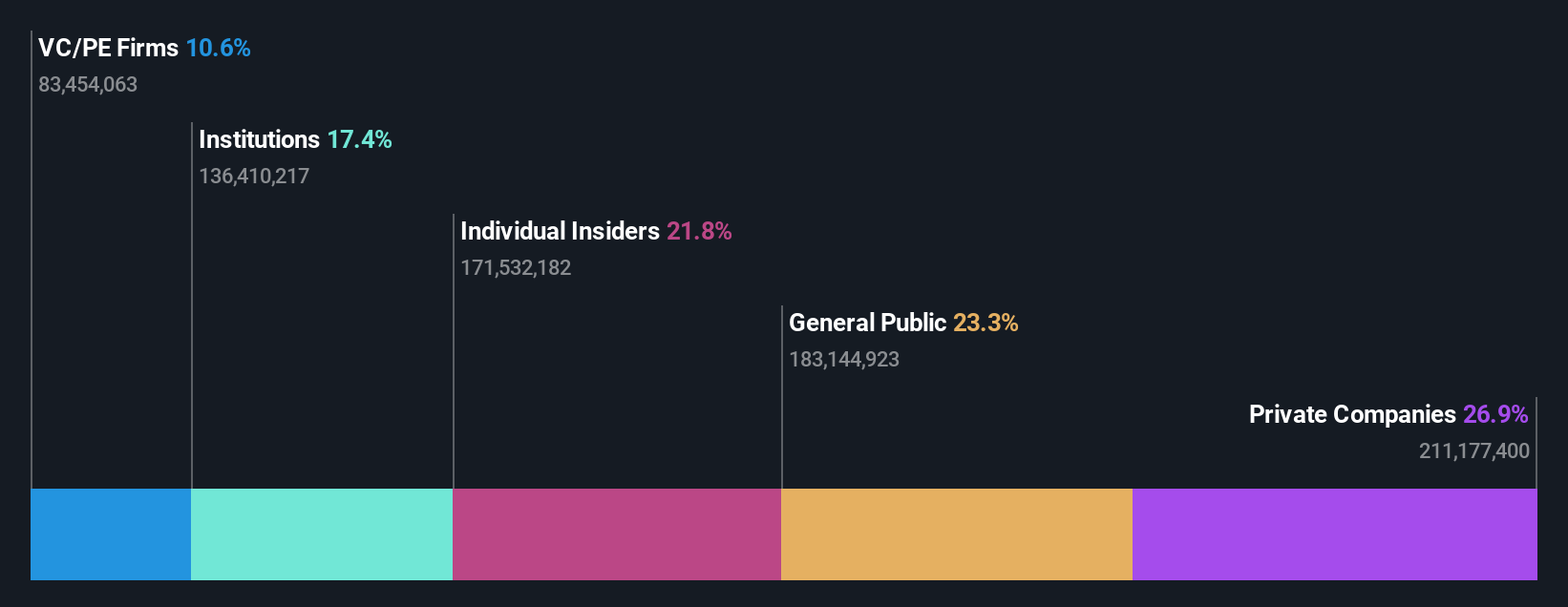

SG Micro (SZSE:300661)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SG Micro Corp designs, markets, and sells analog ICs primarily in China and has a market cap of CN¥32.69 billion.

Operations: SG Micro Corp's revenue from the Integrated Circuit Industry is CN¥3.04 billion.

Insider Ownership: 32.9%

Revenue Growth Forecast: 20.8% p.a.

SG Micro Corp. has forecasted annual earnings growth of 42% and revenue growth of 20.8%, both exceeding market averages. Recent board changes include the appointment of Du Meijie and Tang Chunlin as independent directors, alongside amendments to the company's articles of association. For the half year ended June 30, 2024, SG Micro reported sales of CNY 1.58 billion and net income of CNY 178.65 million, reflecting significant year-over-year increases in financial performance.

- Take a closer look at SG Micro's potential here in our earnings growth report.

- Our valuation report unveils the possibility SG Micro's shares may be trading at a premium.

Shenzhen New Industries Biomedical Engineering (SZSE:300832)

Simply Wall St Growth Rating: ★★★★★★

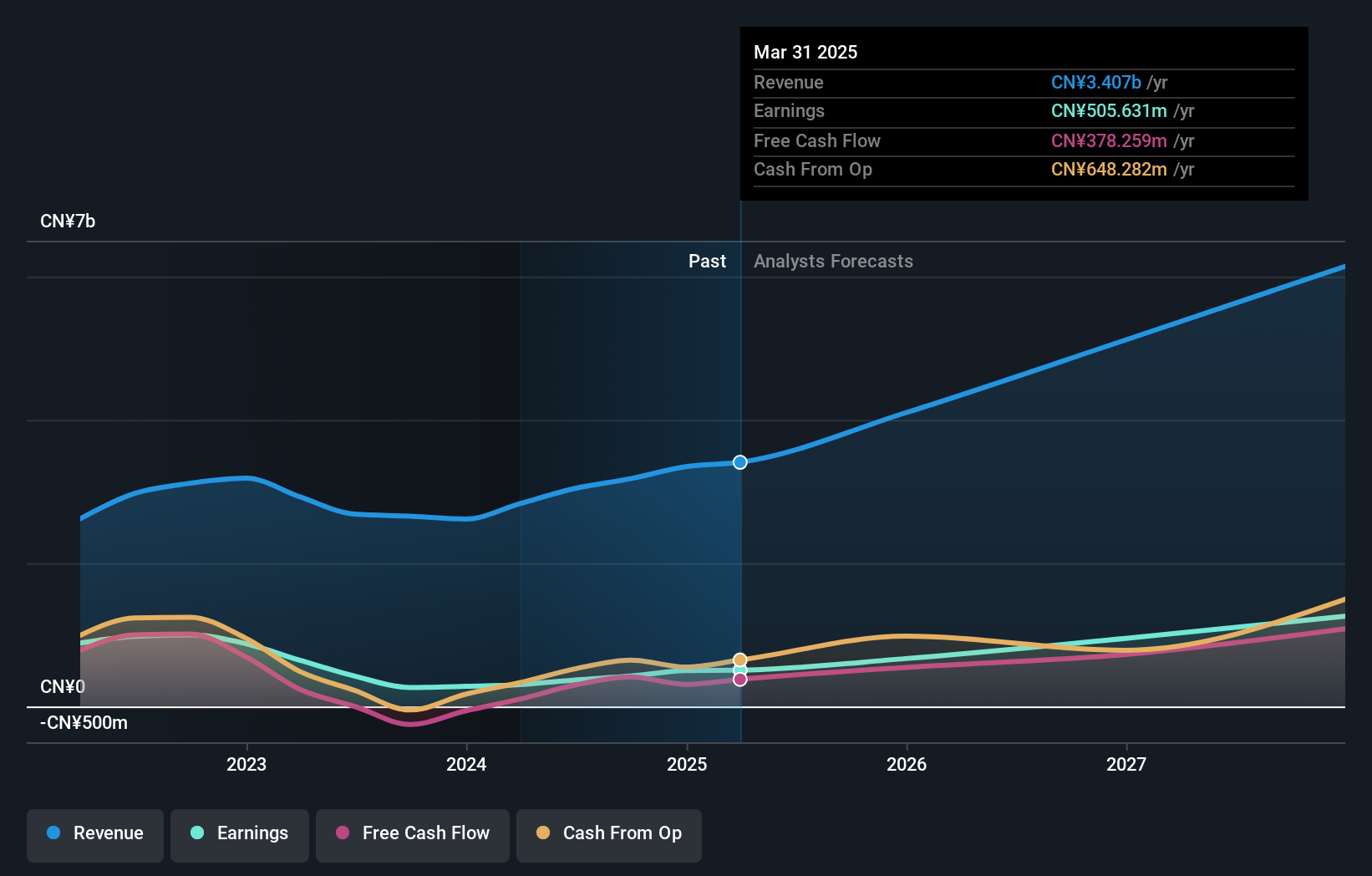

Overview: Shenzhen New Industries Biomedical Engineering Co., Ltd. (SZSE:300832) is a bio-medical company that focuses on the research, development, production, and sale of clinical laboratory instruments and in vitro diagnostic reagents to hospitals in China and internationally, with a market cap of CN¥53.85 billion.

Operations: The company generates revenue primarily from the sale of in vitro diagnostic products, amounting to CN¥4.28 billion.

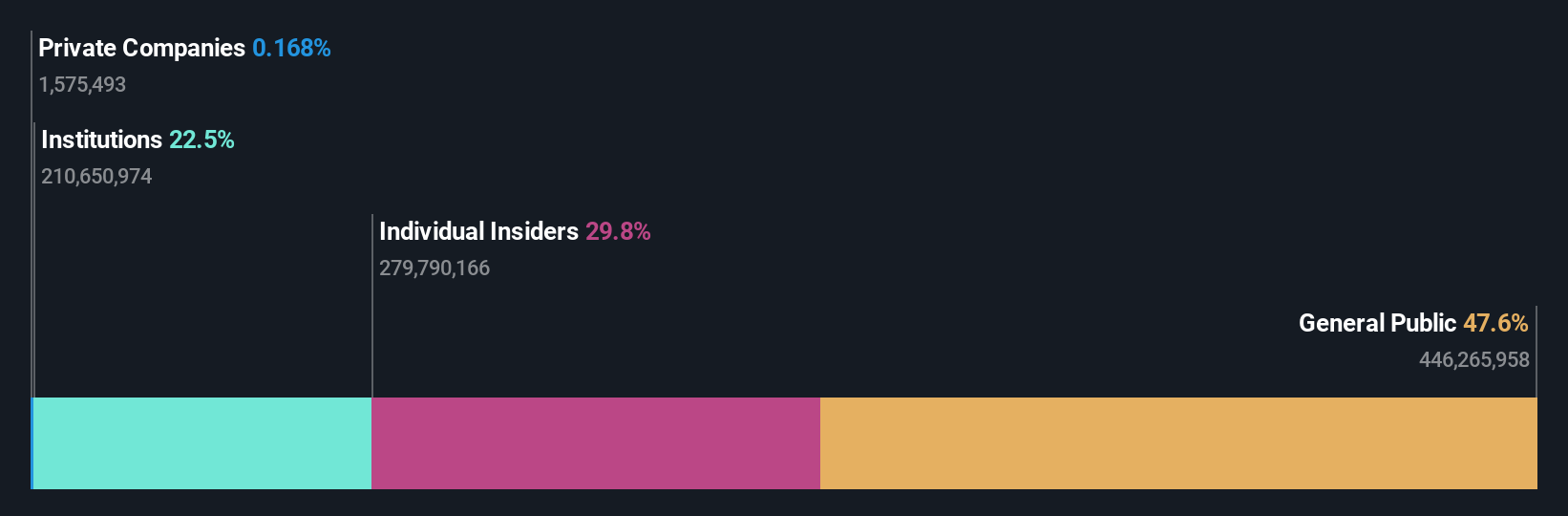

Insider Ownership: 18.7%

Revenue Growth Forecast: 22.8% p.a.

Shenzhen New Industries Biomedical Engineering forecasts annual earnings growth of 23.21% and revenue growth of 22.8%, both surpassing market averages. Recent board elections introduced new non-independent and independent directors, alongside amendments to the company's articles of association. For the half year ended June 30, 2024, the company reported sales of CNY 2.21 billion and net income of CNY 903.15 million, reflecting notable year-over-year increases in financial performance.

- Dive into the specifics of Shenzhen New Industries Biomedical Engineering here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential overvaluation of Shenzhen New Industries Biomedical Engineering shares in the market.

Next Steps

- Gain an insight into the universe of 1523 Fast Growing Companies With High Insider Ownership by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300832

Shenzhen New Industries Biomedical Engineering

Engages in the research, development, production, and sale of clinical laboratory instruments and in vitro diagnostic reagents to hospitals in China and internationally.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives