As tensions in the Middle East escalate, sending oil prices higher and impacting global markets, Asian indices have shown mixed performance with China's deflationary pressures and Japan's trade concerns taking center stage. In this environment of uncertainty, companies with high insider ownership can be appealing as they often signal confidence from those closest to the business; here we explore three such growth-oriented Asian firms.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 59.9% |

| Vuno (KOSDAQ:A338220) | 15.6% | 109.8% |

| Sineng ElectricLtd (SZSE:300827) | 36% | 26.9% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.3% | 23.5% |

| Schooinc (TSE:264A) | 30.6% | 68.9% |

| Samyang Foods (KOSE:A003230) | 11.7% | 24.3% |

| Oscotec (KOSDAQ:A039200) | 21.1% | 94.4% |

| M31 Technology (TPEX:6643) | 30.8% | 63.4% |

| Laopu Gold (SEHK:6181) | 35.5% | 40.3% |

| Fulin Precision (SZSE:300432) | 13.6% | 43% |

We'll examine a selection from our screener results.

Dongyue Group (SEHK:189)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Dongyue Group Limited is an investment holding company engaged in the manufacturing, distribution, and sale of polymers, organic silicone, refrigerants, dichloromethane, PVC, liquid alkali, and other products both in China and internationally with a market capitalization of approximately HK$17.12 billion.

Operations: The company's revenue is primarily derived from polymers (CN¥3.82 billion), refrigerants (CN¥5.52 billion), organic silicon (CN¥5.21 billion), and dichloromethane, PVC, and liquid alkali (CN¥1.13 billion).

Insider Ownership: 15.4%

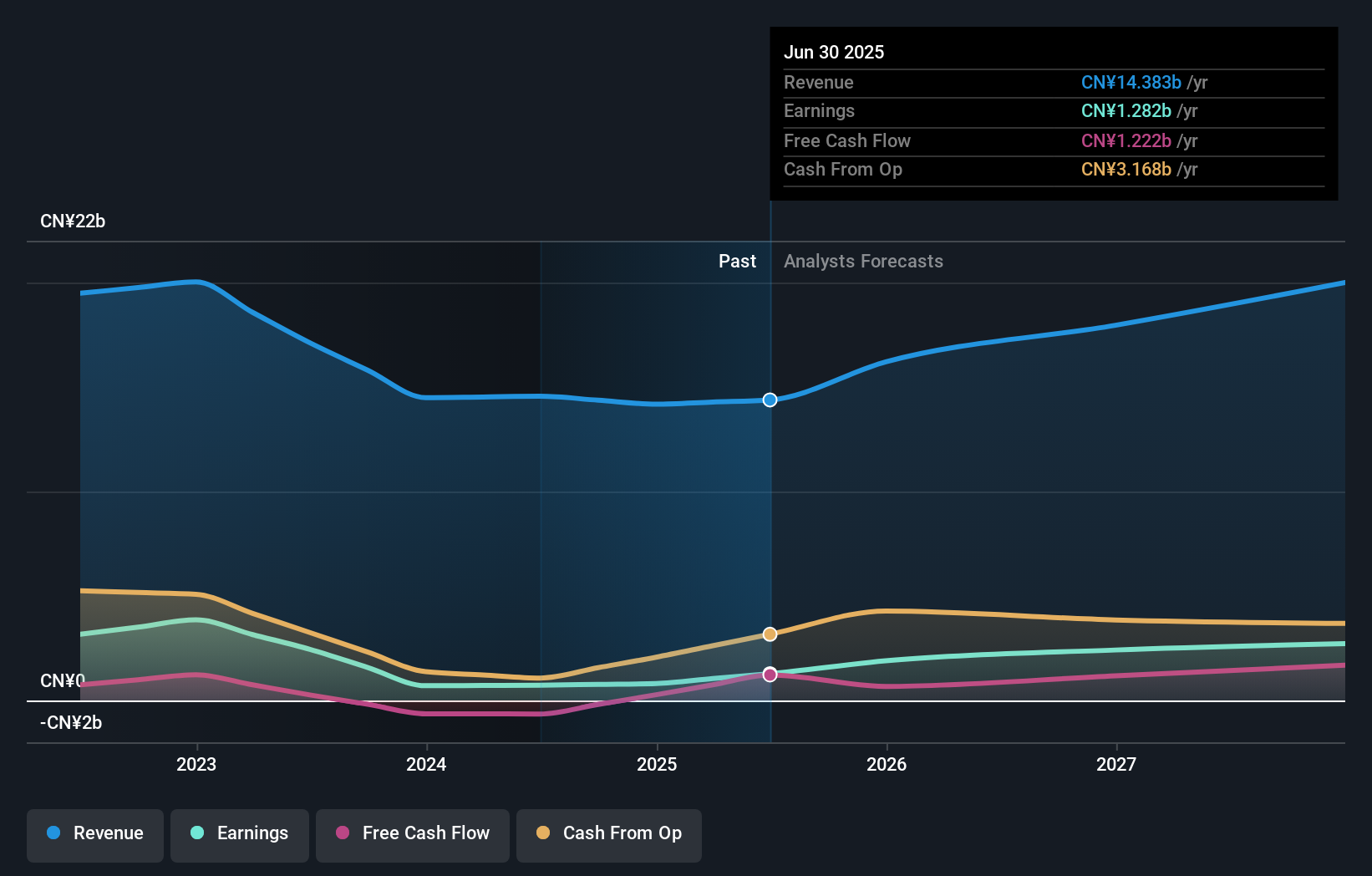

Dongyue Group, with substantial insider ownership, shows strong growth potential. Earnings are forecast to grow significantly at 31.3% annually, outpacing the Hong Kong market's 10.6%. Despite a slight decline in sales to CNY 14.18 billion for 2024, net income rose to CNY 810.8 million. The company declared a final dividend of HK$0.10 per share for the year ended December 2024, reflecting stable shareholder returns amidst growth prospects.

- Get an in-depth perspective on Dongyue Group's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that Dongyue Group is trading behind its estimated value.

Xi'an Actionpower Electric (SHSE:688719)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Xi'an Actionpower Electric Co., Ltd. focuses on the research, development, production, and sale of power supply and quality control equipment in China, with a market cap of CN¥4.74 billion.

Operations: Xi'an Actionpower Electric Co., Ltd.'s revenue is derived from the research, development, production, and sale of power supply and quality control equipment in China.

Insider Ownership: 31%

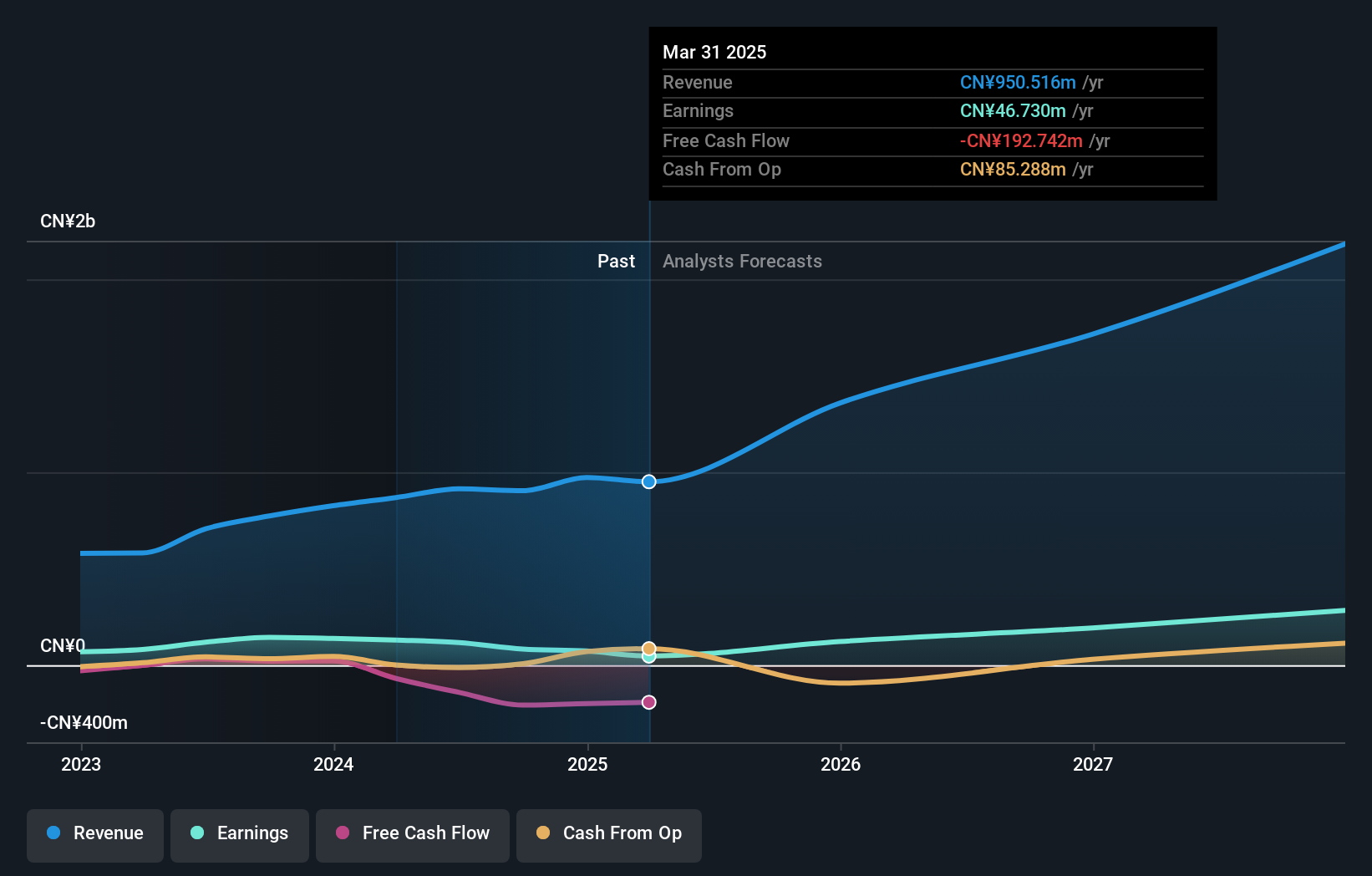

Xi'an Actionpower Electric, with substantial insider ownership, is poised for significant growth despite recent challenges. Earnings are expected to increase by 52% annually, surpassing the Chinese market average of 23.2%. However, the company reported a net loss of CNY 21.05 million in Q1 2025 compared to a net income last year. Revenue is projected to grow at 28.1% per year, driven by strategic buybacks totaling CNY 77.78 million completed recently.

- Dive into the specifics of Xi'an Actionpower Electric here with our thorough growth forecast report.

- According our valuation report, there's an indication that Xi'an Actionpower Electric's share price might be on the expensive side.

Shenzhen Capchem Technology (SZSE:300037)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Capchem Technology Co., Ltd. engages in the research, development, production, sale, and servicing of electronic chemicals and functional materials both in China and internationally, with a market cap of approximately CN¥25.75 billion.

Operations: Shenzhen Capchem Technology Co., Ltd. generates its revenue through the research, development, production, sale, and servicing of electronic chemicals and functional materials across domestic and international markets.

Insider Ownership: 39.7%

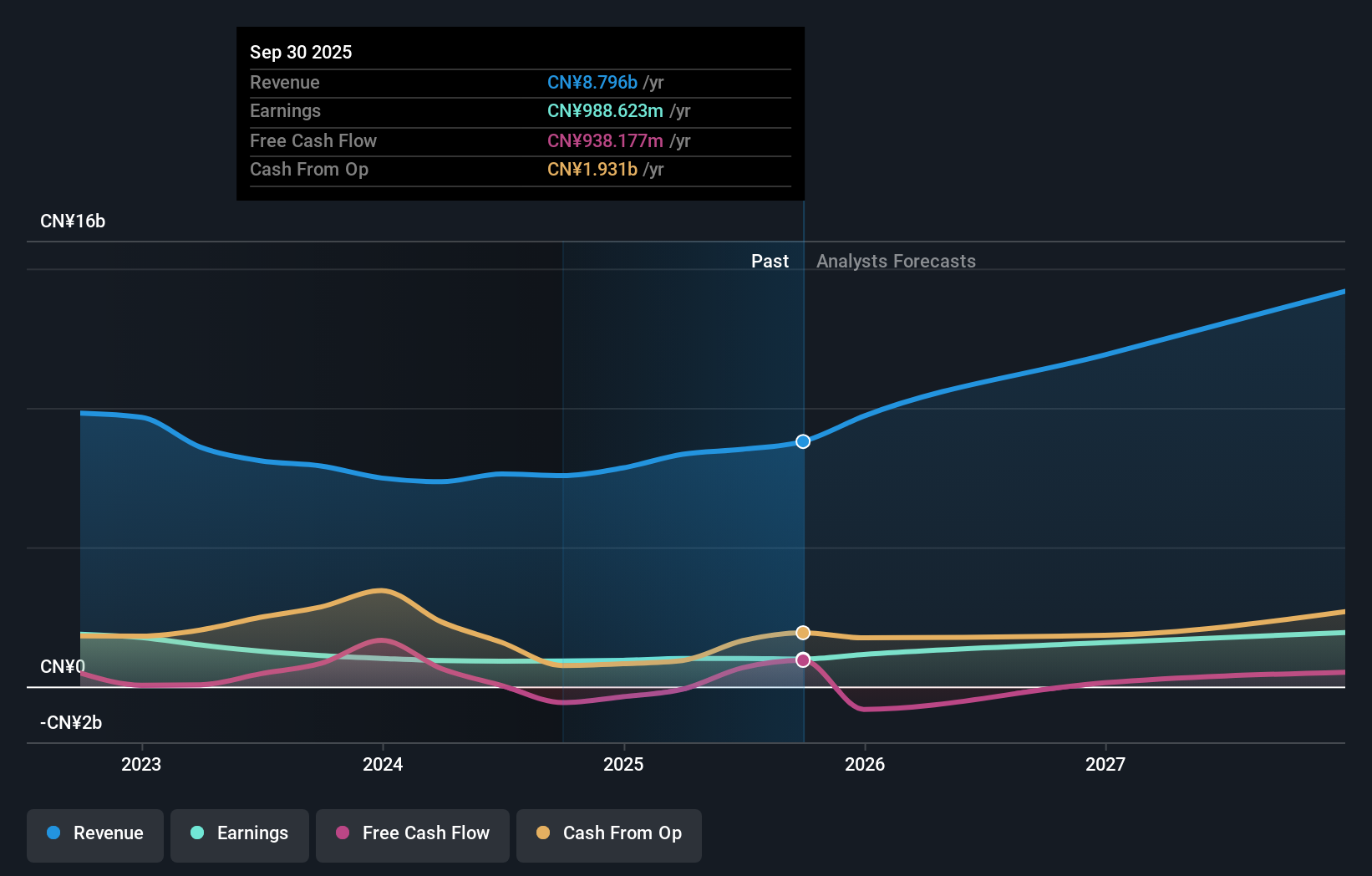

Shenzhen Capchem Technology, with strong insider ownership, demonstrates growth potential despite some challenges. Recent earnings show an 8.2% increase over the past year, with forecasts suggesting a 23.16% annual growth rate in earnings, outpacing the Chinese market average. The company completed a share buyback worth CNY 199.95 million by April 2025 and trades at a favorable price-to-earnings ratio of 25.6x compared to the market's 38.1x, indicating good relative value.

- Navigate through the intricacies of Shenzhen Capchem Technology with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Shenzhen Capchem Technology shares in the market.

Next Steps

- Discover the full array of 611 Fast Growing Asian Companies With High Insider Ownership right here.

- Want To Explore Some Alternatives? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300037

Shenzhen Capchem Technology

Researches and develops, produces, sells, and services electronic chemicals products and functional materials in China and internationally.

High growth potential with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives