- China

- /

- Basic Materials

- /

- SZSE:003037

Guangdong Sanhe Pile Co., Ltd.'s (SZSE:003037) Popularity With Investors Under Threat As Stock Sinks 26%

Guangdong Sanhe Pile Co., Ltd. (SZSE:003037) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 56% share price decline.

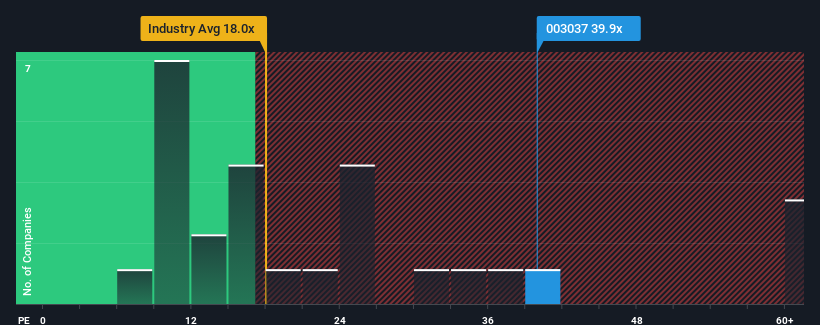

Even after such a large drop in price, Guangdong Sanhe Pile may still be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 39.9x, since almost half of all companies in China have P/E ratios under 30x and even P/E's lower than 18x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

For instance, Guangdong Sanhe Pile's receding earnings in recent times would have to be some food for thought. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. If not, then existing shareholders may be quite nervous about the viability of the share price.

Check out our latest analysis for Guangdong Sanhe Pile

Is There Enough Growth For Guangdong Sanhe Pile?

In order to justify its P/E ratio, Guangdong Sanhe Pile would need to produce impressive growth in excess of the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 42%. The last three years don't look nice either as the company has shrunk EPS by 79% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Comparing that to the market, which is predicted to deliver 38% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

With this information, we find it concerning that Guangdong Sanhe Pile is trading at a P/E higher than the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

What We Can Learn From Guangdong Sanhe Pile's P/E?

Despite the recent share price weakness, Guangdong Sanhe Pile's P/E remains higher than most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Guangdong Sanhe Pile currently trades on a much higher than expected P/E since its recent earnings have been in decline over the medium-term. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the high P/E lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

It is also worth noting that we have found 4 warning signs for Guangdong Sanhe Pile (1 is a bit unpleasant!) that you need to take into consideration.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:003037

Guangdong Sanhe Pile

Engages in the research and development, production, and sale of prestressed concrete pipe pile products in China.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives