Exploring 3 Undiscovered Gems in Asia with Strong Fundamentals

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by fluctuating inflation rates and geopolitical tensions, investors are increasingly turning their attention to Asia, where small-cap stocks present unique opportunities amidst broader market dynamics. In this environment, identifying stocks with strong fundamentals becomes crucial for those looking to capitalize on potential growth in emerging markets.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Toukei Computer | NA | 5.68% | 13.35% | ★★★★★★ |

| VICOM | NA | 5.01% | 2.30% | ★★★★★★ |

| ITOCHU-SHOKUHIN | NA | 1.17% | 14.31% | ★★★★★★ |

| Minmetals Development | 35.99% | 0.88% | -12.63% | ★★★★★★ |

| Yibin City Commercial Bank | 136.61% | 11.29% | 20.39% | ★★★★★★ |

| TOMONY Holdings | 58.26% | 7.99% | 14.24% | ★★★★★☆ |

| Shenzhen Fenda Technology | 46.59% | -5.72% | 55.87% | ★★★★★☆ |

| Pizu Group Holdings | 41.45% | -2.37% | -15.01% | ★★★★☆☆ |

| Sing Investments & Finance | 0.29% | 9.07% | 12.24% | ★★★★☆☆ |

| ShareHope Medicine | 36.85% | 2.73% | -7.82% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Nantong Jiangshan Agrochemical & ChemicalsLtd (SHSE:600389)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Nantong Jiangshan Agrochemical & Chemicals Co., Ltd. operates in the agrochemical and chemical industries, with a market cap of CN¥9.64 billion.

Operations: Nantong Jiangshan generates revenue primarily from its agrochemical and chemical products. The company has a market cap of CN¥9.64 billion, reflecting its scale in the industry.

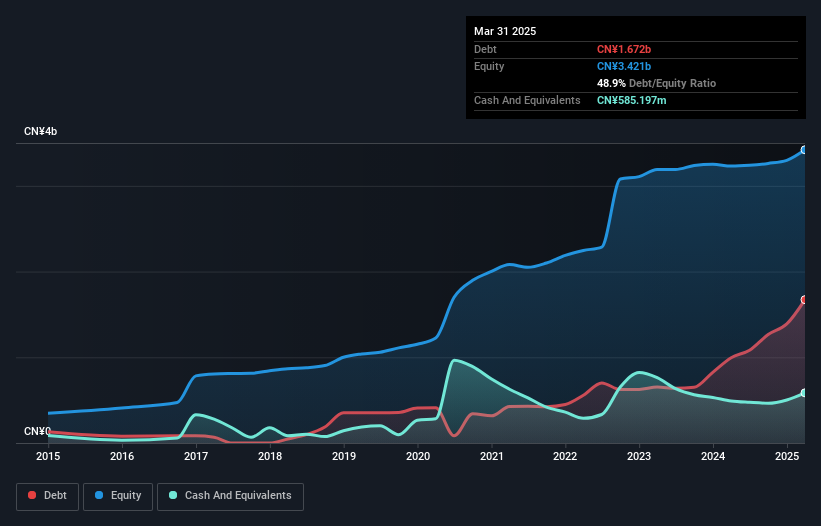

Nantong Jiangshan Agrochemical & Chemicals, a dynamic player in the chemicals industry, has seen its earnings grow by 23.2% over the past year, outpacing the industry's 3.5%. Despite a rise in debt-to-equity from 31.3% to 47.2% over five years, its net debt-to-equity ratio at 16.7% remains satisfactory. The company reported CNY 1,745 million in sales for Q1 2025 compared to CNY 1,585 million last year and net income of CNY 155 million versus CNY 82 million previously. With a P/E ratio of 32x below the CN market's average of 41x, it presents an intriguing valuation opportunity.

Nantong Haixing Electronics (SHSE:603115)

Simply Wall St Value Rating: ★★★★★★

Overview: Nantong Haixing Electronics Co., Ltd. focuses on the research, development, production, and sale of electrode foils for aluminum electrolytic capacitors in China with a market cap of CN¥4.70 billion.

Operations: Nantong Haixing Electronics generates revenue primarily from its electronic materials segment, with reported earnings of CN¥2.03 billion.

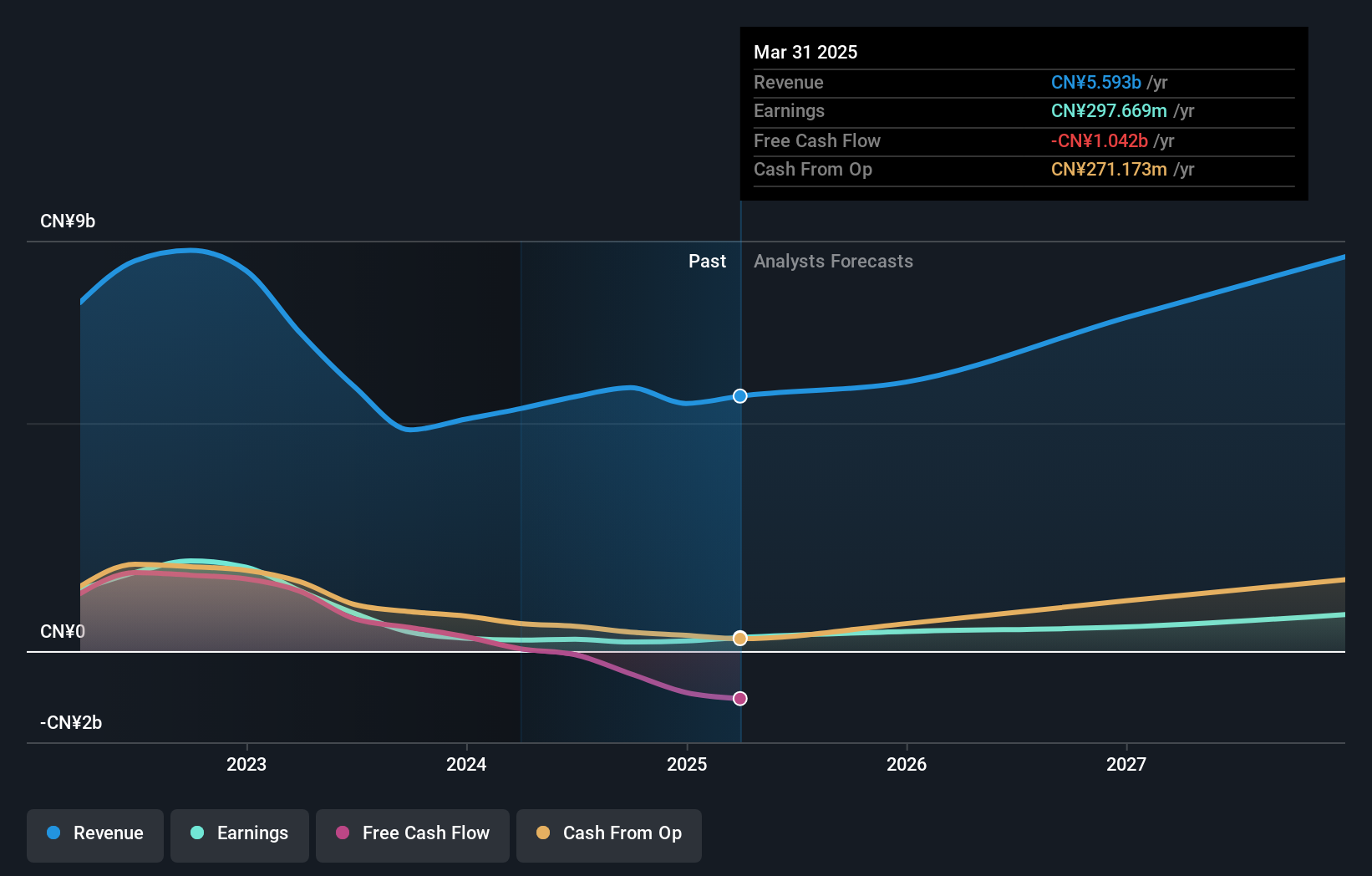

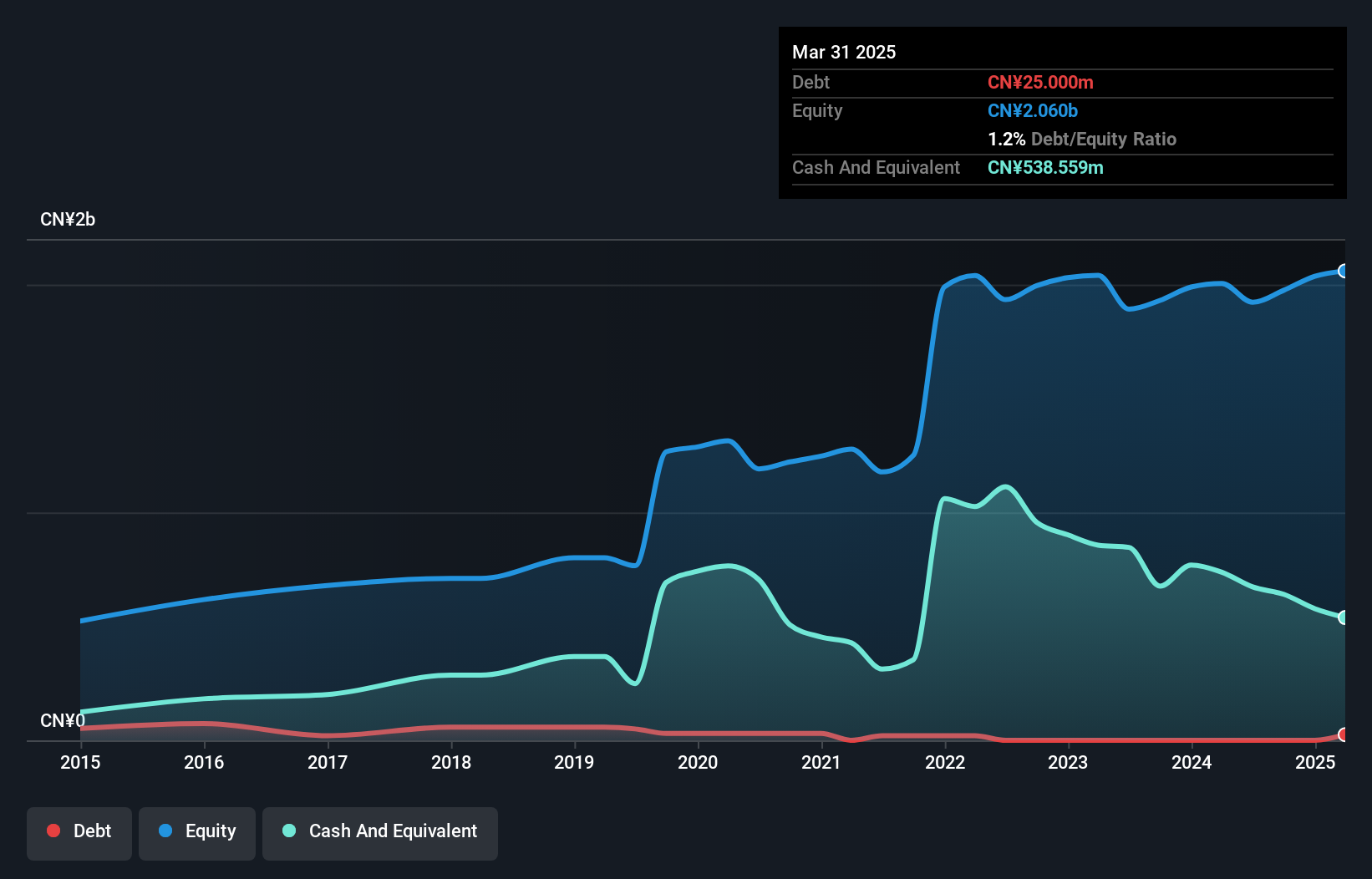

Nantong Haixing Electronics, a smaller player in the electronics sector, has shown impressive earnings growth of 20.8% over the past year, outpacing the industry average of -1.2%. The company's debt-to-equity ratio improved significantly from 2.3 to 1.2 over five years, indicating better financial health and management efficiency. Despite a price-to-earnings ratio of 27.9x being lower than China's market average of 41x, it seems there is potential value for investors here. However, with high levels of non-cash earnings and negative free cash flow recently recorded at -A$126 million in March 2025, careful consideration is advised when evaluating future prospects.

- Get an in-depth perspective on Nantong Haixing Electronics' performance by reading our health report here.

Gain insights into Nantong Haixing Electronics' past trends and performance with our Past report.

Shandong Dawn PolymerLtd (SZSE:002838)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shandong Dawn Polymer Co., Ltd. is engaged in the development, production, sale, and servicing of thermoplastic elastomers, modified plastics, master batches, and other products both in China and internationally with a market cap of CN¥10.51 billion.

Operations: Dawn Polymer generates revenue primarily from the sale of thermoplastic elastomers, modified plastics, and master batches. The company has a market cap of CN¥10.51 billion.

Shandong Dawn Polymer, a nimble player in the Asian market, showcases a mixed bag of financials. Its net debt to equity ratio stands at 29.2%, deemed satisfactory, while interest payments are comfortably covered by EBIT at 4.8 times. Despite earnings declining by an average of 38.6% annually over the last five years, recent growth of 6.6% outpaces industry averages and suggests resilience. The company reported Q1 sales of CNY 1,285 million and net income rose to CNY 44 million from CNY 35 million year-on-year, reflecting potential for recovery amidst broader challenges in free cash flow generation and capital expenditure management.

Taking Advantage

- Embark on your investment journey to our 2610 Asian Undiscovered Gems With Strong Fundamentals selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nantong Jiangshan Agrochemical & ChemicalsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600389

Nantong Jiangshan Agrochemical & ChemicalsLtd

Nantong Jiangshan Agrochemical & Chemicals Co.,Ltd.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives