In the current landscape, Asian markets are witnessing a nuanced interplay of economic indicators and market sentiment, with small-cap stocks often reflecting broader regional dynamics. As investors search for opportunities amidst these fluctuations, identifying promising small-cap companies can offer unique insights into potential growth areas. In this article, we explore three such undiscovered gems in Asia that stand out due to their innovative approaches and adaptability to evolving market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wuxi Double Elephant Micro Fibre MaterialLtd | 6.32% | 9.86% | 52.64% | ★★★★★★ |

| QuickLtd | 0.67% | 10.29% | 16.51% | ★★★★★★ |

| Araya Industrial | 17.96% | 3.77% | 10.32% | ★★★★★★ |

| Co-Tech Development | 3.46% | 0.29% | 2.02% | ★★★★★★ |

| Hong Leong Finance | 0.07% | 6.89% | 6.61% | ★★★★★☆ |

| Hunan Investment GroupLtd | 4.50% | 25.84% | 15.32% | ★★★★★☆ |

| Praise Victor Industrial | 85.87% | 1.77% | 44.52% | ★★★★★☆ |

| HannStar Board | 68.83% | -2.82% | -3.15% | ★★★★☆☆ |

| Silvery Dragon Prestressed MaterialsLTD Tianjin | 34.13% | 1.81% | 9.01% | ★★★★☆☆ |

| Qingdao Daneng Environmental Protection Equipment | 65.76% | 31.58% | 23.66% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Star Plus Legend Holdings (SEHK:6683)

Simply Wall St Value Rating: ★★★★★☆

Overview: Star Plus Legend Holdings Limited is an investment holding company operating in the retail and IP creation sectors in China, with a market capitalization of approximately HK$5.50 billion.

Operations: Star Plus Legend Holdings generates revenue primarily from its New Retail segment, which contributed CN¥269.75 million, and its IP Creation and Operation segment, with CN¥314.26 million. The net profit margin trend provides a key insight into the company's financial performance over time.

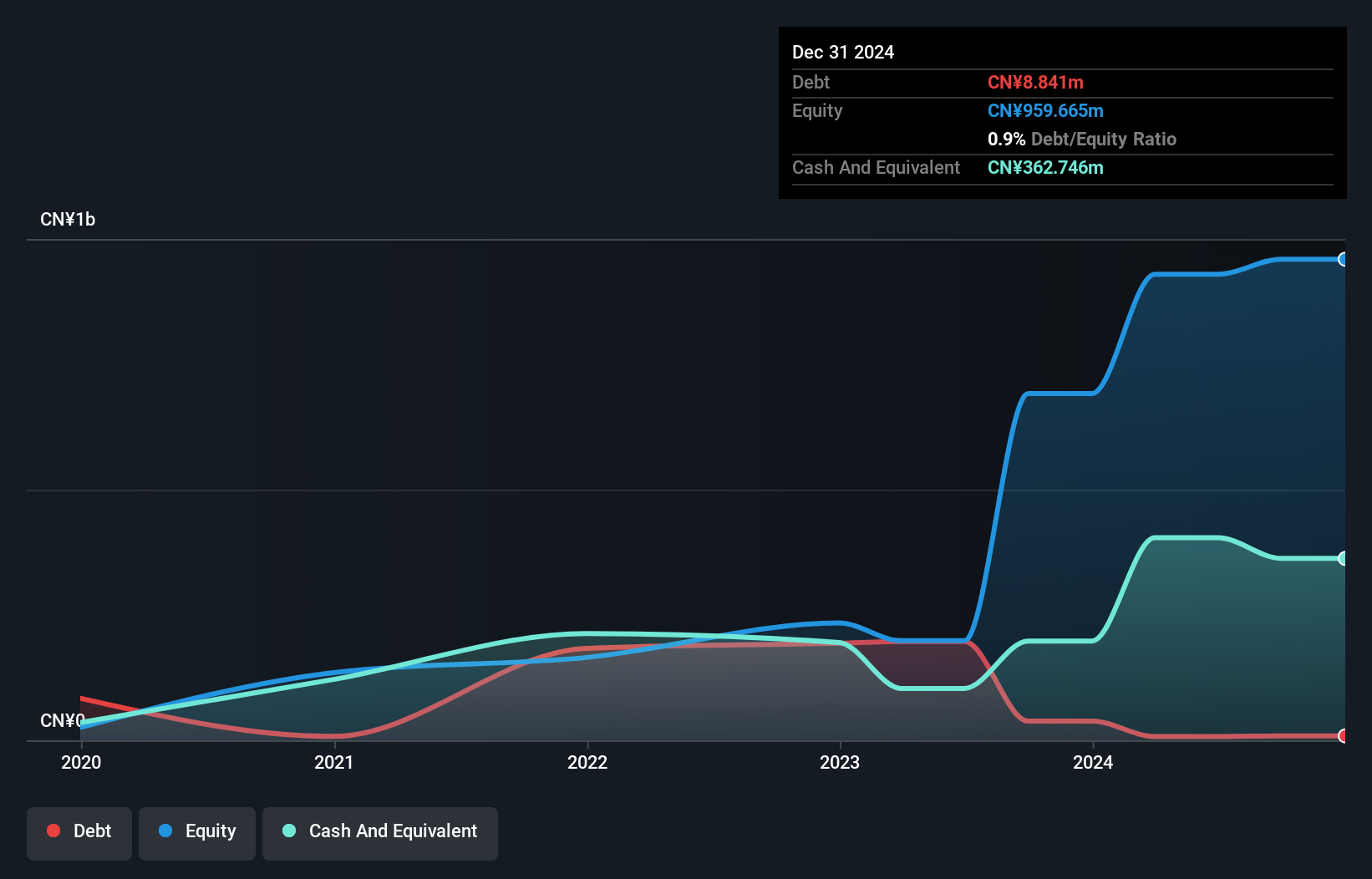

Star Plus Legend Holdings has demonstrated impressive earnings growth of 62.4% over the past year, outpacing the Food industry average of 18.8%. Despite this growth, its share price has been highly volatile in recent months. The company boasts a strong financial position with a debt-to-equity ratio reduced from 326.9% to just 0.9% over five years, indicating effective debt management. However, free cash flow remains negative at -US$58 million as of July 2025, suggesting challenges in generating cash despite profitability and high-quality non-cash earnings contributing to its robust performance metrics.

- Take a closer look at Star Plus Legend Holdings' potential here in our health report.

Evaluate Star Plus Legend Holdings' historical performance by accessing our past performance report.

Zhejiang Jingxin Pharmaceutical (SZSE:002020)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhejiang Jingxin Pharmaceutical Co., Ltd. is a company engaged in the research, development, production, and sale of pharmaceutical products with a market cap of CN¥12.48 billion.

Operations: Jingxin Pharmaceutical generates revenue primarily through the sale of pharmaceutical products. The company's net profit margin is 10.5%, reflecting its ability to manage costs effectively relative to its revenue.

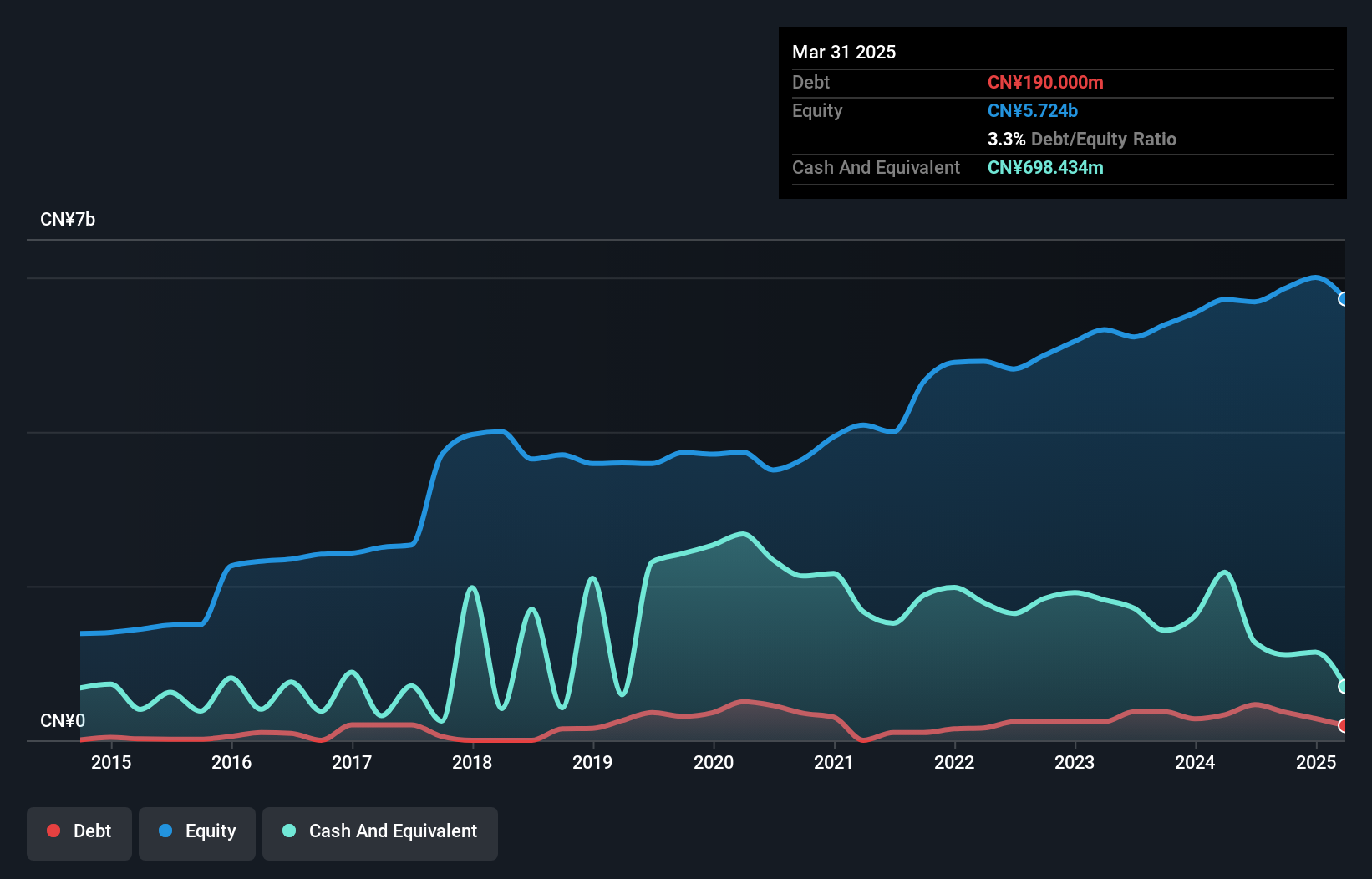

Zhejiang Jingxin Pharmaceutical, a promising player in the pharmaceutical sector, has shown resilience with earnings growth of 10.2% over the past year, outpacing the industry's -2.5%. The company enjoys high-quality earnings and maintains a debt-to-equity ratio that has improved from 13.4% to 3.3% over five years, indicating prudent financial management. Despite a slight dip in first-quarter sales to CNY 956 million from CNY 1 billion last year, net income remains robust at CNY 163 million. Trading at nearly half its estimated fair value suggests potential upside for investors seeking undervalued opportunities in Asia's dynamic markets.

Tibet GaoZheng Explosive (SZSE:002827)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Tibet GaoZheng Explosive Co., Ltd. is engaged in the production and sale of civil explosives and blasting products within China, with a market capitalization of CN¥9.87 billion.

Operations: Tibet GaoZheng Explosive generates revenue primarily through the sale of civil explosives and blasting products in China. The company's financial performance includes a focus on its net profit margin, which reflects its efficiency in converting revenue into actual profit.

Tibet GaoZheng Explosive, a modestly sized player in the chemicals sector, has shown remarkable earnings growth of 53.4% over the past year, outpacing its industry peers. The company's interest payments are comfortably covered by EBIT at 8.8 times, signaling robust financial health. Despite a rise in debt-to-equity from 18% to 92.8% over five years, it maintains a satisfactory net debt-to-equity ratio of 35.2%. Recent financials reveal revenue climbed to CNY 1.69 billion and net income reached CNY 148.17 million for the full year ending December 2024, with dividends set at CNY 0.80 per share for shareholders as of June this year.

- Unlock comprehensive insights into our analysis of Tibet GaoZheng Explosive stock in this health report.

Assess Tibet GaoZheng Explosive's past performance with our detailed historical performance reports.

Key Takeaways

- Dive into all 2605 of the Asian Undiscovered Gems With Strong Fundamentals we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Jingxin Pharmaceutical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002020

Zhejiang Jingxin Pharmaceutical

Zhejiang Jingxin Pharmaceutical Co., Ltd.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives