- China

- /

- Metals and Mining

- /

- SZSE:002824

Not Many Are Piling Into Guangdong Hoshion Industrial Aluminium Co., Ltd. (SZSE:002824) Just Yet

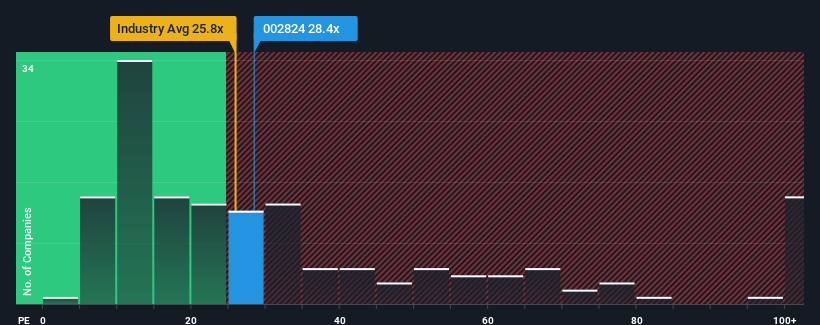

With a median price-to-earnings (or "P/E") ratio of close to 28x in China, you could be forgiven for feeling indifferent about Guangdong Hoshion Industrial Aluminium Co., Ltd.'s (SZSE:002824) P/E ratio of 28.4x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Guangdong Hoshion Industrial Aluminium could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

View our latest analysis for Guangdong Hoshion Industrial Aluminium

Is There Some Growth For Guangdong Hoshion Industrial Aluminium?

Guangdong Hoshion Industrial Aluminium's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Retrospectively, the last year delivered a frustrating 26% decrease to the company's bottom line. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the two analysts covering the company suggest earnings should grow by 28% each year over the next three years. That's shaping up to be materially higher than the 24% per annum growth forecast for the broader market.

With this information, we find it interesting that Guangdong Hoshion Industrial Aluminium is trading at a fairly similar P/E to the market. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Guangdong Hoshion Industrial Aluminium's P/E

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Guangdong Hoshion Industrial Aluminium currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Guangdong Hoshion Industrial Aluminium (at least 1 which doesn't sit too well with us), and understanding them should be part of your investment process.

If you're unsure about the strength of Guangdong Hoshion Industrial Aluminium's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002824

Guangdong Hoshion Industrial Aluminium

Guangdong Hoshion Industrial Aluminium Co., Ltd.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives