3 Asian Growth Companies With High Insider Ownership Expecting 82% Earnings Growth

Reviewed by Simply Wall St

As global markets navigate a landscape marked by easing trade tensions and mixed economic signals, Asia's stock markets are similarly influenced by these developments, with Chinese indices showing slight declines amidst ongoing trade discussions. In this environment, growth companies with high insider ownership can be attractive to investors due to their potential for robust earnings growth and the confidence insiders demonstrate through substantial personal stakes in the business.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Bethel Automotive Safety Systems (SHSE:603596) | 20.2% | 24.3% |

| Sineng ElectricLtd (SZSE:300827) | 36% | 29.0% |

| UTour Group (SZSE:002707) | 23.5% | 40.9% |

| Laopu Gold (SEHK:6181) | 36.4% | 40.2% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 44.2% |

| Schooinc (TSE:264A) | 26.6% | 68.9% |

| Oscotec (KOSDAQ:A039200) | 21.1% | 85.9% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 60.8% |

| Suzhou Gyz Electronic TechnologyLtd (SHSE:688260) | 16.4% | 121.7% |

Here we highlight a subset of our preferred stocks from the screener.

Zhejiang XCC GroupLtd (SHSE:603667)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zhejiang XCC Group Co., Ltd specializes in the research, development, manufacture, and sale of bearings across the United States, Japan, Korea, Brazil, and other international markets with a market cap of CN¥13.78 billion.

Operations: The company generates revenue primarily from the research, development, manufacturing, and sale of bearings across various international markets including the United States, Japan, Korea, and Brazil.

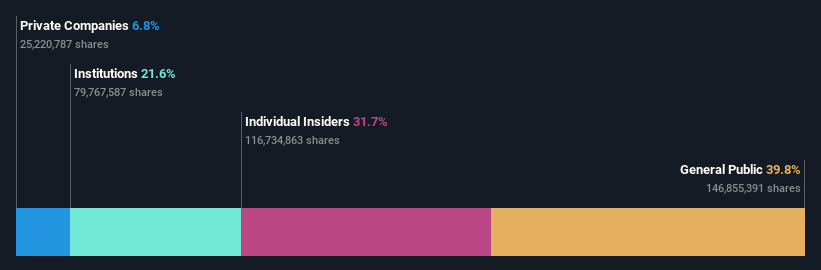

Insider Ownership: 31.7%

Earnings Growth Forecast: 28.5% p.a.

Zhejiang XCC Group Ltd is forecasted to experience significant annual earnings growth of 28.5% over the next three years, outpacing the Chinese market's 24%. Despite a volatile share price recently, its revenue growth of 14.2% per year surpasses the market average. Recent earnings showed stable net income at CNY 37.85 million for Q1 2025 with sales increasing to CNY 889.22 million, highlighting consistent operational performance amidst high insider ownership dynamics in Asia's growth sector.

- Navigate through the intricacies of Zhejiang XCC GroupLtd with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Zhejiang XCC GroupLtd is priced higher than what may be justified by its financials.

Shijiazhuang Yiling Pharmaceutical (SZSE:002603)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shijiazhuang Yiling Pharmaceutical Co., Ltd. operates in the pharmaceutical industry, focusing on the development and sale of traditional Chinese medicines, with a market cap of CN¥22.96 billion.

Operations: The company's revenue is primarily derived from its Pharmaceutical Manufacturing segment, which generated CN¥6.35 billion.

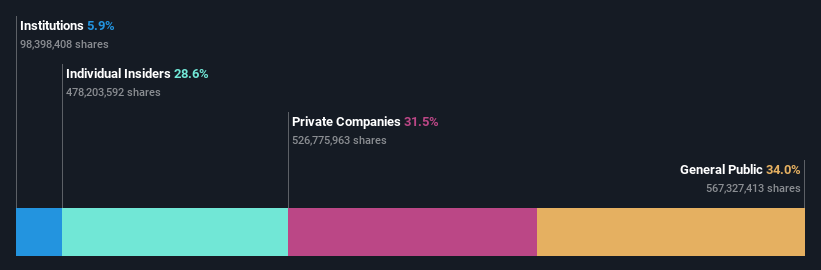

Insider Ownership: 28.6%

Earnings Growth Forecast: 59% p.a.

Shijiazhuang Yiling Pharmaceutical is expected to achieve robust revenue growth of 22.6% annually, surpassing the market's 12.6% pace, with earnings projected to grow at a substantial 59% per year. Despite a slight decline in Q1 sales to CNY 2.36 billion from CNY 2.52 billion, net income improved to CNY 325.95 million from CNY 303.93 million year-on-year, reflecting strong profitability potential as it transitions towards becoming profitable over the next three years.

- Unlock comprehensive insights into our analysis of Shijiazhuang Yiling Pharmaceutical stock in this growth report.

- Insights from our recent valuation report point to the potential overvaluation of Shijiazhuang Yiling Pharmaceutical shares in the market.

Yunnan Energy New Material (SZSE:002812)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Yunnan Energy New Material Co., Ltd., along with its subsidiaries, provides film products both in China and internationally, with a market cap of CN¥26.69 billion.

Operations: Yunnan Energy New Material Co., Ltd. generates revenue from its film products, serving both domestic and international markets.

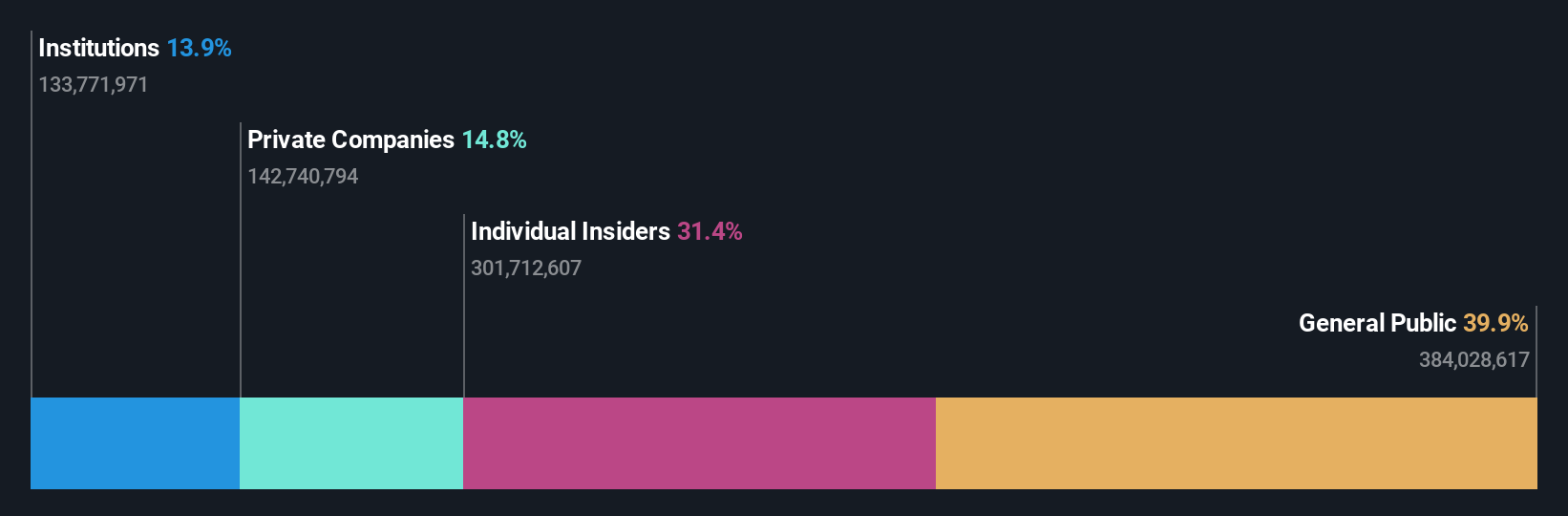

Insider Ownership: 30.8%

Earnings Growth Forecast: 82.3% p.a.

Yunnan Energy New Material's recent earnings reveal a challenging period, with Q1 2025 net income dropping to CNY 25.99 million from CNY 158.14 million the previous year, and a full-year 2024 net loss of CNY 556.32 million compared to prior profits. Despite these setbacks, the company is forecasted to achieve an above-market revenue growth rate of 19.6% annually and is projected to become profitable within three years, indicating potential for recovery amidst high insider ownership levels in Asia.

- Dive into the specifics of Yunnan Energy New Material here with our thorough growth forecast report.

- According our valuation report, there's an indication that Yunnan Energy New Material's share price might be on the cheaper side.

Next Steps

- Gain an insight into the universe of 628 Fast Growing Asian Companies With High Insider Ownership by clicking here.

- Curious About Other Options? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002603

Shijiazhuang Yiling Pharmaceutical

Shijiazhuang Yiling Pharmaceutical Co., Ltd.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives