Suzhou Hycan Holdings' (SZSE:002787 five-year decrease in earnings delivers investors with a 11% loss

Ideally, your overall portfolio should beat the market average. But even the best stock picker will only win with some selections. At this point some shareholders may be questioning their investment in Suzhou Hycan Holdings Co., Ltd. (SZSE:002787), since the last five years saw the share price fall 13%. The last month has also been disappointing, with the stock slipping a further 21%.

With the stock having lost 13% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

View our latest analysis for Suzhou Hycan Holdings

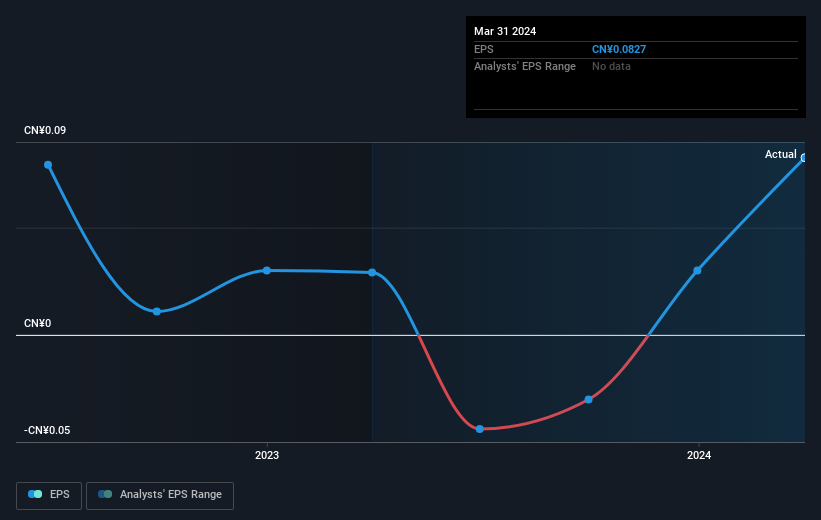

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the five years over which the share price declined, Suzhou Hycan Holdings' earnings per share (EPS) dropped by 12% each year. The share price decline of 3% per year isn't as bad as the EPS decline. So the market may previously have expected a drop, or else it expects the situation will improve. The high P/E ratio of 78.01 suggests that shareholders believe earnings will grow in the years ahead.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Suzhou Hycan Holdings' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About The Total Shareholder Return (TSR)?

We've already covered Suzhou Hycan Holdings' share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Its history of dividend payouts mean that Suzhou Hycan Holdings' TSR, which was a 11% drop over the last 5 years, was not as bad as the share price return.

A Different Perspective

Although it hurts that Suzhou Hycan Holdings returned a loss of 8.6% in the last twelve months, the broader market was actually worse, returning a loss of 10%. Given the total loss of 2% per year over five years, it seems returns have deteriorated in the last twelve months. While some investors do well specializing in buying companies that are struggling (but nonetheless undervalued), don't forget that Buffett said that 'turnarounds seldom turn'. It's always interesting to track share price performance over the longer term. But to understand Suzhou Hycan Holdings better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for Suzhou Hycan Holdings (of which 1 is a bit concerning!) you should know about.

But note: Suzhou Hycan Holdings may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002787

Suzhou Hycan Holdings

Engages in the research and development, design, production, and sale of packaging solutions in China and internationally.

Excellent balance sheet very low.