Undiscovered Gems with Potential To Explore This December 2024

Reviewed by Simply Wall St

As global markets navigate a landscape marked by record highs in major indexes and mixed performances in smaller-cap segments like the Russell 2000, investors are keenly observing economic indicators such as job growth and interest rate expectations that could sway market dynamics. In this environment of varied sector performance, identifying undiscovered gems requires a focus on stocks with strong fundamentals, potential for growth, and resilience to broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SHL Consolidated Bhd | NA | 16.14% | 19.01% | ★★★★★★ |

| PSC | 17.90% | 2.07% | 13.38% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Inverfal PerúA | 31.20% | 10.56% | 17.83% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Ningbo Lehui International Engineering EquipmentLtd (SHSE:603076)

Simply Wall St Value Rating: ★★★★☆☆

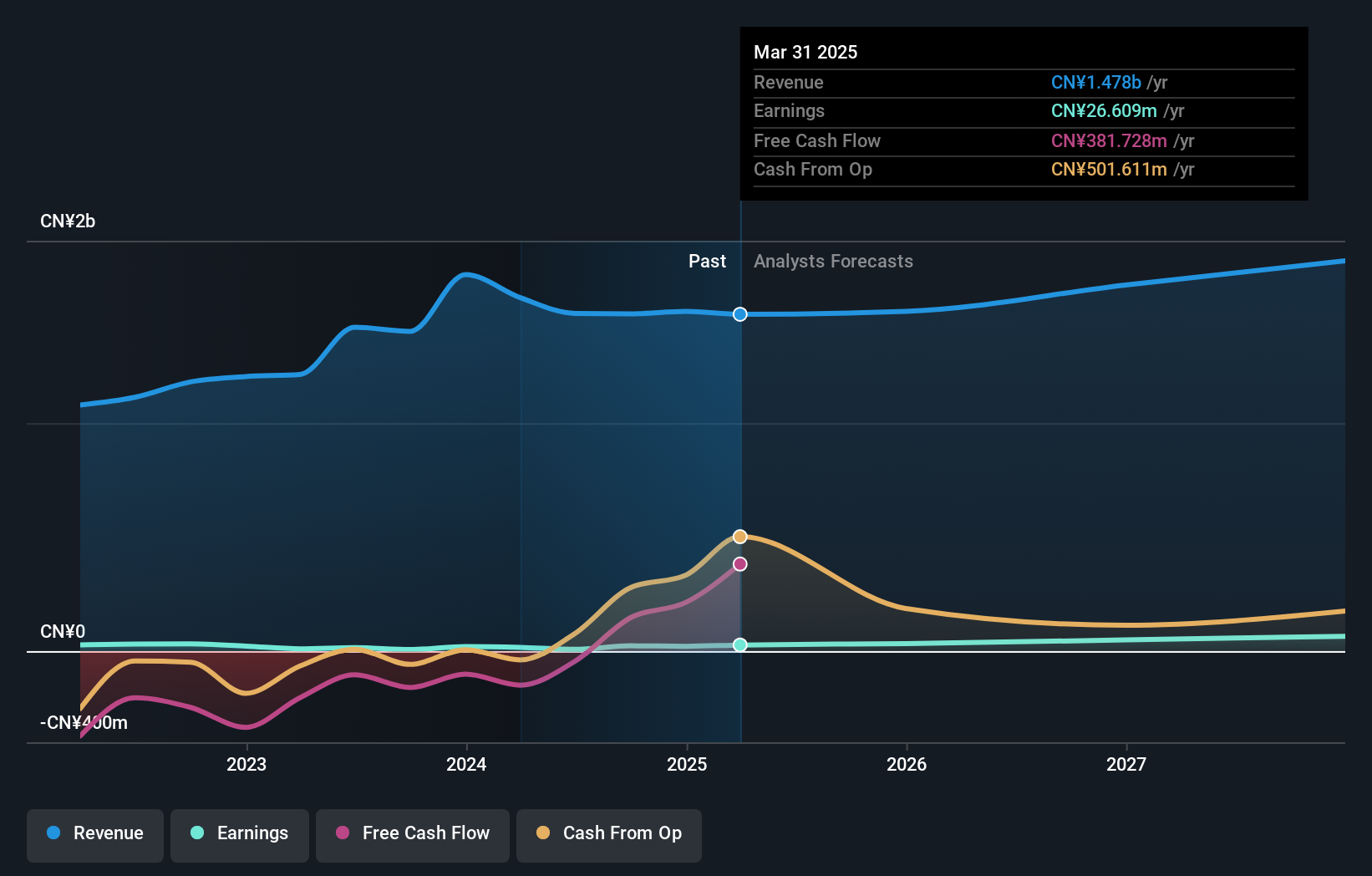

Overview: Ningbo Lehui International Engineering Equipment Co., Ltd. specializes in the manufacturing and engineering of equipment for the brewing, beverage, and food industries with a market cap of CN¥2.87 billion.

Operations: Ningbo Lehui generates revenue primarily from manufacturing equipment for the brewing, beverage, and food industries. The company's financial performance is highlighted by a net profit margin of 7.5%, reflecting its profitability within these sectors.

Ningbo Lehui International Engineering Equipment Co., Ltd, a smaller player in the machinery industry, has shown a robust earnings growth of 243% over the past year, significantly outpacing the industry's -0.4%. The company reported net income of CN¥40.53 million for the nine months ending September 2024, up from CN¥37.04 million last year, despite a drop in sales from CN¥1.12 billion to CN¥947.08 million. A satisfactory net debt to equity ratio of 18% indicates manageable leverage levels, although it has risen from 36.5% to 57.9% over five years, suggesting cautious monitoring is warranted moving forward.

Qingdao Gon Technology (SZSE:002768)

Simply Wall St Value Rating: ★★★★☆☆

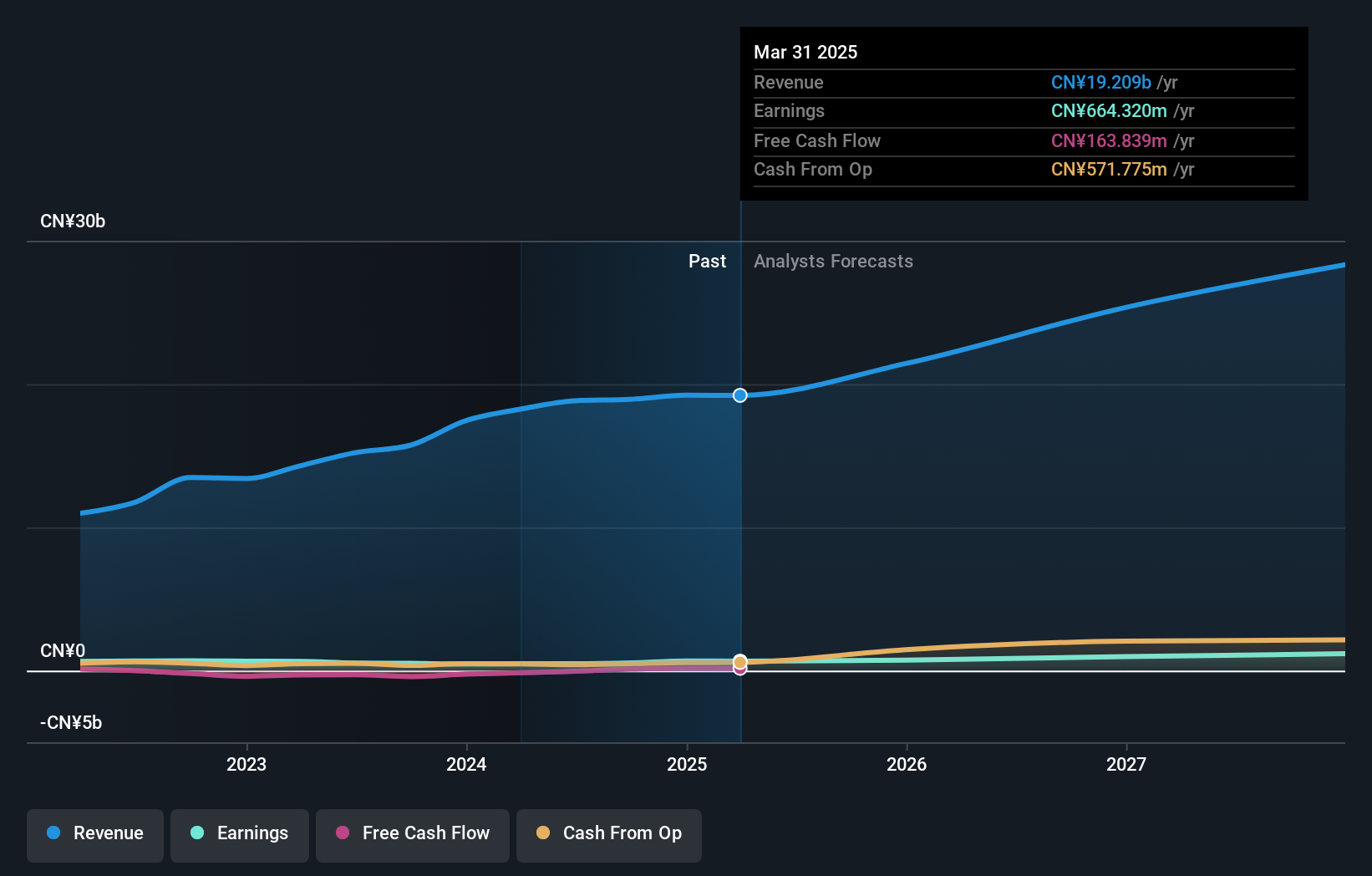

Overview: Qingdao Gon Technology Co., Ltd. focuses on the research, development, production, and sale of modified plastic particles and products as well as functional plastic plates both in China and internationally, with a market capitalization of CN¥6.17 billion.

Operations: Qingdao Gon Technology generates revenue primarily from the sale of modified plastic particles and functional plastic plates. The company has a market capitalization of CN¥6.17 billion.

Qingdao Gon Technology, a notable player in the chemicals sector, has been making waves with its robust financial performance. Its earnings for the first nine months of 2024 reached CNY 458.19 million, up from CNY 378.15 million last year. The company boasts high-quality earnings and trades at an attractive price-to-earnings ratio of 11.6x compared to the CN market's average of 37.2x, indicating good relative value against peers and industry standards. With a satisfactory net debt to equity ratio of 25%, it seems well-positioned financially despite an increase in debt over five years from 36.7% to 71.8%.

Takasago International (TSE:4914)

Simply Wall St Value Rating: ★★★★★★

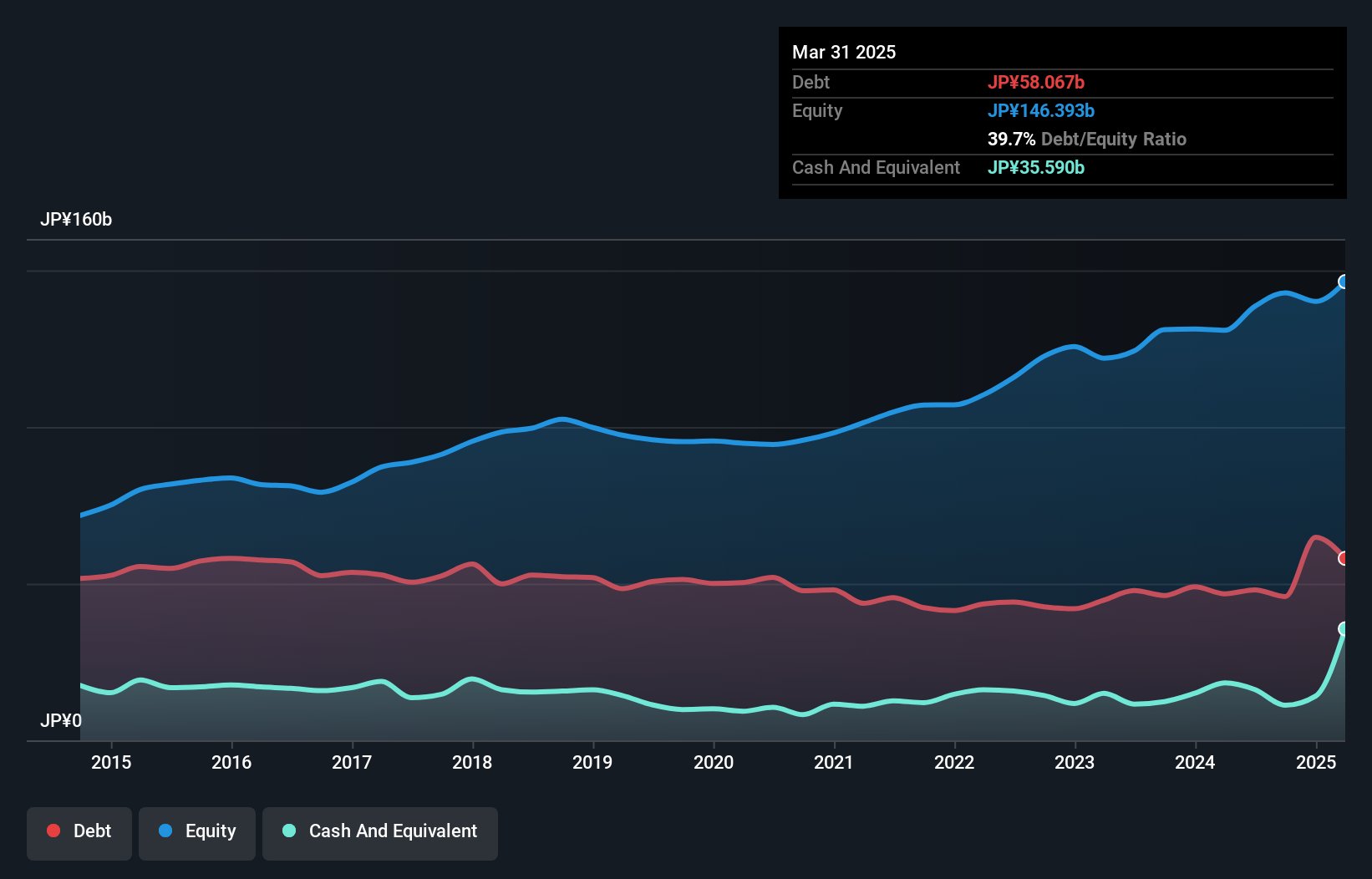

Overview: Takasago International Corporation specializes in the production and sale of flavors, fragrances, aroma ingredients, and other fine chemicals with a market capitalization of ¥107.59 billion.

Operations: Takasago International generates revenue primarily through its flavors, fragrances, aroma ingredients, and fine chemicals segments. The company's market capitalization is ¥107.59 billion.

Takasago International, a relatively small player in the chemicals industry, has been making waves with impressive financial strides. Earnings surged by 34% last year, outpacing the industry average of 14%, and showcasing high-quality earnings. The company has successfully reduced its debt to equity ratio from 54% to a satisfactory 32% over five years. Recent guidance for fiscal year ending March 2025 shows optimism with net sales expected at ¥220 billion and operating income projected at ¥10 billion, significantly higher than previous forecasts. Despite share price volatility recently, Takasago's robust performance hints at promising prospects ahead.

- Unlock comprehensive insights into our analysis of Takasago International stock in this health report.

Gain insights into Takasago International's past trends and performance with our Past report.

Summing It All Up

- Click this link to deep-dive into the 4644 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Lehui International Engineering EquipmentLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603076

Ningbo Lehui International Engineering EquipmentLtd

Ningbo Lehui International Engineering Equipment Co.,Ltd.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives