- China

- /

- Metals and Mining

- /

- SZSE:300963

Undiscovered Gems in Asia for July 2025

Reviewed by Simply Wall St

As global markets continue to experience fluctuations, the Asian market presents unique opportunities amid a backdrop of mixed economic indicators and evolving trade dynamics. With smaller-cap indexes showing robust performance in recent weeks, investors are increasingly turning their attention to lesser-known stocks that could offer potential growth in this dynamic region. Identifying promising stocks often involves looking for companies with strong fundamentals and the ability to adapt within their respective industries, particularly as they navigate current market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| YAPP Automotive Systems | 1.38% | -1.99% | -0.31% | ★★★★★★ |

| Sinotherapeutics | NA | 25.52% | -7.66% | ★★★★★★ |

| Shenzhen Coship Electronics | NA | 8.20% | 44.45% | ★★★★★★ |

| Anhui Guqi Down & Feather Textile | 30.32% | 21.48% | 23.11% | ★★★★★★ |

| Qingdao Eastsoft Communication TechnologyLtd | NA | 5.88% | -20.71% | ★★★★★★ |

| Nanjing Well Pharmaceutical GroupLtd | 28.52% | 11.19% | 6.51% | ★★★★★☆ |

| Techshine ElectronicsLtd | 8.66% | 23.58% | 16.34% | ★★★★★☆ |

| KNJ | 80.14% | 9.45% | 44.19% | ★★★★★☆ |

| Anhui Wanyi Science and TechnologyLtd | 12.18% | 14.34% | -21.44% | ★★★★★☆ |

| Guangdong Tloong Technology GroupLtd | 39.59% | -7.11% | -21.90% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Cisen Pharmaceutical (SHSE:603367)

Simply Wall St Value Rating: ★★★★★★

Overview: Cisen Pharmaceutical Co., Ltd. engages in the research, development, production, and sale of drug products both in China and internationally, with a market capitalization of approximately CN¥7.07 billion.

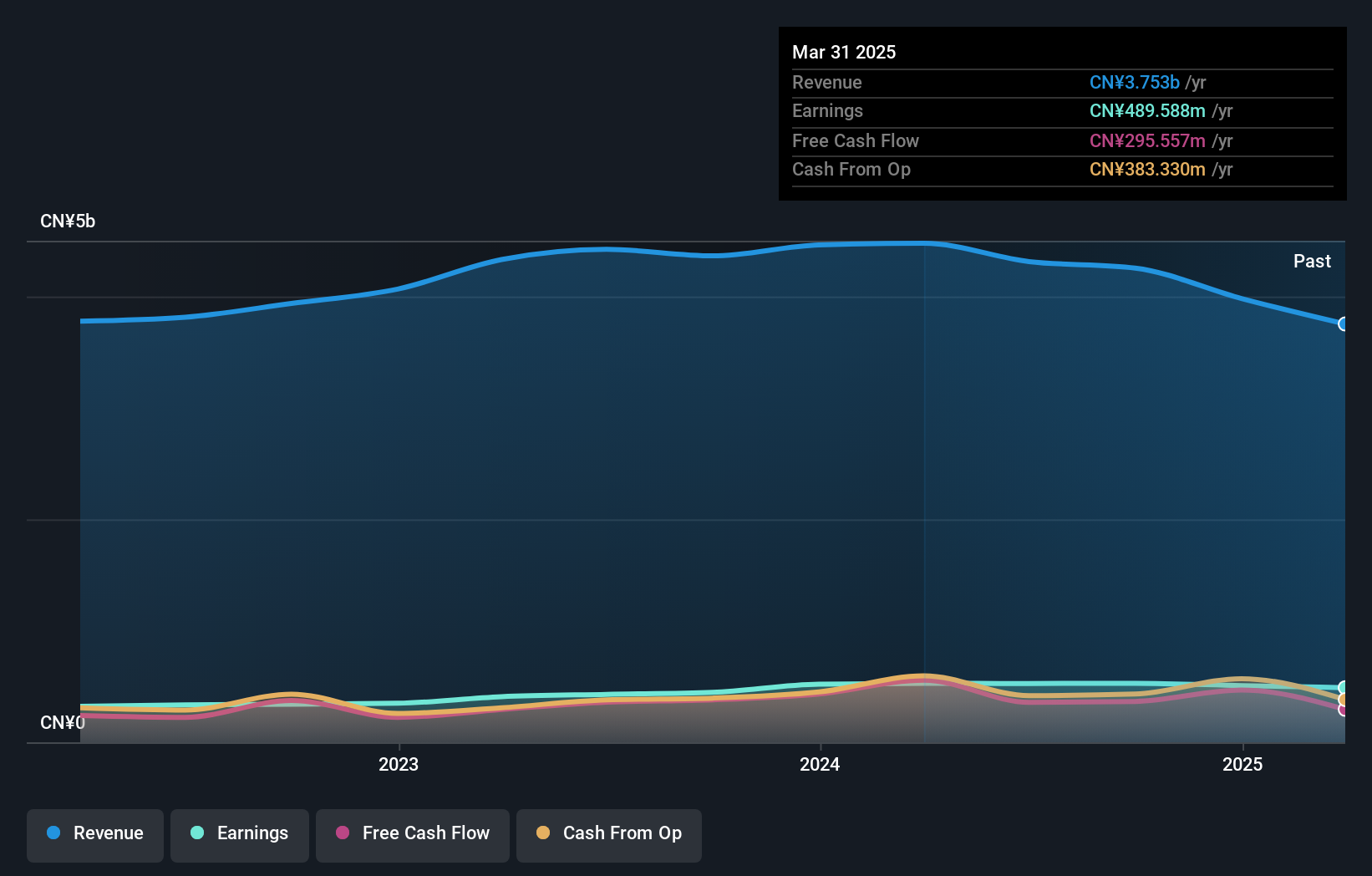

Operations: Cisen generates revenue primarily from its pharmaceutical manufacturing segment, which reported CN¥3.75 billion. The company focuses on drug production, with financial performance closely tied to this core activity.

Cisen Pharmaceutical, a small cap player in the Asian market, has faced some challenges recently. Their debt to equity ratio impressively dropped from 6.5% to 0.2% over five years, indicating strong financial management. Despite this, earnings growth was negative at -7.3%, lagging behind the industry average of -2.5%. The company reported annual sales of CNY 3.97 billion for 2024, down from CNY 4.45 billion the previous year, with net income slightly decreasing to CNY 508 million from CNY 521 million last year. These figures suggest a need for strategic adjustments in their operations moving forward.

- Delve into the full analysis health report here for a deeper understanding of Cisen Pharmaceutical.

Evaluate Cisen Pharmaceutical's historical performance by accessing our past performance report.

Qingdao Gon Technology (SZSE:002768)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Qingdao Gon Technology Co., Ltd. focuses on the research, development, production, and sale of modified plastic particles and products as well as functional plastic plates both in China and internationally, with a market cap of CN¥7.79 billion.

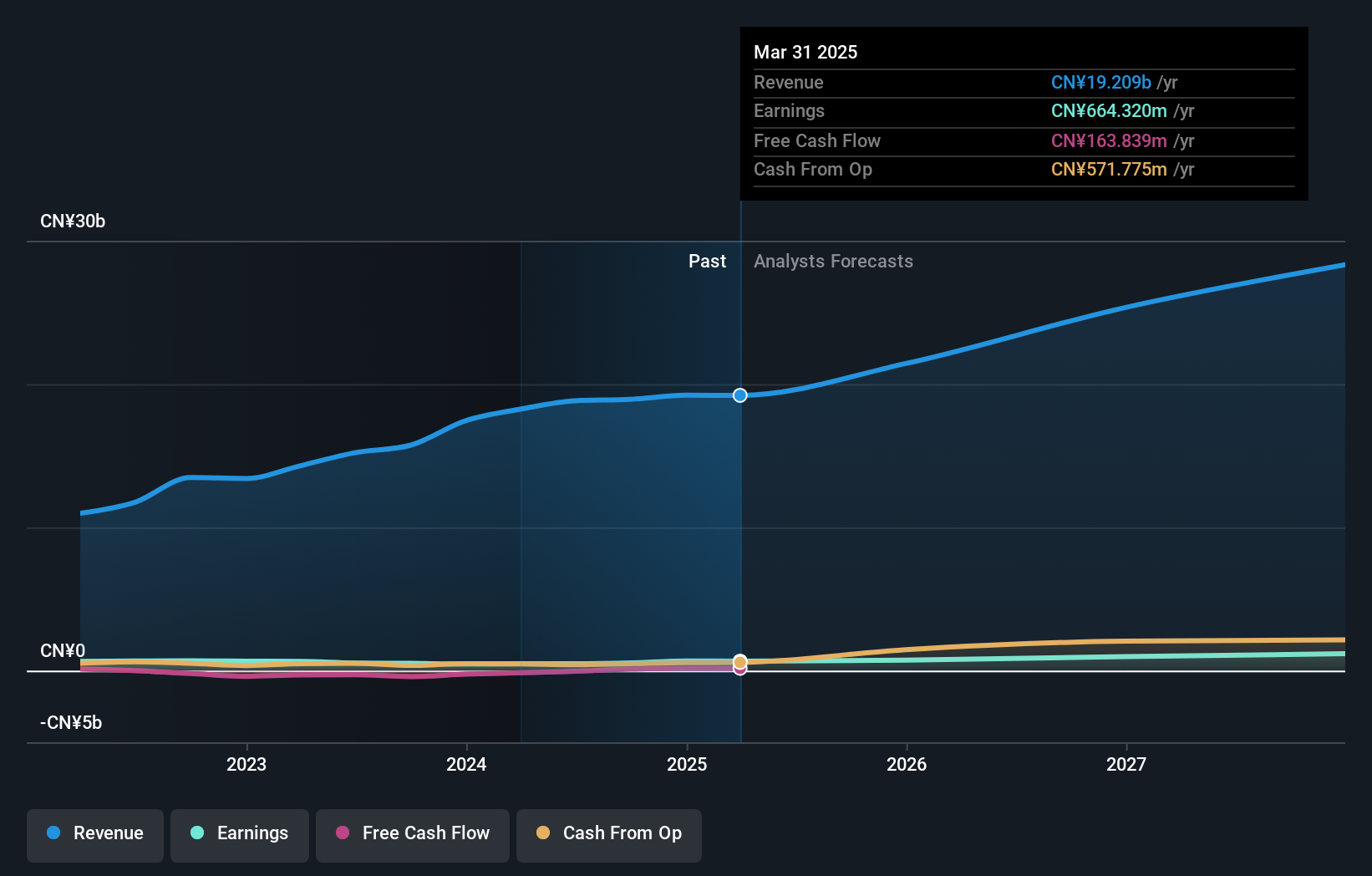

Operations: Qingdao Gon Technology generates revenue from the sale of modified plastic particles and functional plastic plates. The company's net profit margin has shown variability, reflecting changes in cost structure and market conditions.

Qingdao Gon Technology, a nimble player in the chemicals industry, showcases an enticing profile with its price-to-earnings ratio at 11.7x, markedly lower than the CN market's 39.4x. The company has demonstrated robust earnings growth of 36.6% over the past year, outpacing the industry average of 4%. A notable one-off gain of ¥149 million influenced recent financial results, yet Qingdao remains on solid footing with interest payments well-covered by EBIT at 6.4x and a satisfactory net debt to equity ratio of 33.7%. Recent dividend approval further underscores shareholder value focus amidst evolving corporate governance structures.

- Take a closer look at Qingdao Gon Technology's potential here in our health report.

Assess Qingdao Gon Technology's past performance with our detailed historical performance reports.

Shanghai Zhongzhou Special Alloy Materials (SZSE:300963)

Simply Wall St Value Rating: ★★★★★★

Overview: Shanghai Zhongzhou Special Alloy Materials Co., Ltd. operates in the special alloy materials industry and has a market capitalization of CN¥10.92 billion.

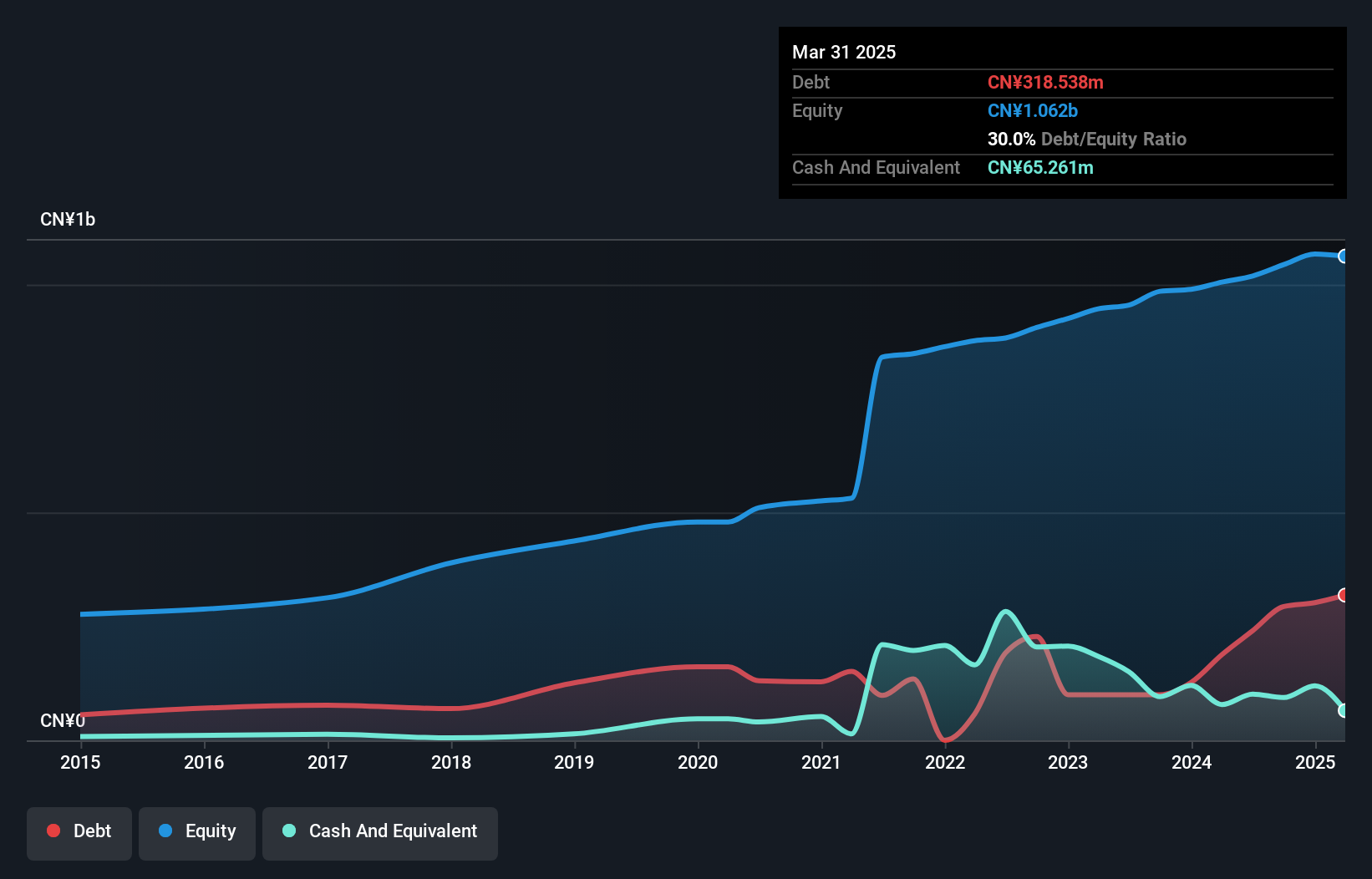

Operations: Shanghai Zhongzhou Special Alloy Materials generates revenue primarily through its special alloy materials segment. The company's net profit margin has shown fluctuations, with recent figures around 15%.

Shanghai Zhongzhou Special Alloy Materials, a nimble player in the metals and mining sector, has shown impressive earnings growth of 21.2% over the past year, outpacing the industry's -4.1%. With interest payments well covered at 17.2 times by EBIT and a satisfactory net debt to equity ratio of 23.8%, financial stability seems solid. However, free cash flow remains negative, which could be a concern for some investors. Recent changes include amendments to company bylaws and an upcoming stock split set for June 2025, indicating strategic shifts that may influence future performance positively or negatively depending on execution effectiveness.

Taking Advantage

- Access the full spectrum of 2612 Asian Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300963

Shanghai Zhongzhou Special Alloy Materials

Shanghai Zhongzhou Special Alloy Materials Co., Ltd.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives