In a week marked by busy earnings reports and economic data, global markets experienced volatility, with major indices like the S&P MidCap 400 and Nasdaq Composite reaching highs before retreating. Amidst this backdrop, small-cap stocks demonstrated resilience compared to their larger counterparts, highlighting the potential for undiscovered gems in a balanced portfolio. Identifying such stocks often involves looking for companies with solid fundamentals that can weather macroeconomic uncertainties and capitalize on niche opportunities within their sectors.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| Padma Oil | 0.87% | -0.90% | 3.72% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Pro-Hawk | 20.47% | -3.86% | -2.71% | ★★★★★☆ |

| Jetwell Computer | 57.20% | 6.93% | 24.36% | ★★★★★☆ |

| TBS Energi Utama | 77.67% | 4.11% | -2.54% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

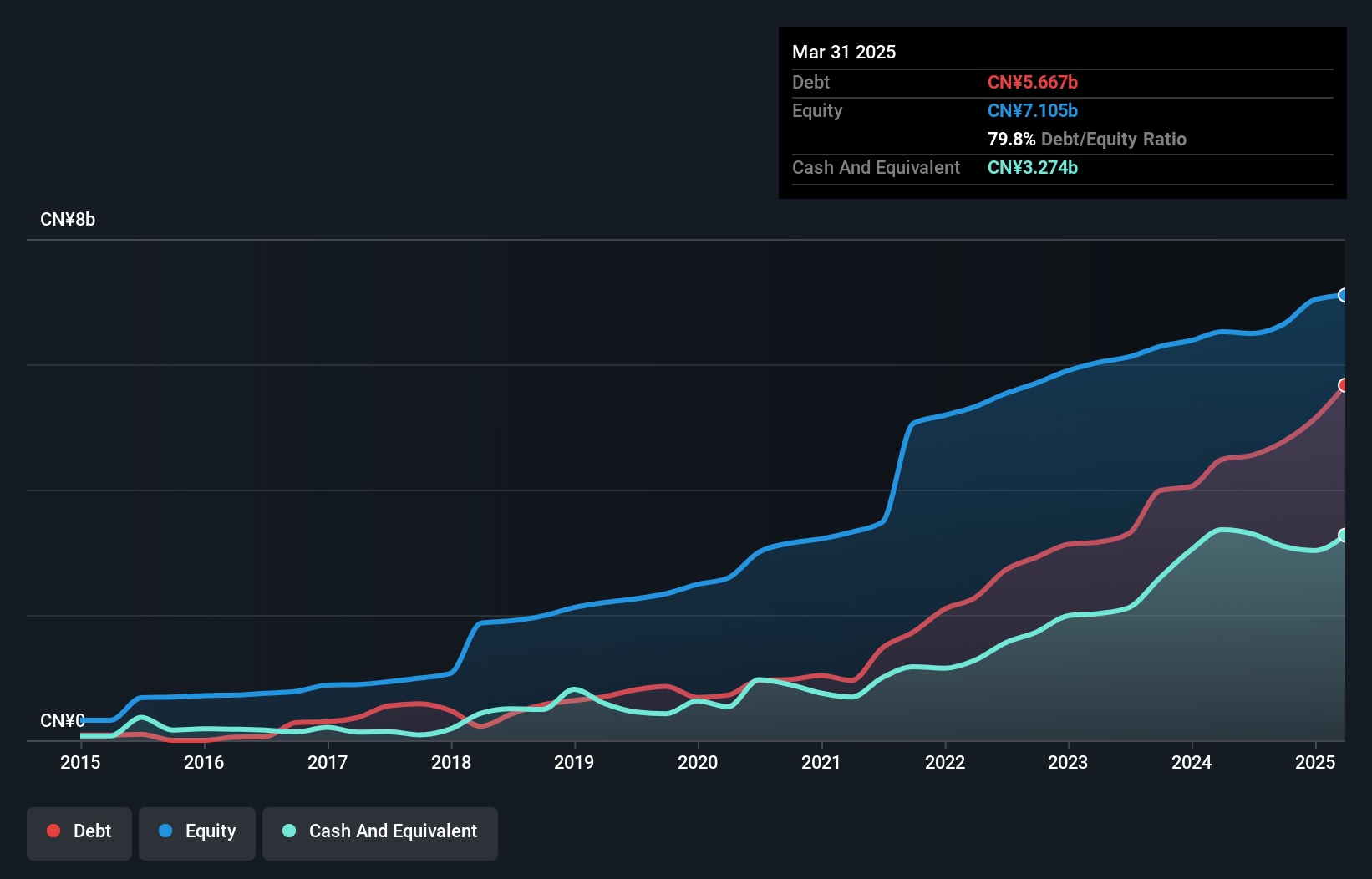

Qingdao Gon Technology (SZSE:002768)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Qingdao Gon Technology Co., Ltd. focuses on the research and development, production, and sale of modified plastic particles and products, as well as functional plastic plates in China and internationally, with a market cap of CN¥6.16 billion.

Operations: Qingdao Gon Technology generates revenue primarily from the sale of modified plastic particles and functional plastic plates. The company experienced fluctuations in its gross profit margin, which was 20% in the most recent period.

Qingdao Gon Technology, a promising player in the chemicals sector, has shown robust earnings growth of 7.9% over the past year, outpacing the industry average of -3.8%. The company is trading at an attractive price-to-earnings ratio of 11.3x compared to the broader CN market's 34.4x, suggesting good value relative to peers. Qingdao Gon's recent financials reflect a solid performance with sales reaching CNY 14.16 billion and net income at CNY 458 million for nine months ending September 2024. Additionally, it completed a share buyback of about 2.31% for CNY 130 million this year, enhancing shareholder value.

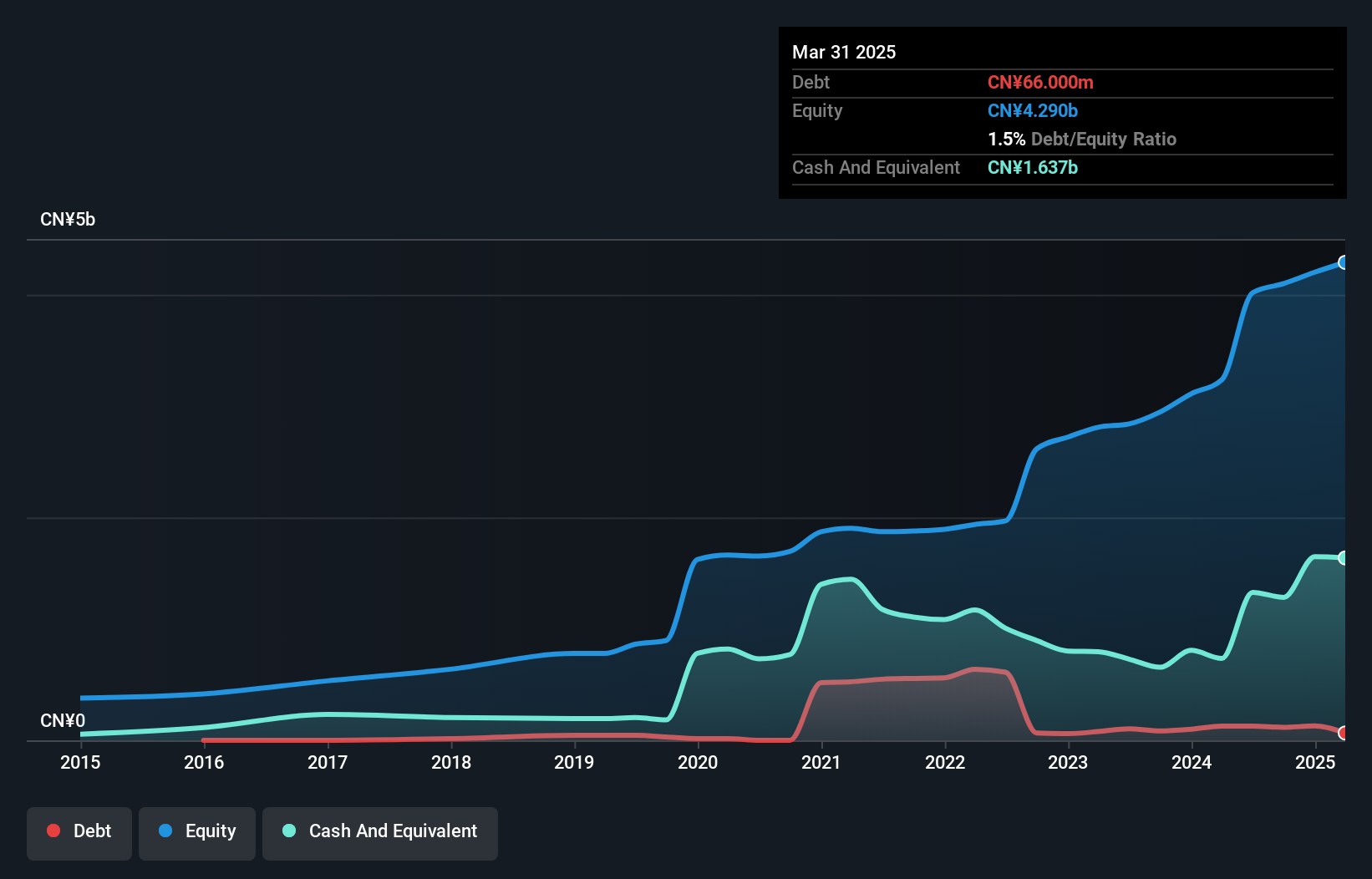

Lucky Harvest (SZSE:002965)

Simply Wall St Value Rating: ★★★★★☆

Overview: Lucky Harvest Co., Ltd. focuses on the research, development, production, and sale of precision stamping dies and structural metal parts in China with a market capitalization of CN¥6.27 billion.

Operations: Lucky Harvest generates revenue primarily from the sale of precision stamping dies and structural metal parts. The company's financial performance is influenced by its ability to manage production costs effectively, impacting its net profit margin.

Lucky Harvest, a dynamic player in its sector, has shown impressive sales growth with CNY 4.88 billion for the first nine months of 2024, up from CNY 3.91 billion the previous year. Despite this sales boost, net income slightly decreased to CNY 269 million from CNY 277 million. The company's earnings per share also saw a minor dip to CNY 1.46 from last year's CNY 1.56. While shareholders experienced some dilution over the past year, Lucky Harvest remains an attractive value proposition with a price-to-earnings ratio of just under half the CN market average at 15.7x, suggesting potential for future appreciation in value.

- Navigate through the intricacies of Lucky Harvest with our comprehensive health report here.

Understand Lucky Harvest's track record by examining our Past report.

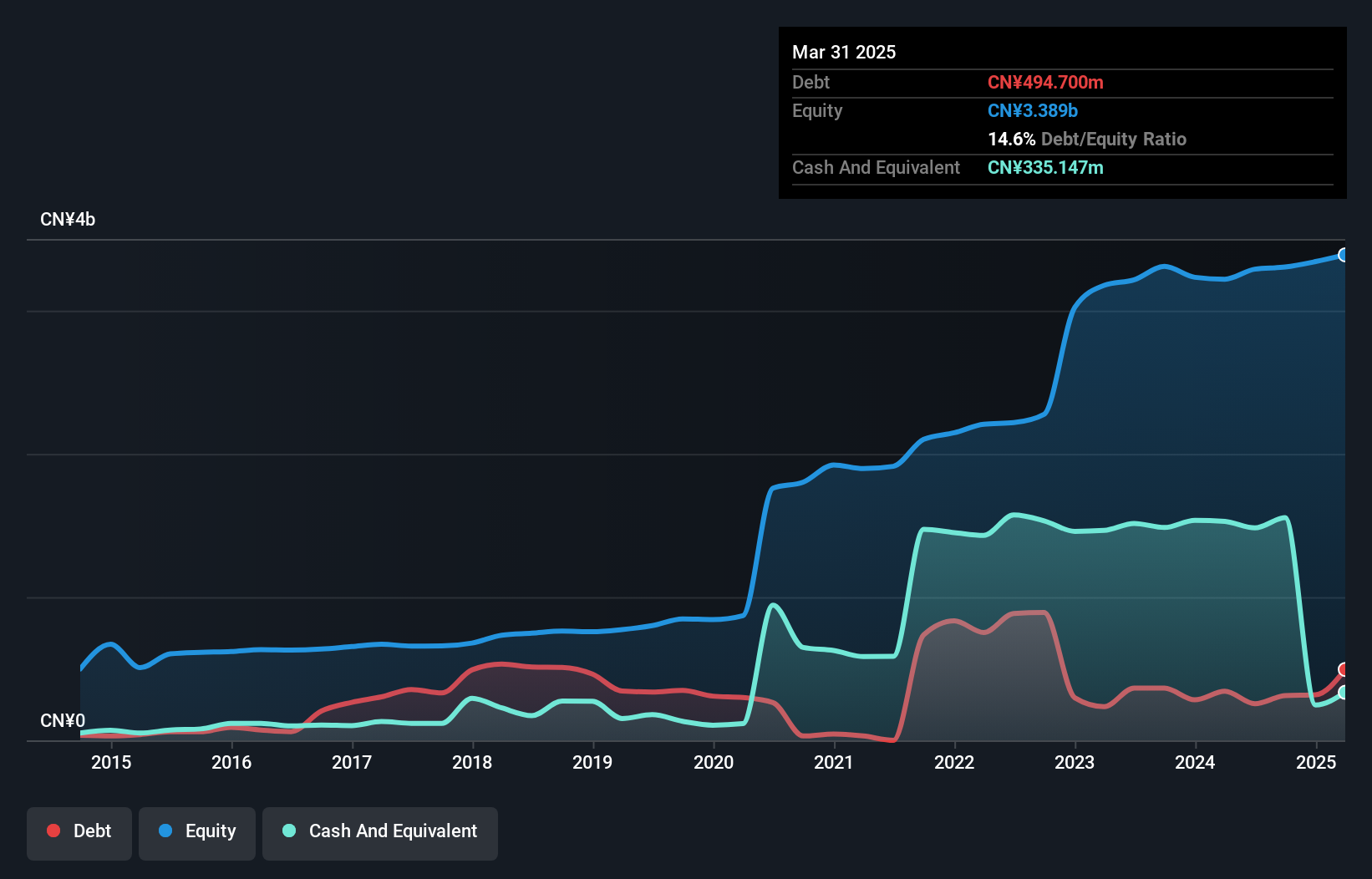

Fujian Yuanli Active CarbonLtd (SZSE:300174)

Simply Wall St Value Rating: ★★★★★★

Overview: Fujian Yuanli Active Carbon Co., Ltd. is a company that manufactures and sells activated carbon in China, with a market capitalization of CN¥6.20 billion.

Operations: Yuanli Active Carbon generates its revenue primarily from the sale of activated carbon products. The company's financial performance is reflected in its net profit margin, which has shown variation over recent periods.

Fujian Yuanli Active Carbon, a relatively small player in the chemicals sector, has shown impressive financial agility. The company's debt to equity ratio improved significantly from 41.1% to 9.4% over five years, indicating better financial health. Earnings growth of 16.8% last year outpaced the industry average of -3.8%, reflecting its robust performance amid challenges. With earnings forecasted to grow by 22.46% annually and a price-to-earnings ratio at 22.7x—below the CN market's average—it's positioned attractively for investors seeking value opportunities in niche markets like active carbon production, despite revenue dipping slightly from CNY 1,478 million to CNY 1,396 million recently.

Next Steps

- Embark on your investment journey to our 4733 Undiscovered Gems With Strong Fundamentals selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Qingdao Gon Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002768

Qingdao Gon Technology

Engages in the research and development, manufacture, and sales of organic polymer modified materials in China and internationally.

Proven track record with adequate balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion