As global markets navigate a choppy start to the year, small-cap stocks have notably underperformed their large-cap counterparts, with the Russell 2000 Index slipping into correction territory amid persistent inflation concerns and political uncertainties. In this environment, identifying promising undiscovered gems requires a keen focus on companies that demonstrate resilience and adaptability in challenging economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Voltamp Energy SAOG | 35.98% | -1.56% | 50.16% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| ASRock Rack Incorporation | NA | 45.76% | 269.05% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Co-Tech Development | 26.81% | 3.29% | 6.53% | ★★★★★☆ |

| Jamuna Bank | 85.07% | 7.37% | -3.87% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Jiang Su Suyan JingshenLtd (SHSE:603299)

Simply Wall St Value Rating: ★★★★★★

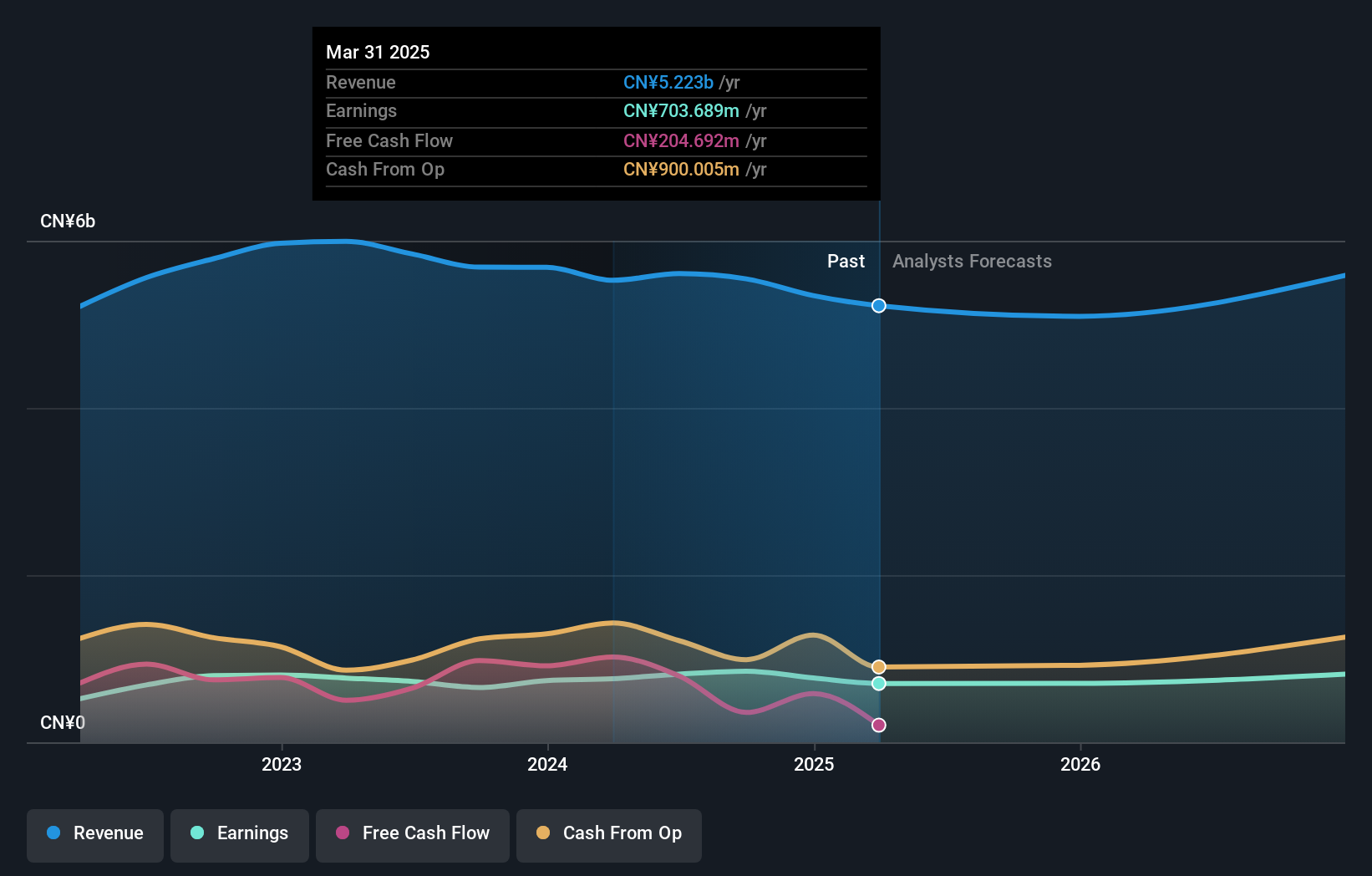

Overview: Jiang Su Suyan Jingshen Co., Ltd. is involved in the mining, research, production, distribution, and sale of salt and salt chemicals in China with a market capitalization of CN¥8.45 billion.

Operations: The company generates revenue primarily from the production and sale of salt and salt chemicals. It focuses on optimizing its cost structure to enhance profitability, reflected in its net profit margin trends.

Jiang Su Suyan Jingshen Ltd, a notable player in the chemicals industry, has shown robust earnings growth of 29.7% over the past year, surpassing the industry's -5%. The company’s debt-to-equity ratio improved from 40% to 30.6% over five years, reflecting prudent financial management. With a price-to-earnings ratio of 9.9x versus the market's 34.2x, it appears undervalued. Recent reports highlight net income rising to CNY 655 million from CNY 544 million last year despite sales dipping slightly to CNY 4 billion from CNY 4.19 billion, suggesting efficient cost control and operational resilience amidst fluctuating revenues.

- Unlock comprehensive insights into our analysis of Jiang Su Suyan JingshenLtd stock in this health report.

Understand Jiang Su Suyan JingshenLtd's track record by examining our Past report.

Guangdong Cellwise Microelectronics (SHSE:688325)

Simply Wall St Value Rating: ★★★★★★

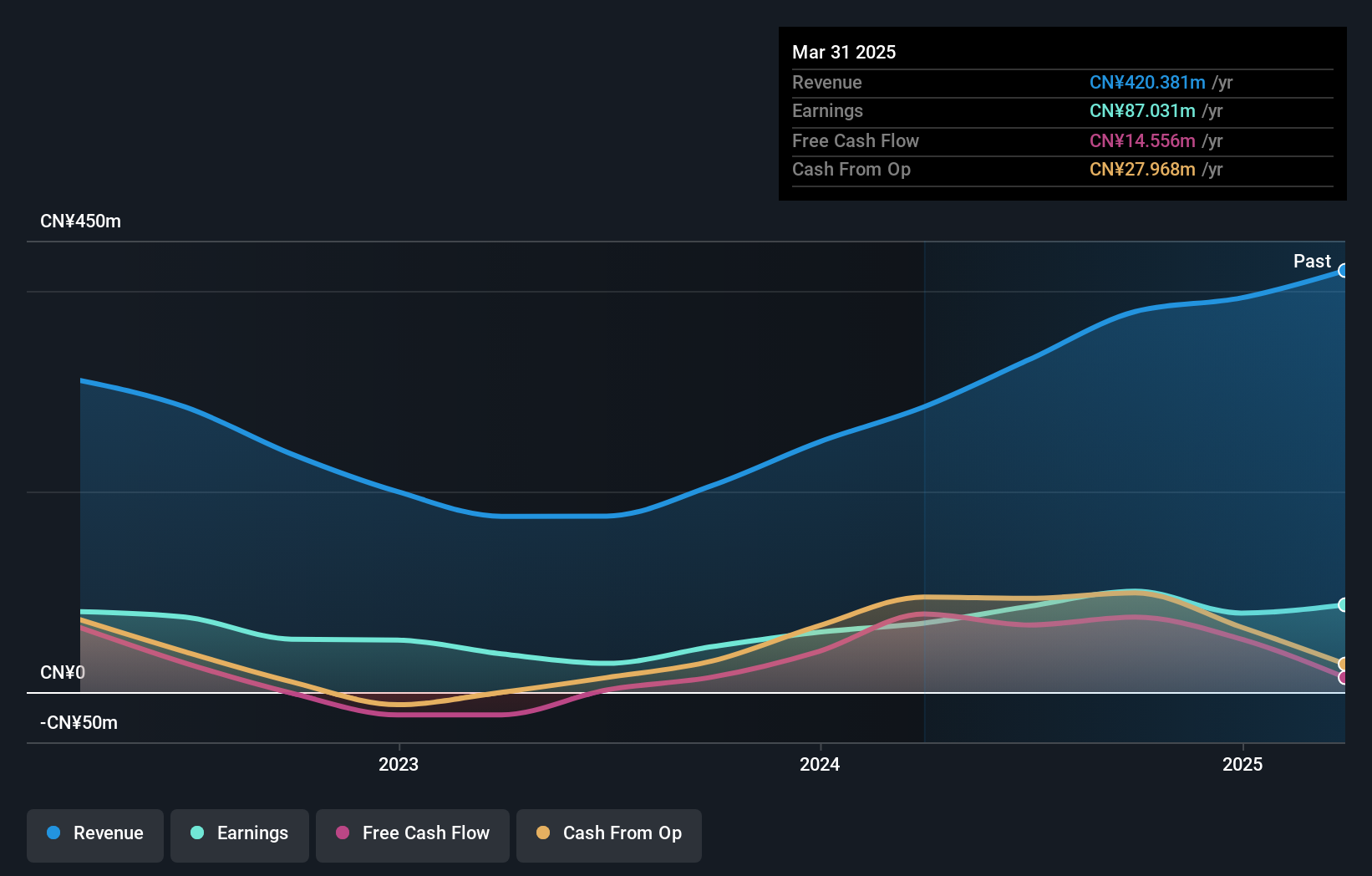

Overview: Guangdong Cellwise Microelectronics Co., Ltd. (ticker: SHSE:688325) is a company involved in the semiconductor industry with a market capitalization of CN¥4.06 billion.

Operations: Cellwise generates revenue primarily from its semiconductor segment, totaling CN¥379.37 million.

Guangdong Cellwise Microelectronics showcases impressive growth, with earnings surging 122% over the past year, outpacing the broader semiconductor industry. The company operates debt-free, a notable shift from a debt-to-equity ratio of 4.8 five years ago. Recent financials highlight net income reaching CNY 60 million for nine months ending September 2024, up from CNY 19 million previously. Basic earnings per share rose to CNY 0.735 from CNY 0.233 last year. Despite a volatile share price recently, it trades at an attractive value—47% below its estimated fair value—while completing a buyback of nearly 1.5 million shares worth CNY 37.58 million in late December.

Sunrise Group (SZSE:002752)

Simply Wall St Value Rating: ★★★★★☆

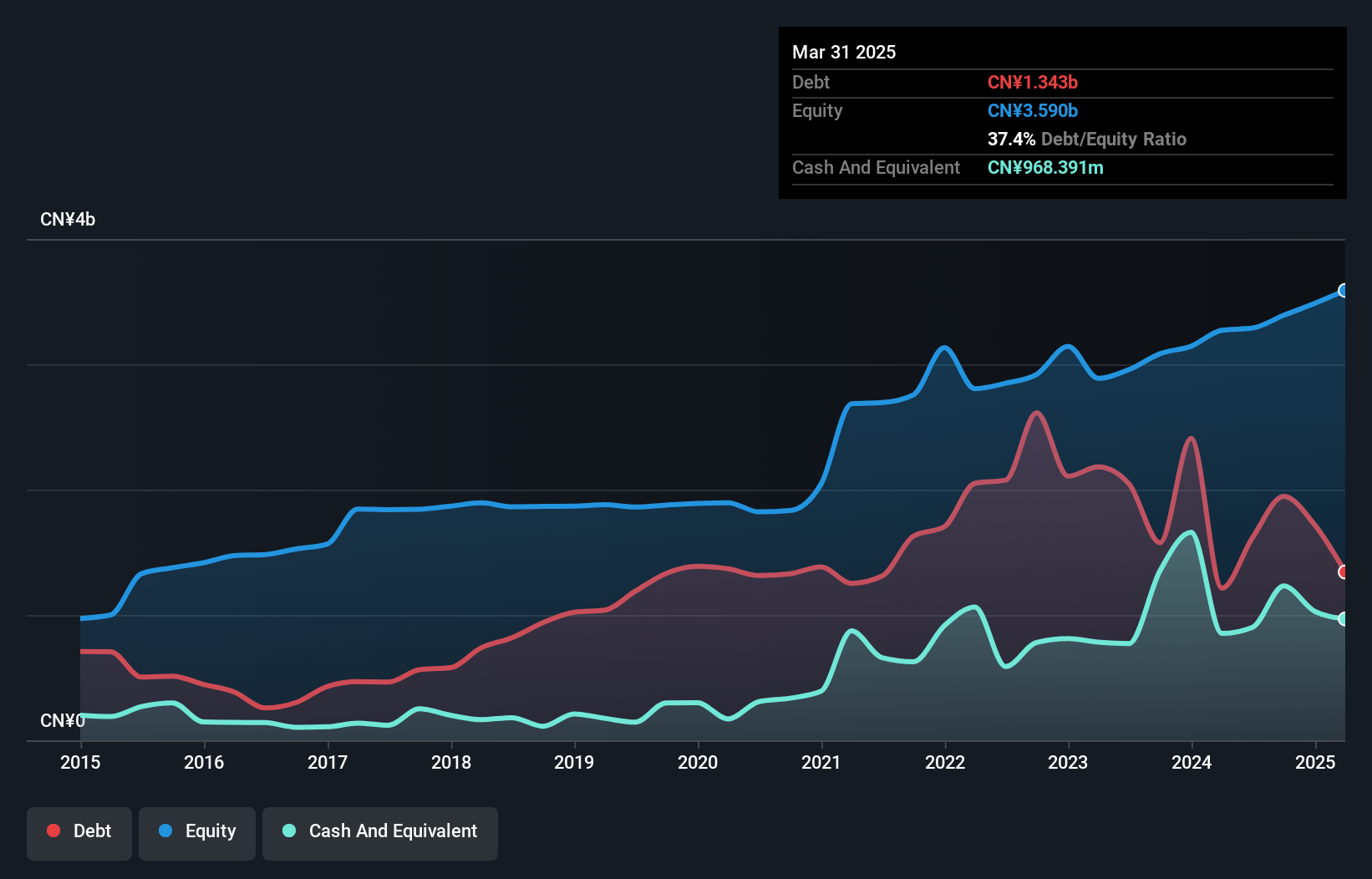

Overview: Sunrise Group Company Limited focuses on the research, development, design, production, and sales of food and beverage packaging containers in China with a market capitalization of CN¥5.44 billion.

Operations: Sunrise Group generates its revenue primarily from the production and sales of food and beverage packaging containers. The company's net profit margin is a notable aspect of its financial performance, reflecting efficiency in managing costs relative to revenue.

Sunrise Group, a smaller player in its sector, showcases robust financial health with earnings growth of 44.8% over the past year, outpacing the Packaging industry's 18.4%. The company's price-to-earnings ratio of 13.6x is notably lower than the CN market average of 34.2x, indicating strong relative value. Its net debt to equity ratio stands at a satisfactory 21.1%, having decreased from 71% to 57.4% over five years, reflecting prudent financial management. Recent earnings reveal an increase in net income to CNY 343 million from CNY 275 million last year, suggesting effective operational strategies and potential for continued growth.

- Dive into the specifics of Sunrise Group here with our thorough health report.

Assess Sunrise Group's past performance with our detailed historical performance reports.

Key Takeaways

- Investigate our full lineup of 4631 Undiscovered Gems With Strong Fundamentals right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002752

Sunrise Group

Engages in the research and development, design, production, and sales of food and beverage packaging containers in China.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives