As global markets navigate a busy earnings season and mixed economic signals, major indices have seen fluctuations with technology stocks experiencing notable volatility. Amidst these dynamics, dividend stocks continue to attract attention for their potential to provide steady income streams even when market conditions are unpredictable. In such an environment, a good dividend stock is often characterized by its ability to maintain stable payouts and demonstrate resilience against economic uncertainties.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.18% | ★★★★★★ |

| Mitsubishi Shokuhin (TSE:7451) | 3.82% | ★★★★★★ |

| Globeride (TSE:7990) | 4.11% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.23% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.61% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.19% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.52% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.35% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.62% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 4.99% | ★★★★★★ |

Click here to see the full list of 1960 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

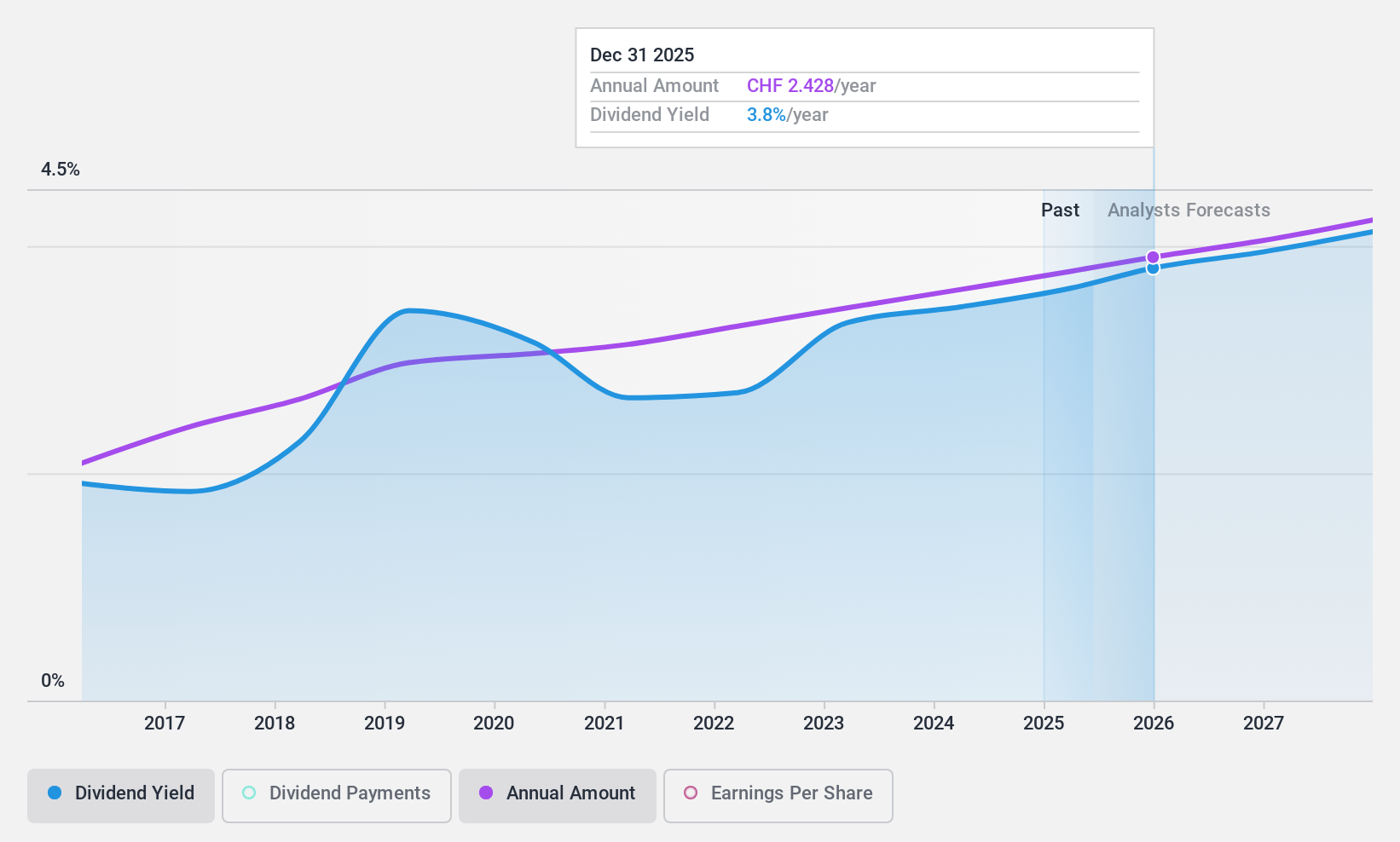

DKSH Holding (SWX:DKSH)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: DKSH Holding AG offers market expansion services across Thailand, Greater China, Malaysia, Singapore, the rest of the Asia Pacific, and internationally with a market cap of CHF4.19 billion.

Operations: DKSH Holding AG's revenue segments include Healthcare at CHF5.55 billion, Consumer Goods at CHF3.43 billion, Performance Materials at CHF1.38 billion, and Technology at CHF526.50 million.

Dividend Yield: 3.5%

DKSH Holding offers a reliable dividend with a yield of 3.49%, though it falls short compared to the top Swiss dividend payers. The company has consistently increased dividends over the past decade, supported by stable earnings and cash flow coverage, with a payout ratio of 77% and cash payout ratio of 45.8%. Despite trading below its estimated fair value, DKSH's modest growth forecast may limit immediate appeal for those seeking high-yield dividends.

- Click here to discover the nuances of DKSH Holding with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, DKSH Holding's share price might be too pessimistic.

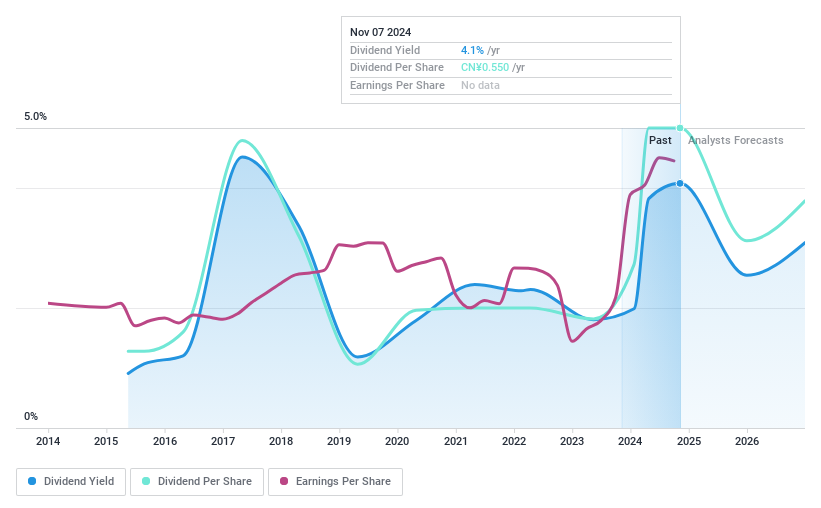

Sichuan Guoguang Agrochemical (SZSE:002749)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sichuan Guoguang Agrochemical Co., Ltd. is involved in the research and development, manufacture, marketing, and distribution of agrochemical products and materials both in China and internationally, with a market cap of CN¥6.10 billion.

Operations: Sichuan Guoguang Agrochemical Co., Ltd.'s revenue segments include the production and sale of agrochemical products and materials.

Dividend Yield: 4.2%

Sichuan Guoguang Agrochemical offers a dividend yield of 4.22%, placing it in the top 25% of Chinese dividend payers. Despite being covered by earnings with a payout ratio of 31.2%, its dividends have been volatile over the past nine years, reflecting an unstable track record. Recent earnings growth and inclusion in the S&P Global BMI Index highlight potential, although shareholder dilution last year is a concern for long-term stability.

- Unlock comprehensive insights into our analysis of Sichuan Guoguang Agrochemical stock in this dividend report.

- In light of our recent valuation report, it seems possible that Sichuan Guoguang Agrochemical is trading behind its estimated value.

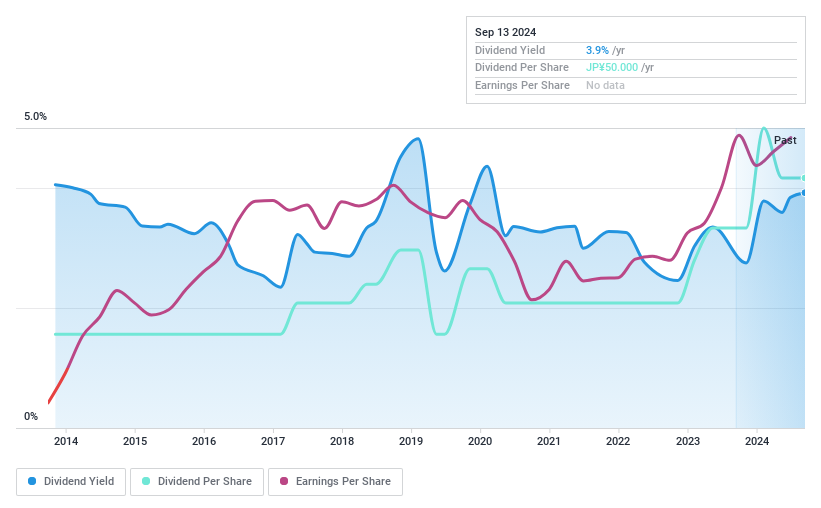

Asahi Kogyosha (TSE:1975)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Asahi Kogyosha Co., Ltd. primarily engages in air-conditioning and sanitation installation works in Japan and has a market cap of ¥34.06 billion.

Operations: Asahi Kogyosha Co., Ltd. generates its revenue primarily from Facility Construction, which accounts for ¥86.67 billion, and the Equipment Manufacturing Sales Business, contributing ¥4.27 billion.

Dividend Yield: 3.8%

Asahi Kogyosha's dividend yield of 3.78% is slightly below the top 25% of Japanese dividend payers. The payout ratio stands at a sustainable 26%, supported by cash flows with a cash payout ratio of 74.6%. Despite earnings growth of 27.8% over the past year, dividends have been volatile and unreliable over the last decade. Its inclusion in the S&P Global BMI Index may enhance visibility among investors.

- Click here and access our complete dividend analysis report to understand the dynamics of Asahi Kogyosha.

- Our expertly prepared valuation report Asahi Kogyosha implies its share price may be too high.

Taking Advantage

- Reveal the 1960 hidden gems among our Top Dividend Stocks screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002749

Sichuan Guoguang Agrochemical

Engages in the research and development, manufacture, marketing, and distribution of agrochemical products and materials in China and internationally.

Solid track record with excellent balance sheet and pays a dividend.