- China

- /

- Communications

- /

- SZSE:002446

Exploring High Growth Tech Stocks Including Three Promising Picks

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by cautious earnings reports and mixed economic signals, small-cap stocks have demonstrated resilience, holding up better than their larger counterparts. This backdrop sets the stage for exploring high growth tech stocks, where identifying promising picks involves assessing their ability to innovate and adapt amidst fluctuating market conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.41% | 70.53% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1282 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

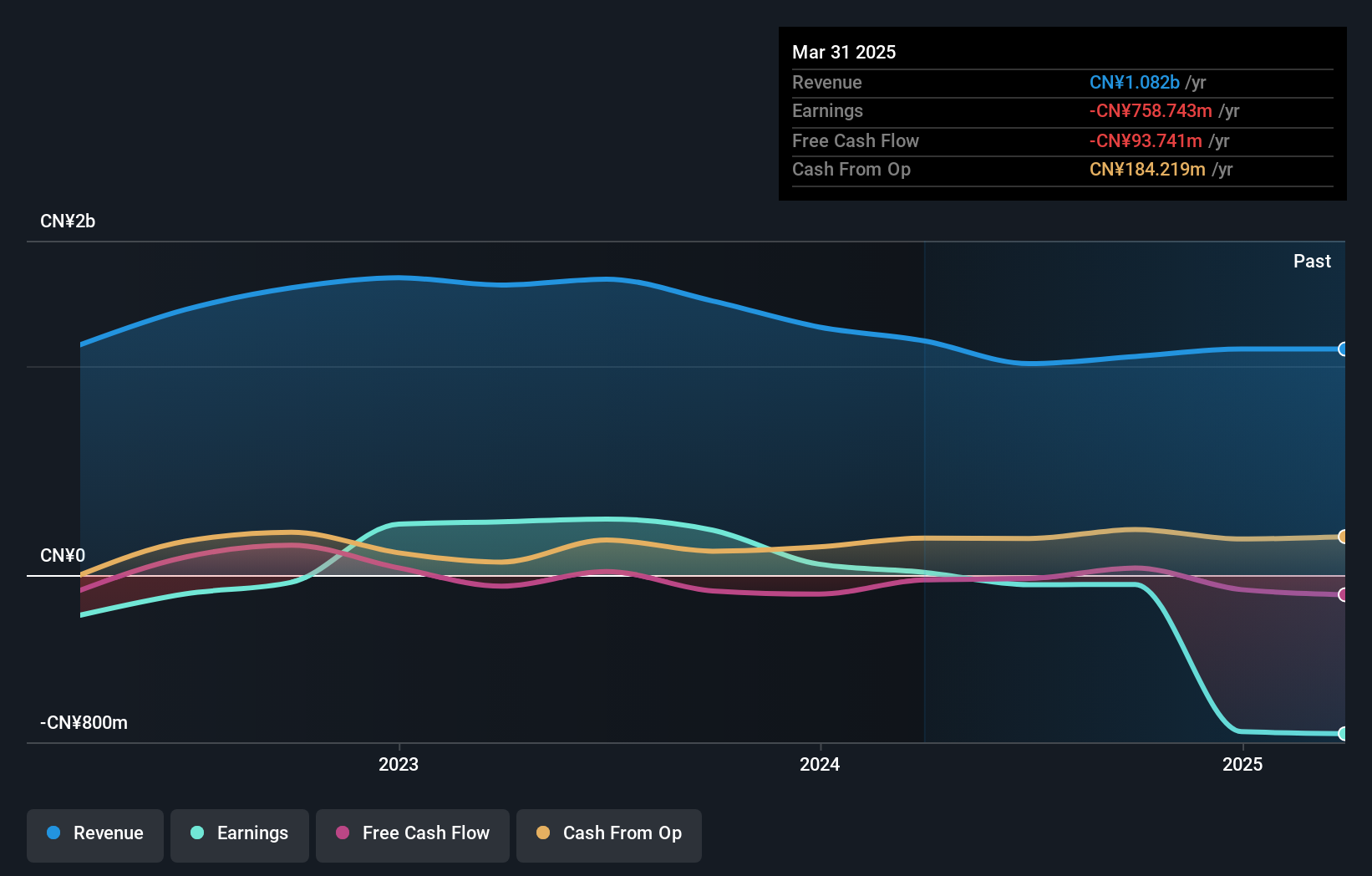

Guangdong Shenglu Telecommunication Tech (SZSE:002446)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangdong Shenglu Telecommunication Tech focuses on the development and production of telecommunication equipment, with a market cap of CN¥6.65 billion.

Operations: The company generates revenue primarily from the sale of telecommunication equipment. Its financial performance is characterized by a focus on cost efficiency and strategic production capabilities.

Guangdong Shenglu Telecommunication Tech has navigated a challenging fiscal period with its recent earnings showing a downturn, as sales dropped to CNY 833.42 million from CNY 974.59 million year-over-year and net income fell significantly to CNY 66.46 million from CNY 163.45 million. Despite these hurdles, the company is poised for recovery with expected revenue growth of 37.7% annually, outpacing the broader Chinese market's growth rate of 14%. This optimism is bolstered by strategic corporate adjustments including a change in registered capital and amendments to company bylaws aimed at enhancing operational flexibility and governance—an essential step in fortifying its market position amidst evolving industry dynamics.

- Unlock comprehensive insights into our analysis of Guangdong Shenglu Telecommunication Tech stock in this health report.

Understand Guangdong Shenglu Telecommunication Tech's track record by examining our Past report.

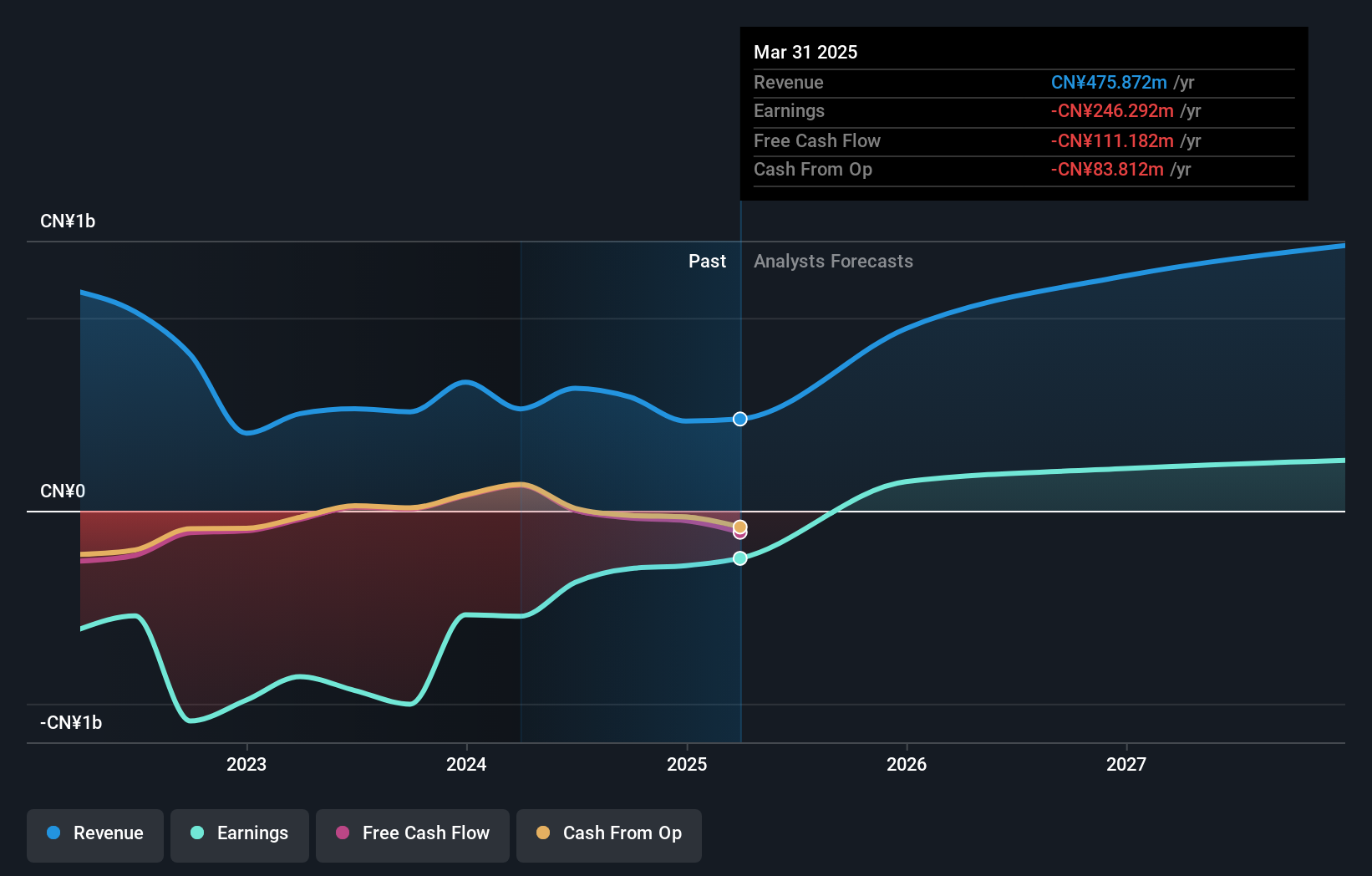

Huayi Brothers Media (SZSE:300027)

Simply Wall St Growth Rating: ★★★★★★

Overview: Huayi Brothers Media Corporation is an entertainment media company with operations in China and internationally, and it has a market cap of CN¥8.10 billion.

Operations: The company generates revenue primarily through film and television production, distribution, and related entertainment services. It operates in both domestic and international markets.

Huayi Brothers Media has shown resilience despite recent challenges, with a notable reduction in net loss to CNY 42.48 million from last year's CNY 281.8 million over the same period, reflecting a strategic pivot that's beginning to bear fruit. The company's R&D expenditure remains a critical focus, underscoring its commitment to innovation in an industry driven by technological advancements and content renewal; this is evident from its increased R&D spending which now constitutes 41.2% of its revenue. Looking ahead, Huayi aims for substantial growth with projected earnings surges of 110.5% annually, positioning it well within the competitive landscape of media and entertainment tech despite recent exits from major indices like the FTSE All-World Index.

- Click here to discover the nuances of Huayi Brothers Media with our detailed analytical health report.

Evaluate Huayi Brothers Media's historical performance by accessing our past performance report.

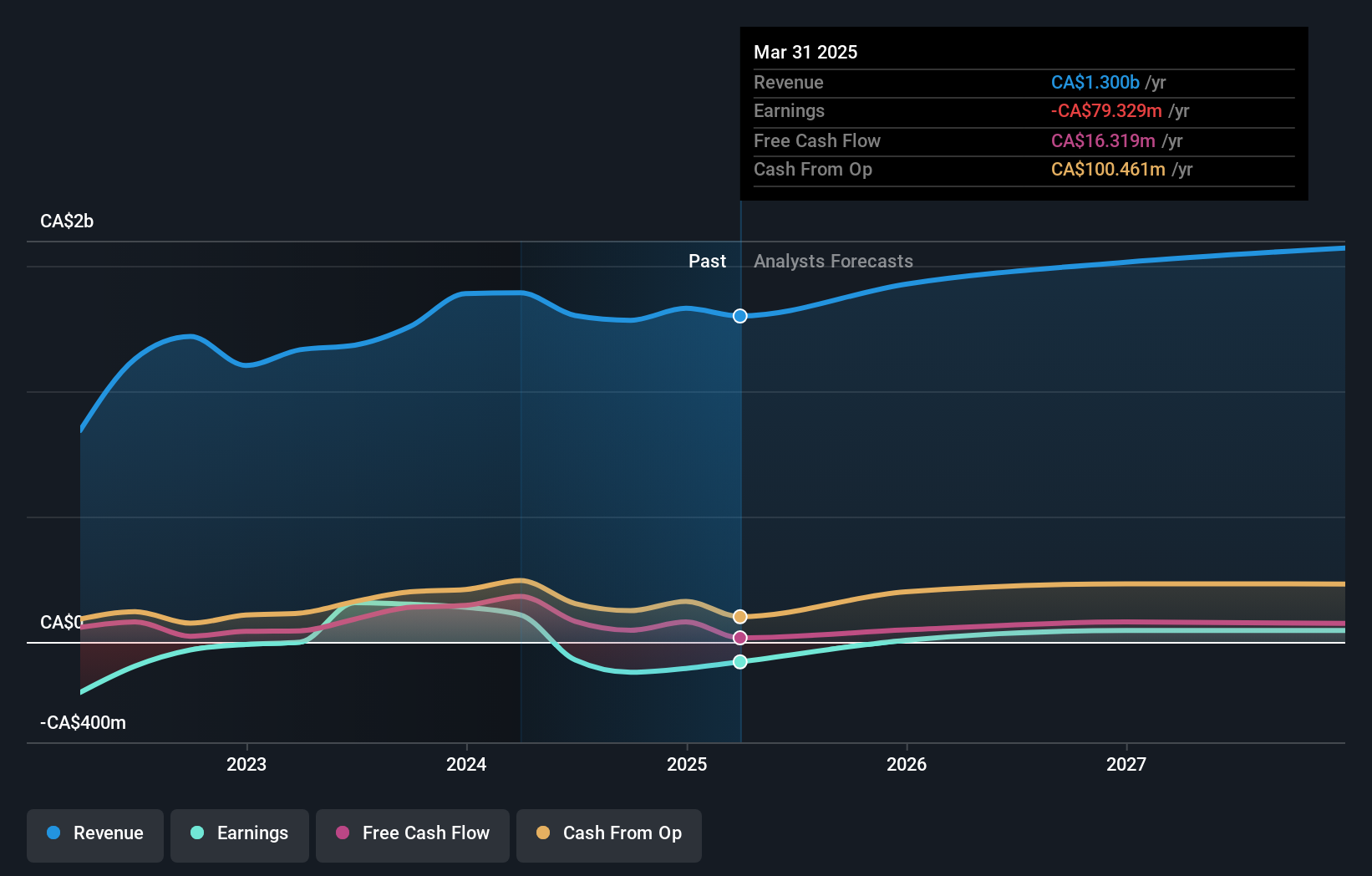

Cineplex (TSX:CGX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Cineplex Inc. operates as an entertainment and media company in Canada and internationally, with a market cap of CA$684.53 million.

Operations: Cineplex generates revenue primarily from Film Entertainment and Content (CA$1.05 billion), followed by Location-Based Entertainment (CA$132.08 million) and Media (CA$120.16 million).

Despite facing a challenging year with a net loss widening to CAD 41.01 million from a net income of CAD 176.12 million, Cineplex has demonstrated resilience in its box office segment, which nearly reached pre-pandemic levels in August, capturing 119% of the revenue from the same month in 2019. The company's commitment to returning value to shareholders is evident as it repurchased and cancelled over 6 million shares, signaling confidence in its future prospects. With earnings forecasted to surge by an impressive 179.27% annually and revenue growth projected at a steady rate of 7.2% per year—outpacing the Canadian market's average—Cineplex is strategically positioning itself for recovery and growth within the entertainment sector.

Taking Advantage

- Reveal the 1282 hidden gems among our High Growth Tech and AI Stocks screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002446

Guangdong Shenglu Telecommunication Tech

Guangdong Shenglu Telecommunication Tech.

Flawless balance sheet with high growth potential.