As global markets navigate a complex landscape of economic reports and corporate earnings, major indices have recently experienced volatility, with growth stocks underperforming relative to value shares. Amidst these fluctuations, investors are increasingly focused on identifying undervalued opportunities that may offer potential for long-term growth. In this environment, a good stock is often characterized by strong fundamentals and resilience in the face of market uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Avant Group (TSE:3836) | ¥1979.00 | ¥3936.25 | 49.7% |

| On the Beach Group (LSE:OTB) | £1.522 | £3.03 | 49.8% |

| SEI Medical (SET:SEI) | THB5.80 | THB11.54 | 49.7% |

| SciDev (ASX:SDV) | A$0.615 | A$1.23 | 49.8% |

| Laboratorio Reig Jofre (BME:RJF) | €2.88 | €5.74 | 49.8% |

| Alnylam Pharmaceuticals (NasdaqGS:ALNY) | US$273.01 | US$545.05 | 49.9% |

| Shinsung E&GLtd (KOSE:A011930) | ₩1418.00 | ₩2821.10 | 49.7% |

| Orascom Development Holding (SWX:ODHN) | CHF3.90 | CHF7.79 | 49.9% |

| Suzhou Zelgen BiopharmaceuticalsLtd (SHSE:688266) | CN¥63.90 | CN¥127.14 | 49.7% |

| Cellnex Telecom (BME:CLNX) | €32.50 | €64.80 | 49.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

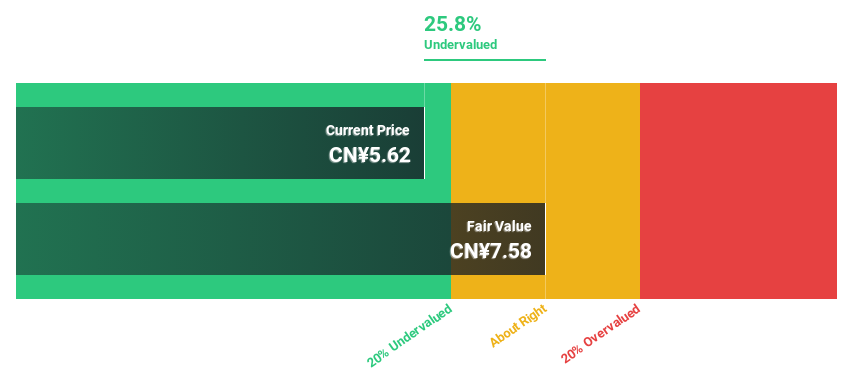

Inmyshow Digital Technology(Group)Co.Ltd (SHSE:600556)

Overview: Inmyshow Digital Technology (Group) Co., Ltd. operates in the digital marketing and advertising industry, with a market capitalization of approximately CN¥8.70 billion.

Operations: Unfortunately, the provided text for the revenue segments is incomplete or missing. If you can provide specific details about the revenue segments of Inmyshow Digital Technology (Group) Co., Ltd., I would be able to help summarize that information into one sentence.

Estimated Discount To Fair Value: 36.4%

Inmyshow Digital Technology is trading 36.4% below its estimated fair value of CN¥7.56, with a current price of CN¥4.81, indicating undervaluation based on discounted cash flow analysis. Despite a decline in net income from CN¥112.63 million to CN¥65.42 million year-over-year, earnings are forecast to grow at 62.38% annually over the next three years, outpacing the market's growth rate of 26.1%. However, profit margins have decreased from 2.1% to 1.1%.

- Upon reviewing our latest growth report, Inmyshow Digital Technology(Group)Co.Ltd's projected financial performance appears quite optimistic.

- Dive into the specifics of Inmyshow Digital Technology(Group)Co.Ltd here with our thorough financial health report.

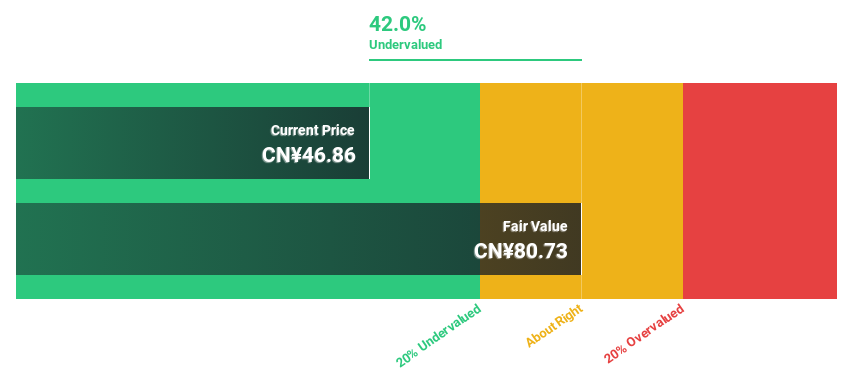

Gambol Pet Group (SZSE:301498)

Overview: Gambol Pet Group Co., Ltd. is involved in the research, development, production, and sale of pet food products in China with a market cap of CN¥26.07 billion.

Operations: The company generates revenue of CN¥4.89 billion from its Pet Food & Supplies segment.

Estimated Discount To Fair Value: 28.4%

Gambol Pet Group is trading at CN¥65.18, 28.4% below its estimated fair value of CN¥91.05, suggesting it is undervalued based on cash flows. The company reported nine-month sales of CN¥3.67 billion, up from CN¥3.11 billion a year ago, with net income rising to CN¥470.42 million from CN¥314.36 million, reflecting strong growth in earnings and revenue despite a forecasted slower earnings growth rate than the market's 26.1%.

- Our earnings growth report unveils the potential for significant increases in Gambol Pet Group's future results.

- Delve into the full analysis health report here for a deeper understanding of Gambol Pet Group.

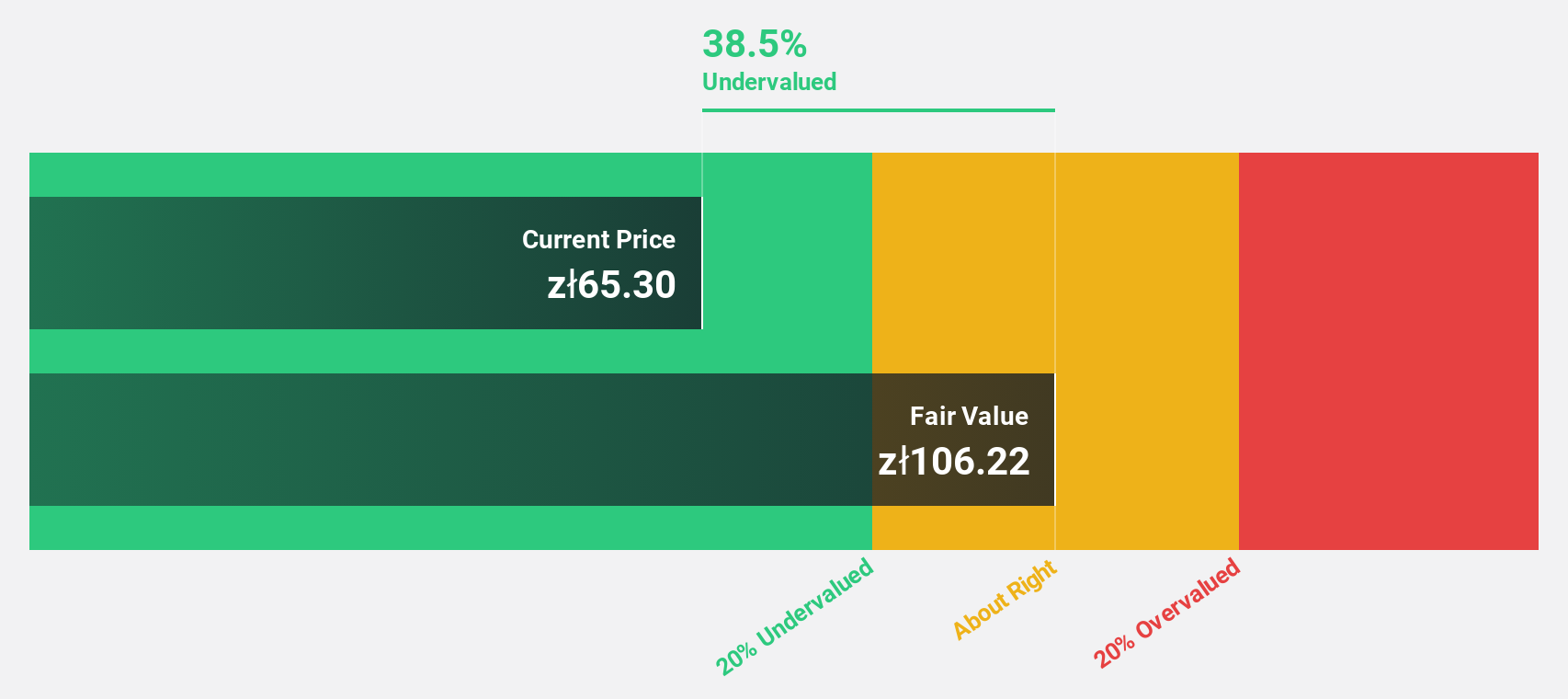

Grupa Pracuj (WSE:GPP)

Overview: Grupa Pracuj S.A. operates in the digital recruitment market in Poland and Ukraine, with a market cap of PLN3.72 billion.

Operations: The company generates revenue from its Staffing & Outsourcing Services segment, amounting to PLN744.28 million.

Estimated Discount To Fair Value: 42.4%

Grupa Pracuj, trading at PLN54.5, is 42.4% below its estimated fair value of PLN94.62, highlighting its undervaluation based on cash flows. Despite a decline in net income to PLN41.54 million for Q2 2024 from PLN58.36 million the previous year, revenue grew to PLN193.59 million from PLN184.35 million year-over-year. The company's earnings are projected to grow faster than the Polish market at 16.2% annually, with a high future return on equity forecasted at 54%.

- Insights from our recent growth report point to a promising forecast for Grupa Pracuj's business outlook.

- Get an in-depth perspective on Grupa Pracuj's balance sheet by reading our health report here.

Seize The Opportunity

- Dive into all 936 of the Undervalued Stocks Based On Cash Flows we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600556

Inmyshow Digital Technology(Group)Co.Ltd

Inmyshow Digital Technology(Group)Co.,Ltd.

Undervalued with excellent balance sheet.