- China

- /

- Semiconductors

- /

- SHSE:688270

High Insider Ownership Drives Growth In These 3 Companies

Reviewed by Simply Wall St

In a week marked by busy earnings reports and economic data, global markets experienced mixed performance, with major indexes like the Nasdaq Composite and S&P MidCap 400 reaching record highs before retreating. Amidst this backdrop, growth stocks generally lagged behind value shares as cautious earnings from tech giants influenced market sentiment. In such volatile conditions, companies with high insider ownership often attract attention due to their potential for aligned interests between management and shareholders. This article explores three growth companies where significant insider stakes may play a crucial role in driving their success.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.6% |

| Medley (TSE:4480) | 34% | 30.4% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Brightstar Resources (ASX:BTR) | 14.8% | 84.6% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

We'll examine a selection from our screener results.

Great Microwave Technology (SHSE:688270)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Great Microwave Technology Co., Ltd. focuses on the research, development, production, and sale of integrated circuit chips and microsystems in China with a market cap of CN¥7.97 billion.

Operations: Great Microwave Technology Co., Ltd. generates revenue through the research, development, production, and sale of integrated circuit chips and microsystems in China.

Insider Ownership: 21%

Earnings Growth Forecast: 67.2% p.a.

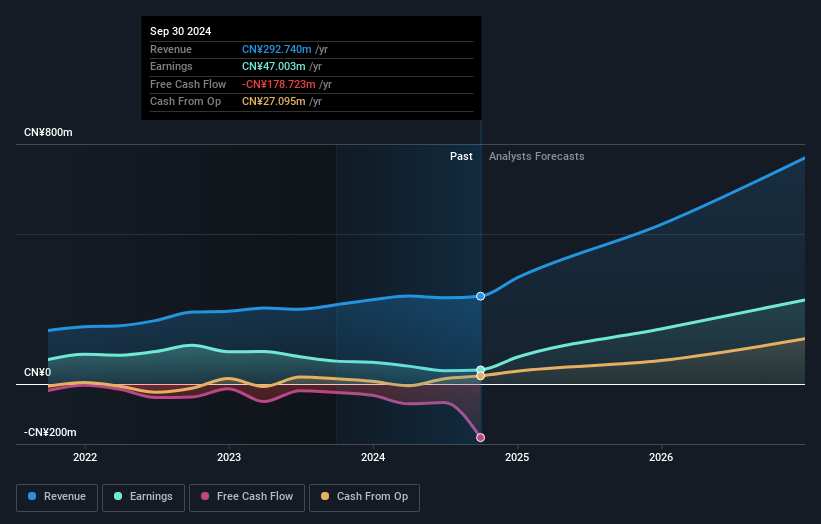

Great Microwave Technology demonstrates potential as a growth company with high insider ownership, despite recent earnings challenges. The company's revenue for the nine months ended September 2024 increased to CNY 182.42 million from CNY 170.48 million, although net income declined significantly to CNY 14.46 million from CNY 39.94 million year-on-year. Forecasts indicate strong annual revenue and profit growth, expected at rates exceeding market averages, although current profit margins have decreased compared to last year.

- Delve into the full analysis future growth report here for a deeper understanding of Great Microwave Technology.

- In light of our recent valuation report, it seems possible that Great Microwave Technology is trading beyond its estimated value.

Suzhou Recodeal Interconnect SystemLtd (SHSE:688800)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Suzhou Recodeal Interconnect System Co., Ltd develops, produces, and sells connection systems and microwave components globally, with a market cap of CN¥6.73 billion.

Operations: The company generates revenue primarily from its Electric Equipment segment, which amounts to CN¥2.10 billion.

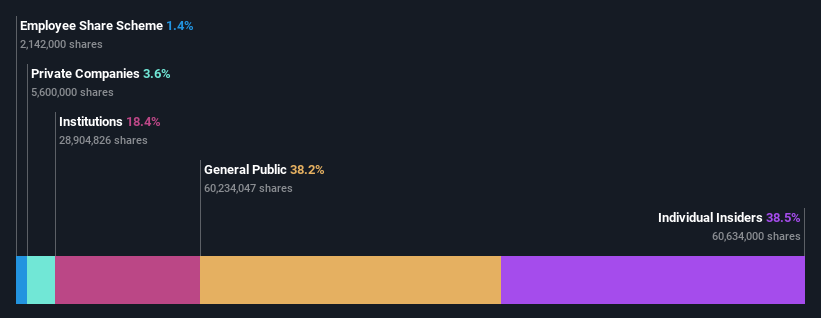

Insider Ownership: 38.5%

Earnings Growth Forecast: 35.5% p.a.

Suzhou Recodeal Interconnect System Ltd shows potential for growth with high insider ownership, reporting a revenue increase to CNY 1.59 billion for the nine months ended September 2024 from CNY 1.04 billion a year ago. Despite lower profit margins compared to last year, earnings are forecasted to grow significantly at 35.5% annually, outpacing market averages. The company trades below its estimated fair value, though recent share price volatility is notable without substantial insider trading activity reported recently.

- Take a closer look at Suzhou Recodeal Interconnect SystemLtd's potential here in our earnings growth report.

- Our valuation report unveils the possibility Suzhou Recodeal Interconnect SystemLtd's shares may be trading at a premium.

Konfoong Materials International (SZSE:300666)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Konfoong Materials International Co., Ltd. operates in the advanced materials industry, focusing on producing high-purity metal sputtering targets for semiconductor and display applications, with a market cap of CN¥18.35 billion.

Operations: The company's revenue is primarily derived from the Computer, Communications, and other Electronic Equipment Manufacturing segment, which generated CN¥3.38 billion.

Insider Ownership: 24.1%

Earnings Growth Forecast: 23.1% p.a.

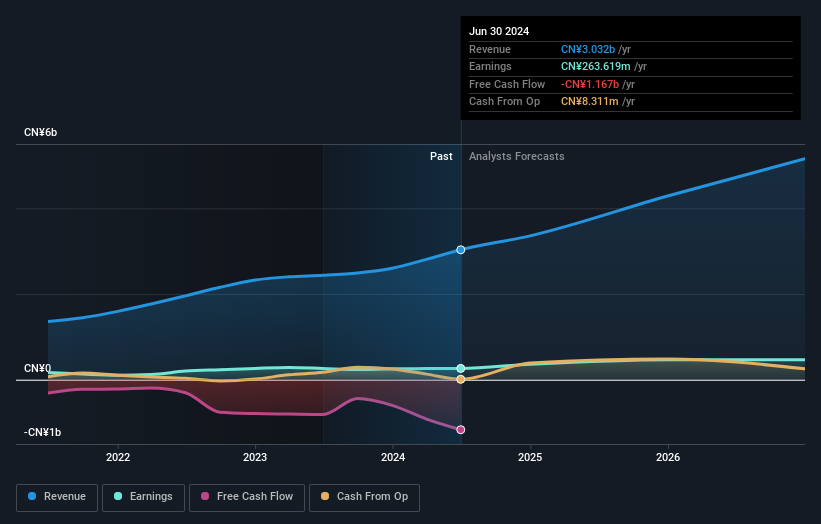

Konfoong Materials International displays growth potential with increased revenue to CNY 2.63 billion for the nine months ended September 2024, up from CNY 1.85 billion a year ago. Earnings are projected to grow significantly at over 20% annually, though below market averages. The stock trades at a favorable price-to-earnings ratio of 52.6x compared to the industry average of 66x, despite recent share price volatility and no substantial insider trading activity reported recently.

- Dive into the specifics of Konfoong Materials International here with our thorough growth forecast report.

- The analysis detailed in our Konfoong Materials International valuation report hints at an inflated share price compared to its estimated value.

Summing It All Up

- Unlock more gems! Our Fast Growing Companies With High Insider Ownership screener has unearthed 1519 more companies for you to explore.Click here to unveil our expertly curated list of 1522 Fast Growing Companies With High Insider Ownership.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688270

Great Microwave Technology

Engages in the research and development, production, and sale of integrated circuit chips and microsystems in China.

Flawless balance sheet with high growth potential.