Guangdong Guanghua Sci-Tech Co., Ltd.'s (SZSE:002741) Shares Leap 26% Yet They're Still Not Telling The Full Story

Those holding Guangdong Guanghua Sci-Tech Co., Ltd. (SZSE:002741) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 40% over that time.

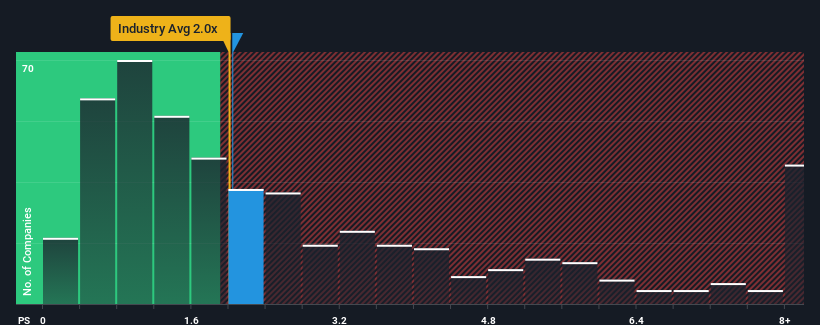

In spite of the firm bounce in price, it's still not a stretch to say that Guangdong Guanghua Sci-Tech's price-to-sales (or "P/S") ratio of 2x right now seems quite "middle-of-the-road" compared to the Chemicals industry in China, seeing as it matches the P/S ratio of the wider industry. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Guangdong Guanghua Sci-Tech

What Does Guangdong Guanghua Sci-Tech's P/S Mean For Shareholders?

Guangdong Guanghua Sci-Tech could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Guangdong Guanghua Sci-Tech's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Guangdong Guanghua Sci-Tech?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Guangdong Guanghua Sci-Tech's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 23%. Still, the latest three year period has seen an excellent 40% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 102% during the coming year according to the two analysts following the company. That's shaping up to be materially higher than the 25% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Guangdong Guanghua Sci-Tech's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

Its shares have lifted substantially and now Guangdong Guanghua Sci-Tech's P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Looking at Guangdong Guanghua Sci-Tech's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Guangdong Guanghua Sci-Tech with six simple checks on some of these key factors.

If these risks are making you reconsider your opinion on Guangdong Guanghua Sci-Tech, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002741

Guangdong Guanghua Sci-Tech

Produces and sells electronic chemicals, chemical reagents, and new energy materials in China.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.