- China

- /

- Electric Utilities

- /

- SHSE:605162

Undiscovered Gems And 2 Other Promising Stocks With Strong Potential

Reviewed by Simply Wall St

In a global market characterized by choppy conditions and heightened inflation concerns, small-cap stocks have notably underperformed, with the Russell 2000 Index dipping into correction territory. As investors navigate these turbulent waters, identifying promising stocks requires a keen focus on those companies that demonstrate resilience and growth potential amidst economic uncertainty.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Transnational Corporation of Nigeria | 45.51% | 31.42% | 58.48% | ★★★★★☆ |

| Hermes Transportes Blindados | 50.88% | 4.57% | 3.33% | ★★★★★☆ |

| Chita Kogyo | 8.34% | 2.84% | 8.49% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| Hayleys | 140.54% | 19.07% | 20.35% | ★★★★☆☆ |

| Standard Chartered Bank Kenya | 9.32% | 12.22% | 22.08% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

CNSIG Anhui Hongsifang Fertilizer (SHSE:603395)

Simply Wall St Value Rating: ★★★★☆☆

Overview: CNSIG Anhui Hongsifang Fertilizer Co., Ltd. operates in the fertilizer industry with a market capitalization of CN¥8.99 billion, focusing on various regional branches across China.

Operations: CNSIG Anhui Hongsifang Fertilizer generates revenue primarily from its Anhui Branch with CN¥3.67 billion, followed by contributions from the Hubei and Hunan branches at CN¥626.74 million and CN¥689.77 million, respectively.

CNSIG Anhui Hongsifang Fertilizer, a small player in the chemicals sector, has shown promising financial health with its earnings growing by 14.9% over the past year, surpassing the industry average of -3.4%. The company's interest payments are well covered by EBIT at 28.7 times, indicating robust financial management. Recent developments include a successful IPO raising CNY 399 million and reporting net income of CNY 83 million for the first half of 2024. Despite a volatile share price recently, its high-quality earnings and cash position suggest resilience in navigating market fluctuations.

- Dive into the specifics of CNSIG Anhui Hongsifang Fertilizer here with our thorough health report.

Learn about CNSIG Anhui Hongsifang Fertilizer's historical performance.

Zhejiang Xinzhonggang Thermal Power (SHSE:605162)

Simply Wall St Value Rating: ★★★★★☆

Overview: Zhejiang Xinzhonggang Thermal Power Co., LTD. operates in the thermal power industry and has a market capitalization of CN¥2.64 billion.

Operations: The company generates revenue primarily from its thermal power operations. It has an estimated market capitalization of CN¥2.64 billion, reflecting its position in the industry.

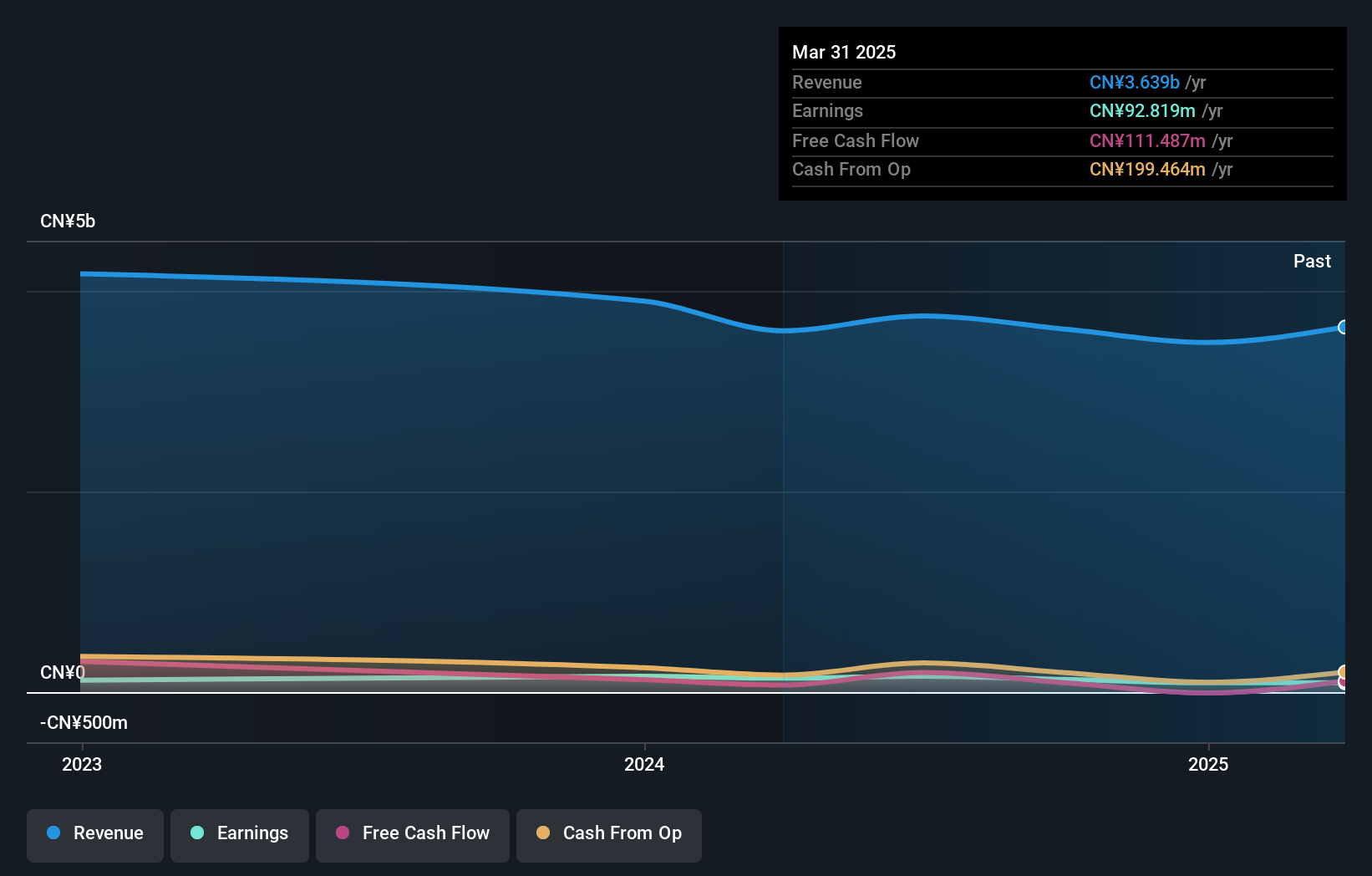

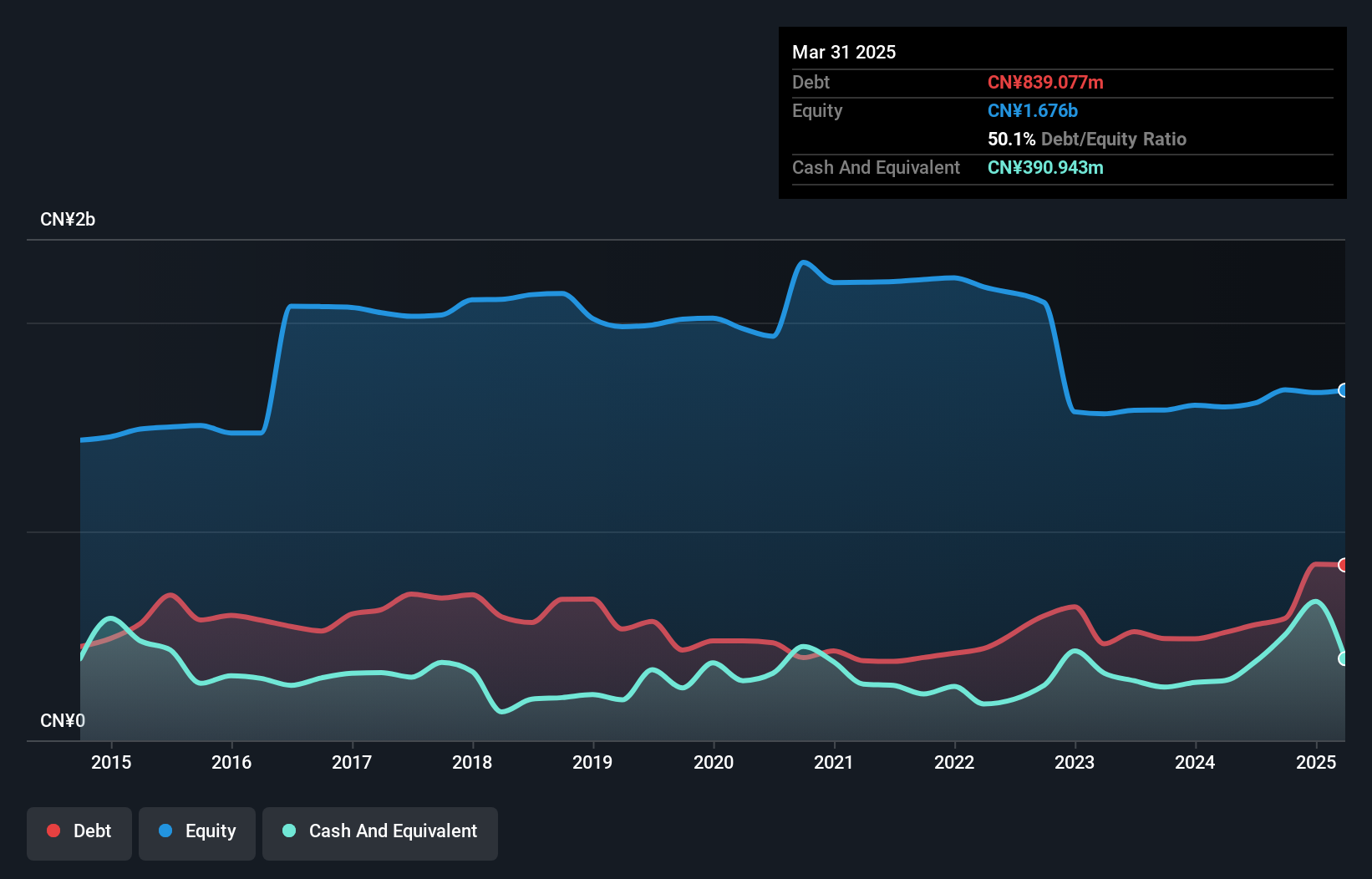

Zhejiang Xinzhonggang Thermal Power, a smaller player in the energy sector, has shown mixed financial performance. Over the past year, earnings surged by 44.6%, outpacing the Electric Utilities industry average of 13%. Despite this growth, its debt to equity ratio rose from 24.5% to 29.5% over five years, indicating increased leverage. However, with cash exceeding total debt and interest payments well covered at 17 times EBIT, financial stability seems solid. Recent reports show net income rose slightly to CNY 89 million for nine months ending September 2024 despite a dip in revenue from CNY 683 million to CNY 649 million year-over-year.

Shandong Longquan Pipe IndustryLtd (SZSE:002671)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shandong Longquan Pipe Industry Co., Ltd specializes in the production, sale, installation, and service of prestressed concrete cylinder pipes and metal pipe fittings in China, with a market cap of CN¥2.48 billion.

Operations: Longquan Pipe Industry derives its revenue primarily from the production and sale of prestressed concrete cylinder pipes and metal pipe fittings. The company's cost structure includes expenses related to manufacturing, distribution, and installation services. Its financial performance is reflected in a net profit margin trend that provides insight into operational efficiency over time.

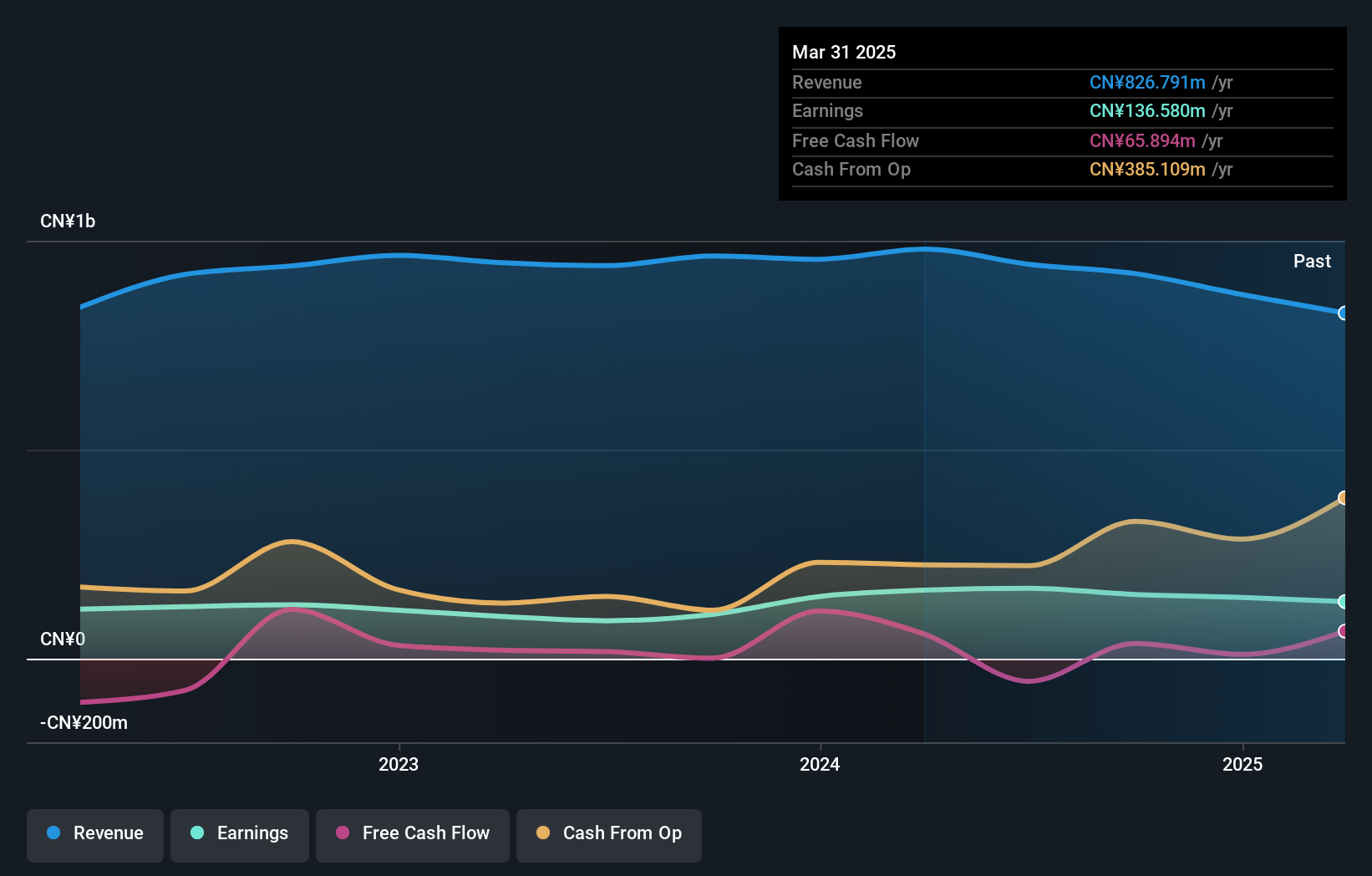

Shandong Longquan Pipe Industry, with its recent profitability, has caught attention by reporting a net income of CNY 79.43 million for the nine months ending September 2024, a significant leap from CNY 2.94 million the previous year. Its price-to-earnings ratio stands attractively at 24.4x, undercutting the broader CN market's average of 31.8x, suggesting potential value appeal. The company's debt situation seems manageable with a satisfactory net debt to equity ratio of 4.6%, though it has risen over five years from 21.4% to 34.8%. A share repurchase program worth up to CNY 18 million further signals confidence in its long-term prospects and employee engagement strategies.

Taking Advantage

- Click through to start exploring the rest of the 4548 Undiscovered Gems With Strong Fundamentals now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Xinzhonggang Thermal Power might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:605162

Zhejiang Xinzhonggang Thermal Power

Zhejiang Xinzhonggang Thermal Power Co., LTD.

Excellent balance sheet and fair value.

Market Insights

Community Narratives