- China

- /

- Electronic Equipment and Components

- /

- SZSE:301510

Exploring Undiscovered Gems in Global Markets November 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by AI-related concerns and fluctuating stock valuations, small-cap indices like the S&P MidCap 400 and Russell 2000 have shown resilience despite broader market declines. In this climate, identifying undiscovered gems requires a keen eye for companies that demonstrate strong fundamentals and potential for growth amidst economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Natural Food International Holding | NA | 8.04% | 37.71% | ★★★★★★ |

| Daphne International Holdings | NA | -5.92% | 82.03% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Yibin City Commercial Bank | 82.57% | -1.19% | 15.94% | ★★★★★★ |

| Uju Holding | 34.04% | 5.58% | -25.17% | ★★★★★★ |

| Palasino Holdings | 9.75% | 10.88% | -14.54% | ★★★★★☆ |

| Tai Sin Electric | 37.42% | 10.92% | 7.66% | ★★★★☆☆ |

| Pizu Group Holdings | 41.45% | -2.37% | -15.01% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Billion Industrial Holdings | 33.11% | 16.86% | -16.10% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Xiamen King Long Motor Group (SHSE:600686)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Xiamen King Long Motor Group Co., Ltd. focuses on the research, development, design, manufacturing, and sale of passenger vehicles both in China and internationally with a market cap of CN¥11.04 billion.

Operations: The primary revenue stream for King Long Motor Group is from vehicles and vehicle parts, generating CN¥24.89 billion.

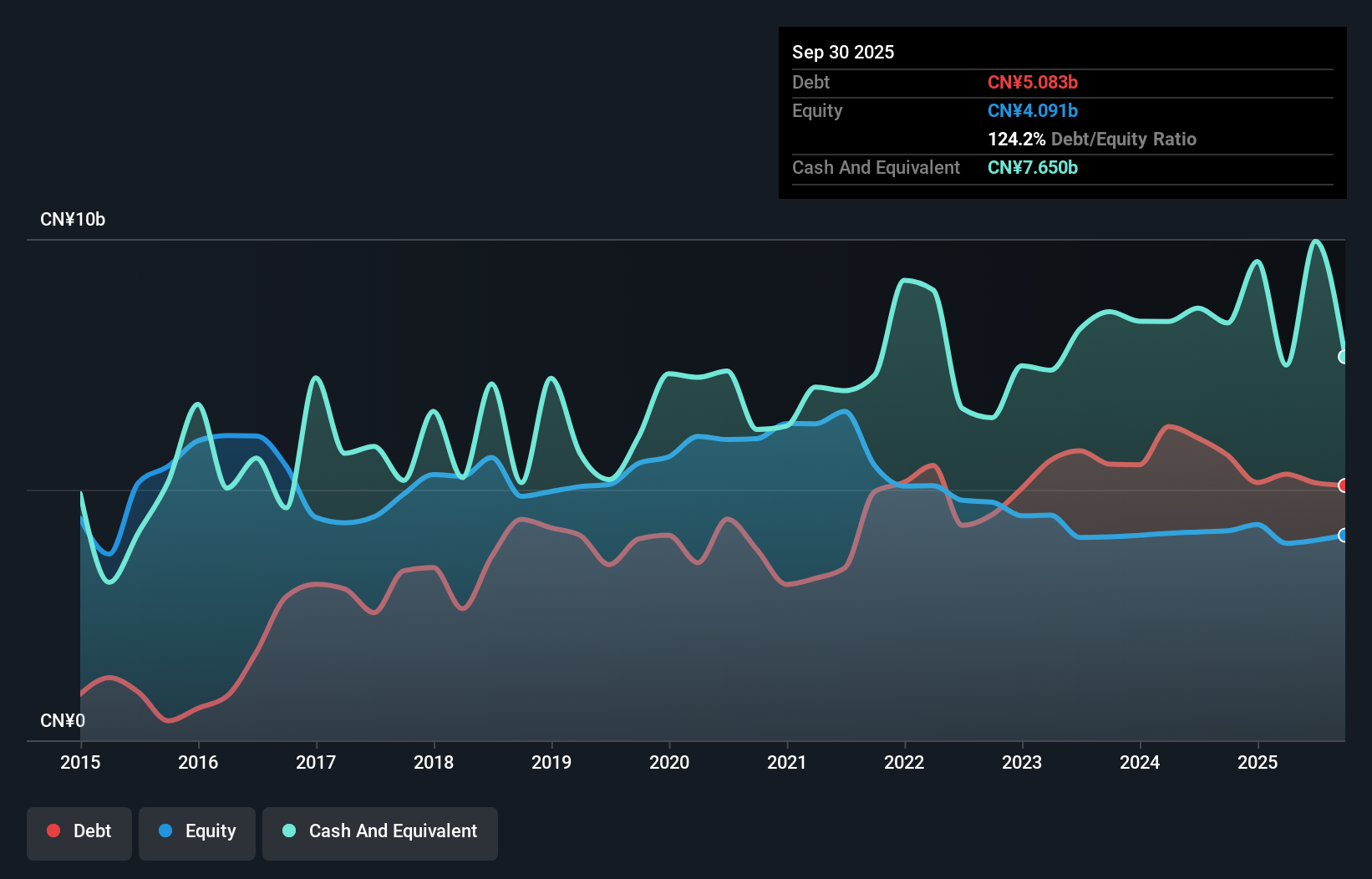

Xiamen King Long Motor Group, a notable player in the machinery sector, has shown impressive earnings growth of 246.7% over the past year, outpacing the industry's 6.3%. With a price-to-earnings ratio of 34.8x below the CN market average of 43.1x, it seems attractively valued for its growth prospects. The company's net income for nine months ending September 2025 was CN¥247.29 million, up from CN¥76.39 million last year, reflecting strong operational performance despite a volatile share price recently observed over three months. Their debt to equity ratio increased from 63.3% to 124.2%, suggesting heightened leverage but manageable given their cash position exceeding total debt.

Daoming Optics&ChemicalLtd (SZSE:002632)

Simply Wall St Value Rating: ★★★★★☆

Overview: Daoming Optics&Chemical Co., Ltd specializes in the research, development, production, and sale of functional films and polymer synthetic materials both domestically and internationally, with a market cap of CN¥7.06 billion.

Operations: The company's revenue is primarily derived from the sale of functional films and polymer synthetic materials. It operates both in domestic and international markets, contributing to its financial performance.

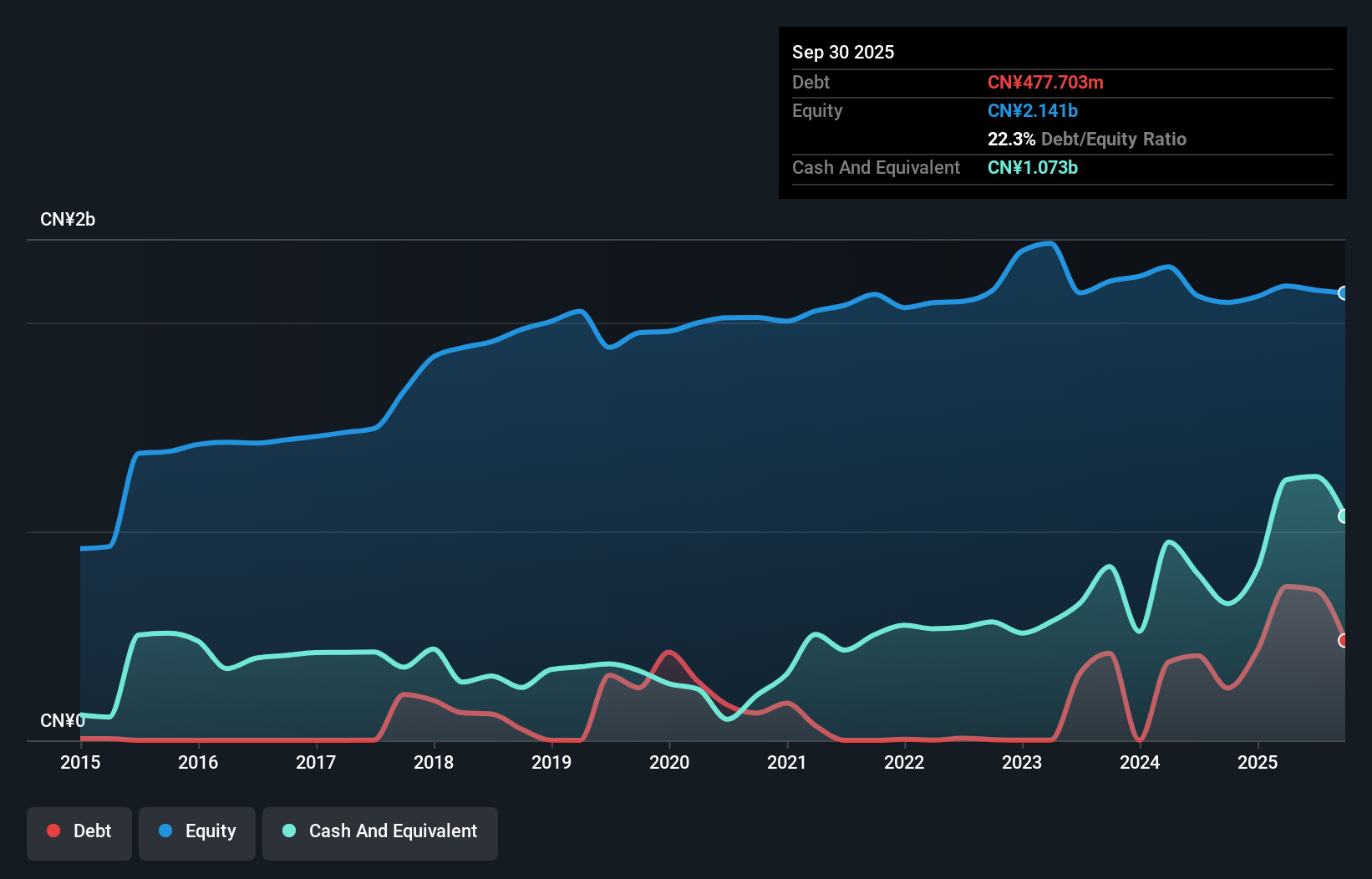

Daoming Optics & Chemical Co. seems to be carving out a niche in the chemicals sector, with its earnings growth of 23% over the past year surpassing the industry average of 6.8%. The company’s net income for the first nine months of 2025 reached CNY 179.54 million, up from CNY 143.99 million a year earlier, reflecting robust performance. Trading at approximately 67% below its estimated fair value suggests potential undervaluation in market perception. Despite an increase in debt to equity ratio from 6.4% to 22.3% over five years, Daoming remains financially sound with more cash than total debt and high-quality earnings supporting interest coverage comfortably.

- Click to explore a detailed breakdown of our findings in Daoming Optics&ChemicalLtd's health report.

Learn about Daoming Optics&ChemicalLtd's historical performance.

Googol Technology (SZSE:301510)

Simply Wall St Value Rating: ★★★★★★

Overview: Googol Technology Co., Ltd. focuses on the research and development, manufacturing, and sale of motion control products both in China and internationally, with a market cap of CN¥12.08 billion.

Operations: Googol Technology generates revenue primarily from its Industrial Automatic Control System Equipment Manufacturing segment, which accounts for CN¥491.02 million. The company has a market capitalization of CN¥12.08 billion.

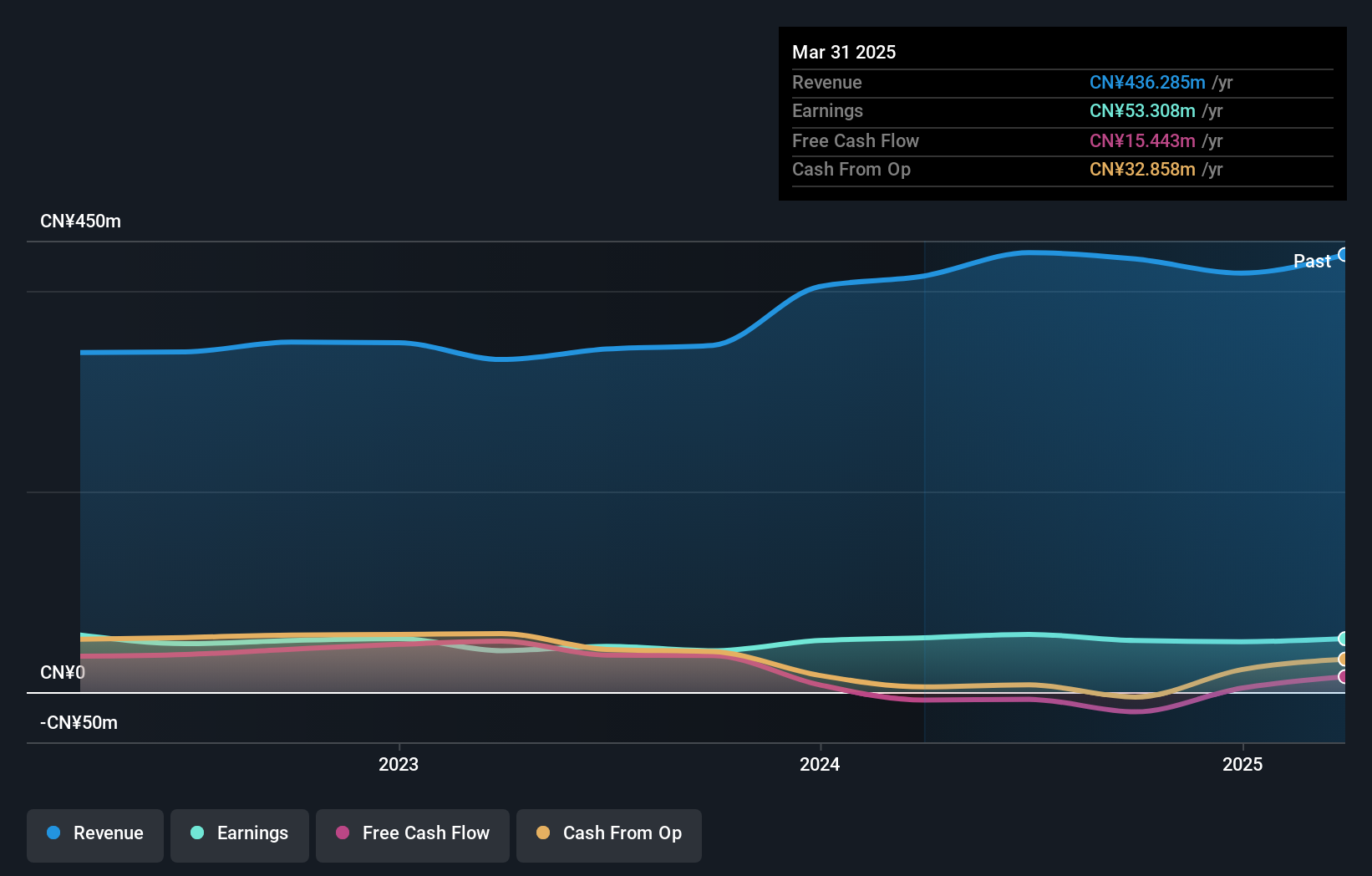

Googol Technology, a nimble player in the electronics industry, is making waves with its impressive earnings growth of 27.6% over the past year, outpacing the industry's 9%. The company's debt to equity ratio has notably decreased from 13.1% to just 1% over five years, reflecting strong financial management. Recent earnings reports show sales climbing to CN¥373.3 million from CN¥295.6 million last year, with net income rising to CN¥44.62 million from CN¥29.22 million. Despite a large one-off gain of CN¥15.5M impacting results, Googol remains free cash flow positive and covers interest payments comfortably.

- Delve into the full analysis health report here for a deeper understanding of Googol Technology.

Evaluate Googol Technology's historical performance by accessing our past performance report.

Taking Advantage

- Explore the 3014 names from our Global Undiscovered Gems With Strong Fundamentals screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301510

Googol Technology

Engages in the research and development, manufacturing, and sale of motion control products in China and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.