Global Value Stocks Priced Below Estimated Worth In November 2025

Reviewed by Simply Wall St

In November 2025, global markets are grappling with a complex mix of factors, including record-low U.S. consumer sentiment and a prolonged government shutdown impacting investor confidence. Amidst these challenges, the search for value becomes paramount as investors look for stocks that may be priced below their estimated worth, offering potential opportunities in an uncertain economic environment.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Roche Bobois (ENXTPA:RBO) | €34.80 | €69.24 | 49.7% |

| PharmaEssentia (TWSE:6446) | NT$482.50 | NT$963.42 | 49.9% |

| Nokian Panimo Oyj (HLSE:BEER) | €2.45 | €4.88 | 49.8% |

| Nippon Thompson (TSE:6480) | ¥708.00 | ¥1412.69 | 49.9% |

| Nichicon (TSE:6996) | ¥1296.00 | ¥2584.67 | 49.9% |

| Mobvista (SEHK:1860) | HK$18.86 | HK$37.71 | 50% |

| Food Empire Holdings (SGX:F03) | SGD2.57 | SGD5.06 | 49.2% |

| E-Globe (BIT:EGB) | €0.645 | €1.29 | 50% |

| eDreams ODIGEO (BME:EDR) | €7.21 | €14.35 | 49.7% |

| Corporativo Fragua. de (BMV:FRAGUA B) | MX$540.00 | MX$1065.06 | 49.3% |

We're going to check out a few of the best picks from our screener tool.

Laboratorios Farmaceuticos Rovi (BME:ROVI)

Overview: Laboratorios Farmaceuticos Rovi, S.A. is a pharmaceutical company that manufactures, sells, and markets its products in Spain, the European Union, OECD countries, and internationally with a market cap of €3.01 billion.

Operations: Laboratorios Farmaceuticos Rovi, S.A. generates revenue through the production and distribution of pharmaceutical products across Spain, the European Union, OECD countries, and other international markets.

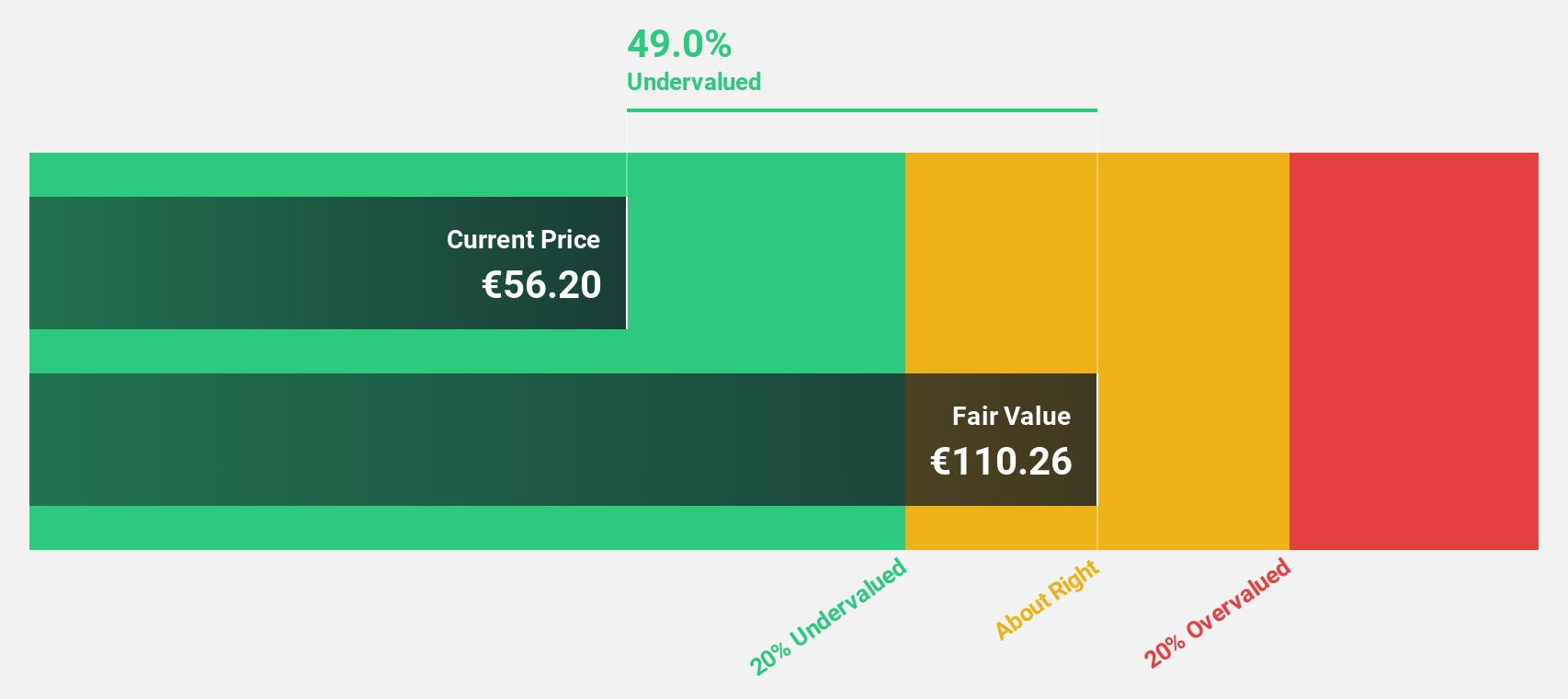

Estimated Discount To Fair Value: 41.3%

Laboratorios Farmaceuticos Rovi is trading at €58.85, significantly below its estimated fair value of €100.24, indicating potential undervaluation based on cash flows. Despite a recent dip in sales and net income for the nine months ending September 2025, earnings are forecast to grow by 20.54% annually, outpacing the Spanish market's growth rate. The company's acquisition of a manufacturing site in Phoenix could bolster future revenue streams and operational capacity.

- According our earnings growth report, there's an indication that Laboratorios Farmaceuticos Rovi might be ready to expand.

- Unlock comprehensive insights into our analysis of Laboratorios Farmaceuticos Rovi stock in this financial health report.

Suning.com (SZSE:002024)

Overview: Suning.com Co., Ltd. operates as a retail business in China with a market cap of CN¥16.48 billion.

Operations: Suning.com Co., Ltd. generates its revenue primarily through its retail operations in China.

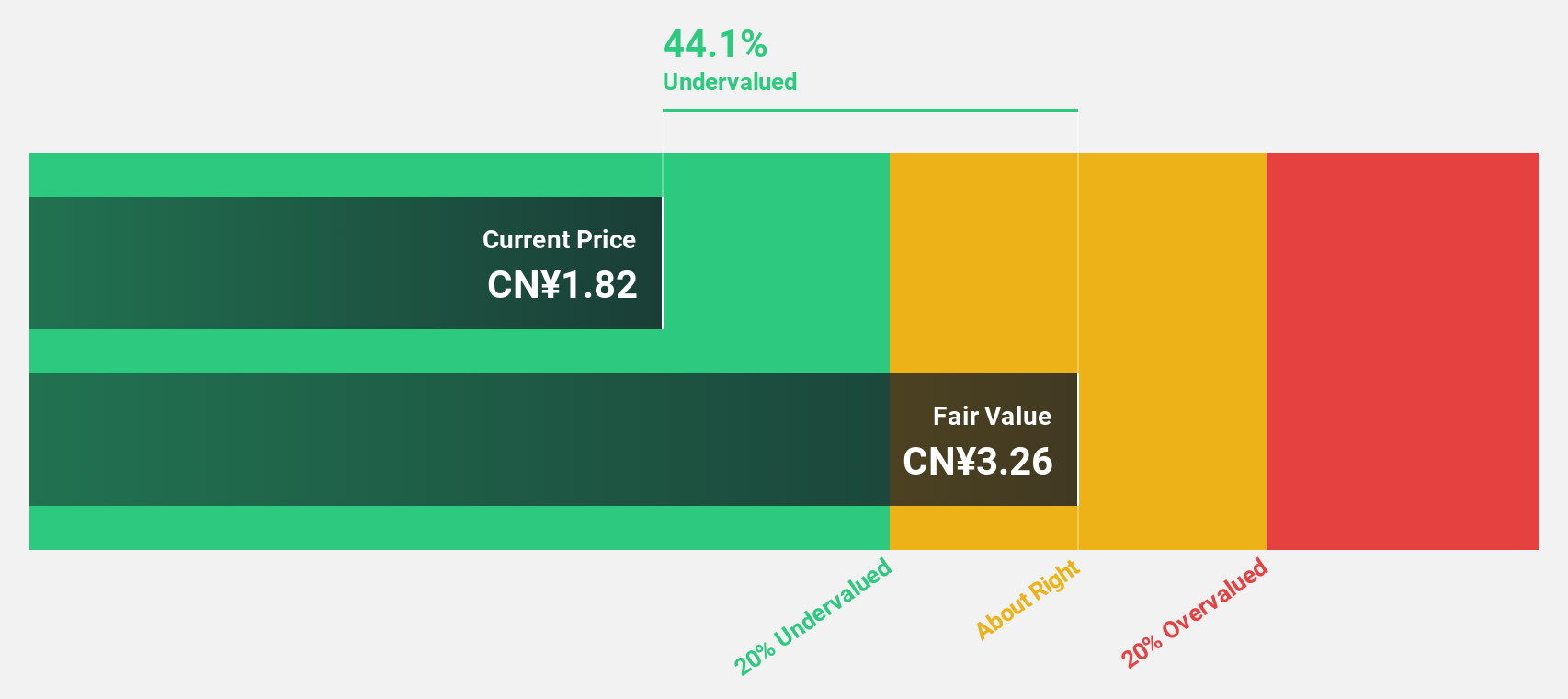

Estimated Discount To Fair Value: 44.1%

Suning.com is trading at CN¥1.82, significantly below its estimated fair value of CN¥3.26, highlighting potential undervaluation based on cash flows. The company's earnings are forecast to grow substantially at 63% annually over the next three years, surpassing the broader Chinese market growth rate. However, recent financial results show a decline in net income to CN¥73.33 million for the nine months ended September 2025, compared to CN¥599.22 million a year ago.

- In light of our recent growth report, it seems possible that Suning.com's financial performance will exceed current levels.

- Dive into the specifics of Suning.com here with our thorough financial health report.

Anhui Jinhe IndustrialLtd (SZSE:002597)

Overview: Anhui Jinhe Industrial Co., Ltd. is involved in the R&D, production, and sales of food additives, daily chemical flavors, bulk chemicals, and intermediates with a market cap of CN¥11.86 billion.

Operations: The company generates revenue through its involvement in the research, development, production, and sales of food additives, daily chemical flavors, bulk chemicals, and intermediates.

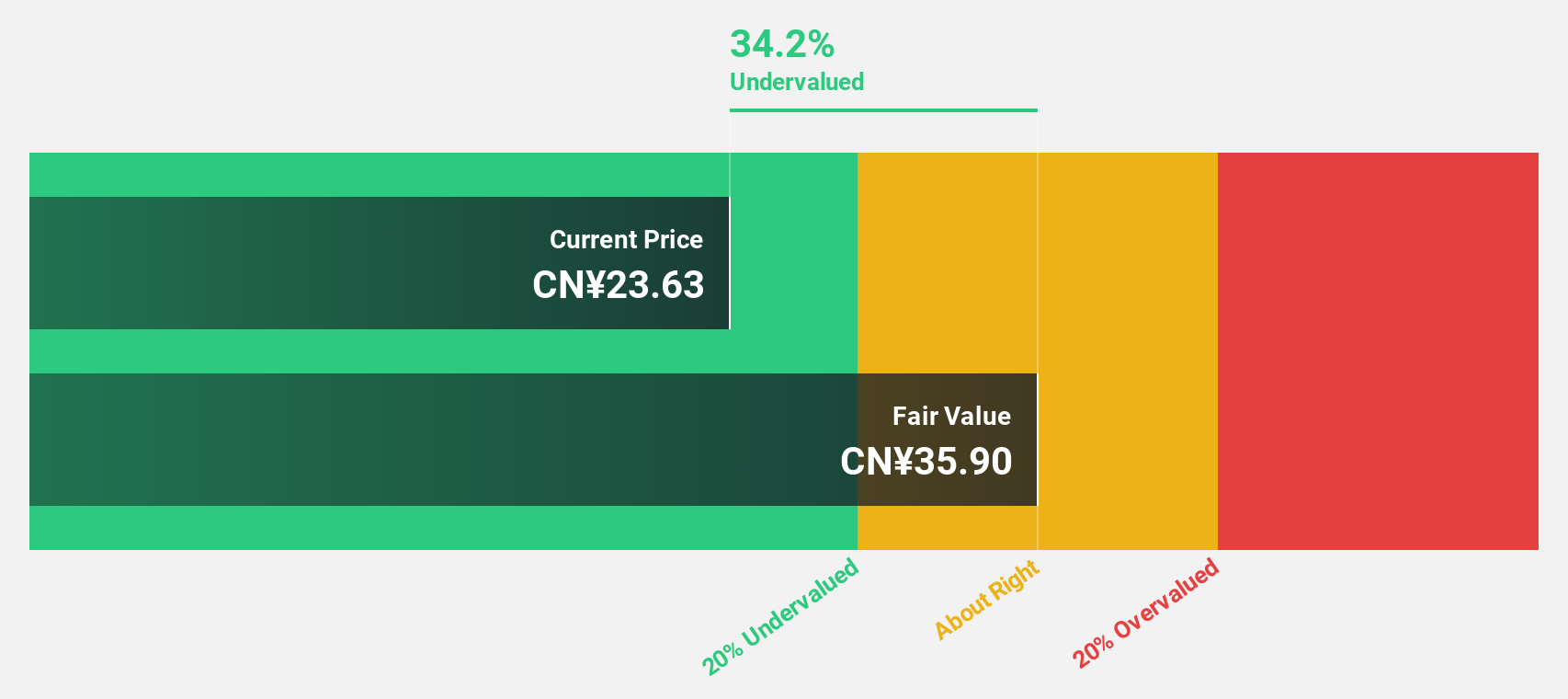

Estimated Discount To Fair Value: 34.4%

Anhui Jinhe Industrial Ltd. is trading at CN¥22.41, significantly below its estimated fair value of CN¥34.17, suggesting potential undervaluation based on cash flows. The company's earnings are forecast to grow substantially at 40.6% annually over the next three years, outpacing the broader Chinese market growth rate of 27.4%. However, recent results show a decline in net income to CNY 391.02 million for the nine months ended September 2025 from CNY 409.17 million a year ago.

- Our growth report here indicates Anhui Jinhe IndustrialLtd may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Anhui Jinhe IndustrialLtd.

Where To Now?

- Get an in-depth perspective on all 499 Undervalued Global Stocks Based On Cash Flows by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002597

Anhui Jinhe IndustrialLtd

Engages in the research and development, production, and sales of food additives, daily chemical flavors, bulk chemicals, and intermediates.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives