- Japan

- /

- Specialty Stores

- /

- TSE:2726

Asian Market Insights: Anhui Jinhe IndustrialLtd And Two Other Stocks Estimated Below Fair Value

Reviewed by Simply Wall St

As global markets navigate a period of economic uncertainty, the Asian stock market presents unique opportunities for discerning investors. With interest rates being adjusted across major economies and concerns about technology valuations impacting indices, identifying stocks that are estimated to be below their fair value can offer potential benefits. In this context, understanding what makes a stock undervalued—such as strong fundamentals or growth potential not yet reflected in its price—is crucial for those looking to explore investment opportunities in Asia's diverse markets.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zhejiang Jiemei Electronic And Technology (SZSE:002859) | CN¥30.52 | CN¥59.85 | 49% |

| Xi'an NovaStar Tech (SZSE:301589) | CN¥154.80 | CN¥304.27 | 49.1% |

| Wuhan Guide Infrared (SZSE:002414) | CN¥12.93 | CN¥25.33 | 48.9% |

| Tianqi Lithium (SZSE:002466) | CN¥52.10 | CN¥102.06 | 49% |

| LOIVELtd (TSE:352A) | ¥811.00 | ¥1596.04 | 49.2% |

| JINS HOLDINGS (TSE:3046) | ¥5620.00 | ¥10986.85 | 48.8% |

| Global Security Experts (TSE:4417) | ¥2880.00 | ¥5744.07 | 49.9% |

| Daiichi Sankyo Company (TSE:4568) | ¥3341.00 | ¥6544.37 | 48.9% |

| Andes Technology (TWSE:6533) | NT$243.50 | NT$484.94 | 49.8% |

| ActRO (KOSDAQ:A290740) | ₩12550.00 | ₩25085.06 | 50% |

Let's explore several standout options from the results in the screener.

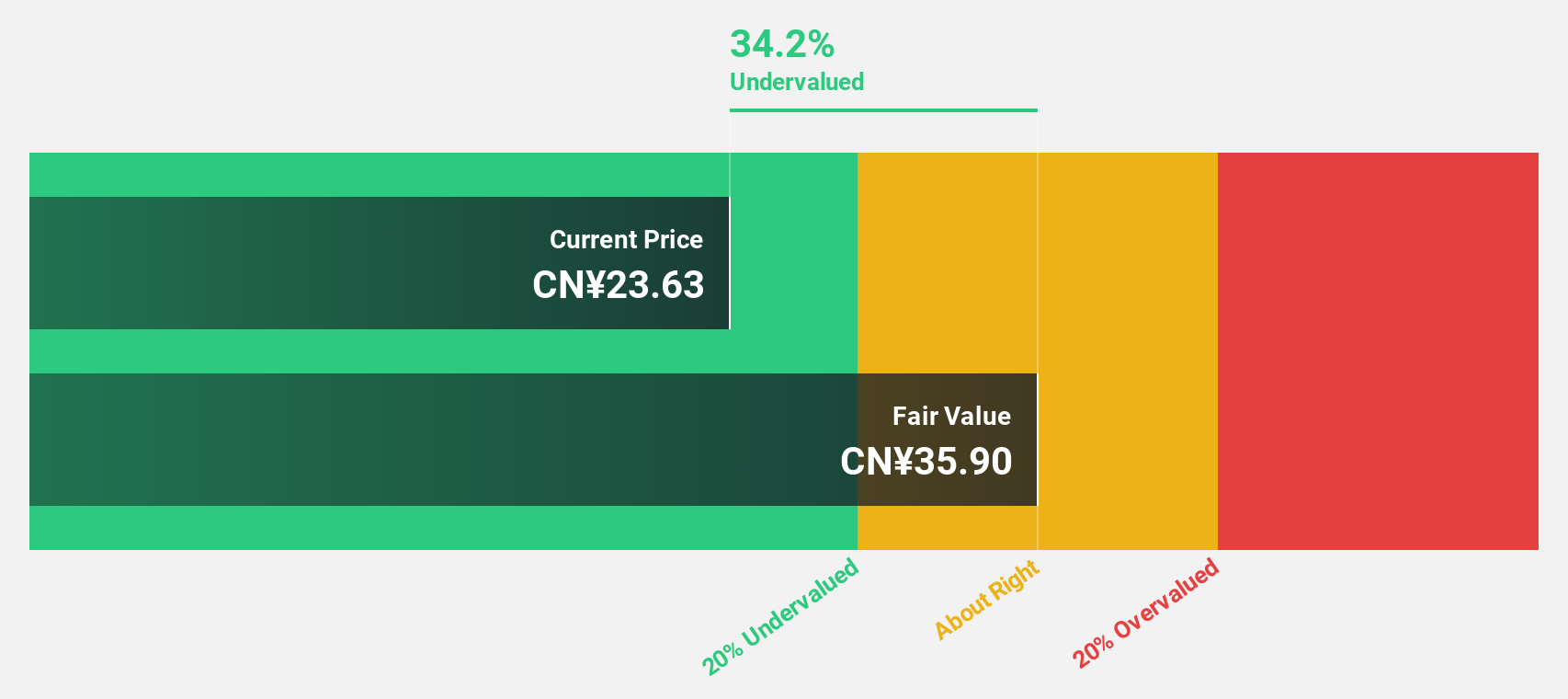

Anhui Jinhe IndustrialLtd (SZSE:002597)

Overview: Anhui Jinhe Industrial Co., Ltd. specializes in the research, development, production, and sales of food additives, daily chemical flavors, bulk chemicals, and intermediates with a market cap of approximately CN¥11.22 billion.

Operations: Anhui Jinhe Industrial Co., Ltd. generates revenue through its involvement in the research, development, production, and sales of food additives, daily chemical flavors, bulk chemicals, and intermediates.

Estimated Discount To Fair Value: 16.4%

Anhui Jinhe Industrial Ltd. is trading at CNY 20.5, below its estimated fair value of CNY 24.53, indicating potential undervaluation based on cash flows. Despite a slight decline in recent earnings and sales figures, the company's revenue is forecast to grow at 23.2% annually, outpacing the Chinese market's growth rate of 14.5%. However, its dividend yield of 4.05% isn't well covered by free cash flows, suggesting some caution for income-focused investors.

- Our growth report here indicates Anhui Jinhe IndustrialLtd may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Anhui Jinhe IndustrialLtd.

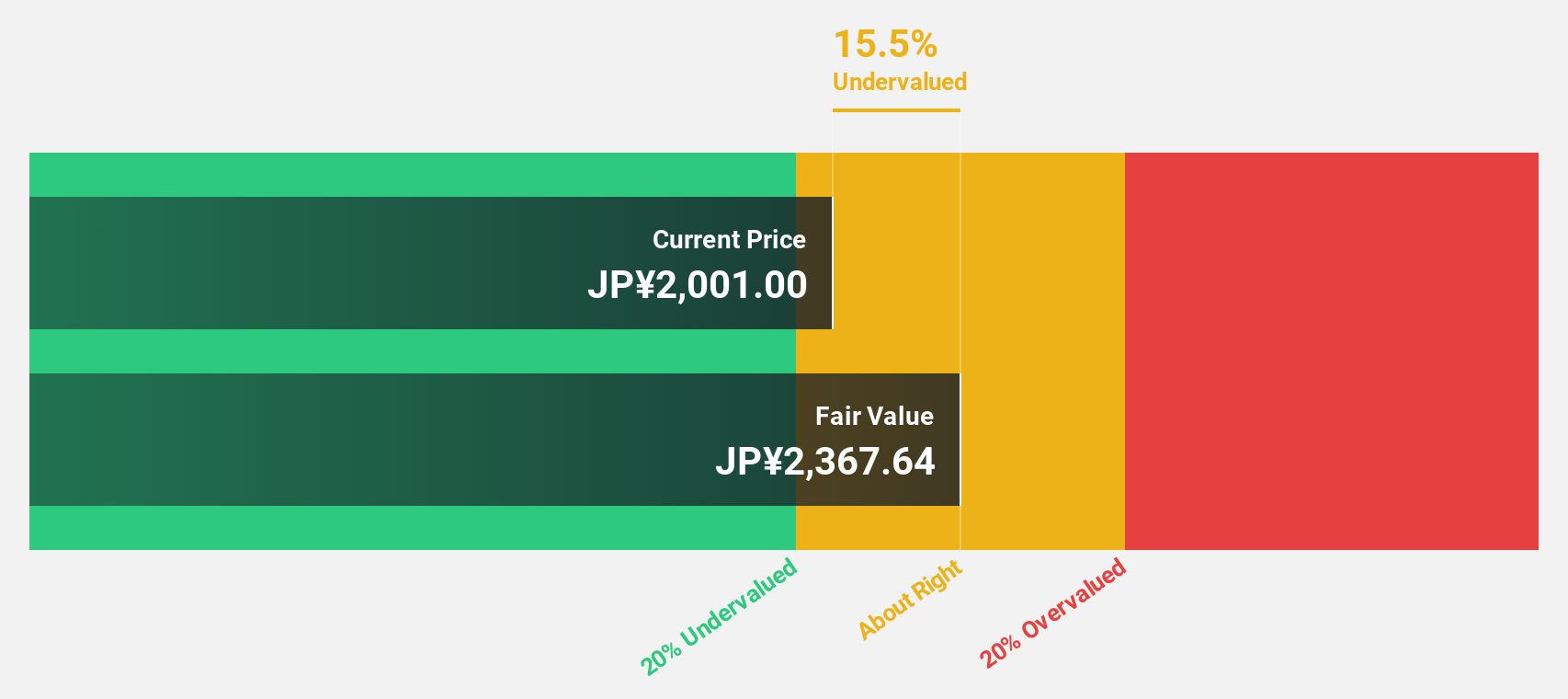

PAL GROUP Holdings (TSE:2726)

Overview: PAL GROUP Holdings CO., LTD. operates in Japan, focusing on the planning, manufacture, wholesale, and retail of men's and women's clothing and accessories, with a market cap of ¥368.48 billion.

Operations: The company's revenue is derived from two main segments: the Clothing Business, which generates ¥138.52 billion, and the Miscellaneous Goods Business, contributing ¥84.72 billion.

Estimated Discount To Fair Value: 13.5%

PAL GROUP Holdings is trading at ¥2,122, below its estimated fair value of ¥2,451.97, reflecting potential undervaluation based on cash flows. Earnings are forecast to grow at 17.3% annually, outpacing the Japanese market's 8.5% growth rate. However, recent management changes due to health issues could introduce uncertainty in leadership stability. Despite these challenges, the company's robust revenue and earnings growth forecasts may attract investors seeking undervalued opportunities in Asia's markets.

- Our earnings growth report unveils the potential for significant increases in PAL GROUP Holdings' future results.

- Click to explore a detailed breakdown of our findings in PAL GROUP Holdings' balance sheet health report.

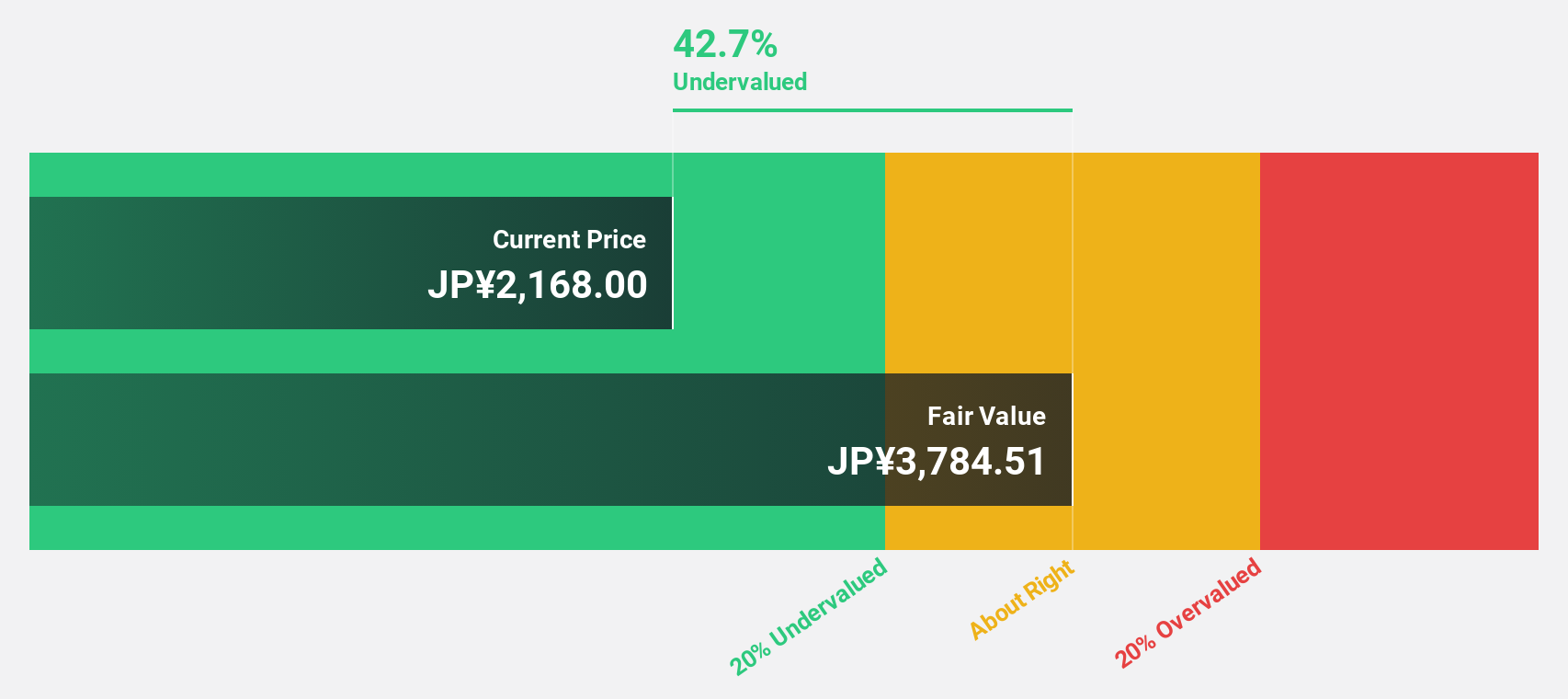

Plus Alpha ConsultingLtd (TSE:4071)

Overview: Plus Alpha Consulting Co., Ltd. offers marketing and HR solutions in Japan, with a market cap of ¥103.89 billion.

Operations: The company generates revenue from HR Solutions amounting to ¥13.25 billion and Marketing Solutions totaling ¥3.84 billion.

Estimated Discount To Fair Value: 46.5%

Plus Alpha Consulting Ltd. is trading at ¥2,452, significantly below its estimated fair value of ¥4,583.61, highlighting potential undervaluation based on cash flows. Earnings are forecast to grow by 18.7% annually, surpassing the Japanese market's 8.5% growth rate, while revenue is expected to increase by 12.3% per year. Despite extraordinary losses from impairment charges on subsidiaries and recent dividend hikes aiming for sustainable growth, the company's financial outlook remains promising for investors seeking value in Asia.

- Our expertly prepared growth report on Plus Alpha ConsultingLtd implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Plus Alpha ConsultingLtd.

Key Takeaways

- Embark on your investment journey to our 276 Undervalued Asian Stocks Based On Cash Flows selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2726

PAL GROUP Holdings

Engages in the planning, manufacture, wholesale, and retail of clothing products, including men’s and women’s clothing and accessories in Japan.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion