Anhui Jinhe Industrial Co.,Ltd.'s (SZSE:002597) Price Is Right But Growth Is Lacking After Shares Rocket 31%

Anhui Jinhe Industrial Co.,Ltd. (SZSE:002597) shares have continued their recent momentum with a 31% gain in the last month alone. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 5.5% over the last year.

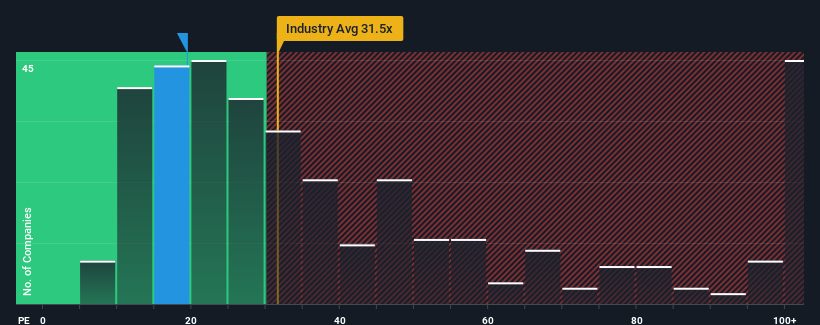

Although its price has surged higher, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 31x, you may still consider Anhui Jinhe IndustrialLtd as an attractive investment with its 19.4x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Anhui Jinhe IndustrialLtd could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Anhui Jinhe IndustrialLtd

Is There Any Growth For Anhui Jinhe IndustrialLtd?

There's an inherent assumption that a company should underperform the market for P/E ratios like Anhui Jinhe IndustrialLtd's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 58% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 2.5% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the nine analysts covering the company suggest earnings should grow by 13% per annum over the next three years. With the market predicted to deliver 20% growth per annum, the company is positioned for a weaker earnings result.

With this information, we can see why Anhui Jinhe IndustrialLtd is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

The latest share price surge wasn't enough to lift Anhui Jinhe IndustrialLtd's P/E close to the market median. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Anhui Jinhe IndustrialLtd maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Anhui Jinhe IndustrialLtd that you should be aware of.

If these risks are making you reconsider your opinion on Anhui Jinhe IndustrialLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002597

Anhui Jinhe IndustrialLtd

Engages in the research and development, production, and sales of food additives, daily chemical flavors, bulk chemicals, and intermediates.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives