- Taiwan

- /

- Semiconductors

- /

- TPEX:6679

Undiscovered Gems To Explore In November 2024

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by a busy earnings season and mixed economic signals, small-cap stocks have shown resilience, holding up better than their large-cap counterparts amidst the volatility. With manufacturing activity subdued and labor market data presenting divergent signals, investors are keenly observing how these factors might impact smaller companies that often thrive on nimbleness and innovation. In such an environment, identifying undiscovered gems involves seeking out companies with solid fundamentals and unique growth potential that can withstand broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Techno Smart | NA | 6.07% | -0.57% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.63% | 22.92% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Compañía Electro Metalúrgica | 72.83% | 12.17% | 19.18% | ★★★★☆☆ |

| Hermes Transportes Blindados | 58.80% | 4.29% | 2.04% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Al Wathba National Insurance Company PJSC | 14.56% | 13.48% | 31.31% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

UIE (CPSE:UIE)

Simply Wall St Value Rating: ★★★★★★

Overview: UIE Plc is an investment company operating in the agro-industrial, industrial, and technology sectors across Malaysia, Indonesia, the United States, Europe, and internationally with a market cap of DKK9.02 billion.

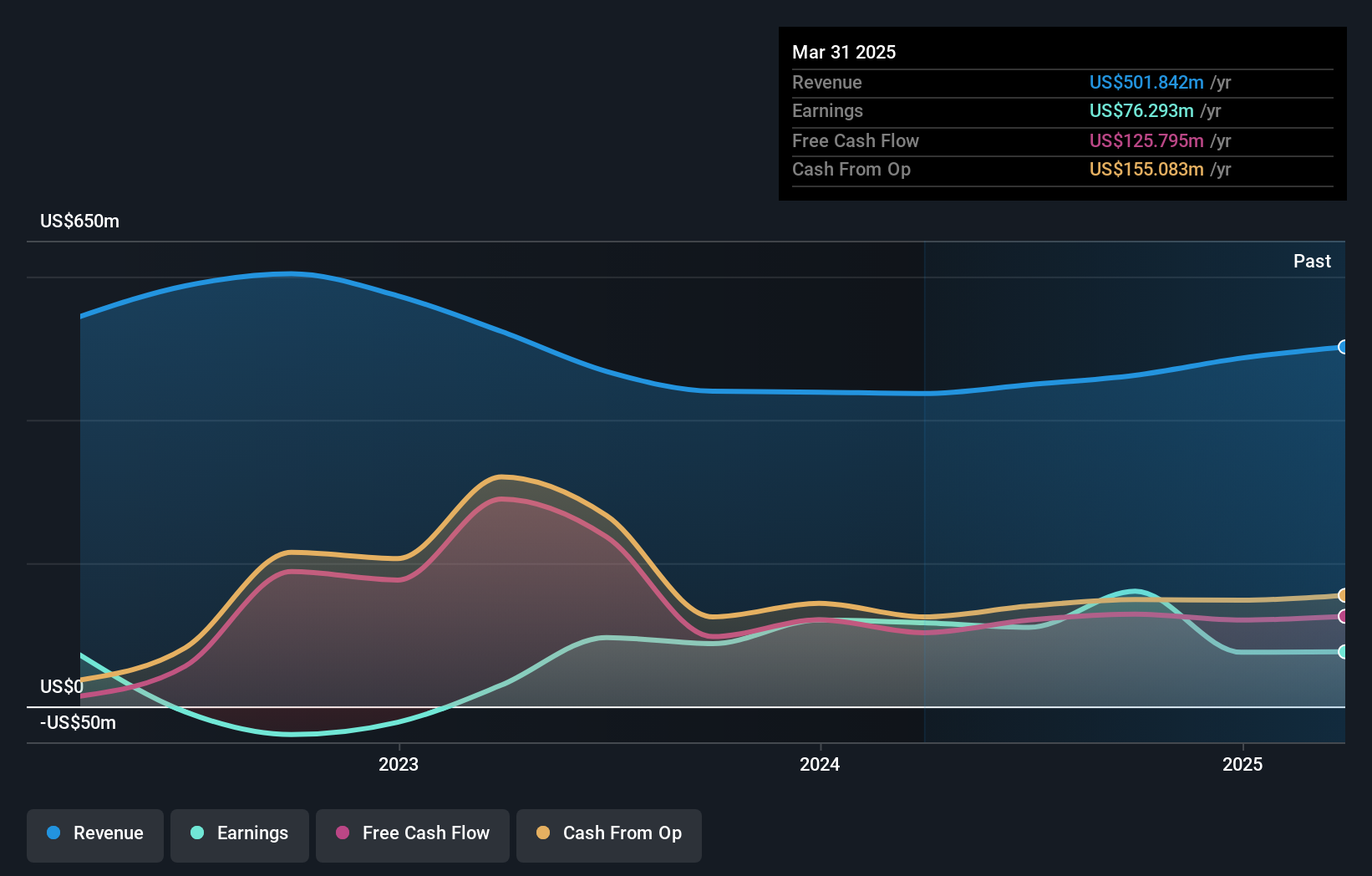

Operations: UIE Plc generates revenue primarily through its investment in United Plantations Berhad, contributing $449.09 million.

UIE, a small player in the market, stands out with its debt-free status and consistent earnings growth of 7.3% annually over the past five years. The company has initiated share repurchases to reduce capital, with plans to buy back up to 950,000 shares under a Safe Harbour program valued at DKK 265 million. Despite a lower net income of US$21.79 million in Q2 2024 compared to US$28.13 million last year, UIE's price-to-earnings ratio of 12x remains attractive against the Danish market average of 14.5x, suggesting potential value for investors seeking stable returns without leverage concerns.

- Delve into the full analysis health report here for a deeper understanding of UIE.

Examine UIE's past performance report to understand how it has performed in the past.

Xilong Scientific (SZSE:002584)

Simply Wall St Value Rating: ★★★★★☆

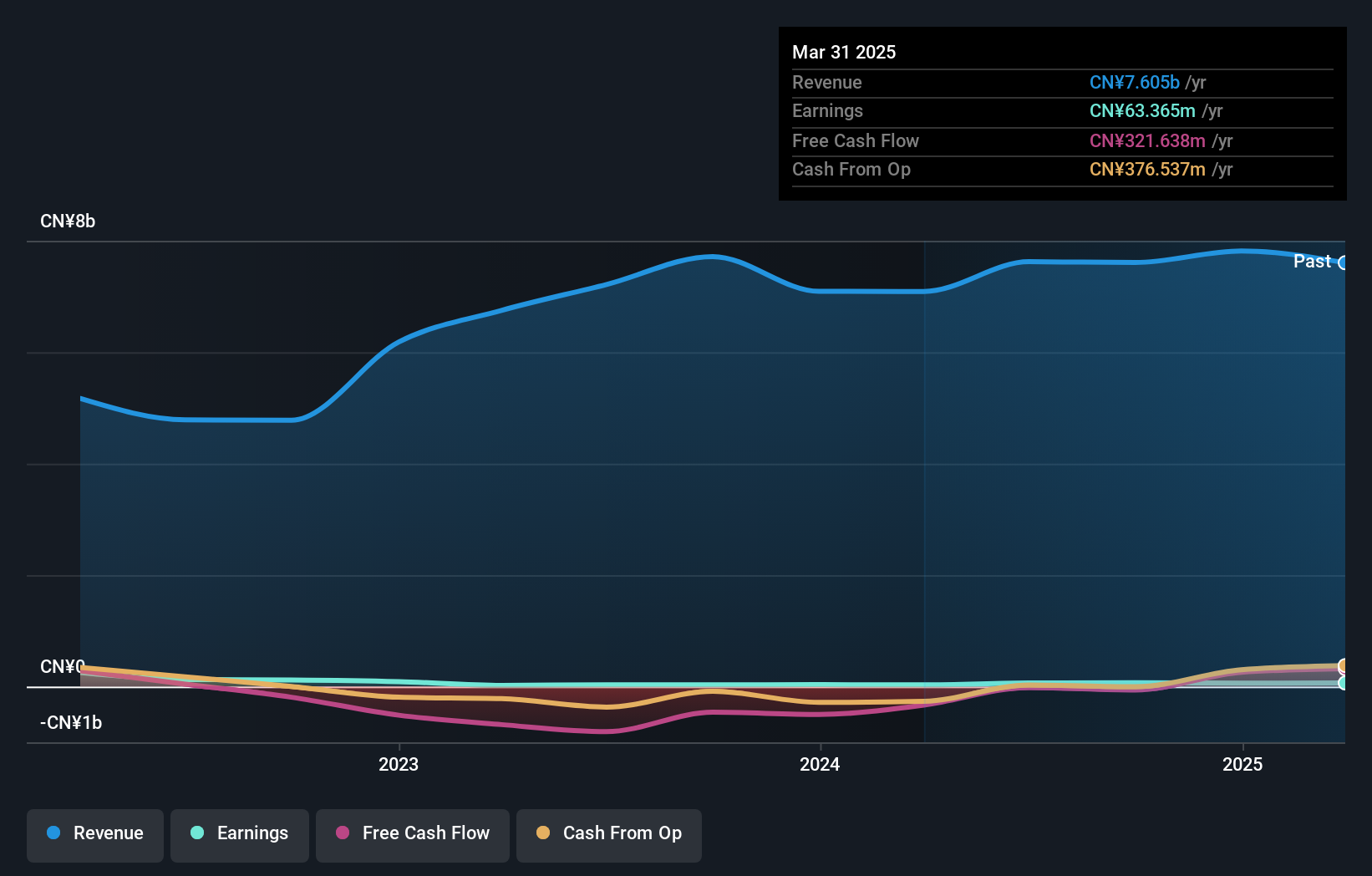

Overview: Xilong Scientific Co., Ltd. engages in the research, development, manufacturing, and sale of chemical reagents in China with a market cap of CN¥4.75 billion.

Operations: The company generates revenue primarily from the sale of chemical reagents. It has a market capitalization of CN¥4.75 billion.

Xilong Scientific, a small-cap player in the chemicals sector, has shown impressive earnings growth of 124.5% over the past year, outpacing its industry peers. Recent financials highlight a net income rise to CNY 64.19 million from CNY 29.5 million year-on-year for the first nine months of 2024, reflecting robust performance with basic earnings per share doubling to CNY 0.11. Despite not being free cash flow positive recently, its net debt to equity ratio is satisfactory at 32.7%, and interest payments are well-covered by EBIT at a coverage ratio of 3.4x, indicating solid financial health amidst ongoing expansion efforts like recent M&A activities valued at approximately CNY 230 million.

- Click here and access our complete health analysis report to understand the dynamics of Xilong Scientific.

Gain insights into Xilong Scientific's past trends and performance with our Past report.

Zilltek Technology (TPEX:6679)

Simply Wall St Value Rating: ★★★★★★

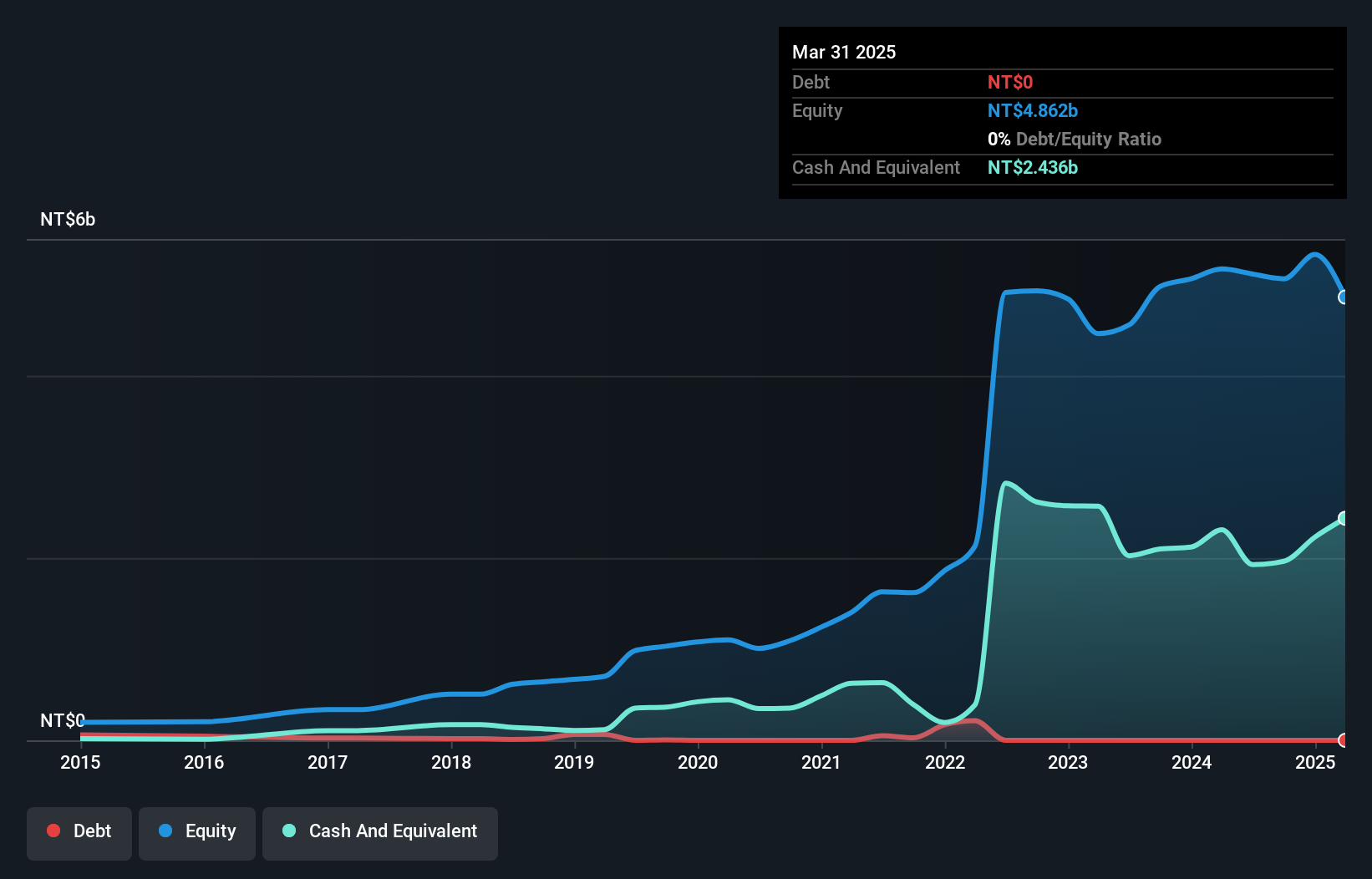

Overview: Zilltek Technology Corp. is an IC design company with operations in Taiwan, China, and internationally, and has a market capitalization of NT$19.26 billion.

Operations: Zilltek Technology generates revenue primarily from its Electronic Components & Parts segment, amounting to NT$2.13 billion. The company's market capitalization stands at NT$19.26 billion.

Zilltek Technology, a nimble player in the tech arena, boasts impressive earnings growth of 53% over the past year, significantly outpacing the Semiconductor industry's meager 0.01%. The company appears to be on solid ground with no debt and a positive free cash flow trajectory, recently reaching US$414.59 million. This financial stability is complemented by high-quality earnings that have consistently been robust. Looking ahead, Zilltek's forecasted annual earnings growth of 22% suggests promising potential for continued expansion in its niche market space.

- Dive into the specifics of Zilltek Technology here with our thorough health report.

Explore historical data to track Zilltek Technology's performance over time in our Past section.

Where To Now?

- Reveal the 4726 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zilltek Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6679

Zilltek Technology

Operates as an IC design company in Taiwan, China, and internationally.

Flawless balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives