As global markets navigate a choppy start to 2025, small-cap stocks have particularly felt the pressure, with the Russell 2000 Index dipping into correction territory amid inflation concerns and political uncertainty. Despite these challenges, the resilience of certain economic indicators suggests potential opportunities for investors willing to explore beyond the surface. In such a volatile environment, identifying stocks with strong fundamentals and growth potential can be key to uncovering hidden gems that may thrive despite broader market headwinds.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Voltamp Energy SAOG | 23.14% | -3.64% | 30.64% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| ASRock Rack Incorporation | NA | 45.76% | 269.05% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Co-Tech Development | 26.81% | 3.29% | 6.53% | ★★★★★☆ |

| Jamuna Bank | 85.07% | 7.37% | -3.87% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Beijing Tianma Intelligent Control Technology (SHSE:688570)

Simply Wall St Value Rating: ★★★★★★

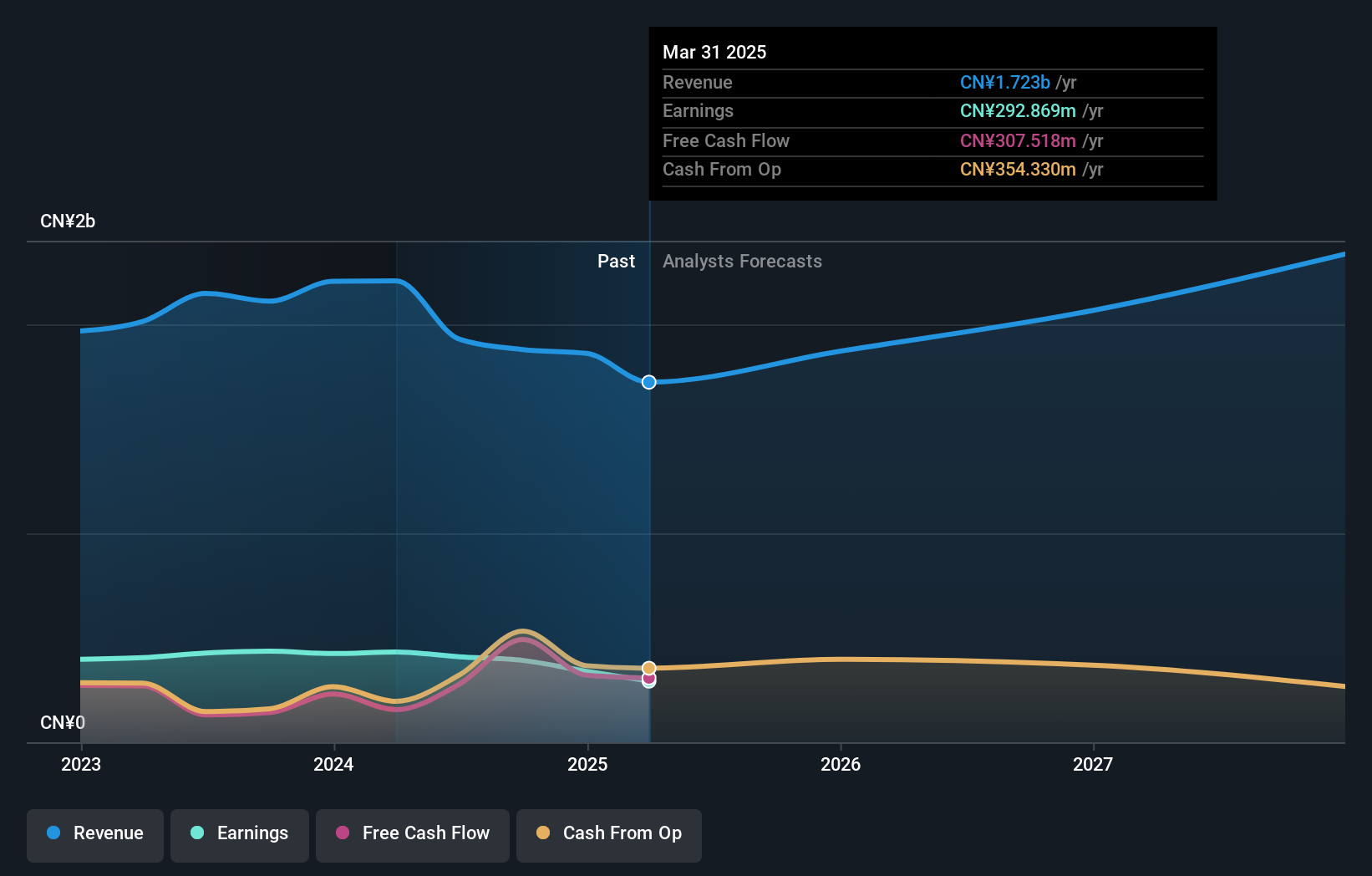

Overview: Beijing Tianma Intelligent Control Technology Co., Ltd. specializes in the development and manufacturing of intelligent control systems for construction machinery, with a market cap of CN¥7.99 billion.

Operations: Tianma Intelligent Control generates revenue primarily from the construction machinery and equipment segment, totaling CN¥1.88 billion. The company's gross profit margin is 35%, reflecting its efficiency in managing production costs within this sector.

Beijing Tianma Intelligent Control Technology, a small player in its field, is debt-free and boasts high-quality past earnings. Despite being profitable with positive free cash flow, it faced negative earnings growth of 10% last year, lagging behind the Machinery industry average. Trading at 53% below its estimated fair value suggests potential undervaluation. Recent financials show sales of CNY 1.21 billion for the first nine months of 2024 compared to CNY 1.54 billion a year ago, with net income dropping to CNY 280 million from CNY 313 million. Earnings per share also fell to CNY 0.65 from CNY 0.82.

Central China Land MediaLTD (SZSE:000719)

Simply Wall St Value Rating: ★★★★★★

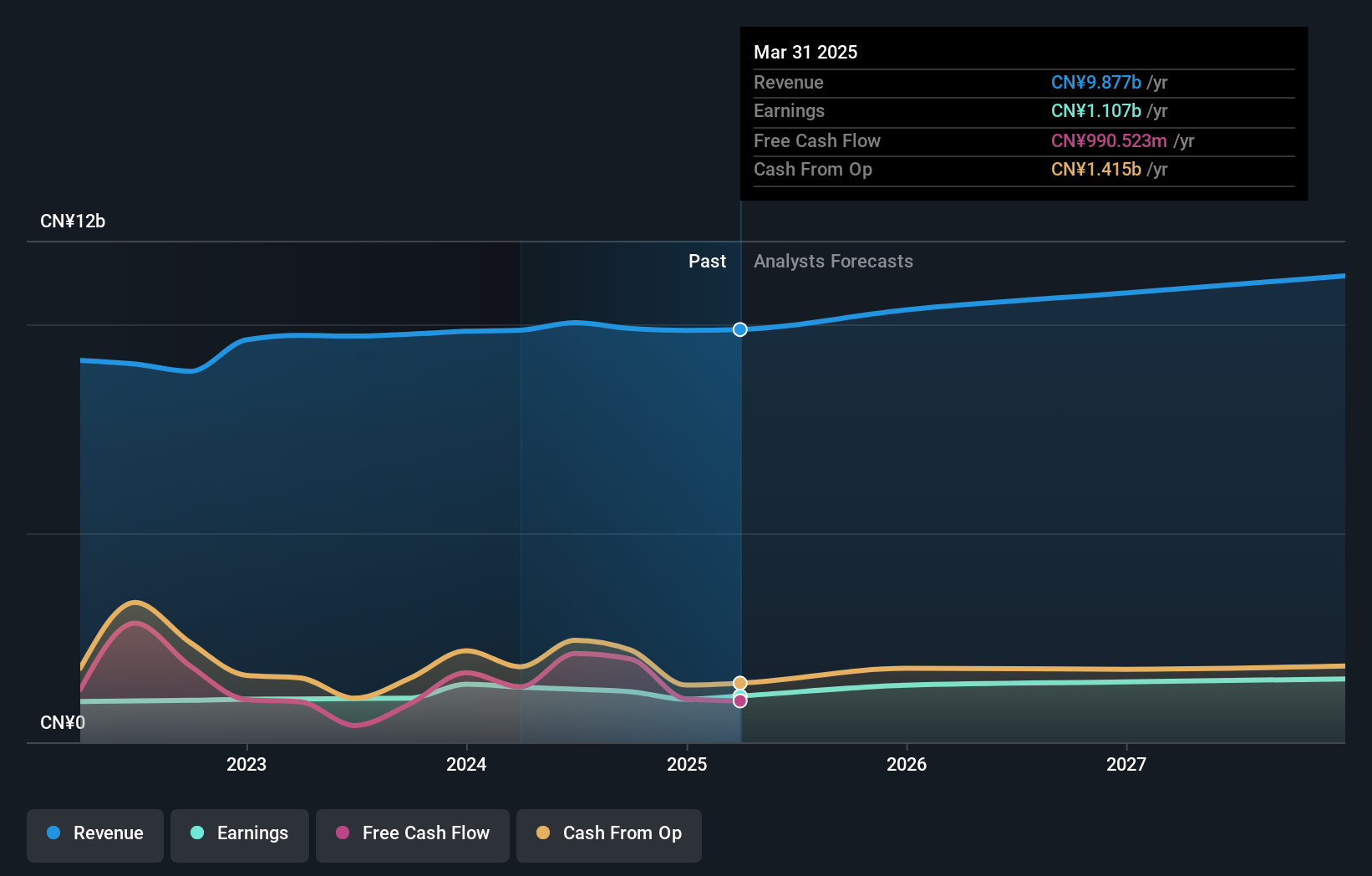

Overview: Central China Land Media CO., LTD operates in the editing, publishing, printing, marketing, distribution, and material supply of various media products including books and electronic publications with a market cap of CN¥11.18 billion.

Operations: Central China Land Media generates revenue primarily through the editing, publishing, printing, and distribution of books and electronic media. The company incurs costs related to material supply and production processes. Its financial performance is reflected in a net profit margin of 6.5%, indicating the proportion of revenue that translates into profit after all expenses are accounted for.

Central China Land Media seems to be an intriguing player in the media sector, with its recent earnings report indicating sales of CNY 6.70 billion for the first nine months of 2024, slightly up from CNY 6.63 billion a year prior. However, net income has taken a hit, dropping to CNY 508.2 million from CNY 685.59 million last year, reflecting challenges in profitability as basic and diluted EPS both stand at CNY 0.5 compared to last year's CNY 0.67. Despite these hurdles, the company is debt-free and trades at a significant discount of around two-thirds below its estimated fair value, suggesting potential upside if market conditions improve or operations stabilize further in line with industry trends where it outpaced average growth by achieving a notable earnings increase of about 14% over the past year while peers saw declines around -10%.

Anhui Sierte Fertilizer industry company (SZSE:002538)

Simply Wall St Value Rating: ★★★★★★

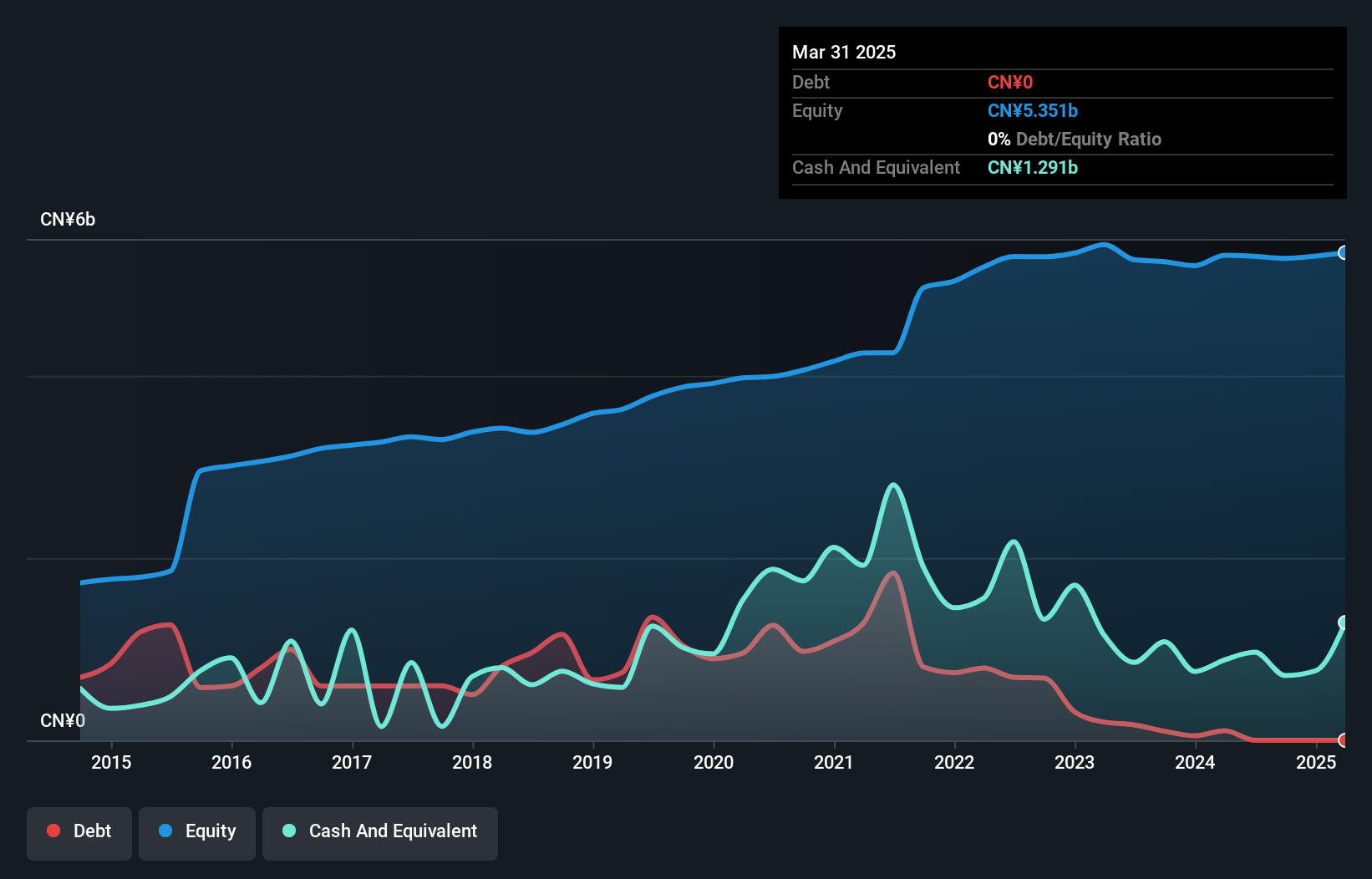

Overview: Anhui Sierte Fertilizer Industry Co., Ltd. produces and sells compound fertilizers in China with a market capitalization of CN¥4.72 billion.

Operations: The company's primary revenue stream is from the sale of compound fertilizers in China. With a market capitalization of CN¥4.72 billion, it focuses on optimizing its cost structure to enhance profitability.

Anhui Sierte Fertilizer, a nimble player in the chemicals industry, has demonstrated impressive earnings growth of 61.9% over the past year, outpacing the industry's -5%. Despite a historical decline of 5.5% annually over five years, recent performance shows resilience with net income climbing to CNY 244.51 million from CNY 123.19 million year-over-year for nine months ending September 2024. The company is debt-free now compared to a debt-to-equity ratio of 27% five years ago and offers good value with a price-to-earnings ratio of 19.9x against the CN market's average of 34.2x, suggesting potential upside in valuation terms.

Turning Ideas Into Actions

- Investigate our full lineup of 4631 Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Tianma Intelligent Control Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688570

Beijing Tianma Intelligent Control Technology

Beijing Tianma Intelligent Control Technology Co., Ltd.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives