Tianqi Lithium Corporation's (SZSE:002466) Business Is Yet to Catch Up With Its Share Price

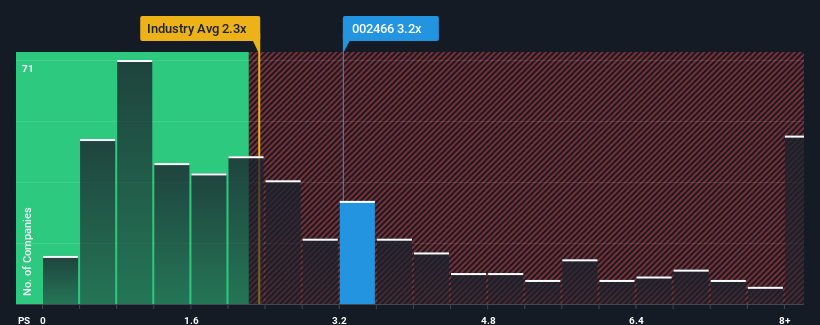

When close to half the companies in the Chemicals industry in China have price-to-sales ratios (or "P/S") below 2.3x, you may consider Tianqi Lithium Corporation (SZSE:002466) as a stock to potentially avoid with its 3.2x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Tianqi Lithium

How Has Tianqi Lithium Performed Recently?

While the industry has experienced revenue growth lately, Tianqi Lithium's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Tianqi Lithium.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Tianqi Lithium would need to produce impressive growth in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 65%. Even so, admirably revenue has lifted 266% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 13% per annum during the coming three years according to the analysts following the company. With the industry predicted to deliver 29% growth per annum, the company is positioned for a weaker revenue result.

With this in consideration, we believe it doesn't make sense that Tianqi Lithium's P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On Tianqi Lithium's P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It comes as a surprise to see Tianqi Lithium trade at such a high P/S given the revenue forecasts look less than stellar. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

It is also worth noting that we have found 1 warning sign for Tianqi Lithium that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Tianqi Lithium might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002466

Tianqi Lithium

Invests, produces, process, extracts, and sells lithium, lithium concentrate, and the lithium specialty compounds in Australia, Chile, and China.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives