Tianqi Lithium Corporation's (SZSE:002466) 25% Share Price Surge Not Quite Adding Up

Despite an already strong run, Tianqi Lithium Corporation (SZSE:002466) shares have been powering on, with a gain of 25% in the last thirty days. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 22% in the last twelve months.

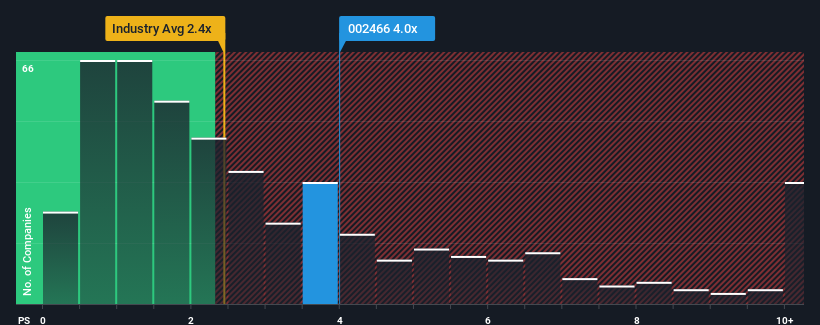

Following the firm bounce in price, given close to half the companies operating in China's Chemicals industry have price-to-sales ratios (or "P/S") below 2.4x, you may consider Tianqi Lithium as a stock to potentially avoid with its 4x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Tianqi Lithium

What Does Tianqi Lithium's Recent Performance Look Like?

Tianqi Lithium could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Tianqi Lithium will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Tianqi Lithium would need to produce impressive growth in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 65%. Still, the latest three year period has seen an excellent 266% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 7.7% per annum as estimated by the analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 31% per annum, which is noticeably more attractive.

With this in consideration, we believe it doesn't make sense that Tianqi Lithium's P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Key Takeaway

Tianqi Lithium shares have taken a big step in a northerly direction, but its P/S is elevated as a result. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It comes as a surprise to see Tianqi Lithium trade at such a high P/S given the revenue forecasts look less than stellar. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. At these price levels, investors should remain cautious, particularly if things don't improve.

Before you take the next step, you should know about the 1 warning sign for Tianqi Lithium that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Tianqi Lithium might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002466

Tianqi Lithium

Invests, produces, process, extracts, and sells lithium, lithium concentrate, and the lithium specialty compounds in Australia, Chile, and China.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives