- China

- /

- Semiconductors

- /

- SHSE:688498

3 Global Growth Stocks With High Insider Ownership Expecting 35% Revenue Growth

Reviewed by Simply Wall St

Amidst easing trade concerns and positive earnings reports, global markets have shown resilience with U.S. stocks climbing for consecutive weeks and European indices rising as tariff worries subside. In this environment of cautious optimism, growth companies with high insider ownership can be particularly appealing to investors seeking alignment between management interests and shareholder value, especially when these companies are poised for significant revenue growth.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 11.8% | 43.1% |

| KebNi (OM:KEBNI B) | 38.3% | 67.3% |

| Vow (OB:VOW) | 13.1% | 76.9% |

| Laopu Gold (SEHK:6181) | 36.4% | 40.2% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 44.2% |

| CD Projekt (WSE:CDR) | 29.7% | 37.4% |

| Nordic Halibut (OB:NOHAL) | 29.7% | 60.7% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 88.2% |

| OrganoClick (OM:ORGC) | 33.7% | 66.8% |

Let's explore several standout options from the results in the screener.

Yuanjie Semiconductor Technology (SHSE:688498)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Yuanjie Semiconductor Technology Co., Ltd. (ticker: SHSE:688498) operates in the semiconductor industry, focusing on the development and production of semiconductor materials and devices, with a market cap of CN¥10.54 billion.

Operations: Unfortunately, the specific revenue segments for Yuanjie Semiconductor Technology Co., Ltd. are not provided in the text. Therefore, I am unable to summarize them into a sentence.

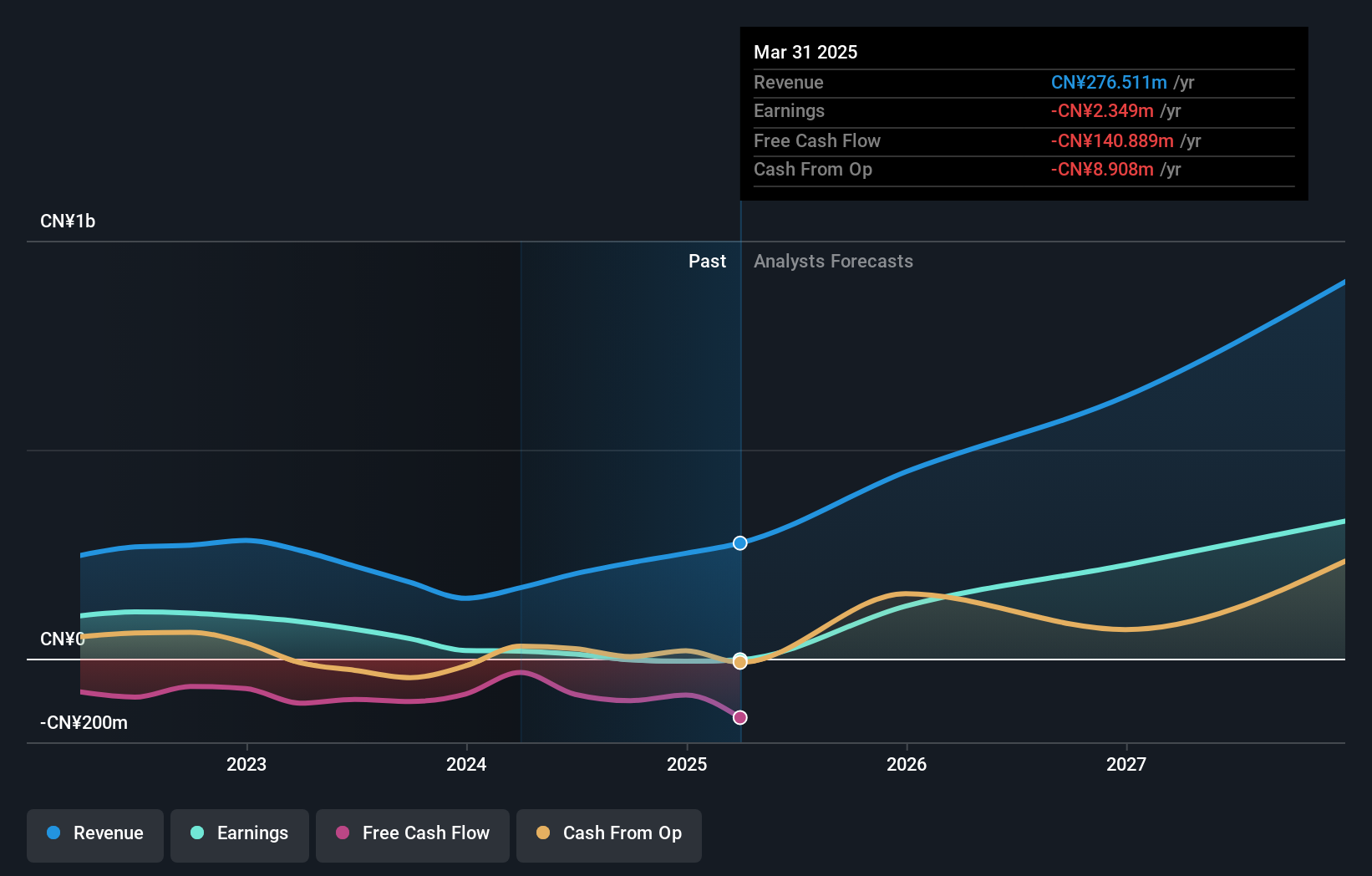

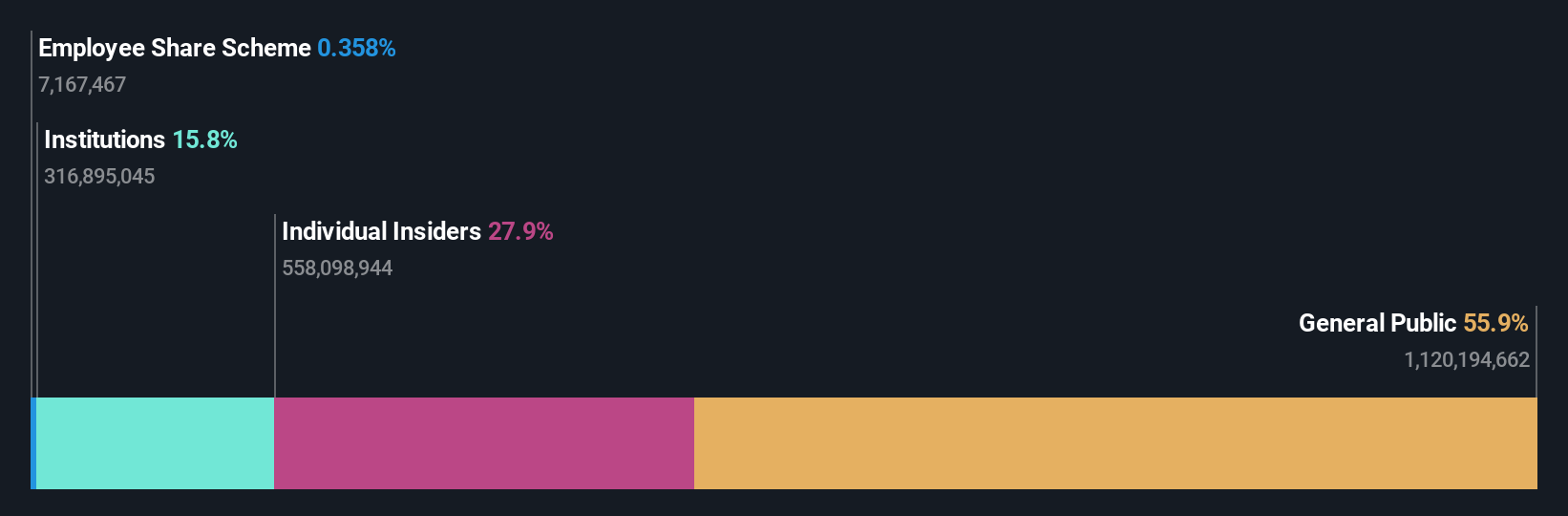

Insider Ownership: 27.9%

Revenue Growth Forecast: 35.4% p.a.

Yuanjie Semiconductor Technology shows promising growth potential with its revenue forecasted to grow at 35.4% annually, outpacing the broader CN market. Despite a volatile share price, the company reported CNY 84.4 million in Q1 2025 sales, up from CNY 60.06 million year-on-year, and net income increased to CNY 14.32 million from CNY 10.53 million. However, return on equity is projected to be modest at 8.7% in three years without significant insider trading activity recently noted.

- Dive into the specifics of Yuanjie Semiconductor Technology here with our thorough growth forecast report.

- According our valuation report, there's an indication that Yuanjie Semiconductor Technology's share price might be on the expensive side.

Ganfeng Lithium Group (SZSE:002460)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ganfeng Lithium Group Co., Ltd. is a company that manufactures and sells lithium products across Mainland China, South Korea, Europe, the rest of Asia, North America, and internationally, with a market cap of CN¥56.47 billion.

Operations: Ganfeng Lithium Group Co., Ltd. generates revenue from the manufacturing and sale of lithium products across various regions including Mainland China, South Korea, Europe, the rest of Asia, North America, and other international markets.

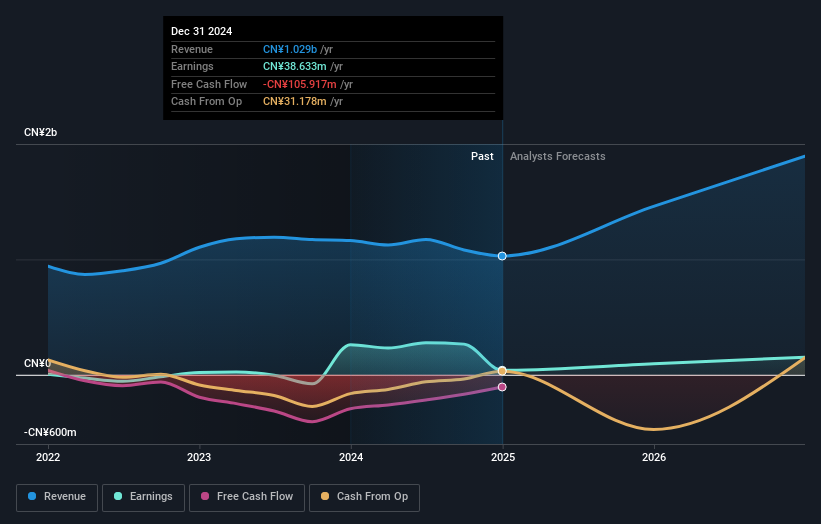

Insider Ownership: 28.0%

Revenue Growth Forecast: 17.7% p.a.

Ganfeng Lithium Group's insider ownership supports its strategic initiatives, including a joint venture with Lithium Argentina AG aimed at enhancing production efficiency. Despite recent financial struggles, with Q1 2025 sales dropping to CNY 3.77 billion and a net loss of CNY 355.83 million, the company forecasts earnings growth of over 50% annually. However, revenue growth is expected to be moderate at 17.7% per year, and return on equity remains low at an estimated 9.8%.

- Get an in-depth perspective on Ganfeng Lithium Group's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Ganfeng Lithium Group's shares may be trading at a premium.

Kyland Technology (SZSE:300353)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Kyland Technology Co., Ltd. specializes in industrial Ethernet technology both in China and internationally, with a market cap of CN¥13.51 billion.

Operations: Kyland Technology Co., Ltd. generates revenue through its industrial Ethernet technology operations, serving both domestic and international markets.

Insider Ownership: 15.3%

Revenue Growth Forecast: 23.8% p.a.

Kyland Technology's insider ownership aligns with its growth trajectory, despite a volatile share price. The company reported improved Q1 2025 results, reducing net loss to CNY 49.88 million from CNY 89.12 million a year ago. Earnings and revenue are forecast to grow significantly at 37.9% and 23.8% annually, outpacing the market averages of 24% and 12.6%, respectively, though return on equity remains low at an estimated future rate of 6.7%.

- Click here and access our complete growth analysis report to understand the dynamics of Kyland Technology.

- Insights from our recent valuation report point to the potential overvaluation of Kyland Technology shares in the market.

Seize The Opportunity

- Access the full spectrum of 844 Fast Growing Global Companies With High Insider Ownership by clicking on this link.

- Curious About Other Options? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688498

Yuanjie Semiconductor Technology

Yuanjie Semiconductor Technology Co., Ltd.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives