- China

- /

- Metals and Mining

- /

- SZSE:002418

Shareholders in Zhe Jiang KangshengLtd (SZSE:002418) have lost 28%, as stock drops 11% this past week

It is a pleasure to report that the Zhe Jiang Kangsheng Co.,Ltd. (SZSE:002418) is up 41% in the last quarter. But that doesn't change the fact that the returns over the last three years have been less than pleasing. After all, the share price is down 28% in the last three years, significantly under-performing the market.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

Check out our latest analysis for Zhe Jiang KangshengLtd

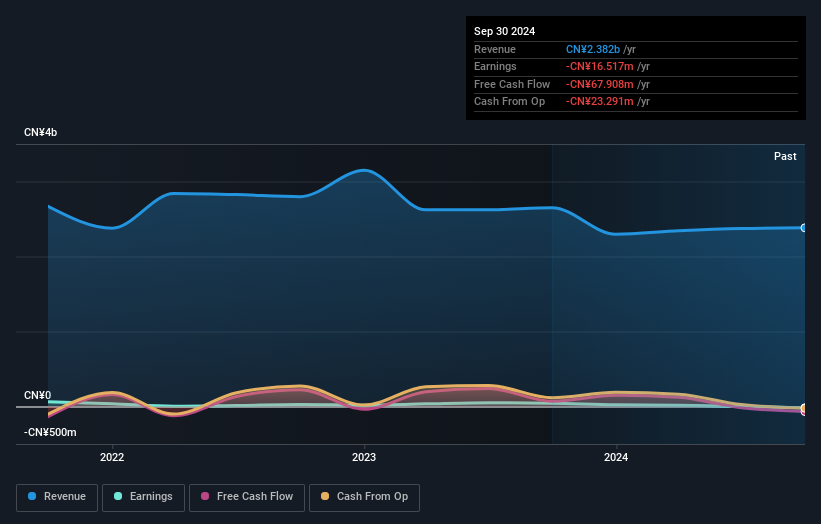

Given that Zhe Jiang KangshengLtd didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually desire strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

In the last three years Zhe Jiang KangshengLtd saw its revenue shrink by 5.2% per year. That's not what investors generally want to see. The annual decline of 8% per year in that period has clearly disappointed holders. That makes sense given the lack of either profits or revenue growth. Of course, sentiment could become too negative, and the company may actually be making progress to profitability.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Zhe Jiang KangshengLtd's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Zhe Jiang KangshengLtd shareholders are up 0.7% for the year. But that was short of the market average. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 0.7% endured over half a decade. It could well be that the business is stabilizing. You could get a better understanding of Zhe Jiang KangshengLtd's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Zhe Jiang KangshengLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002418

Zhe Jiang KangshengLtd

Engages in the research and development, production, and sale of refrigeration pipelines and accessories, and new energy commercial vehicles in China.

Adequate balance sheet and overvalued.

Market Insights

Community Narratives