- China

- /

- Basic Materials

- /

- SZSE:002398

Lets Holdings Group Co., Ltd.'s (SZSE:002398) Shares Not Telling The Full Story

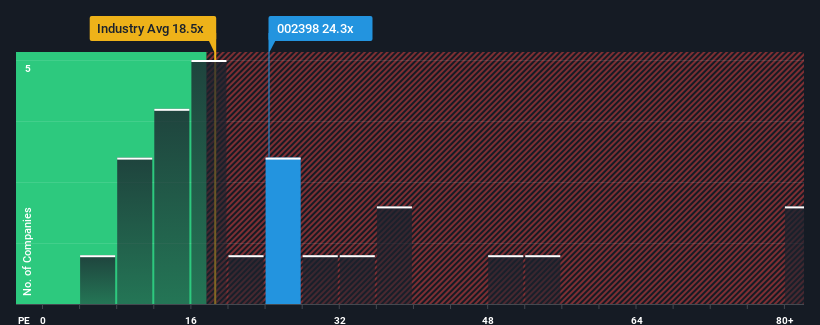

When close to half the companies in China have price-to-earnings ratios (or "P/E's") above 30x, you may consider Lets Holdings Group Co., Ltd. (SZSE:002398) as an attractive investment with its 24.3x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Recent times haven't been advantageous for Lets Holdings Group as its earnings have been falling quicker than most other companies. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Check out our latest analysis for Lets Holdings Group

How Is Lets Holdings Group's Growth Trending?

In order to justify its P/E ratio, Lets Holdings Group would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 50%. This means it has also seen a slide in earnings over the longer-term as EPS is down 69% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 30% per year as estimated by the three analysts watching the company. With the market only predicted to deliver 19% per year, the company is positioned for a stronger earnings result.

With this information, we find it odd that Lets Holdings Group is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Lets Holdings Group currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

You always need to take note of risks, for example - Lets Holdings Group has 3 warning signs we think you should be aware of.

You might be able to find a better investment than Lets Holdings Group. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002398

Lets Holdings Group

Engages in the research and development, production, and sale of construction materials in China and internationally.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives