- China

- /

- Basic Materials

- /

- SZSE:002398

Lets Holdings Group Co., Ltd.'s (SZSE:002398) 27% Jump Shows Its Popularity With Investors

Despite an already strong run, Lets Holdings Group Co., Ltd. (SZSE:002398) shares have been powering on, with a gain of 27% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 47% in the last year.

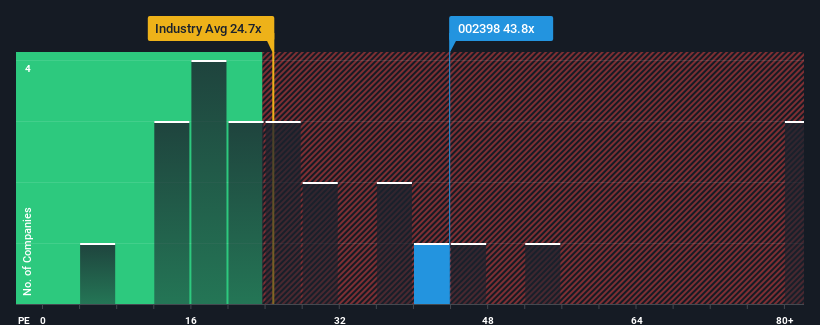

After such a large jump in price, Lets Holdings Group may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 43.8x, since almost half of all companies in China have P/E ratios under 34x and even P/E's lower than 20x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Recent times haven't been advantageous for Lets Holdings Group as its earnings have been falling quicker than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Lets Holdings Group

How Is Lets Holdings Group's Growth Trending?

Lets Holdings Group's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

Retrospectively, the last year delivered a frustrating 50% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 72% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 106% as estimated by the three analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 38%, which is noticeably less attractive.

In light of this, it's understandable that Lets Holdings Group's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

The large bounce in Lets Holdings Group's shares has lifted the company's P/E to a fairly high level. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Lets Holdings Group maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you take the next step, you should know about the 2 warning signs for Lets Holdings Group that we have uncovered.

You might be able to find a better investment than Lets Holdings Group. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002398

Lets Holdings Group

Engages in the research and development, production, and sale of construction materials in China and internationally.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives