- China

- /

- Metals and Mining

- /

- SZSE:002392

Unearthing Hidden Stock Gems This December 2024

Reviewed by Simply Wall St

As December 2024 unfolds, global markets are experiencing a mixed performance with major indexes like the S&P 500 and Nasdaq Composite reaching record highs, while small-cap stocks represented by the Russell 2000 Index have recently underperformed. Amid this backdrop of economic data releases and anticipated Federal Reserve policy decisions, investors are keenly observing growth opportunities in smaller companies that might offer unique value propositions. In such an environment, identifying promising stocks involves looking beyond current market sentiment to uncover companies with strong fundamentals and potential for growth that have not yet been fully recognized by the broader market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 34.89% | 3.23% | 3.61% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Ellaktor | 73.80% | -24.52% | 51.72% | ★★★★★☆ |

| Nederman Holding | 73.66% | 10.94% | 15.88% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

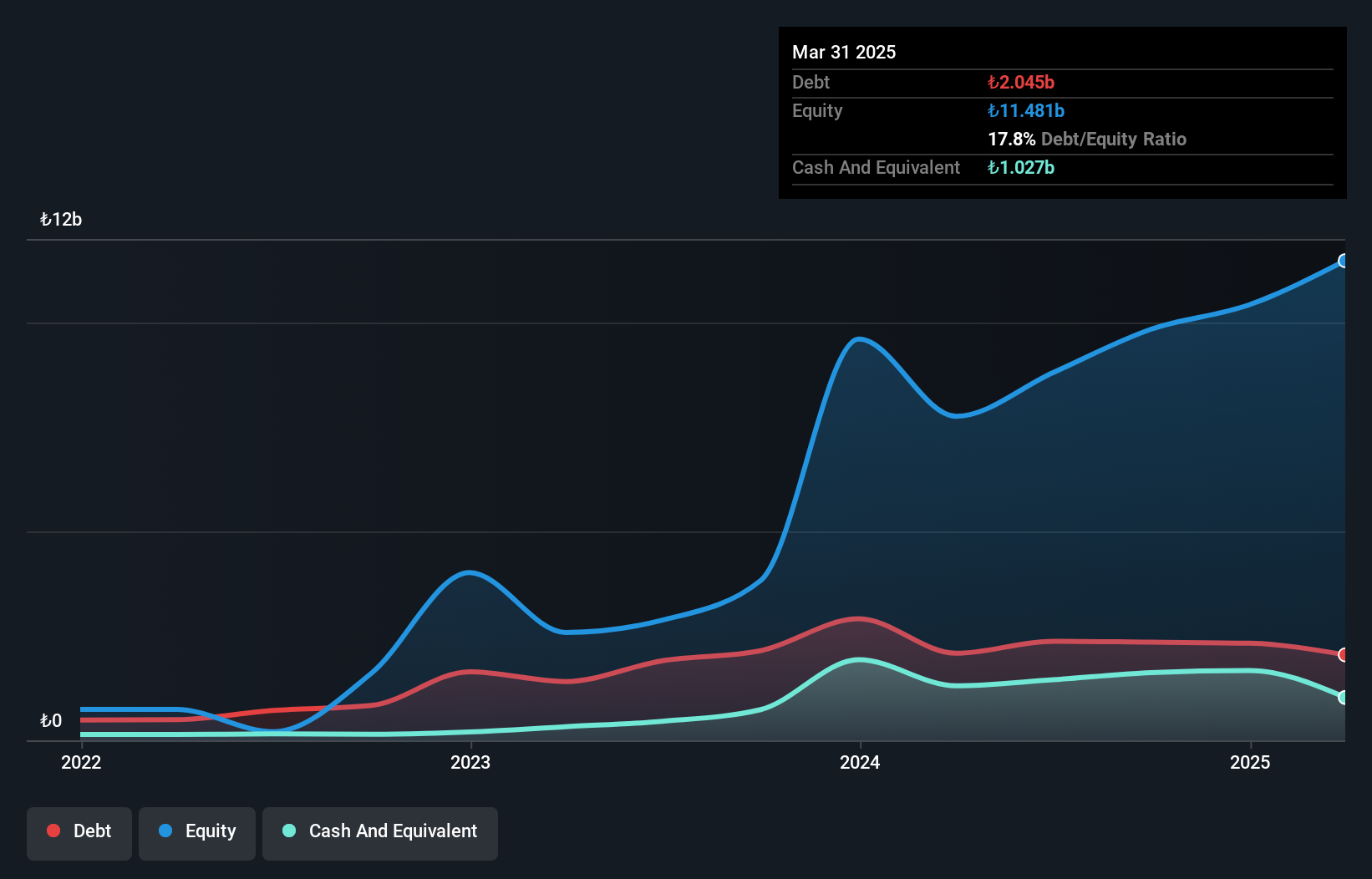

DAP Gayrimenkul Gelistirme (IBSE:DAPGM)

Simply Wall St Value Rating: ★★★★☆☆

Overview: DAP Gayrimenkul Gelistirme A.S. operates in the real estate development sector in Turkey, with a market capitalization of TRY15.49 billion.

Operations: DAP Gayrimenkul Gelistirme generates revenue primarily from its real estate operations and development, amounting to TRY6.37 billion.

DAP Gayrimenkul Gelistirme, a small player in the real estate sector, has shown notable financial characteristics. The company boasts a strong earnings growth of 25.5% over the past year, outpacing the industry average of 7.5%. Despite this growth, revenue decreased by 36.7%, highlighting some volatility in its operations. With a price-to-earnings ratio of 7.5x compared to the market's 16.3x, it appears undervalued relative to peers. DAPGM maintains a satisfactory net debt to equity ratio at 10.5%, indicating prudent financial management amidst fluctuating revenues and robust earnings performance.

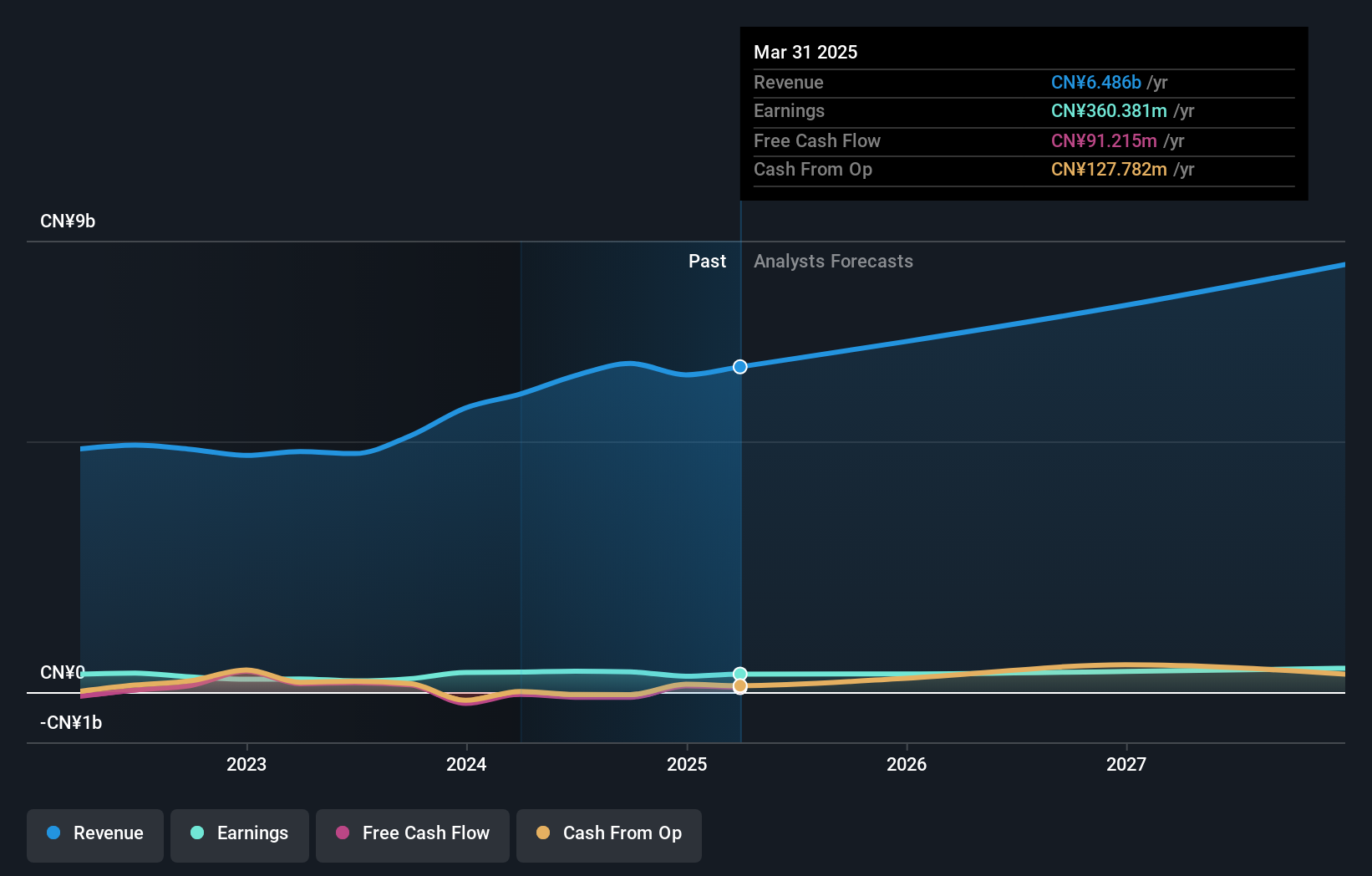

Beijing Lier High-temperature MaterialsLtd (SZSE:002392)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Beijing Lier High-temperature Materials Co., Ltd. specializes in the production and distribution of high-temperature resistant materials, with a market cap of CN¥5.92 billion.

Operations: Beijing Lier High-temperature Materials Co., Ltd. generates its revenue primarily from the production and distribution of high-temperature resistant materials. The company's financial performance is reflected in its market capitalization of CN¥5.92 billion, indicating its valuation in the market.

Beijing Lier High-temperature Materials Co., Ltd. showcases strong potential with earnings up 48.5% over the past year, outpacing the Metals and Mining industry’s -2.3%. The company trades at a favorable price-to-earnings ratio of 14.8x compared to the CN market's 37x, indicating good value relative to peers. Despite a debt-to-equity increase from 1.3% to 6.3% over five years, interest payments are well-covered by EBIT at an impressive 487.8x coverage, reflecting robust financial health. Recent share repurchases totaling CNY 13.46 million highlight strategic capital management aimed at enhancing shareholder value through buybacks and incentives programs.

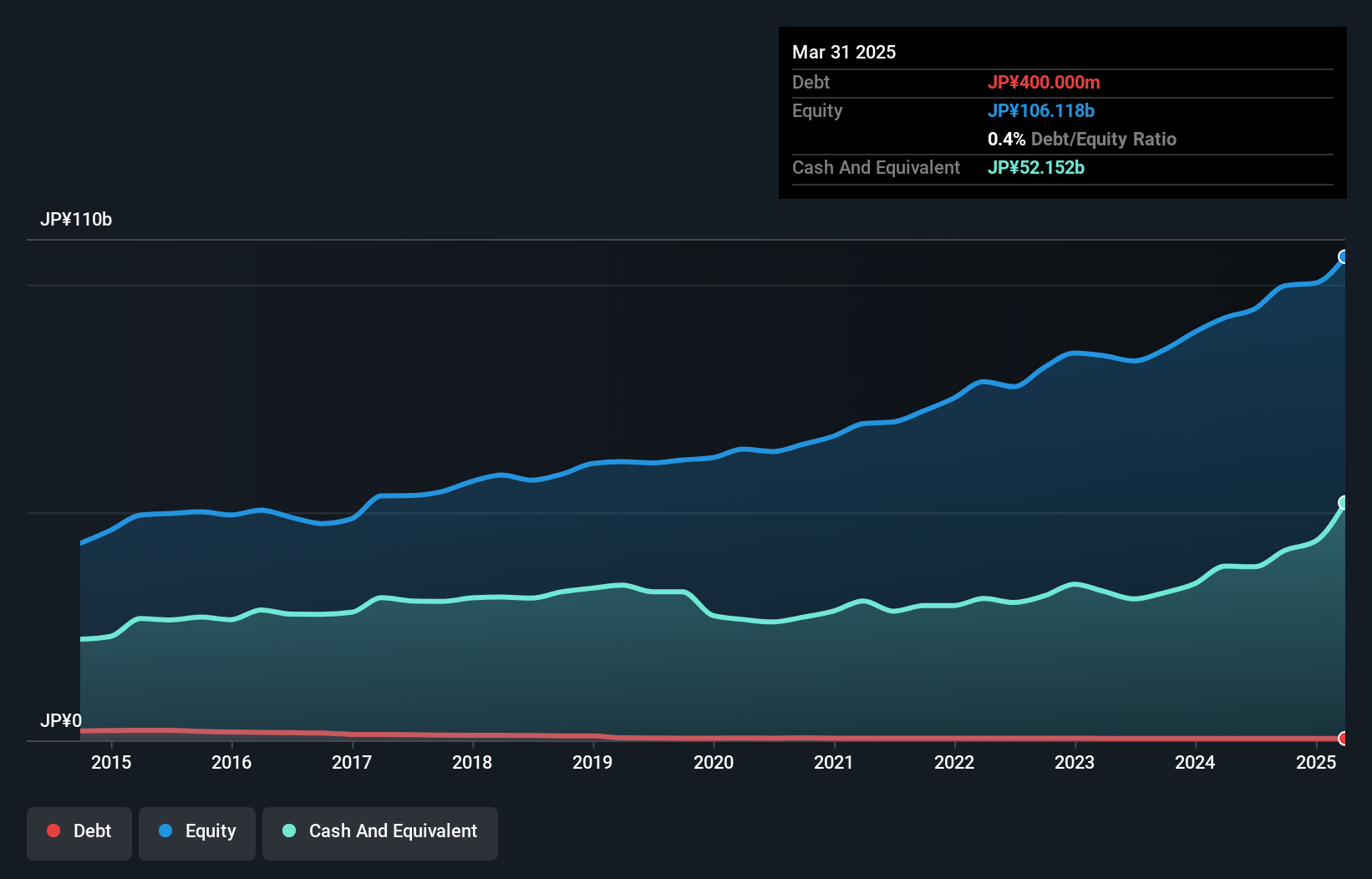

C.UyemuraLtd (TSE:4966)

Simply Wall St Value Rating: ★★★★★★

Overview: C.Uyemura & Co., Ltd. engages in the research, development, manufacturing, and sale of plating chemicals, industrial chemicals, and non-ferrous metals both in Japan and internationally with a market capitalization of approximately ¥183.25 billion.

Operations: C.Uyemura & Co., Ltd. generates its revenue primarily from the Surface Treatment Materials Business, contributing ¥66.01 billion, and the Surface Treatment Machinery Business, adding ¥12.61 billion. The Plating Processing Business and Real Estate Leasing Segment contribute ¥4.32 billion and ¥0.83 billion, respectively.

C.Uyemura Ltd. is making waves with its impressive earnings growth of 57.5% over the past year, far outpacing the Chemicals industry average of 14%. Trading at a significant discount of 34.3% below estimated fair value, it offers an intriguing opportunity for those seeking value plays. The company's debt to equity ratio has halved from 0.8 to 0.4 in five years, showcasing effective financial management and reduced leverage risk. Although its share price has been highly volatile recently, Uyemura's high-quality earnings and strong interest coverage suggest a resilient financial footing moving forward.

- Get an in-depth perspective on C.UyemuraLtd's performance by reading our health report here.

Gain insights into C.UyemuraLtd's past trends and performance with our Past report.

Key Takeaways

- Discover the full array of 4645 Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Lier High-temperature MaterialsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002392

Beijing Lier High-temperature MaterialsLtd

Beijing Lier High-temperature Materials Co.,Ltd.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives