- Italy

- /

- Industrials

- /

- BIT:ITM

Undiscovered Gems With Potential In January 2025

Reviewed by Simply Wall St

As we step into January 2025, global markets present a mixed picture with U.S. stocks finishing the year strong despite recent volatility, while economic indicators such as the Chicago PMI hint at potential challenges ahead for manufacturing sectors. Amidst this backdrop, small-cap stocks could offer intriguing opportunities as they often thrive in dynamic environments where nimble operations and innovative strategies can lead to growth. In searching for undiscovered gems within this landscape, investors might focus on companies that demonstrate resilience through sound financial health and adaptability to shifting market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Tait Marketing & Distribution | 0.75% | 7.36% | 18.40% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Cardig Aero Services | NA | 6.60% | 69.79% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Pro-Hawk | 30.16% | -5.27% | -2.93% | ★★★★★☆ |

| Orient Pharma | 24.74% | 23.50% | 51.62% | ★★★★★☆ |

| TBS Energi Utama | 77.67% | 4.11% | -2.54% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Italmobiliare (BIT:ITM)

Simply Wall St Value Rating: ★★★★★☆

Overview: Italmobiliare S.p.A. is an investment holding company that owns and manages a diverse portfolio of equity and other investments across the financial and industrial sectors both in Italy and internationally, with a market capitalization of approximately €1.10 billion.

Operations: The primary revenue contributors for Italmobiliare are Caffè Borbone (€313.34 million) and the holding company itself (€172.99 million), followed by Italgen and Officina Profumo-Farmaceutica Di Santa Maria Novella, generating €64.72 million and €61.08 million respectively.

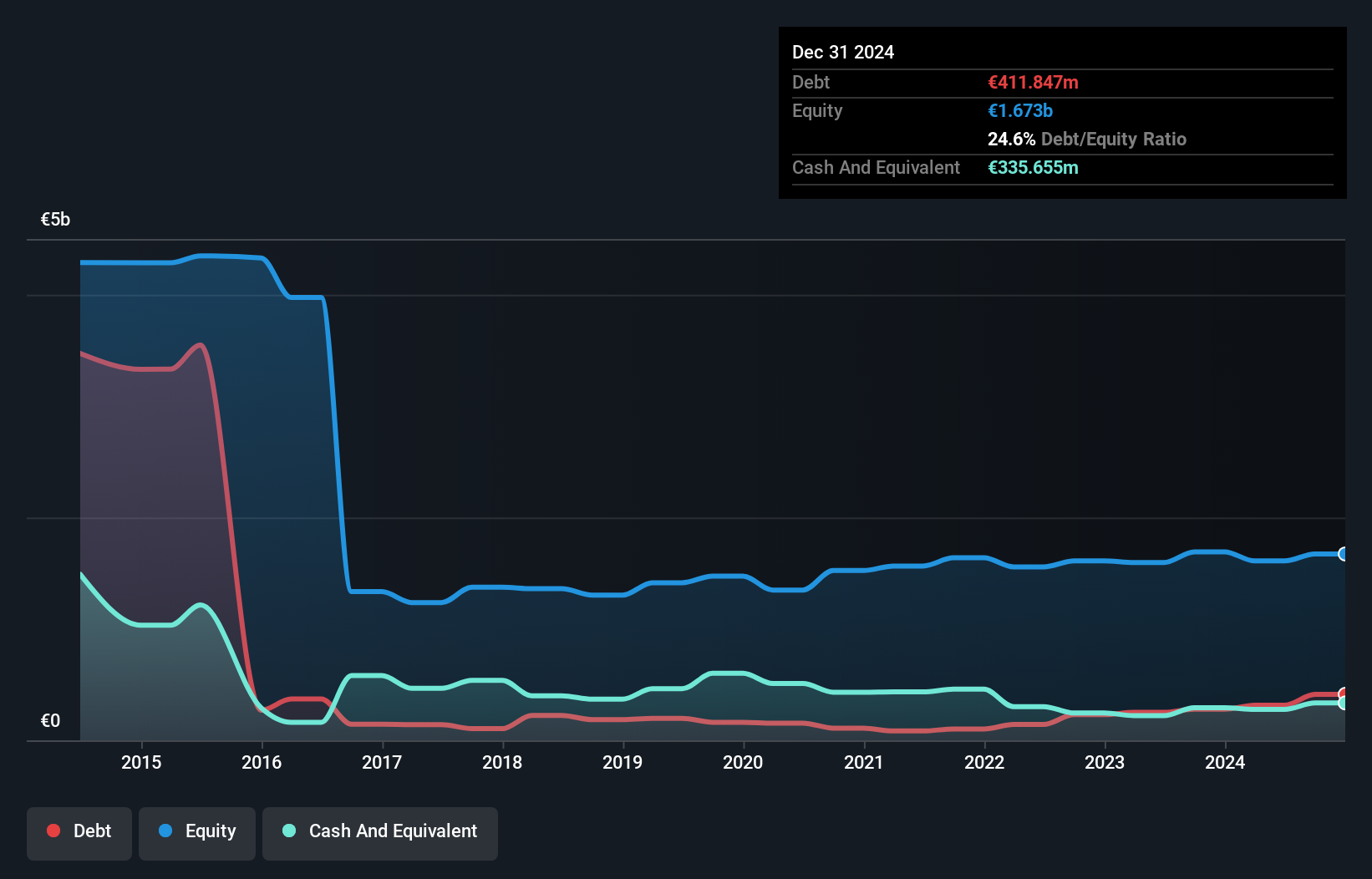

With a price-to-earnings ratio of 9.4x, Italmobiliare is trading below the Italian market average of 14.2x, suggesting it might offer good value compared to peers. Over the past year, earnings surged by an impressive 688%, significantly outpacing the Industrials industry growth of 3.7%. The company's debt situation appears manageable with a net debt to equity ratio at a satisfactory 2.4%, although this has increased from 13.9% over five years to now stand at 19.6%. Interest payments are well-covered by EBIT at a multiple of nearly five times, indicating solid financial health in that aspect.

- Dive into the specifics of Italmobiliare here with our thorough health report.

Explore historical data to track Italmobiliare's performance over time in our Past section.

Chongyi Zhangyuan Tungsten (SZSE:002378)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Chongyi Zhangyuan Tungsten Co., Ltd. is involved in the mining of tungsten and other metal mineral products both in China and internationally, with a market capitalization of CN¥7.86 billion.

Operations: Chongyi Zhangyuan Tungsten generates revenue primarily through the sale of tungsten and other metal mineral products. The company's financial performance indicates a focus on managing its cost structure, impacting its net profit margin.

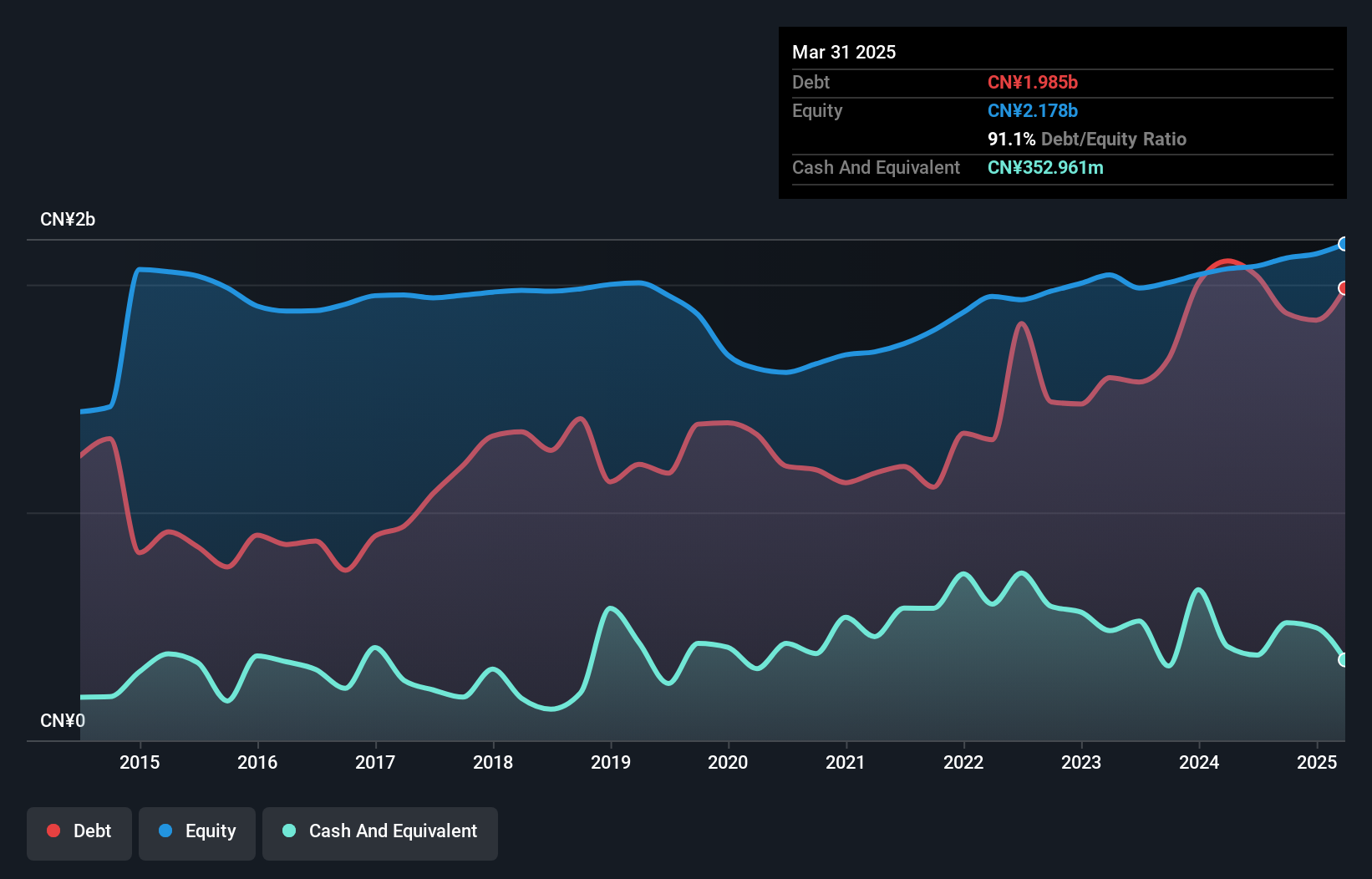

Chongyi Zhangyuan Tungsten, a player in the metals and mining sector, showcases robust growth with earnings climbing 32.9% last year, outpacing the industry average of -2.3%. The company reported sales of CN¥2.82 billion for the nine months ending September 2024, up from CN¥2.52 billion the previous year, while net income rose to CN¥146.58 million from CN¥110.21 million. Despite its high net debt to equity ratio at 64%, interest payments are well-covered by EBIT at 3.2 times coverage, indicating financial resilience amid a challenging landscape for smaller firms like this one in its sector.

Zhejiang Cayi Vacuum Container (SZSE:301004)

Simply Wall St Value Rating: ★★★★★☆

Overview: Zhejiang Cayi Vacuum Container Co., Ltd. specializes in the research, development, design, production, and sale of beverage and food containers made from various materials for both domestic and international markets, with a market cap of CN¥12.09 billion.

Operations: Cayi Vacuum Container generates revenue primarily through the sale of beverage and food containers. The company's net profit margin has shown a notable trend, indicating effective cost management relative to its revenues.

Zhejiang Cayi Vacuum Container, a smaller player in the market, is showing promising performance with its earnings growth outpacing the Consumer Durables industry. Over the past year, earnings surged by 64.8%, significantly exceeding industry averages. The company reported net income of ¥530.99 million for the first nine months of 2024, up from ¥313.82 million last year, reflecting robust operational strength. Its price-to-earnings ratio stands at 17.5x, which is favorable compared to the broader CN market's 32.7x ratio, indicating good value relative to peers and potential for future appreciation in value.

- Navigate through the intricacies of Zhejiang Cayi Vacuum Container with our comprehensive health report here.

Learn about Zhejiang Cayi Vacuum Container's historical performance.

Key Takeaways

- Click through to start exploring the rest of the 4665 Undiscovered Gems With Strong Fundamentals now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ITM

Italmobiliare

An investment holding company, owns and manages a portfolio of equity and other investments in the financial and industrial sectors in Italy and internationally.

Solid track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives