- Japan

- /

- Personal Products

- /

- TSE:7806

Undiscovered Gems In Global Markets To Explore This May 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by easing trade tensions and mixed economic signals, small- and mid-cap indexes have shown resilience with consecutive weekly gains. This positive sentiment provides an opportune backdrop to explore lesser-known stocks that could thrive amid current market dynamics, offering potential growth opportunities for investors seeking to diversify their portfolios.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Changjiu Holdings | NA | 11.55% | 10.44% | ★★★★★★ |

| Shangri-La Hotel | NA | 15.26% | 23.20% | ★★★★★★ |

| Soft-World International | NA | -1.24% | 5.77% | ★★★★★★ |

| PSC | 15.34% | 1.17% | 10.86% | ★★★★★★ |

| VICOM | NA | 5.01% | 2.30% | ★★★★★★ |

| Yibin City Commercial Bank | 136.61% | 11.29% | 20.39% | ★★★★★★ |

| Chongqing Machinery & Electric | 25.60% | 7.97% | 18.73% | ★★★★★☆ |

| Pizu Group Holdings | 48.10% | -4.86% | -19.23% | ★★★★☆☆ |

| Time Interconnect Technology | 78.17% | 24.96% | 19.51% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Shenzhen Qingyi Photomask (SHSE:688138)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shenzhen Qingyi Photomask Limited focuses on the research, design, production, and sales of high precision masks in China with a market capitalization of CN¥8.95 billion.

Operations: Shenzhen Qingyi Photomask Limited generates revenue primarily through the sales of high precision masks. The company has experienced fluctuations in its net profit margin, which is currently at 15%.

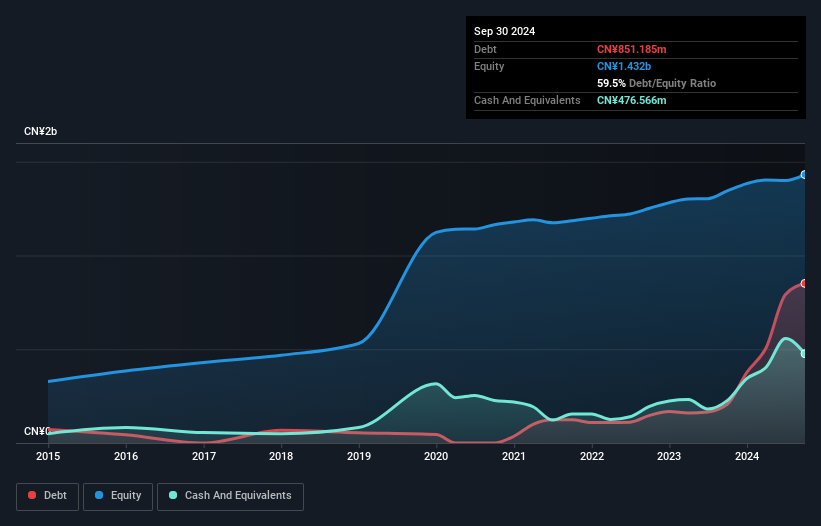

Shenzhen Qingyi Photomask, a smaller player in the electronics sector, has shown promising growth with its recent earnings report indicating sales of CNY 298.54 million for Q1 2025, up from CNY 271.82 million the previous year. Net income also rose to CNY 51.74 million from CNY 49.59 million, reflecting solid performance amidst industry challenges. The company's earnings have grown by 6% over the past year, outpacing the broader electronic industry's growth of approximately 5%. Despite shareholder dilution in recent times and a debt to equity ratio climbing to 59% over five years, its interest payments are comfortably covered by EBIT at an impressive multiple of nearly 52x.

Chongyi Zhangyuan Tungsten (SZSE:002378)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Chongyi Zhangyuan Tungsten Co., Ltd. is involved in the mining of tungsten and other metal mineral products, operating both in China and internationally, with a market cap of CN¥8.63 billion.

Operations: Chongyi Zhangyuan Tungsten generates revenue primarily from the mining and sale of tungsten and other metal mineral products. The company's financial performance is influenced by its ability to manage costs associated with mining operations.

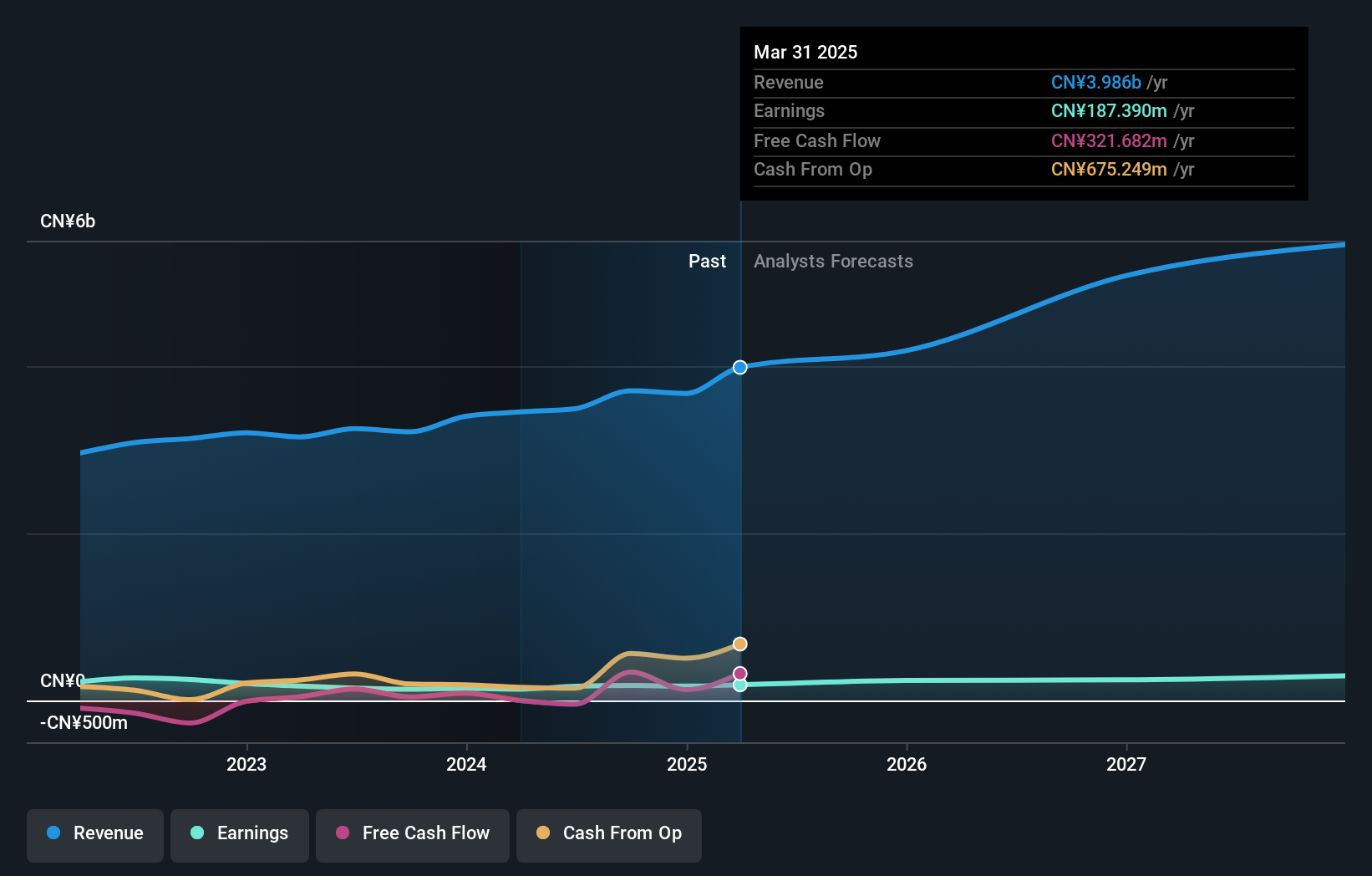

Chongyi Zhangyuan Tungsten, a player in the tungsten market, has shown impressive earnings growth of 37.7% over the past year, outpacing the broader Metals and Mining industry. Despite this growth, its debt to equity ratio has climbed from 82.3% to 91.1% over five years, indicating rising leverage concerns with a net debt to equity ratio at a high 74.9%. The company’s interest payments are comfortably covered by EBIT at 4.4 times coverage, reflecting solid operational earnings quality. Recent results highlight robust sales of CNY 1,186 million for Q1 2025 compared to CNY 874 million last year with net income reaching CNY 42 million up from CNY 27 million previously.

- Delve into the full analysis health report here for a deeper understanding of Chongyi Zhangyuan Tungsten.

Gain insights into Chongyi Zhangyuan Tungsten's past trends and performance with our Past report.

MTG (TSE:7806)

Simply Wall St Value Rating: ★★★★★★

Overview: MTG Co., Ltd. manufactures and sells health, beauty, and hygiene products both in Japan and internationally, with a market cap of ¥122.05 billion.

Operations: MTG generates revenue through the sale of health, beauty, and hygiene products across domestic and international markets. The company's financial performance is reflected in its market capitalization of ¥122.05 billion.

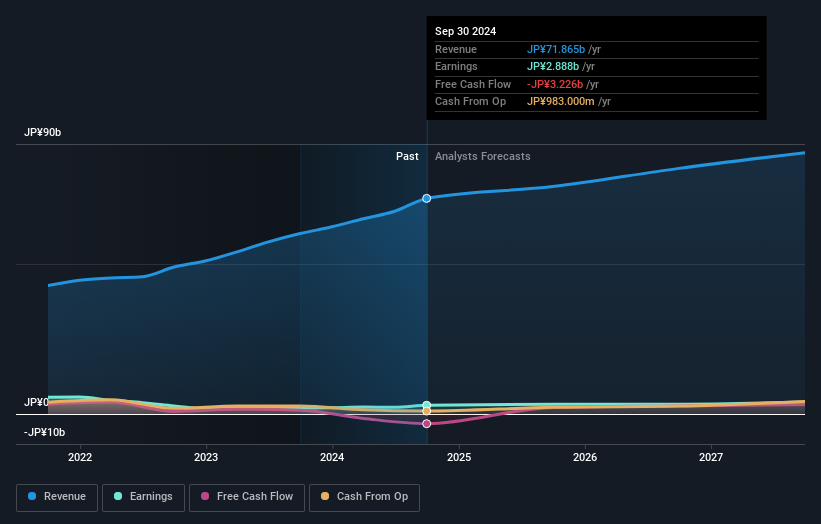

MTG Co., Ltd. stands out with impressive earnings growth of 188% over the past year, far surpassing the Personal Products industry's -4% performance. The company is debt-free, eliminating concerns about interest coverage and providing a solid foundation for future operations. Despite a volatile share price recently, MTG's price-to-earnings ratio of 23x remains attractive compared to the industry average of 27x. Future prospects appear promising with projected earnings per share at JPY 114.67 and an anticipated dividend increase from JPY 13 to JPY 15 per share this year, reflecting confidence in its ongoing profitability and market position.

- Dive into the specifics of MTG here with our thorough health report.

Evaluate MTG's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 3258 Global Undiscovered Gems With Strong Fundamentals now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7806

MTG

Manufactures and sells health, beauty, and hygiene products in Japan and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives