Letong Chemical Co.,LTD's (SZSE:002319) Popularity With Investors Under Threat As Stock Sinks 26%

Letong Chemical Co.,LTD (SZSE:002319) shares have had a horrible month, losing 26% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 21% in that time.

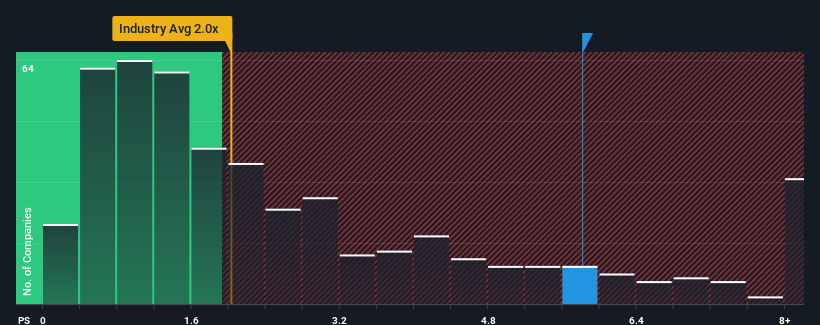

Although its price has dipped substantially, given around half the companies in China's Chemicals industry have price-to-sales ratios (or "P/S") below 2x, you may still consider Letong ChemicalLTD as a stock to avoid entirely with its 5.8x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Letong ChemicalLTD

How Letong ChemicalLTD Has Been Performing

As an illustration, revenue has deteriorated at Letong ChemicalLTD over the last year, which is not ideal at all. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Letong ChemicalLTD's earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Letong ChemicalLTD would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 3.2%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 24% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 21% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this in mind, we find it worrying that Letong ChemicalLTD's P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Final Word

A significant share price dive has done very little to deflate Letong ChemicalLTD's very lofty P/S. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Letong ChemicalLTD revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. When we observe slower-than-industry revenue growth alongside a high P/S ratio, we assume there to be a significant risk of the share price decreasing, which would result in a lower P/S ratio. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these the share price as being reasonable.

Before you take the next step, you should know about the 1 warning sign for Letong ChemicalLTD that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002319

Letong ChemicalLTD

Produces and sells chemical raw materials and chemical products in China and internationally.

Adequate balance sheet with weak fundamentals.

Market Insights

Community Narratives