- Taiwan

- /

- Tech Hardware

- /

- TWSE:2059

Top Growth Companies With High Insider Ownership For August 2024

Reviewed by Simply Wall St

As global markets celebrate the prospect of upcoming interest rate cuts, with indices like the Dow Jones Industrial Average and S&P 500 Index nearing record highs, investors are increasingly optimistic about future growth opportunities. In this favorable economic climate, identifying growth companies with high insider ownership can be particularly appealing, as it often signals strong management confidence and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21% |

| Hartshead Resources (ASX:HHR) | 13.9% | 102.6% |

| Gaming Innovation Group (OB:GIG) | 26.7% | 37.4% |

| On Holding (NYSE:ONON) | 28.4% | 24.4% |

| Global Tax Free (KOSDAQ:A204620) | 21.4% | 78.5% |

| KebNi (OM:KEBNI B) | 37.8% | 86.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.3% | 60.9% |

| Adocia (ENXTPA:ADOC) | 11.9% | 63% |

| Vow (OB:VOW) | 31.7% | 97.7% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 77% |

Underneath we present a selection of stocks filtered out by our screen.

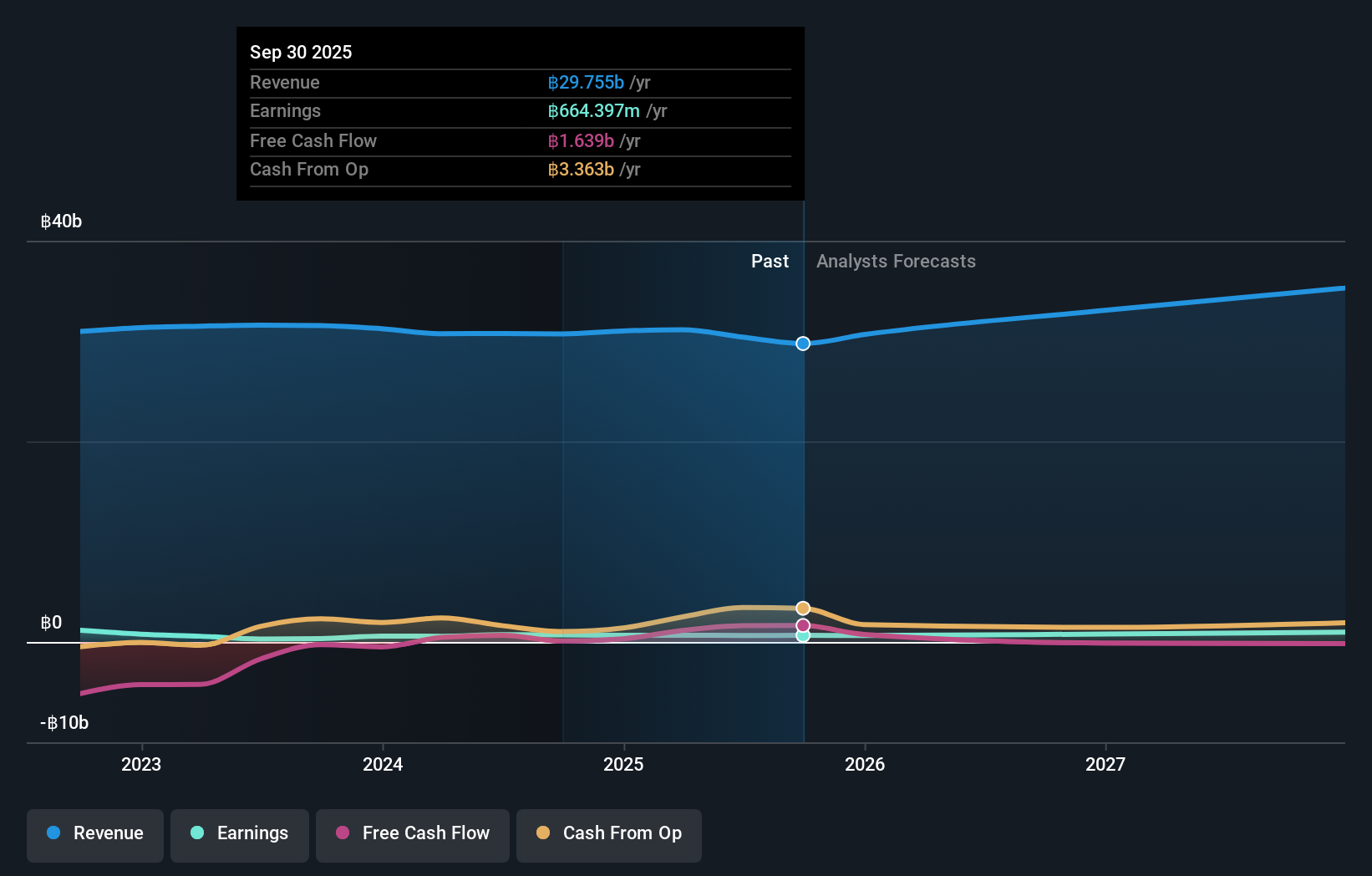

Dohome (SET:DOHOME)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Dohome Public Company Limited, with a market cap of THB37.79 billion, operates in Thailand through retailing and wholesaling construction materials, office equipment, and household products.

Operations: The company generates THB30.75 billion in revenue from its retail and wholesale segments, which include construction materials, office equipment, and household products.

Insider Ownership: 35%

Revenue Growth Forecast: 10.1% p.a.

Dohome's earnings are forecast to grow significantly over the next three years, outpacing the Thai market with an expected annual profit growth of 29%. Despite this, its Return on Equity is projected to remain low at 9.6%. Recent earnings reports show a substantial increase in net income for Q2 2024 (THB 192.59 million) compared to last year (THB 39.39 million). However, interest payments are not well covered by earnings, indicating potential financial challenges ahead.

- Click to explore a detailed breakdown of our findings in Dohome's earnings growth report.

- According our valuation report, there's an indication that Dohome's share price might be on the expensive side.

Sichuan Development LomonLtd (SZSE:002312)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sichuan Development Lomon Co., Ltd. engages in the research, development, production, and sale of phosphorus chemical products in China and has a market cap of approximately CN¥11.84 billion.

Operations: The company's revenue segments include phosphorus chemical products amounting to CN¥11.84 billion.

Insider Ownership: 18.2%

Revenue Growth Forecast: 18.4% p.a.

Sichuan Development Lomon Ltd. is forecast to achieve significant annual earnings growth of 29.4%, outpacing the Chinese market's average. Despite trading at 70.4% below its estimated fair value, profit margins have declined from 9.6% to 5%. Recent shareholder meetings approved a decrease in registered capital and elected new directors, reflecting active governance changes aimed at supporting future growth initiatives and addressing financial structuring needs for subsidiary projects' loans guarantees.

- Unlock comprehensive insights into our analysis of Sichuan Development LomonLtd stock in this growth report.

- Our comprehensive valuation report raises the possibility that Sichuan Development LomonLtd is priced higher than what may be justified by its financials.

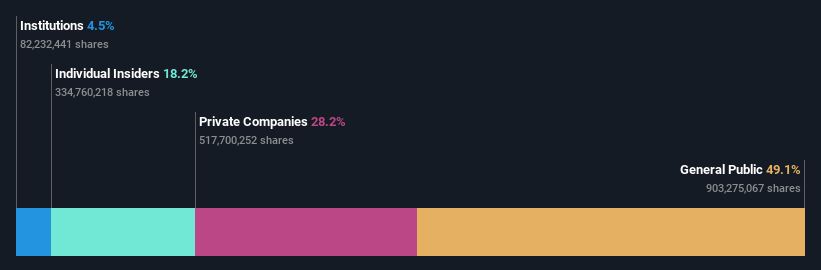

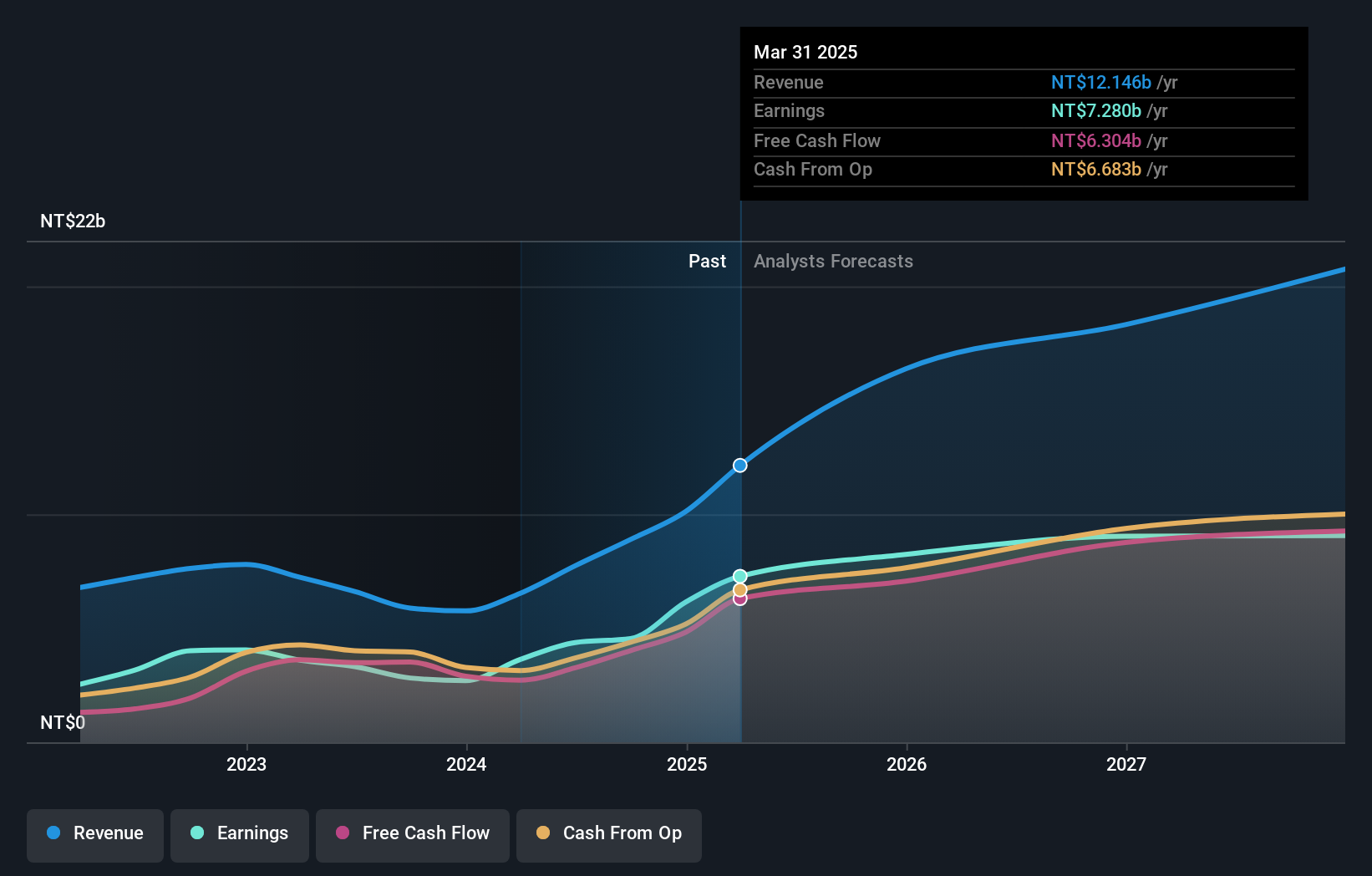

King Slide Works (TWSE:2059)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: King Slide Works Co., Ltd. and its subsidiaries focus on the R&D, design, and sale of rail kits for servers and network communication equipment in Taiwan, with a market cap of NT$121.03 billion.

Operations: The company's revenue segments consist of NT$2.02 billion from Chuanhu Company and NT$6.06 billion from Chuan Yi Company.

Insider Ownership: 17.5%

Revenue Growth Forecast: 20.4% p.a.

King Slide Works' revenue is projected to grow at 20.4% annually, surpassing the Taiwan market's average. Despite a volatile share price, earnings are expected to increase by 10.49% per year, though this lags behind market expectations. Recent Q2 results showed significant growth with net income rising from TWD 714.65 million to TWD 1,456.41 million year-over-year. The company has undergone substantial board changes but maintains high insider ownership and robust return on equity forecasts of 24.6%.

- Delve into the full analysis future growth report here for a deeper understanding of King Slide Works.

- Our expertly prepared valuation report King Slide Works implies its share price may be too high.

Turning Ideas Into Actions

- Access the full spectrum of 1492 Fast Growing Companies With High Insider Ownership by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if King Slide Works might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2059

King Slide Works

Engages in the research and development, design, and sale of rail kits for servers and network communication equipment in Taiwan.

Solid track record with excellent balance sheet.