- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3036

High Growth Tech Stocks To Watch: Vertex And 2 Other Top Picks

Reviewed by Simply Wall St

As global markets rally on the back of anticipated interest rate cuts, small-cap stocks have been outperforming their larger counterparts, signaling a renewed investor confidence in growth sectors. In this favorable climate, identifying high-growth tech stocks with robust fundamentals and innovative edge becomes crucial for investors seeking to capitalize on market momentum.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| TG Therapeutics | 28.62% | 43.05% | ★★★★★★ |

| Sarepta Therapeutics | 24.22% | 44.94% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.97% | 30.50% | ★★★★★★ |

| Facilities by ADF | 32.33% | 94.46% | ★★★★★★ |

| G1 Therapeutics | 27.57% | 57.75% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 22.90% | 28.13% | ★★★★★★ |

| KebNi | 34.75% | 86.11% | ★★★★★★ |

| Adveritas | 66.47% | 103.87% | ★★★★★★ |

| Adocia | 59.08% | 63.00% | ★★★★★★ |

Click here to see the full list of 1275 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Vertex (NasdaqGM:VERX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Vertex, Inc., along with its subsidiaries, offers enterprise tax technology solutions for retail trade, wholesale trade, and manufacturing industries both in the United States and internationally, with a market cap of $5.76 billion.

Operations: Vertex generates revenue primarily through its Software & Programming segment, which contributed $617.83 million. The company focuses on providing enterprise tax technology solutions across various industries both domestically and internationally.

Vertex's revenue surged to $161.1 million in Q2 2024, up from $139.7 million a year ago, with net income hitting $5.16 million compared to a prior loss of $6.9 million. The company forecasts annual revenue between $654 million and $660 million, driven by 28% growth in cloud services. R&D expenses reflect strategic investment at 12.2% of revenue, supporting innovations that could propel future earnings growth by an expected 38.9% annually over the next three years.

- Take a closer look at Vertex's potential here in our health report.

Examine Vertex's past performance report to understand how it has performed in the past.

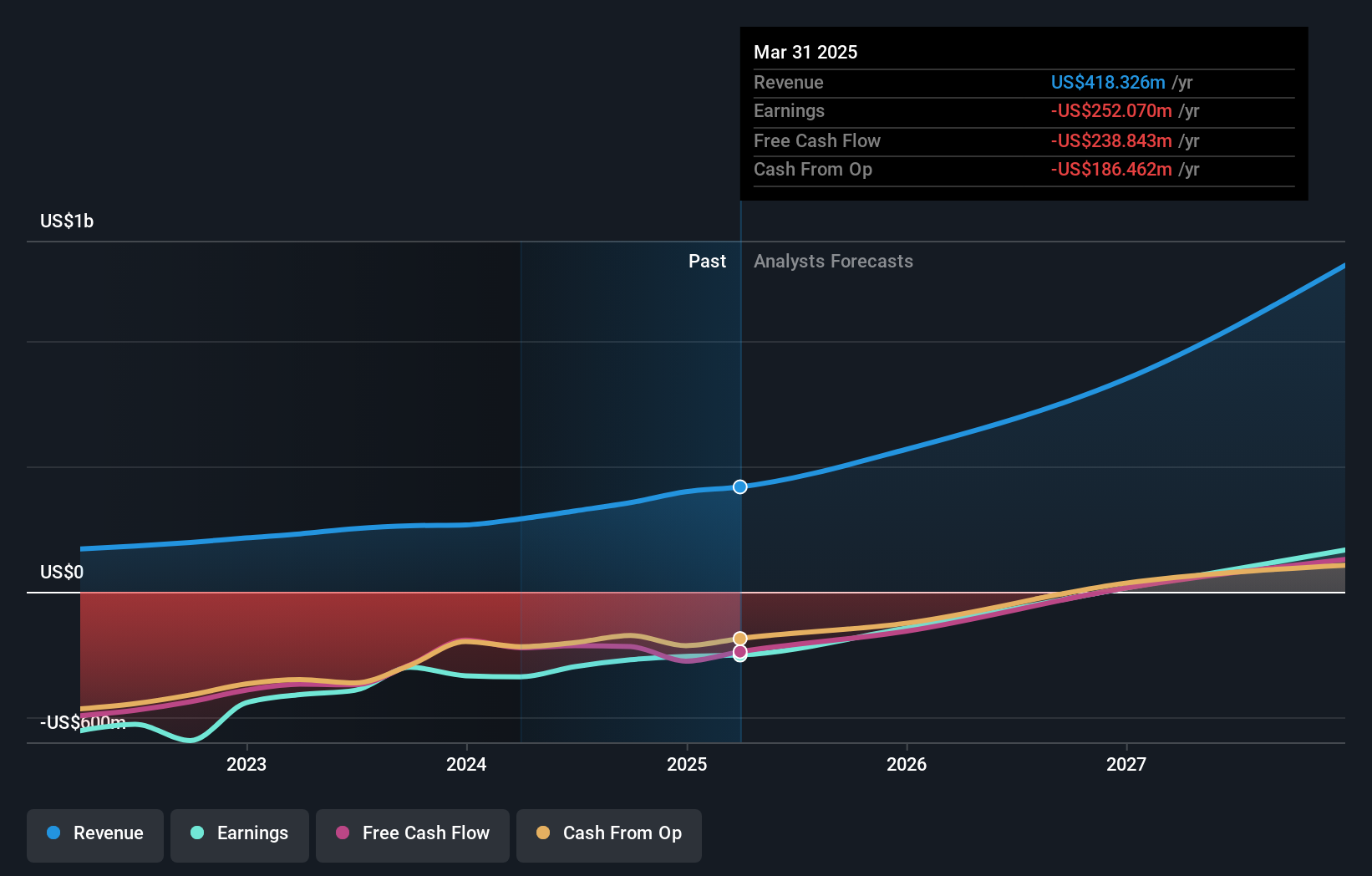

Zai Lab (NasdaqGM:ZLAB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zai Lab Limited develops and commercializes therapies to treat oncology, autoimmune disorders, infectious diseases, and neuroscience, with a market cap of $1.77 billion.

Operations: Zai Lab Limited generates revenue primarily through its biotechnology segment, amounting to $322.71 million. The company focuses on developing and commercializing therapies for oncology, autoimmune disorders, infectious diseases, and neuroscience.

Zai Lab's revenue jumped to $100.5 million in Q2 2024 from $68.86 million a year ago, showcasing a robust growth trajectory. Despite a net loss reduction to $80.28 million from $120.9 million, the company's R&D expenses underscore its commitment to innovation, with significant investments supporting future prospects. Notably, Zai Lab's anticipated revenue growth of 32.9% annually and projected earnings increase of 66.3% per year highlight its potential within the biotech sector, driven by advancements like efgartigimod SC for autoimmune diseases.

- Navigate through the intricacies of Zai Lab with our comprehensive health report here.

Gain insights into Zai Lab's historical performance by reviewing our past performance report.

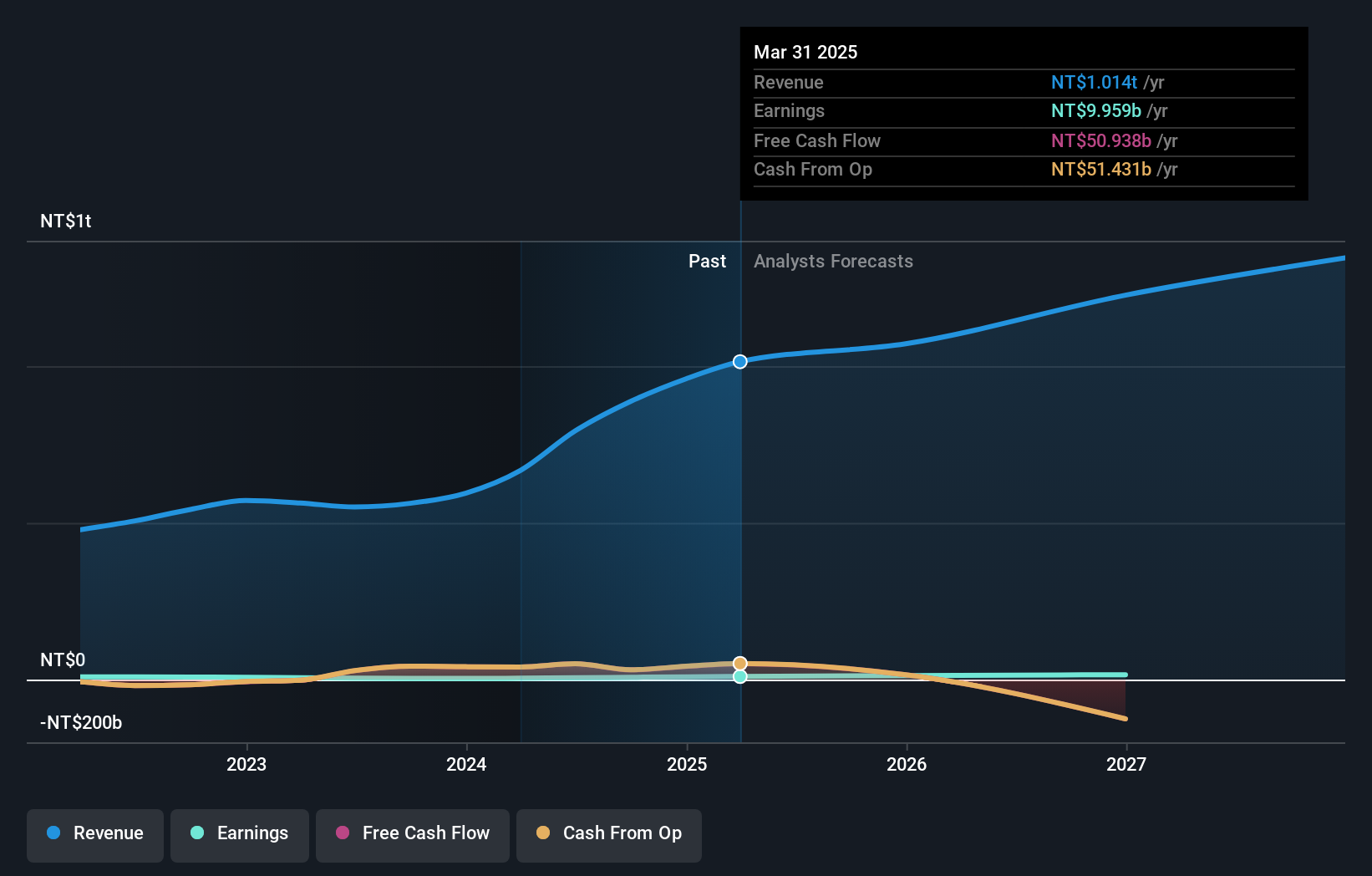

WT Microelectronics (TWSE:3036)

Simply Wall St Growth Rating: ★★★★★☆

Overview: WT Microelectronics Co., Ltd., along with its subsidiaries, develops and sells electronic and communication components in Taiwan, China, and internationally, with a market cap of NT$130.55 billion.

Operations: WT Microelectronics generates revenue by developing and selling electronic and communication components across Taiwan, China, and international markets. The company leverages its extensive distribution network to serve a diverse customer base in these regions.

WT Microelectronics has demonstrated impressive growth, with earnings forecasted to increase by 53.9% annually, outpacing the TW market's 18.7%. The company's revenue is projected to grow at a robust rate of 26% per year, significantly higher than the market average of 11.8%. Noteworthy is their R&D expenditure, which underscores their commitment to innovation and future growth potential. Recent sales figures also reflect strong performance, with July's unaudited consolidated sales reaching TWD 95.2 billion—a notable rise from previous months and years.

- Delve into the full analysis health report here for a deeper understanding of WT Microelectronics.

Explore historical data to track WT Microelectronics' performance over time in our Past section.

Turning Ideas Into Actions

- Navigate through the entire inventory of 1275 High Growth Tech and AI Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WT Microelectronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3036

WT Microelectronics

Develops and sells electronic and communication components in Taiwan, China, and internationally.

High growth potential with excellent balance sheet.