Sichuan Development Lomon Co.,Ltd. (SZSE:002312) Shares May Have Slumped 31% But Getting In Cheap Is Still Unlikely

Sichuan Development Lomon Co.,Ltd. (SZSE:002312) shares have retraced a considerable 31% in the last month, reversing a fair amount of their solid recent performance. The good news is that in the last year, the stock has shone bright like a diamond, gaining 102%.

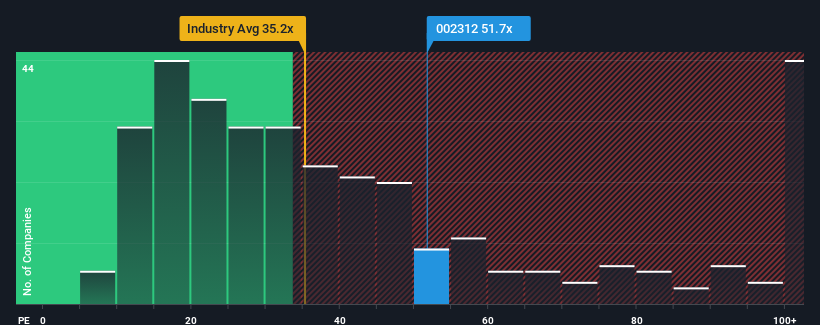

In spite of the heavy fall in price, Sichuan Development LomonLtd's price-to-earnings (or "P/E") ratio of 51.7x might still make it look like a sell right now compared to the market in China, where around half of the companies have P/E ratios below 34x and even P/E's below 20x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Sichuan Development LomonLtd certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for Sichuan Development LomonLtd

Is There Enough Growth For Sichuan Development LomonLtd?

There's an inherent assumption that a company should outperform the market for P/E ratios like Sichuan Development LomonLtd's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 81% last year. However, this wasn't enough as the latest three year period has seen a very unpleasant 39% drop in EPS in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 40% during the coming year according to the three analysts following the company. With the market predicted to deliver 38% growth , the company is positioned for a comparable earnings result.

With this information, we find it interesting that Sichuan Development LomonLtd is trading at a high P/E compared to the market. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/E falls to levels more in line with the growth outlook.

The Final Word

There's still some solid strength behind Sichuan Development LomonLtd's P/E, if not its share price lately. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Sichuan Development LomonLtd's analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Sichuan Development LomonLtd (at least 1 which is a bit unpleasant), and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on Sichuan Development LomonLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002312

Sichuan Development LomonLtd

Engages in the research and development, production, and sale of phosphorus chemical products in China.

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.