Undiscovered Gems In Asia Three Small Caps With Promising Potential

Reviewed by Simply Wall St

As global markets react to recent economic shifts, including the Federal Reserve's interest rate cut and ongoing trade discussions between the U.S. and China, small-cap stocks have shown notable sensitivity to these changes, with indices like the Russell 2000 experiencing significant gains. In this dynamic environment, identifying promising small-cap stocks in Asia can offer unique opportunities for investors seeking growth potential amidst evolving market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ruentex Interior Design | NA | 32.58% | 38.70% | ★★★★★★ |

| Hangzhou Fortune Gas Cryogenic Group | NA | 15.44% | 21.50% | ★★★★★★ |

| Jiangyin Haida Rubber And Plastic | 13.80% | 8.51% | -6.90% | ★★★★★★ |

| Shanghai Haixin Group | 2.04% | -5.07% | 5.13% | ★★★★★★ |

| Yibin City Commercial Bank | 82.57% | -1.19% | 15.94% | ★★★★★★ |

| Lucky Cement | 47.61% | 4.43% | 16.92% | ★★★★★☆ |

| Guangdong Transtek Medical Electronics | 14.33% | -9.94% | 1.91% | ★★★★★☆ |

| Nacity Property Service GroupLtd | 6.90% | 6.11% | -8.48% | ★★★★★☆ |

| Hospital Corporation of China | 137.48% | 28.23% | 50.23% | ★★★★★☆ |

| SBS Philippines | 29.71% | 3.10% | -49.78% | ★★★★★☆ |

Here's a peek at a few of the choices from the screener.

Guangdong Fuxin Technology (SHSE:688662)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guangdong Fuxin Technology Co., Ltd. engages in the research, development, production, and sale of semiconductor thermoelectric materials with a market cap of approximately CN¥5.10 billion.

Operations: With a market cap of approximately CN¥5.10 billion, the company focuses on semiconductor thermoelectric materials. It generates revenue primarily through the sale of these materials, while managing costs associated with research and development as well as production. The financial performance is influenced by its gross profit margin trends over time.

Fuxin Technology, a smaller player in the semiconductor space, has demonstrated impressive earnings growth of 68.6% over the past year, outpacing the industry's 10.4%. Despite this strong performance, its earnings have declined by 32.2% annually over five years. Recent financials show sales at CNY 259.21 million for H1 2025 compared to CNY 251.06 million last year, with net income slightly down to CNY 20.35 million from CNY 22.26 million previously. The company has more cash than debt and maintains positive free cash flow, although its share price remains highly volatile recently.

MYS Group (SZSE:002303)

Simply Wall St Value Rating: ★★★★★☆

Overview: MYS Group Co., Ltd. develops, produces, and sells packaging products in China and internationally with a market cap of CN¥7.20 billion.

Operations: MYS Group generates revenue through the development, production, and sale of packaging products both in China and internationally. The company's market capitalization stands at approximately CN¥7.20 billion.

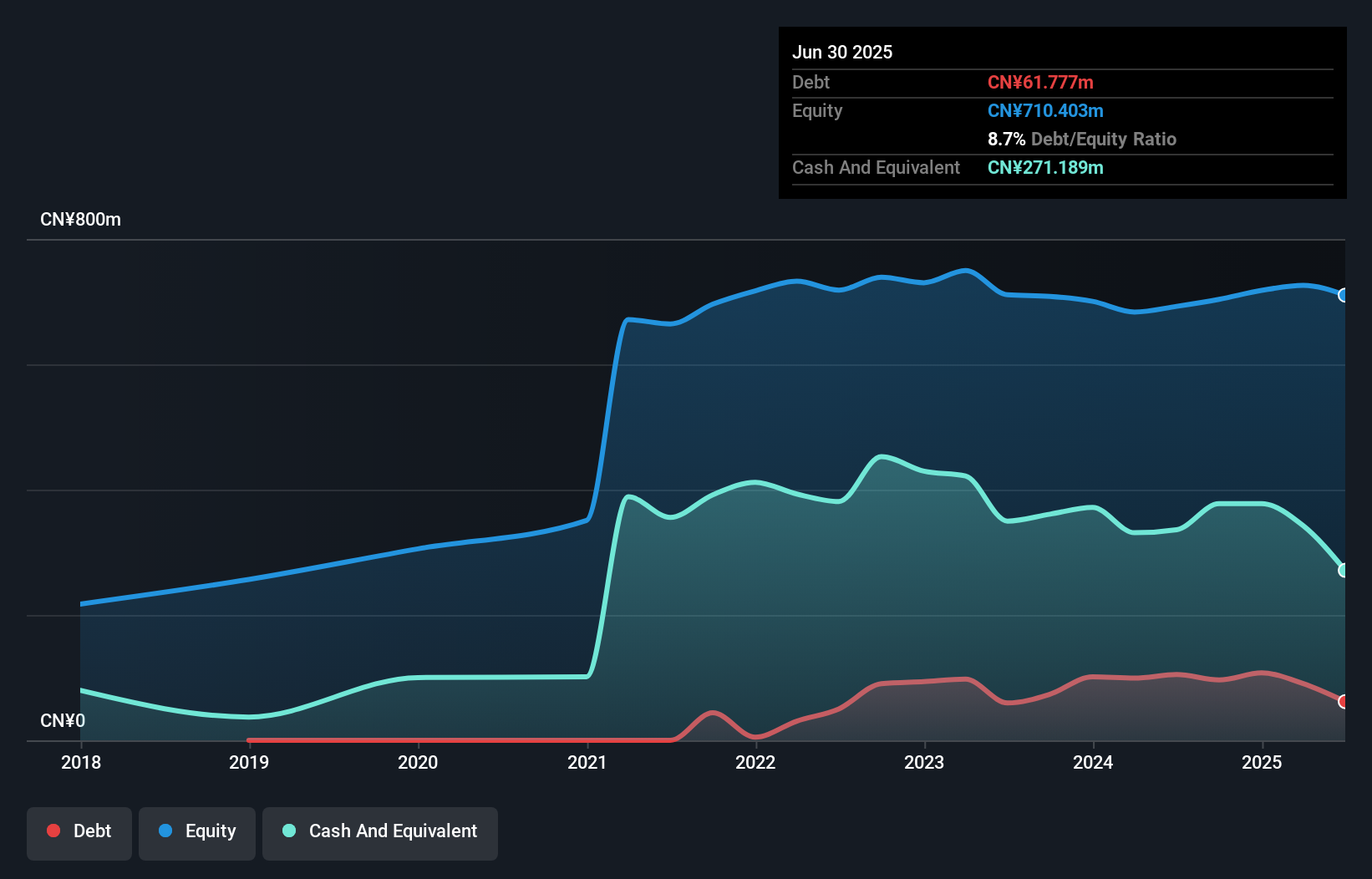

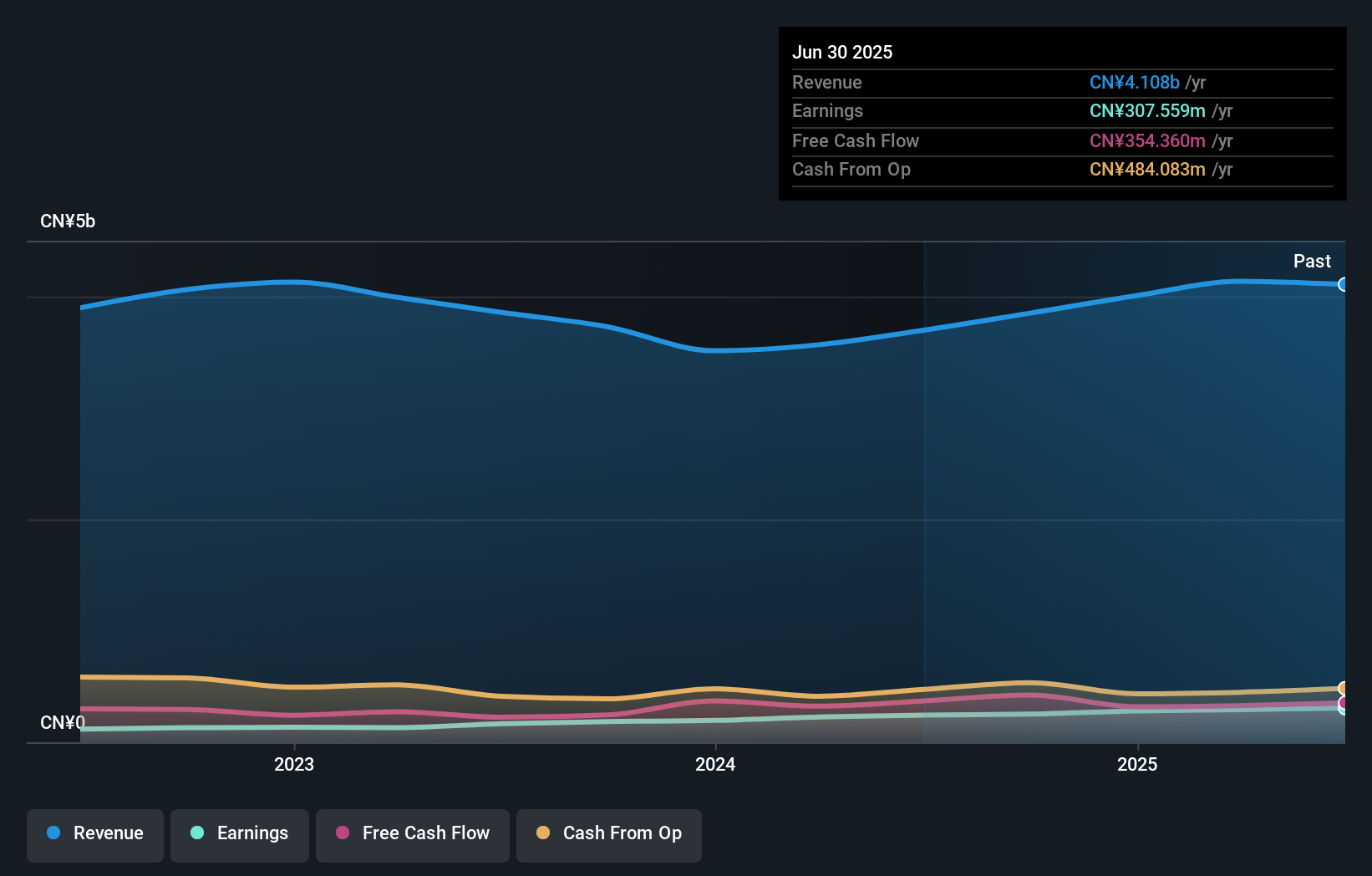

MYS Group is capturing attention with its robust financial performance, reporting a net income of CNY 176.1 million for the first half of 2025, up from CNY 150.15 million the previous year. The company's earnings growth of 25.8% significantly outpaces the packaging industry's -3.1%, highlighting its strong market position and operational efficiency. Despite an increase in the debt-to-equity ratio from 17.6% to 30.8% over five years, MYS maintains more cash than total debt, indicating solid financial health and stability in covering interest payments comfortably. Additionally, trading at a slight discount to fair value suggests potential investment appeal for those seeking growth opportunities in Asia's dynamic markets.

- Navigate through the intricacies of MYS Group with our comprehensive health report here.

Evaluate MYS Group's historical performance by accessing our past performance report.

Xiamen Voke Mold & Plastic Engineering (SZSE:301196)

Simply Wall St Value Rating: ★★★★★☆

Overview: Xiamen Voke Mold & Plastic Engineering Co., Ltd. specializes in the production and sale of high-precision molds, injection products, and health products, with a market capitalization of approximately CN¥13.29 billion.

Operations: Voke Mold's revenue is primarily derived from the production and sale of high-precision molds, injection products, and health products, totaling CN¥2.09 billion. The company has a market capitalization of approximately CN¥13.29 billion.

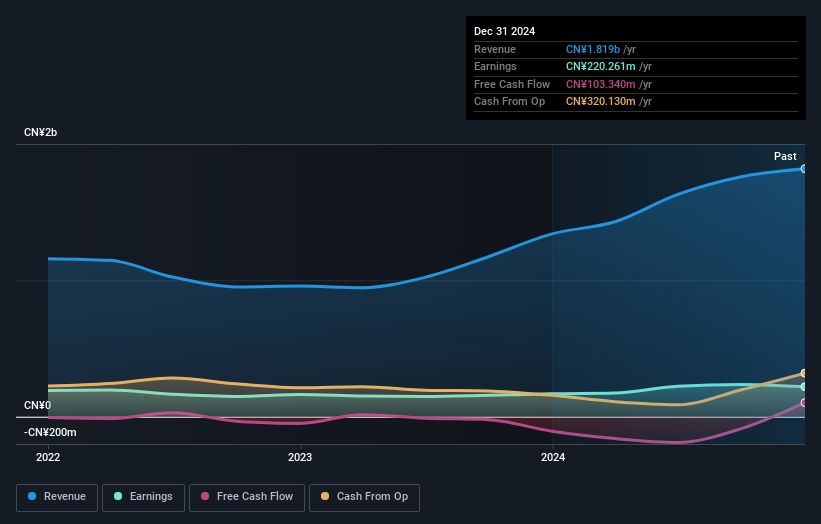

Xiamen Voke Mold & Plastic Engineering, a smaller player in the industry, recently saw its earnings grow by 14.4%, outpacing the broader Machinery sector's 4% rise. Despite a volatile share price in recent months, the company has demonstrated robust financial health with more cash than total debt and positive free cash flow. Its debt-to-equity ratio has increased from 0.7 to 1.3 over five years, but interest payments remain well-covered by profits. Recent transactions include a notable acquisition of a 2.9% stake valued at CNY 280 million, reflecting investor confidence and potential for future growth within this niche market segment.

Key Takeaways

- Get an in-depth perspective on all 2395 Asian Undiscovered Gems With Strong Fundamentals by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002303

MYS Group

Develops, produces, and sells packaging products in China and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.