- China

- /

- Basic Materials

- /

- SZSE:002596

July 2025's Global Market Penny Stocks To Watch

Reviewed by Simply Wall St

As global markets navigate new U.S. tariffs and mixed economic signals, the Nasdaq Composite Index has shown resilience, standing out among major U.S. indexes despite modest declines elsewhere. Amidst these complex market dynamics, penny stocks—often representing smaller or newer companies—remain a compelling area for investors seeking growth opportunities at lower price points. While the term 'penny stock' might seem outdated, their potential for significant returns is underscored when they are backed by strong financials and sound fundamentals.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.15 | A$103.78M | ✅ 4 ⚠️ 3 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.40 | HK$864.4M | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.44 | SGD178.33M | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.41 | £44.36M | ✅ 5 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.32 | SGD9.13B | ✅ 5 ⚠️ 0 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.42 | SEK2.32B | ✅ 4 ⚠️ 1 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.515 | MYR2.56B | ✅ 5 ⚠️ 0 View Analysis > |

| Zetrix AI Berhad (KLSE:ZETRIX) | MYR1.00 | MYR7.7B | ✅ 5 ⚠️ 2 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.60 | £129.47M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 3,819 stocks from our Global Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

MYS Group (SZSE:002303)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: MYS Group Co., Ltd. is involved in the development, production, and sale of packaging products both in China and internationally, with a market cap of CN¥5.60 billion.

Operations: MYS Group Co., Ltd. has not reported specific revenue segments for its operations in packaging product development, production, and sales.

Market Cap: CN¥5.6B

MYS Group Co., Ltd. has shown a robust financial performance with earnings growth of 28.7% over the past year, surpassing industry averages. The company reported significant revenue increases for both the first quarter and full year of 2024, highlighting its operational strength in packaging products. Despite a dividend yield of 15.19%, it is not well covered by earnings or free cash flows, raising sustainability concerns. However, MYS Group's short-term assets comfortably exceed both its short and long-term liabilities, indicating solid liquidity management while maintaining stable weekly volatility at 3%.

- Click to explore a detailed breakdown of our findings in MYS Group's financial health report.

- Learn about MYS Group's historical performance here.

Hainan RuiZe New Building MaterialLtd (SZSE:002596)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hainan RuiZe New Building Material Co., Ltd operates in the production and sale of commercial concrete and municipal sanitation services in China, with a market cap of CN¥4.36 billion.

Operations: The company generates revenue of CN¥1.23 billion from its operations within China.

Market Cap: CN¥4.36B

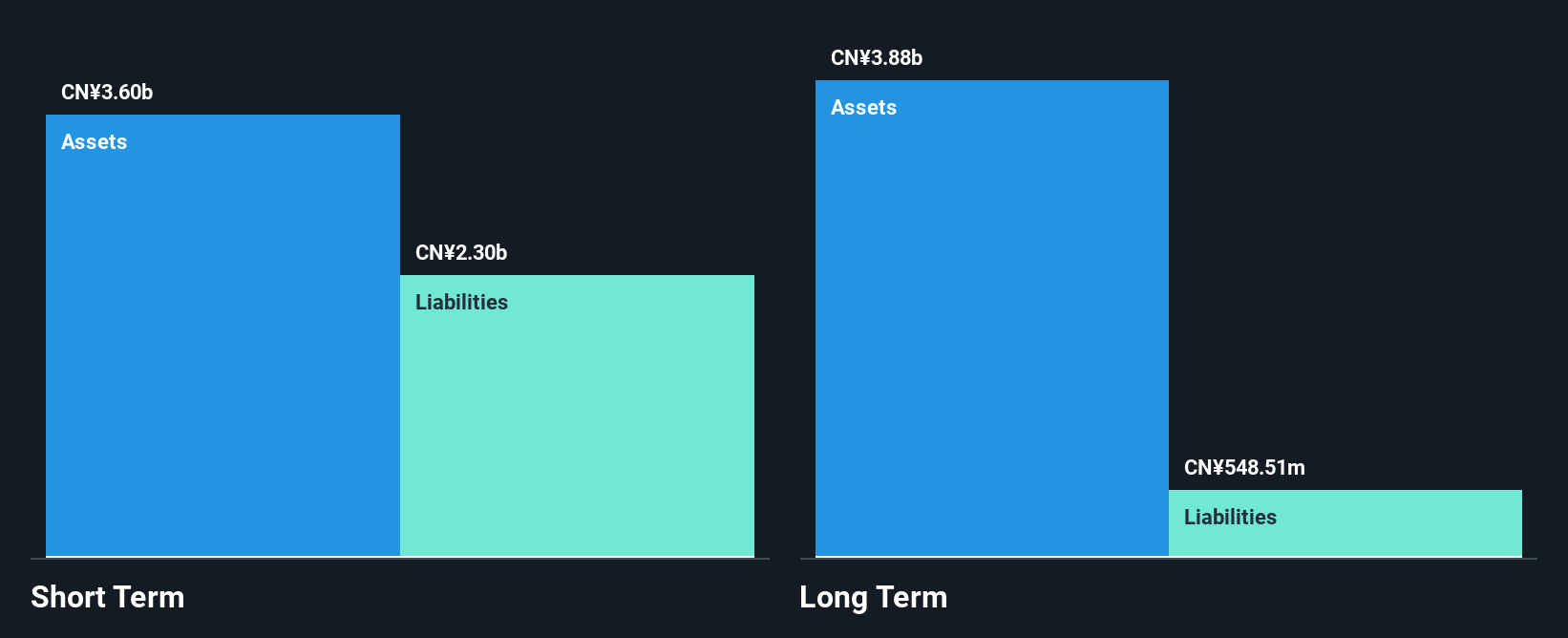

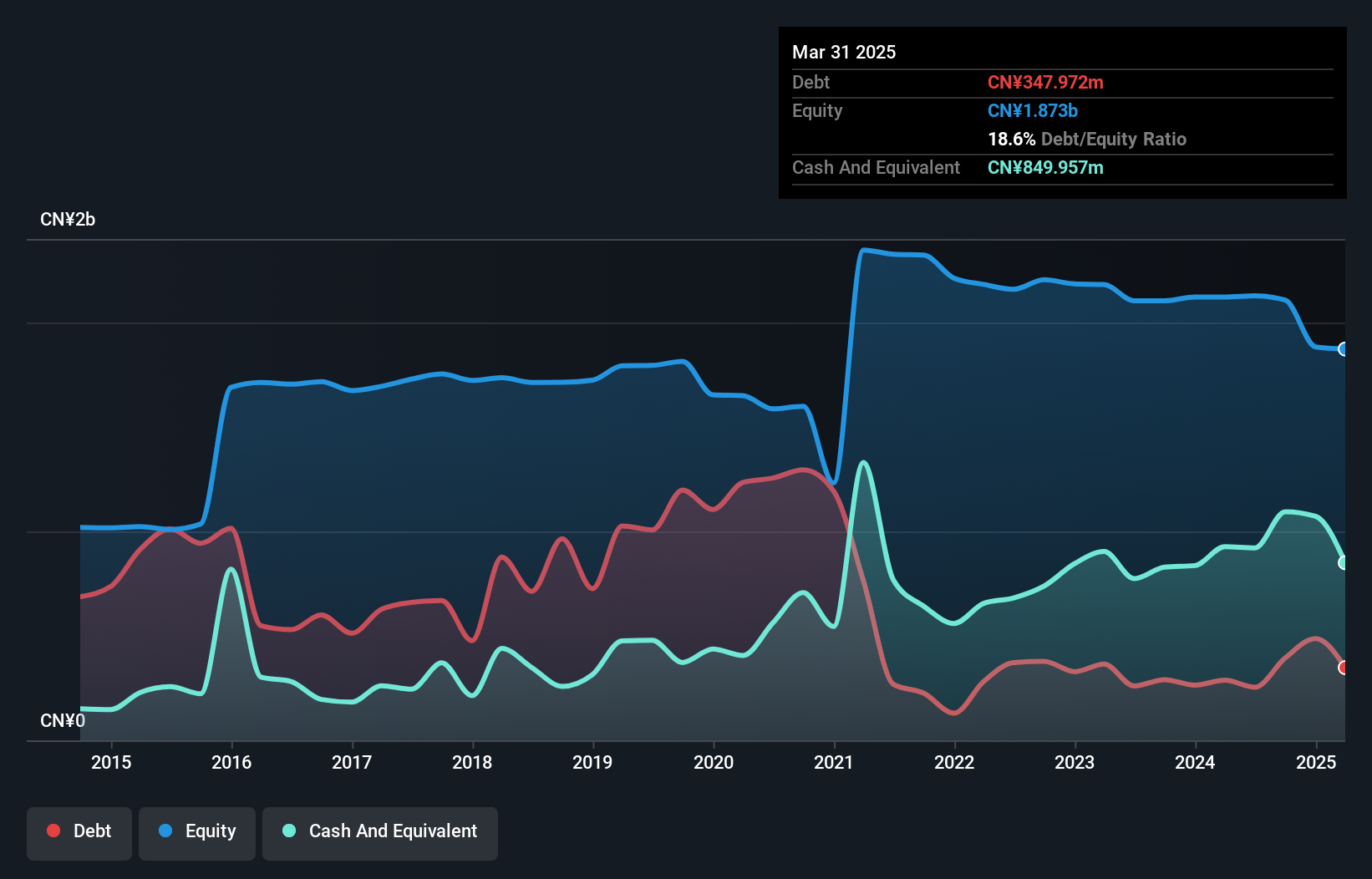

Hainan RuiZe New Building Material Co., Ltd faces challenges with declining revenues, reporting CN¥1.28 billion for 2024, down from CN¥1.65 billion the previous year. The company remains unprofitable with a net loss of CN¥241.53 million in 2024, though this is an improvement from a larger loss in the prior year. Despite high net debt to equity ratio at 175.8%, its short-term assets of CN¥2.4 billion exceed both short and long-term liabilities, suggesting decent liquidity management amidst financial struggles and an inexperienced board averaging 1.1 years tenure could impact strategic direction moving forward.

- Unlock comprehensive insights into our analysis of Hainan RuiZe New Building MaterialLtd stock in this financial health report.

- Understand Hainan RuiZe New Building MaterialLtd's track record by examining our performance history report.

Chongqing Lummy Pharmaceutical (SZSE:300006)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Chongqing Lummy Pharmaceutical Co., Ltd. focuses on the research, development, manufacture, and sale of pharmaceutical products in China with a market cap of CN¥4.23 billion.

Operations: The company generates revenue primarily from its operations in China, amounting to CN¥812.87 million.

Market Cap: CN¥4.23B

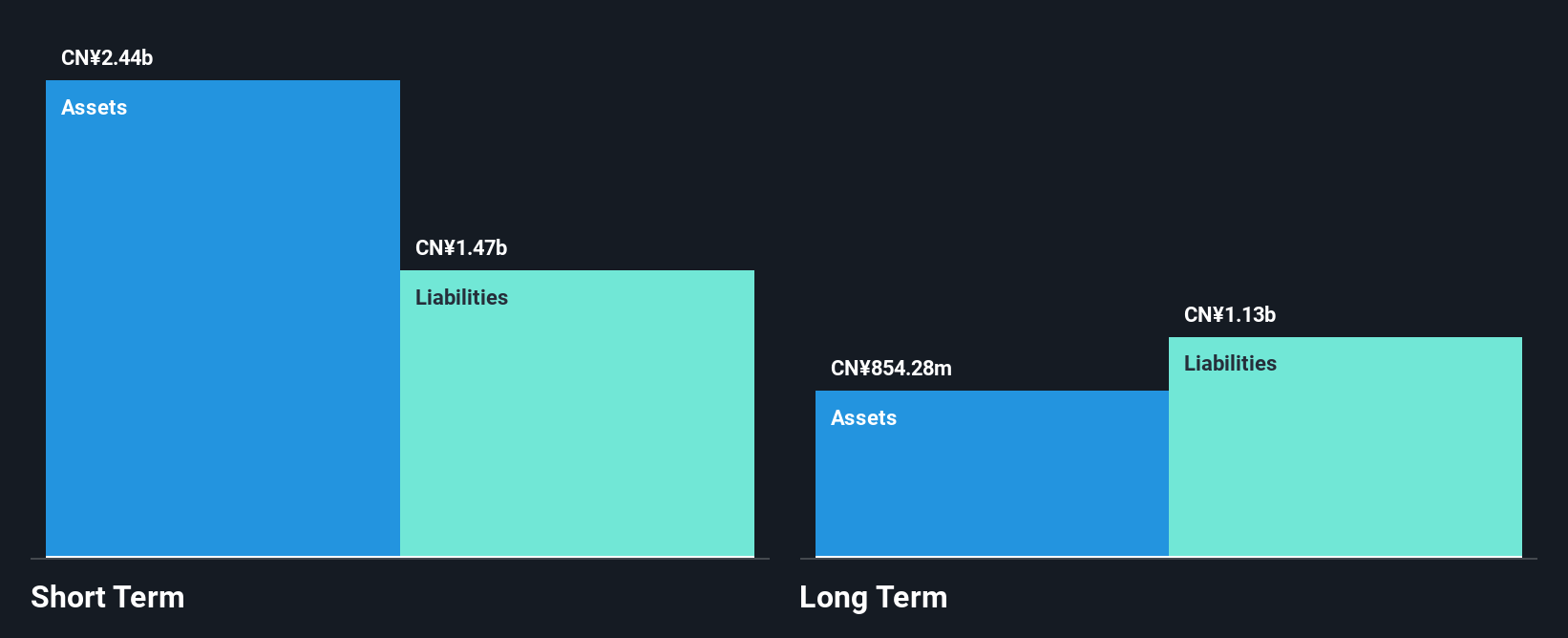

Chongqing Lummy Pharmaceutical Co., Ltd. reported increased revenue of CN¥198.4 million for Q1 2025, up from CN¥181.12 million the previous year, yet it remains unprofitable with a net loss of CN¥13.78 million. The company benefits from strong liquidity, as short-term assets of CN¥1.5 billion surpass both short and long-term liabilities, and it holds more cash than debt. A seasoned management team with an average tenure of 8.3 years supports its strategic direction, while reduced weekly volatility indicates improved market stability despite ongoing challenges in achieving profitability in the competitive pharmaceutical industry.

- Click here to discover the nuances of Chongqing Lummy Pharmaceutical with our detailed analytical financial health report.

- Review our historical performance report to gain insights into Chongqing Lummy Pharmaceutical's track record.

Next Steps

- Gain an insight into the universe of 3,819 Global Penny Stocks by clicking here.

- Ready To Venture Into Other Investment Styles? AI is about to change healthcare. These 28 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hainan RuiZe New Building MaterialLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002596

Hainan RuiZe New Building MaterialLtd

Engages in the production and sale of commercial concrete and municipal sanitation business in China.

Adequate balance sheet with weak fundamentals.

Market Insights

Community Narratives