- China

- /

- Basic Materials

- /

- SZSE:002302

China West Construction Group Co., Ltd's (SZSE:002302) Shares Bounce 33% But Its Business Still Trails The Market

Despite an already strong run, China West Construction Group Co., Ltd (SZSE:002302) shares have been powering on, with a gain of 33% in the last thirty days. Unfortunately, despite the strong performance over the last month, the full year gain of 5.8% isn't as attractive.

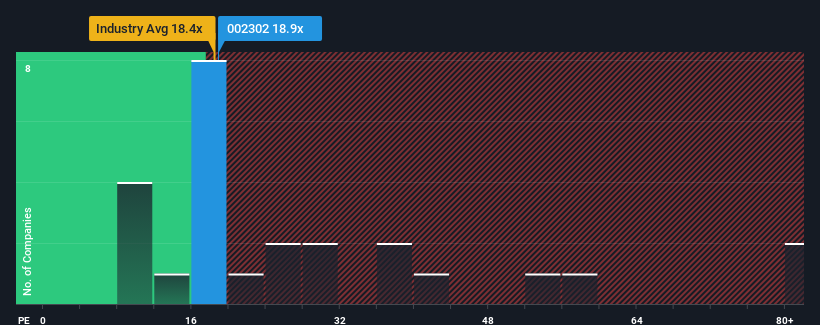

Although its price has surged higher, China West Construction Group may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 18.9x, since almost half of all companies in China have P/E ratios greater than 32x and even P/E's higher than 61x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With earnings growth that's exceedingly strong of late, China West Construction Group has been doing very well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for China West Construction Group

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as China West Construction Group's is when the company's growth is on track to lag the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 58% last year. However, this wasn't enough as the latest three year period has seen a very unpleasant 43% drop in EPS in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Comparing that to the market, which is predicted to deliver 37% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

In light of this, it's understandable that China West Construction Group's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

What We Can Learn From China West Construction Group's P/E?

The latest share price surge wasn't enough to lift China West Construction Group's P/E close to the market median. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of China West Construction Group revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 2 warning signs for China West Construction Group (1 is a bit concerning!) that we have uncovered.

If you're unsure about the strength of China West Construction Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002302

China West Construction Group

Engages in the building materials business in China, Malaysia, Indonesia, Cambodia, and internationally.

Average dividend payer with mediocre balance sheet.

Market Insights

Community Narratives