- China

- /

- Infrastructure

- /

- SHSE:601518

Undiscovered Gems And 2 Other Small Caps With Promising Potential

Reviewed by Simply Wall St

In a week marked by mixed performances across major indices, the Russell 2000 Index saw a decline after previously outperforming its larger-cap counterparts, highlighting the ongoing volatility in small-cap stocks. As investors digest economic indicators such as rebounding job growth and potential interest rate cuts, attention turns to identifying promising opportunities within the small-cap sector. In this context, uncovering undiscovered gems involves looking for companies with strong fundamentals and potential for growth despite broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 7.12% | 6.96% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Ellaktor | 73.80% | -24.52% | 51.72% | ★★★★★☆ |

| Nederman Holding | 73.66% | 10.94% | 15.88% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 16.56% | 6.15% | 10.19% | ★★★★☆☆ |

| Compañía General de Electricidad | 1.98% | 9.75% | -4.52% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Jilin Expressway (SHSE:601518)

Simply Wall St Value Rating: ★★★★★★

Overview: Jilin Expressway Co., Ltd. operates in the investment, development, construction, operation, management, and maintenance of toll roads in Jilin Province with a market capitalization of approximately CN¥5.44 billion.

Operations: The primary revenue stream for Jilin Expressway comes from its toll road operations in Jilin Province. The company's financial performance is significantly influenced by the costs associated with road construction and maintenance.

Jilin Expressway, a player in the infrastructure sector, has shown resilience with earnings growth of 16.5% over the past year, outpacing the industry average of 3.1%. The company trades at 28.6% below its estimated fair value, suggesting potential undervaluation. Despite a dip in sales to ¥869 million from ¥938 million last year, net income remained steady at around ¥390 million. Impressively, Jilin's debt to equity ratio has significantly improved from 57.5% to just 7.1% over five years, indicating strong financial health and positioning it well for future opportunities within its sector.

- Navigate through the intricacies of Jilin Expressway with our comprehensive health report here.

Assess Jilin Expressway's past performance with our detailed historical performance reports.

Suzhou Hesheng Special Material (SZSE:002290)

Simply Wall St Value Rating: ★★★★★★

Overview: Suzhou Hesheng Special Material Co., Ltd. operates in the special materials industry and has a market cap of CN¥4.36 billion.

Operations: The company generates revenue primarily from its operations in the special materials industry, contributing to its market cap of CN¥4.36 billion.

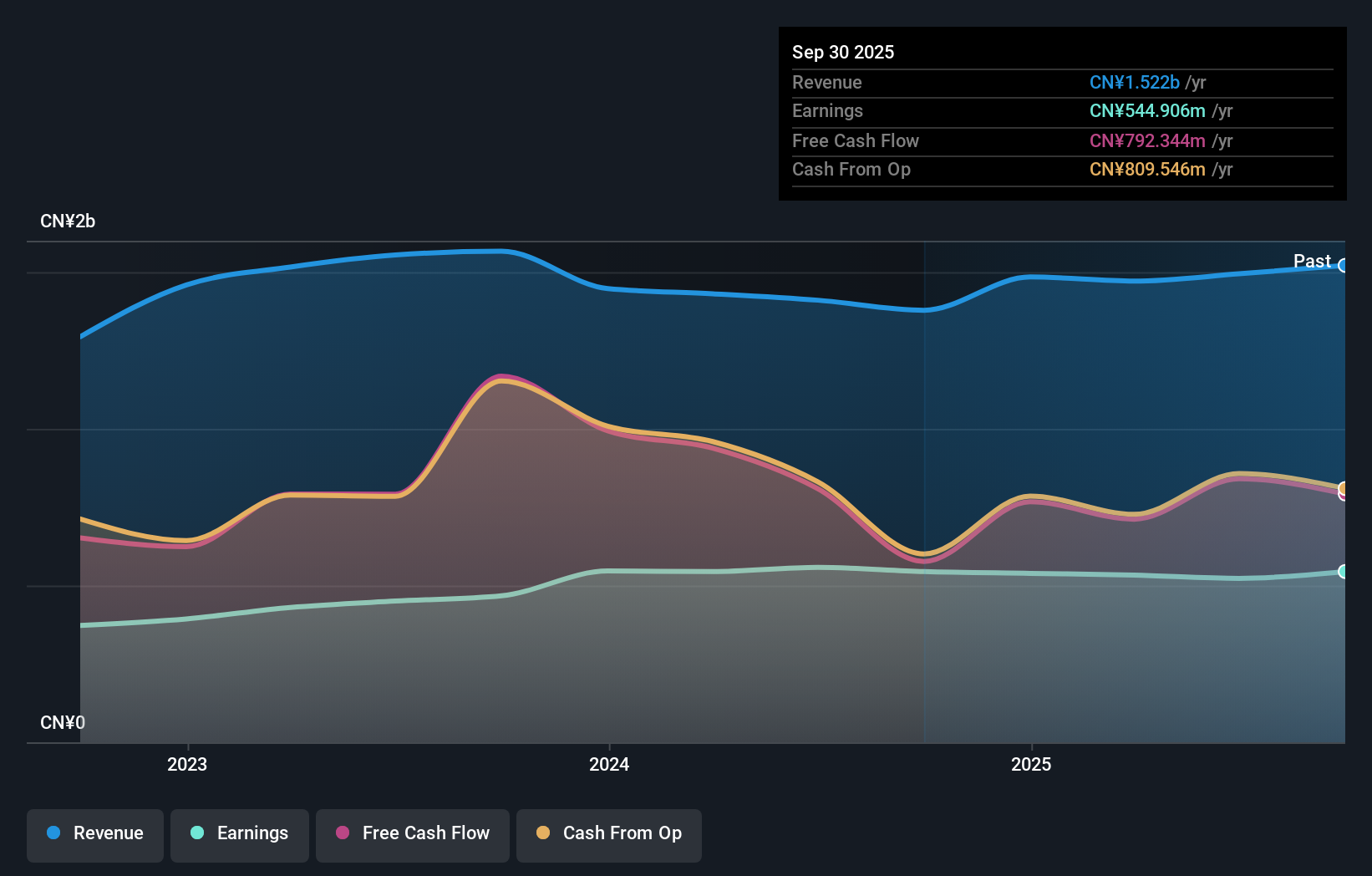

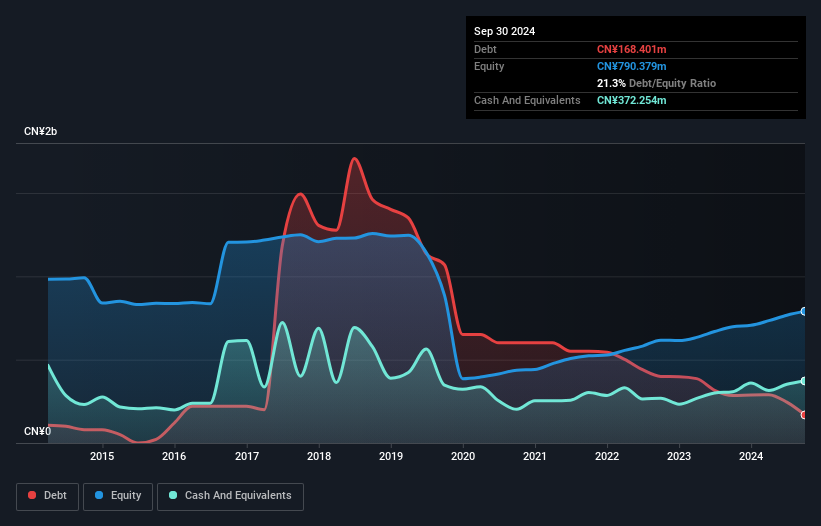

Suzhou Hesheng Special Material showcases a compelling story with its recent performance, reporting sales of CNY 1.84 billion for the first nine months of 2024, up from CNY 1.70 billion last year. Net income slightly rose to CNY 85.82 million compared to CNY 84.73 million previously, indicating stable profitability. The company's debt-to-equity ratio has dramatically improved over five years from 120.6% to just 21.3%, signaling robust financial health and effective debt management strategies. With earnings growth outpacing the industry average by reaching a notable 4.4%, this entity seems well-positioned in the competitive landscape of metals and mining industries in China.

- Take a closer look at Suzhou Hesheng Special Material's potential here in our health report.

Learn about Suzhou Hesheng Special Material's historical performance.

Xiamen Guang Pu Electronics (SZSE:300632)

Simply Wall St Value Rating: ★★★★★☆

Overview: Xiamen Guang Pu Electronics Co., Ltd. focuses on the development, manufacture, and sale of LED packaging and application products in China with a market cap of approximately CN¥3.71 billion.

Operations: Guang Pu Electronics generates revenue primarily from its LED packaging and application products. The company has experienced fluctuations in its net profit margin, which was recently reported at 8.5%.

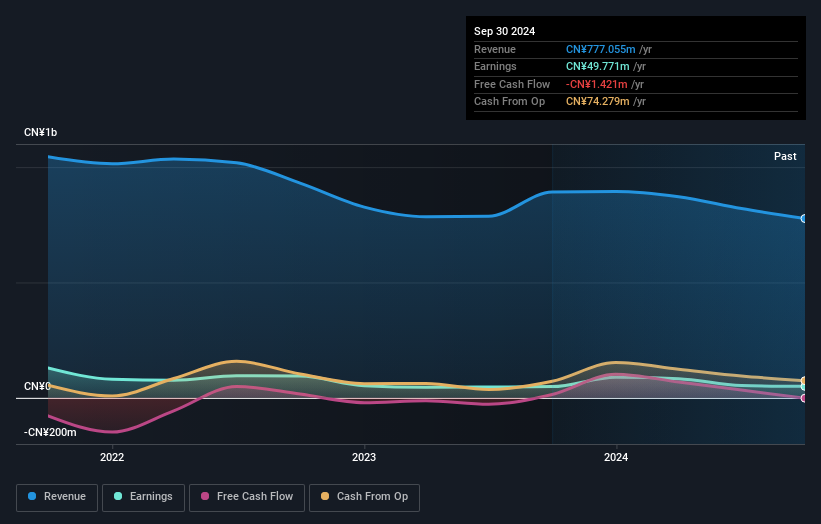

Xiamen Guang Pu Electronics, a smaller player in the electronics sector, has seen its debt to equity ratio improve significantly from 27% to 16.2% over five years. Despite this positive shift, earnings have decreased by an average of 27% annually over the same period. The company reported sales of CNY 639.79 million for the first nine months of 2024, down from CNY 757.22 million last year, with net income falling to CNY 71.71 million from CNY 111.23 million previously. A notable one-off gain of CN¥25M impacted recent financial results, highlighting potential volatility in earnings quality.

Taking Advantage

- Dive into all 4640 of the Undiscovered Gems With Strong Fundamentals we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601518

Jilin Expressway

Through its subsidiaries, invests in, develops, constructs, operates, manages, and maintains toll roads in the Jilin Province, China.

Flawless balance sheet established dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026