Insider-Favored Growth Stocks: WG TECH (Jiang Xi) And Two More Top Picks

Reviewed by Simply Wall St

In a week marked by geopolitical tensions and concerns over consumer spending, global markets faced volatility, with major indices experiencing sharp losses after initial gains. Amidst this uncertain backdrop, investors are increasingly drawn to growth companies with high insider ownership as these stocks often reflect confidence from those who understand the business best.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 50.1% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.7% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 41.9% |

| CD Projekt (WSE:CDR) | 29.7% | 39.4% |

| Pharma Mar (BME:PHM) | 11.9% | 45.4% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

We're going to check out a few of the best picks from our screener tool.

WG TECH (Jiang Xi) (SHSE:603773)

Simply Wall St Growth Rating: ★★★★★☆

Overview: WG TECH (Jiang Xi) Co., Ltd. operates in the photoelectric glass finishing industry in China and has a market capitalization of CN¥5.58 billion.

Operations: The company generates revenue primarily from its optoelectronics segment, amounting to CN¥2.21 billion.

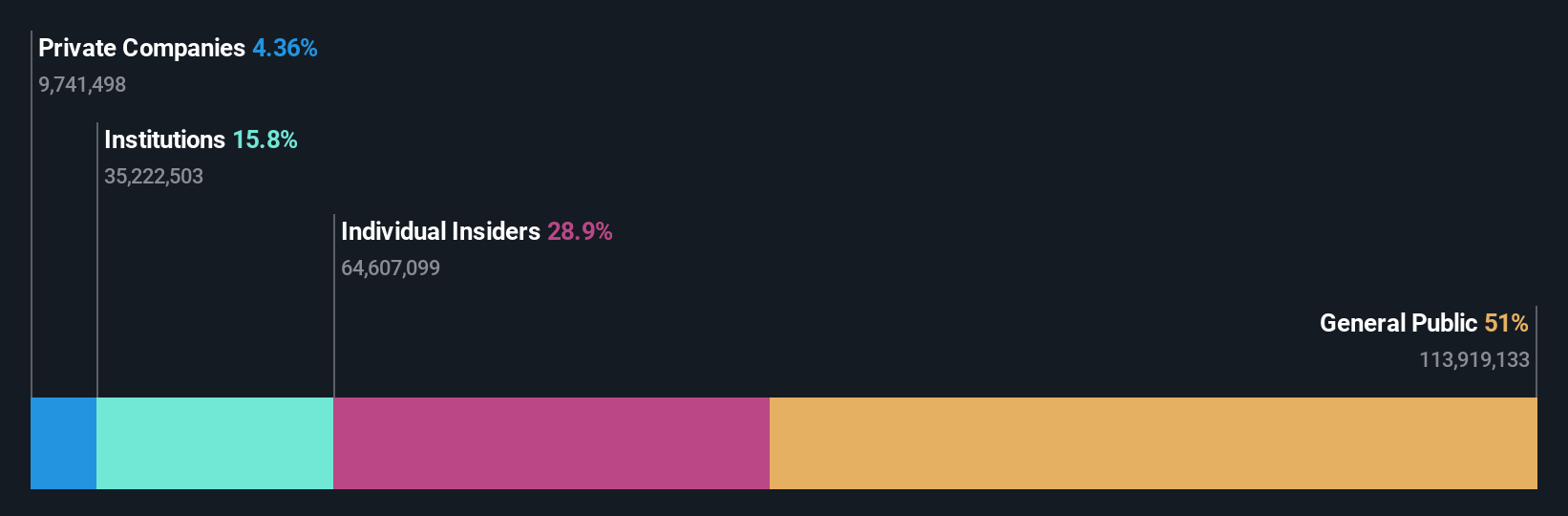

Insider Ownership: 29.0%

Earnings Growth Forecast: 126.9% p.a.

WG TECH (Jiang Xi) is forecast to achieve annual profit growth above the market average, becoming profitable in three years. Revenue growth is expected to surpass 20% annually, outpacing the Chinese market. However, interest payments aren't well-covered by earnings and return on equity is projected to be low at 8.1%. Recent insider activity includes a significant share transfer valued at CNY 281.43 million, indicating substantial insider ownership changes but no recent buying or selling trends over three months.

- Click to explore a detailed breakdown of our findings in WG TECH (Jiang Xi)'s earnings growth report.

- Our comprehensive valuation report raises the possibility that WG TECH (Jiang Xi) is priced higher than what may be justified by its financials.

Lianhe Chemical TechnologyLtd (SZSE:002250)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lianhe Chemical Technology Co., Ltd. operates in the production and sale of chemical products in China with a market cap of CN¥6.29 billion.

Operations: Lianhe Chemical Technology Co., Ltd. generates its revenue from the production and sale of chemical products in China.

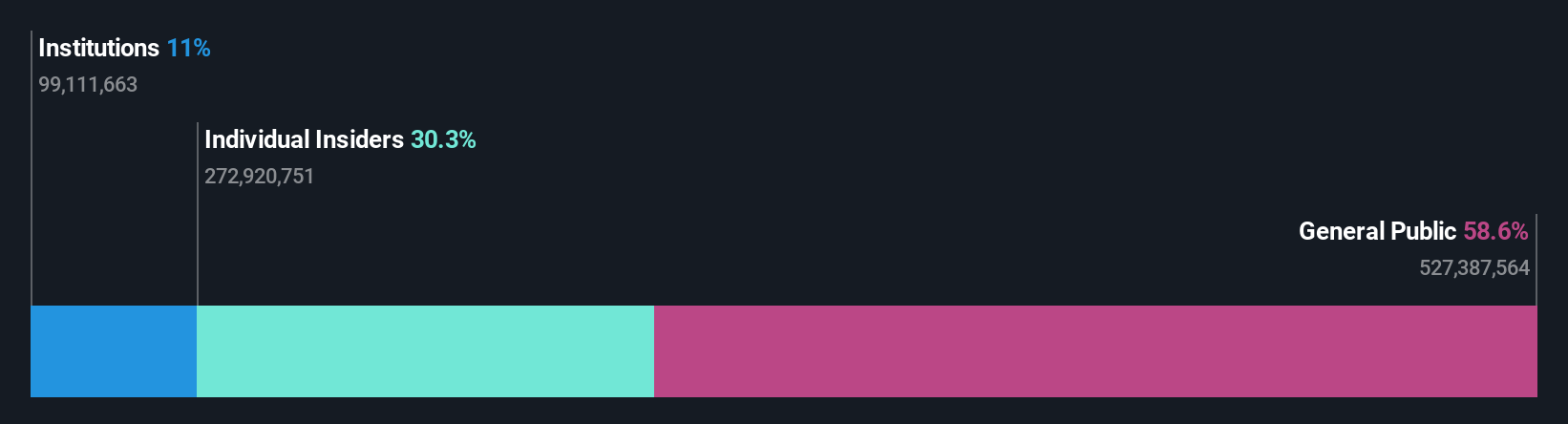

Insider Ownership: 29.9%

Earnings Growth Forecast: 103% p.a.

Lianhe Chemical Technology Ltd. is forecast to achieve profitability within three years, with earnings expected to grow significantly at 102.99% annually, surpassing market averages. The company's revenue growth of 17.9% per year is projected to exceed the Chinese market's rate but remains below 20%. Despite high debt levels and a low forecasted return on equity of 3.9%, it trades at a substantial discount of 56.7% below estimated fair value compared to peers and industry standards, indicating potential investment appeal despite no recent insider trading activity over the last three months.

- Click here and access our complete growth analysis report to understand the dynamics of Lianhe Chemical TechnologyLtd.

- According our valuation report, there's an indication that Lianhe Chemical TechnologyLtd's share price might be on the cheaper side.

Xi'an Sinofuse Electric (SZSE:301031)

Simply Wall St Growth Rating: ★★★★★★

Overview: Xi'an Sinofuse Electric Co., Ltd. specializes in the research, development, production, and sale of circuit protection devices and fuses, with a market capitalization of CN¥7.98 billion.

Operations: Xi'an Sinofuse Electric Co., Ltd. generates revenue primarily through its circuit protection devices, fuses, and related accessories.

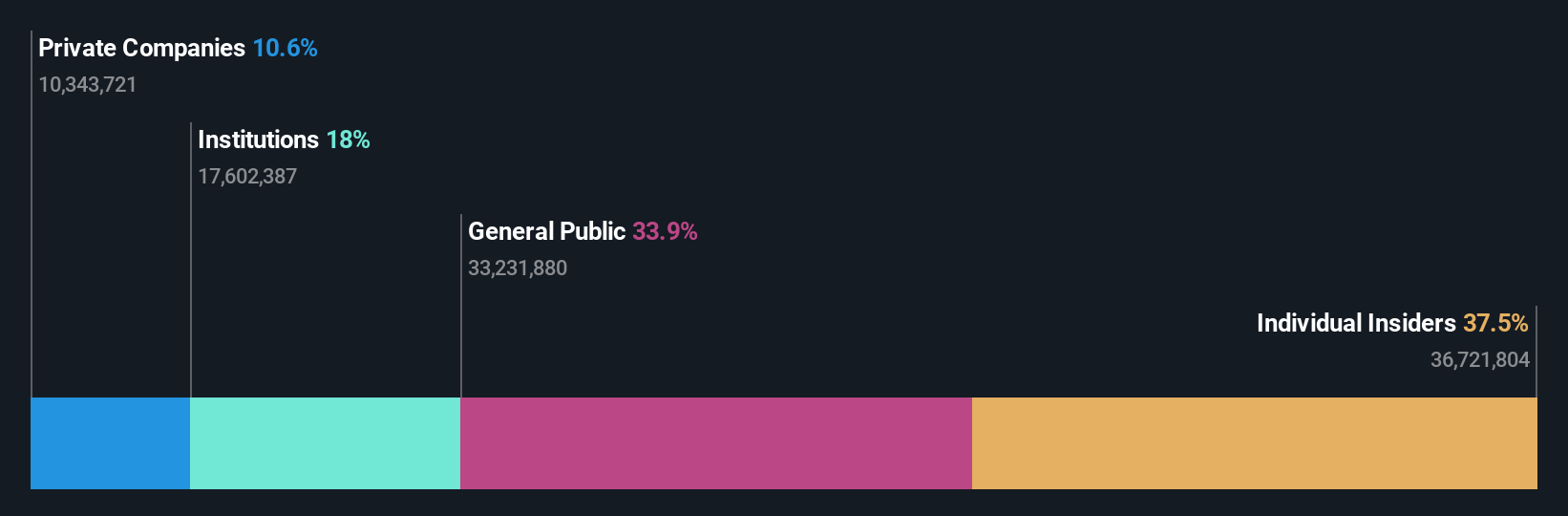

Insider Ownership: 37.4%

Earnings Growth Forecast: 44.4% p.a.

Xi'an Sinofuse Electric's earnings are expected to grow significantly at 44.4% annually, outpacing the Chinese market's average growth rate. Revenue is also forecast to increase by 28.9% per year, surpassing market expectations. Despite no recent insider trading activity, its high return on equity forecast of 24.6% in three years suggests strong future performance potential. The company completed a share buyback worth CNY 20.14 million but repurchased no shares recently.

- Click here to discover the nuances of Xi'an Sinofuse Electric with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Xi'an Sinofuse Electric's current price could be inflated.

Make It Happen

- Click here to access our complete index of 1456 Fast Growing Companies With High Insider Ownership.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002250

Lianhe Chemical TechnologyLtd

Engages in the production and sale of chemical products in China.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives