- China

- /

- Metals and Mining

- /

- SZSE:002237

Three Undiscovered Gems With Strong Potential In None

Reviewed by Simply Wall St

As global markets navigate a mixed start to the new year, with major indices showing varied performance and economic indicators like the Chicago PMI highlighting challenges in manufacturing, investors are keenly observing small-cap stocks for potential opportunities. Despite some economic headwinds, such as revised GDP forecasts and contracting manufacturing activity, the resilience of certain sectors suggests that there may be undiscovered gems with strong potential. In this context, identifying stocks that demonstrate solid fundamentals and adaptability to current market conditions can be key to uncovering promising investments.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Shandong Humon Smelting (SZSE:002237)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shandong Humon Smelting Co., Ltd. is involved in the development of gold mineral resources, precious metal smelting, high-tech materials production, and international trade, with a market cap of CN¥11.63 billion.

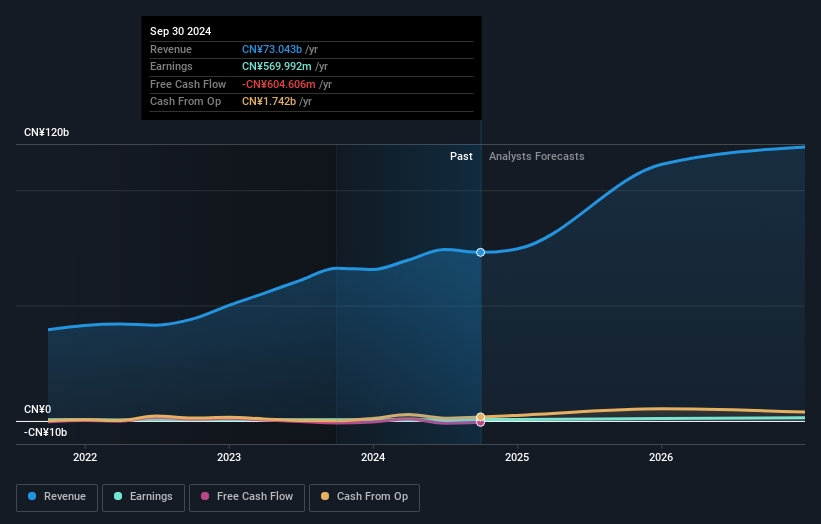

Operations: Shandong Humon Smelting generates revenue primarily from gold mineral resources and precious metal smelting. The company's net profit margin shows variability over recent periods, reflecting changes in operational efficiency and market conditions.

Shandong Humon Smelting, a notable player in the metals and mining sector, reported substantial revenue growth for the nine months ending September 2024, reaching CN¥58.16 billion from CN¥50.69 billion a year prior. Net income also rose to CN¥464.53 million from CN¥410.27 million, with basic earnings per share increasing to CN¥0.40 from CN¥0.36. Despite encountering a one-off loss of CN¥220.4 million impacting recent results, its price-to-earnings ratio remains attractive at 20x compared to the broader market's 33x, suggesting potential value for investors while managing high net debt levels at 82%.

Guangzhou Metro Design & Research Institute (SZSE:003013)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guangzhou Metro Design & Research Institute Co., Ltd. operates in the engineering services sector, focusing on metro and rail transit design and research, with a market cap of CN¥6.13 billion.

Operations: The company's primary revenue stream is from engineering services, generating CN¥2.63 billion.

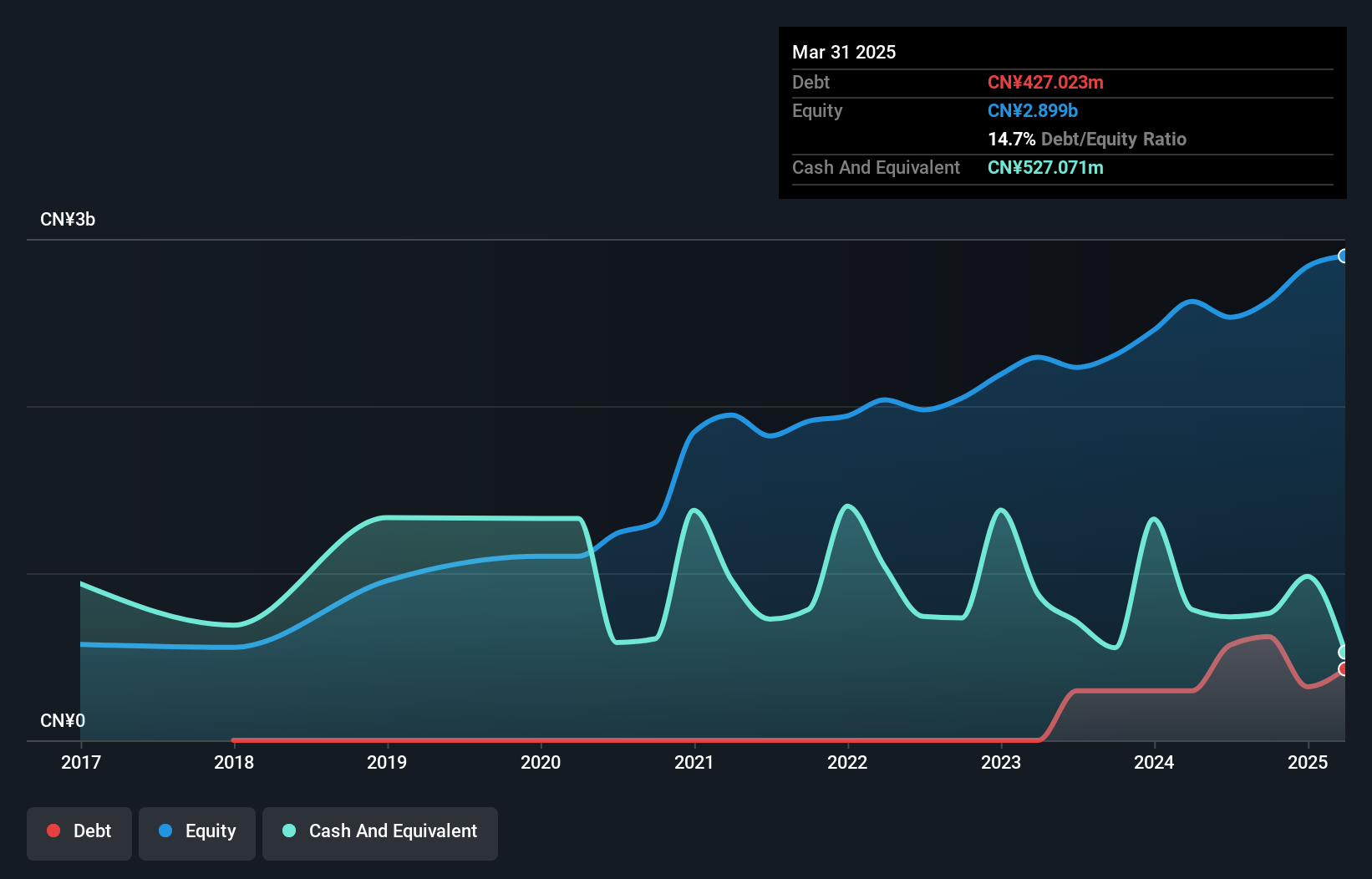

Guangzhou Metro Design & Research Institute, a smaller player in the construction sector, has shown resilience with earnings growing by 3.4% over the past year, outpacing its industry which saw a -3.9% change. The company appears financially stable with more cash than total debt and maintains an attractive price-to-earnings ratio of 13.9x compared to the broader CN market's 33.2x. Despite shareholder dilution recently, it continues to generate positive free cash flow and is forecasted for a 13.69% annual growth in earnings, suggesting potential value amidst recent leadership changes approved at their EGM in October 2024.

Sanyou (SZSE:300932)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sanyou Corporation Limited focuses on the research, development, manufacture, and sale of relays in China with a market capitalization of CN¥3.34 billion.

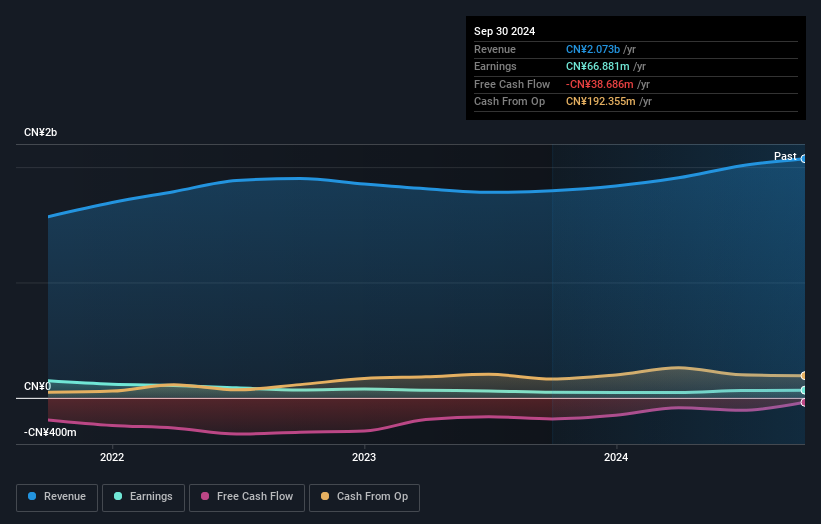

Operations: Sanyou generates revenue primarily through the sale of relays, with a focus on research and development to enhance its product offerings. The company's financial performance includes tracking its net profit margin, which provides insight into profitability trends over time.

Sanyou, a smaller player in its industry, has shown promising growth with earnings surging by 39.5% over the past year. Despite this positive momentum, its earnings have dropped by 25.3% annually over five years, suggesting some volatility. The company's net debt to equity ratio stands at a satisfactory 12.3%, indicating manageable leverage levels. Recent financials reveal revenues of CN¥1.6 billion for the first nine months of 2024, up from CN¥1.36 billion previously, while net income rose to CN¥51 million from CN¥31 million last year, reflecting an upward trend in profitability amid industry challenges and opportunities for future expansion.

- Get an in-depth perspective on Sanyou's performance by reading our health report here.

Assess Sanyou's past performance with our detailed historical performance reports.

Key Takeaways

- Discover the full array of 4650 Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002237

Shandong Humon Smelting

Engages in the development of gold mineral resources; precious metal smelting; research and development, and production of high-tech materials; and international trade business in China and internationally.

High growth potential with proven track record.