February 2025's Top Growth Companies With Strong Insider Ownership

Reviewed by Simply Wall St

As global markets navigate the complexities of tariff uncertainties and a cooling labor market, investors are keenly observing how these factors impact broader economic conditions. Amidst this backdrop, growth companies with high insider ownership often stand out as they can offer unique insights into management's confidence in their business prospects, making them an appealing focus for those seeking resilient investment opportunities.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 22.8% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| CD Projekt (WSE:CDR) | 29.7% | 39.4% |

| Pharma Mar (BME:PHM) | 11.9% | 44.7% |

| Medley (TSE:4480) | 34.1% | 27.3% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Findi (ASX:FND) | 35.8% | 111.4% |

Let's dive into some prime choices out of the screener.

Shanghai Luoman Technologies (SHSE:605289)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai Luoman Technologies Inc. specializes in urban and rural landscape lighting solutions in China, with a market cap of CN¥2.81 billion.

Operations: Shanghai Luoman Technologies Inc. generates its revenue primarily from providing landscape lighting solutions across urban and rural areas in China.

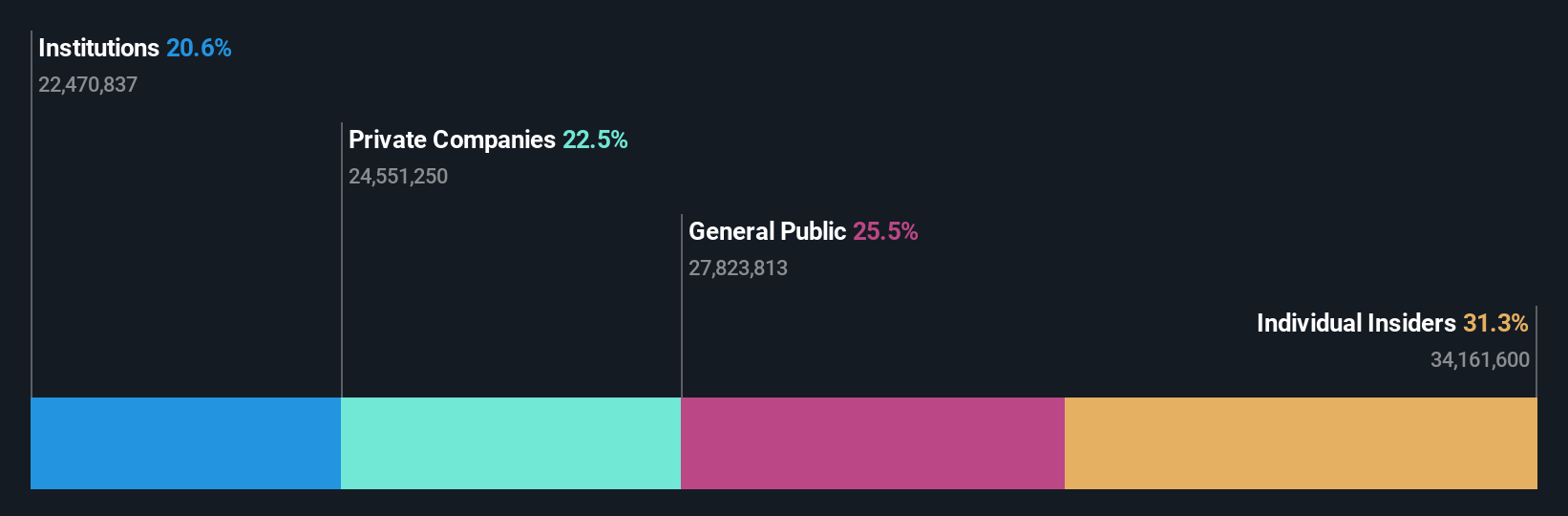

Insider Ownership: 31.2%

Shanghai Luoman Technologies is poised for significant growth, with revenue expected to increase by 28.5% annually, surpassing the Chinese market's rate. Earnings are projected to grow at 49.84% per year, indicating strong potential despite a recent decline in profit margins from 8.7% to 3.2%. The company faces challenges with its low return on equity forecast and unsustainable dividend coverage, while insider trading activity remains stable without substantial buying or selling recently noted.

- Click here to discover the nuances of Shanghai Luoman Technologies with our detailed analytical future growth report.

- Our expertly prepared valuation report Shanghai Luoman Technologies implies its share price may be too high.

Wuxi HyatechLtd (SHSE:688510)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wuxi Hyatech Co., Ltd. is engaged in the research, development, manufacturing, and sale of aero-engine parts and forged medical orthopedic implants both in China and internationally, with a market cap of approximately CN¥4.28 billion.

Operations: The company generates revenue from two primary segments: aero-engine parts and forged medical orthopedic implants, serving both domestic and international markets.

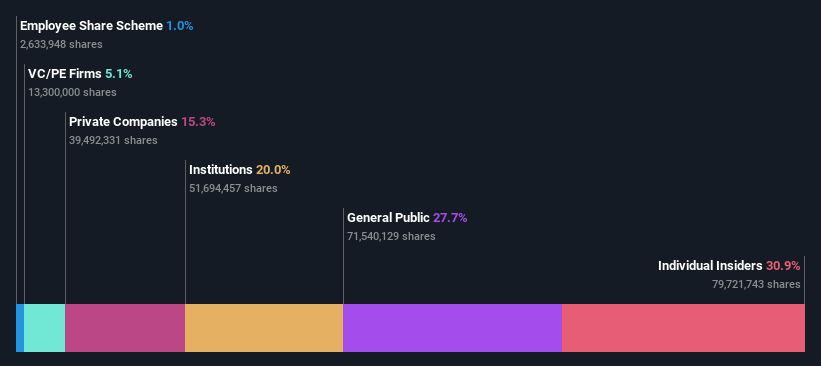

Insider Ownership: 29.6%

Wuxi Hyatech Ltd. demonstrates robust growth potential, with its earnings increasing by 40.4% last year and expected to grow at 27.59% annually, outpacing the Chinese market's forecasted growth rate. Recent earnings results showed a net income rise to CNY 126.62 million from CNY 90.2 million, reflecting strong operational performance. Despite a low return on equity forecast of 14.8%, the company's revenue is anticipated to grow significantly faster than the market average at 22.6% per year.

- Click here and access our complete growth analysis report to understand the dynamics of Wuxi HyatechLtd.

- The analysis detailed in our Wuxi HyatechLtd valuation report hints at an inflated share price compared to its estimated value.

Shenzhen Noposion Crop Science (SZSE:002215)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Noposion Crop Science Co., Ltd. engages in the research, development, production, and sale of agricultural inputs both in China and internationally, with a market cap of CN¥9.97 billion.

Operations: Shenzhen Noposion Crop Science Co., Ltd. generates revenue through the research, development, production, and sale of agricultural inputs across domestic and international markets.

Insider Ownership: 29.6%

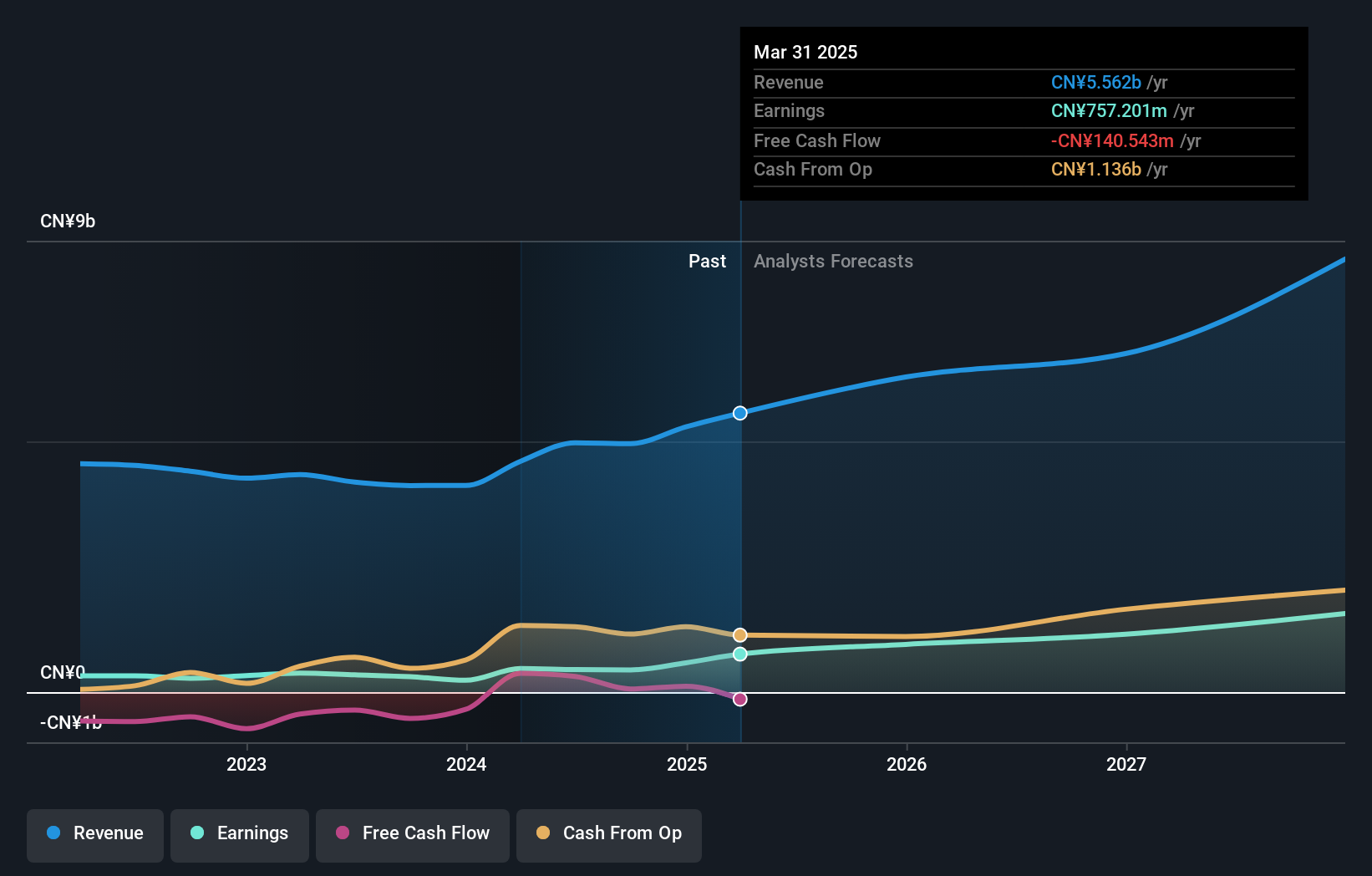

Shenzhen Noposion Crop Science is positioned for significant earnings growth, forecasted at 37% annually, surpassing the Chinese market's 25.5%. Despite a high debt level and slower revenue growth of 7.9% per year compared to the market's 13.6%, it trades at a favorable P/E ratio of 22.8x against the market's 36.7x. The company's recent extraordinary shareholders meeting addressed plans for a comprehensive credit line application, indicating active financial management strategies.

- Click to explore a detailed breakdown of our findings in Shenzhen Noposion Crop Science's earnings growth report.

- Our valuation report unveils the possibility Shenzhen Noposion Crop Science's shares may be trading at a discount.

Seize The Opportunity

- Delve into our full catalog of 1441 Fast Growing Companies With High Insider Ownership here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002215

Shenzhen Noposion Crop Science

Researches and develops, produces, and sells agricultural inputs in China and internationally.

Solid track record with reasonable growth potential.

Market Insights

Community Narratives