- Taiwan

- /

- Metals and Mining

- /

- TWSE:9958

Three Undiscovered Gems with Promising Potential

Reviewed by Simply Wall St

As global markets navigate the uncertainties surrounding the incoming Trump administration and its potential impact on various sectors, small-cap stocks have experienced mixed performance, with indices such as the Russell 2000 reflecting a notable decline. Amid these market dynamics, identifying promising opportunities requires a keen understanding of how policy shifts and economic indicators can influence corporate earnings and growth trajectories. In this context, discovering stocks with robust fundamentals and resilience to external pressures becomes crucial for investors seeking potential gems in today's volatile environment.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Brillian Network & Automation Integrated System | 8.39% | 20.15% | 19.93% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.46% | 20.33% | ★★★★★★ |

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Gallant Precision Machining | 29.51% | -2.07% | 4.51% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Song Hong Garment | 62.50% | 3.80% | -5.84% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Sichuan Gold (SZSE:001337)

Simply Wall St Value Rating: ★★★★★★

Overview: Sichuan Gold Co., Ltd. is involved in the gold mining industry with a market capitalization of CN¥9.62 billion.

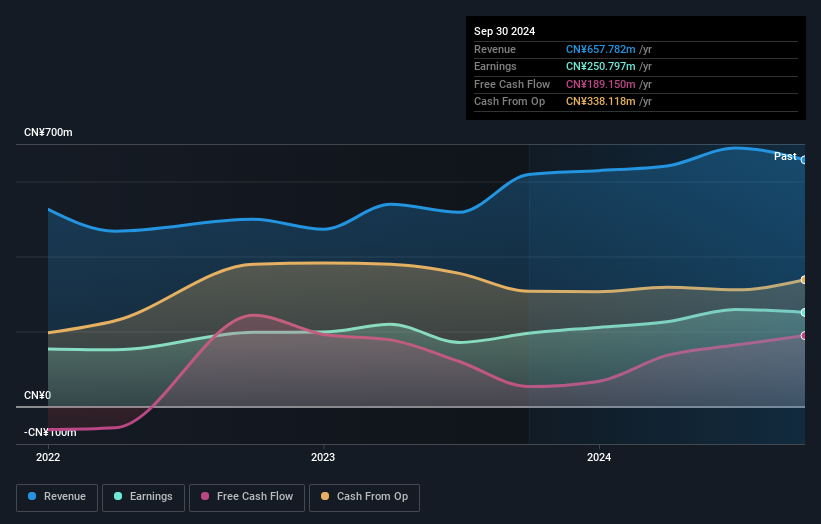

Operations: Sichuan Gold generates revenue primarily from the production and sale of gold concentrate and alloy gold, amounting to CN¥657.78 million.

Sichuan Gold, a promising player in the metals and mining sector, has shown robust growth with earnings surging by 28.4% over the past year, significantly outpacing the industry average of -3%. This debt-free company reported net income of CNY 197 million for the first nine months of 2024, up from CNY 157 million last year. Its basic earnings per share rose to CNY 0.4691 from CNY 0.3864. Recent board changes and dividend affirmations underscore its commitment to shareholder value while maintaining high-quality earnings without interest payment concerns due to zero debt levels.

Jiangsu AMER New Material (SZSE:002201)

Simply Wall St Value Rating: ★★★★★★

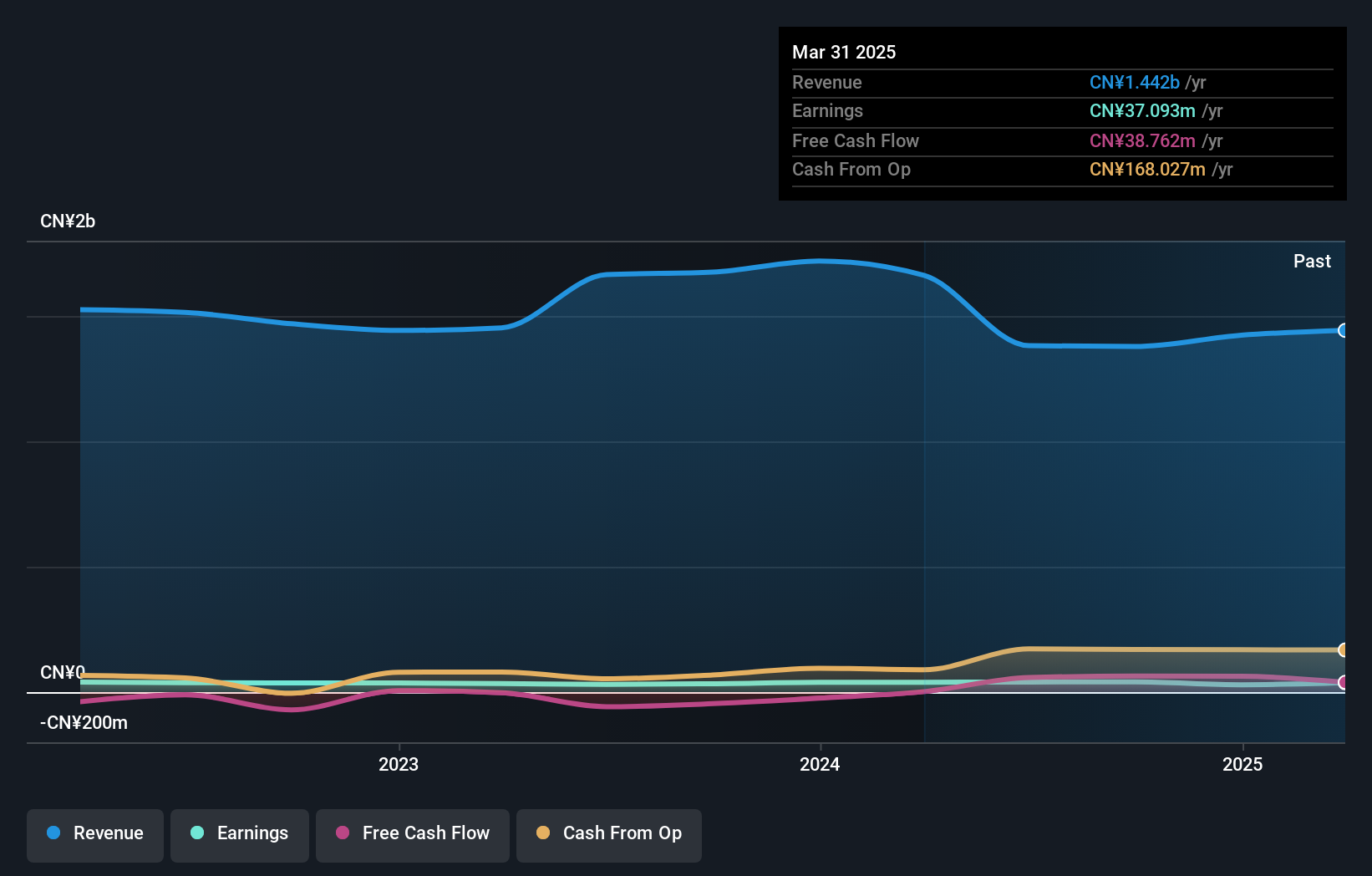

Overview: Jiangsu AMER New Material Co., Ltd. specializes in the production and sale of glass fiber yarn, fabrics, and FRP products in China, with a market capitalization of CN¥3.66 billion.

Operations: The company generates revenue primarily from the sale of glass fiber yarn, fabrics, and FRP products. It has a market capitalization of CN¥3.66 billion. The financial data provided does not include specific revenue figures or cost breakdowns for these segments.

Jiangsu AMER New Material, a smaller player in the chemicals sector, has shown resilience with earnings growth of 20.6% over the past year, outpacing the industry average of -5.3%. The company is trading at 69.2% below its estimated fair value, suggesting potential undervaluation. Its debt to equity ratio improved significantly from 91.2% to 49.1% over five years, reflecting stronger financial health and satisfactory net debt levels at 39.1%. Recent M&A activity includes a CNY 65 million stake acquisition by GU Qingbo and an additional stake purchase by Jiangsu Jiuding Group for CNY 95 million, indicating investor confidence in its prospects.

- Dive into the specifics of Jiangsu AMER New Material here with our thorough health report.

Gain insights into Jiangsu AMER New Material's past trends and performance with our Past report.

Century Iron and Steel IndustrialLtd (TWSE:9958)

Simply Wall St Value Rating: ★★★★★☆

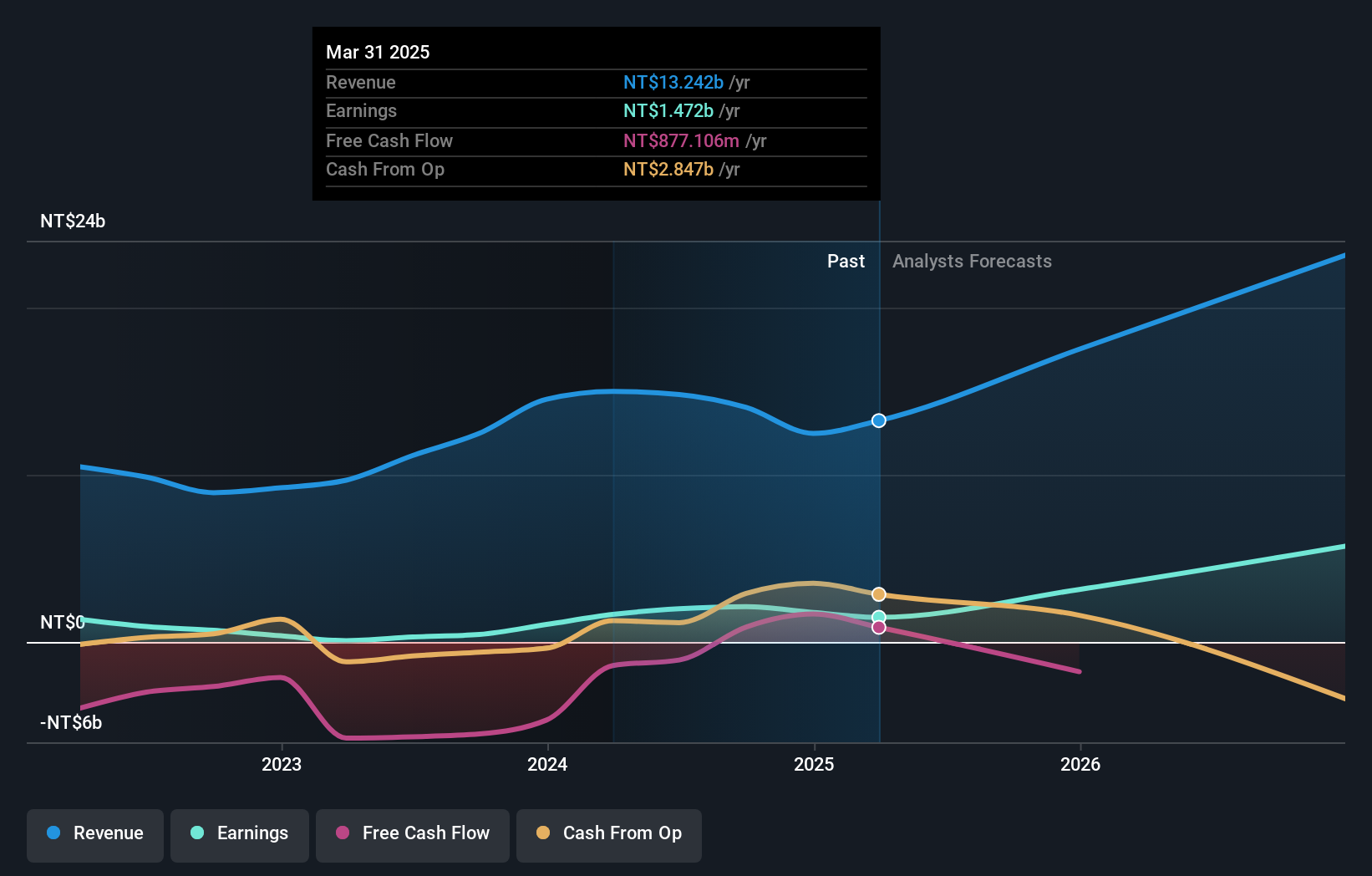

Overview: Century Iron and Steel Industrial Co., Ltd. operates in the steel industry, focusing on manufacturing and distributing iron and steel products, with a market cap of NT$45.21 billion.

Operations: Century Iron and Steel Industrial Co., Ltd. generates revenue primarily from the sale of iron and steel products. The company's net profit margin has shown variability across reporting periods, reflecting changes in operational efficiency and market conditions.

Century Iron and Steel Industrial Co., Ltd. has shown impressive growth with earnings increasing by 369% over the past year, outpacing the broader Metals and Mining industry. Despite a dip in quarterly sales to TWD 2.87 billion from TWD 3.65 billion last year, net income rose to TWD 437 million from TWD 312 million, highlighting strong operational efficiency. The company's net debt to equity ratio stands at a satisfactory 29%, ensuring financial stability. Recent developments include a private placement of convertible bonds worth TWD 4 billion, suggesting strategic financial maneuvers for future expansion or investment opportunities.

Make It Happen

- Get an in-depth perspective on all 4638 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:9958

Century Iron and Steel IndustrialLtd

Century Iron and Steel Industrial Co.,Ltd.

High growth potential with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion